In this week’s edition of Option Flows, Tony Stewart is commenting on mixed Option flows, Mar25 expiry and Jun80-100k Call spread.

March 23

Mixed Option flows.

-Mar26 exp. risk rolled to Apr maintaining exposure via 54k Puts (+spreads) and 60k+ Calls.

-Apr Calls 2way 1k+ as buyers of low vol upside on dips compete with yield sellers.

-Buyer May 50k Puts x500 on BTC drop.

-Buyer Jun 80-100k Call spd x250 near lows.

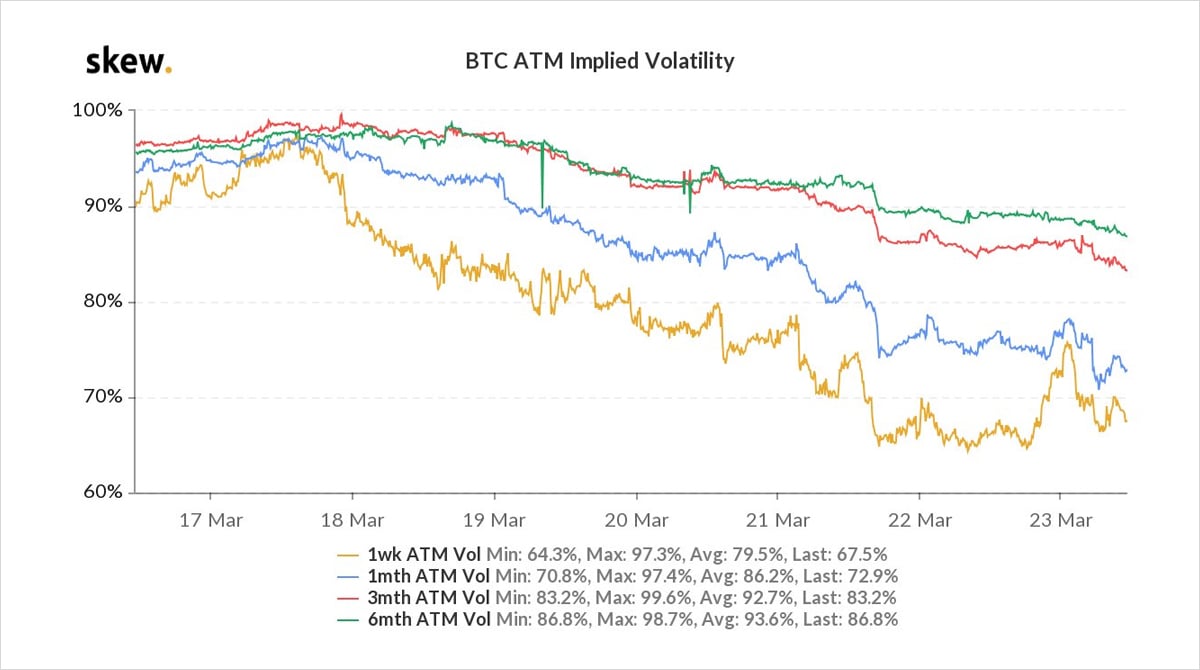

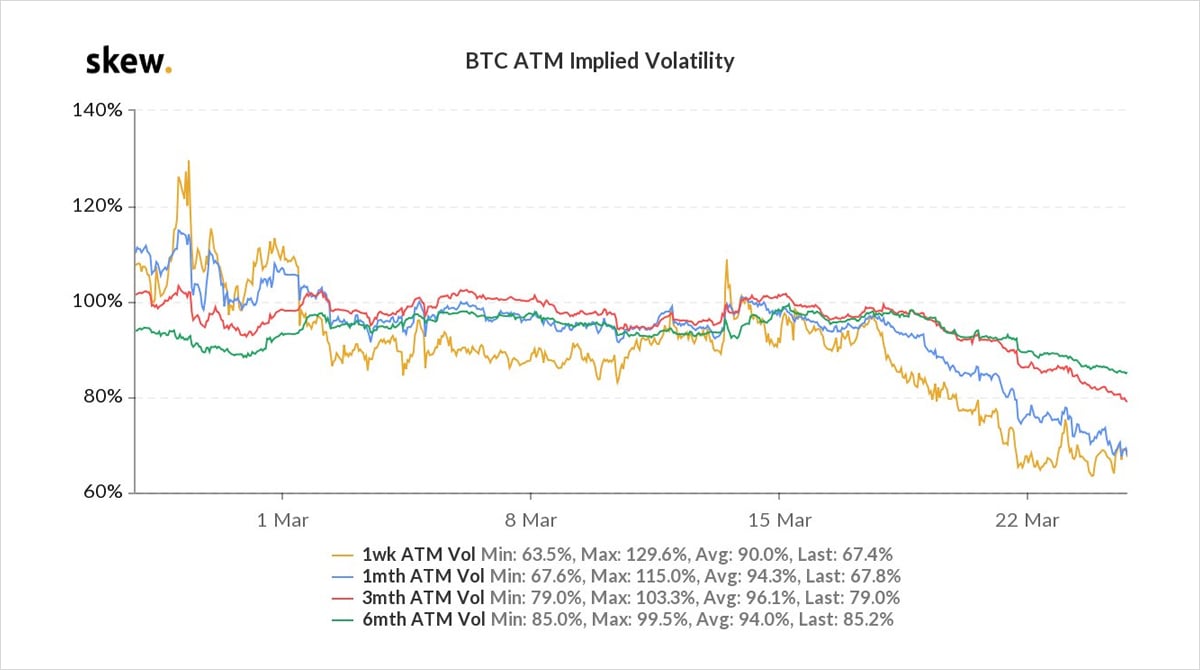

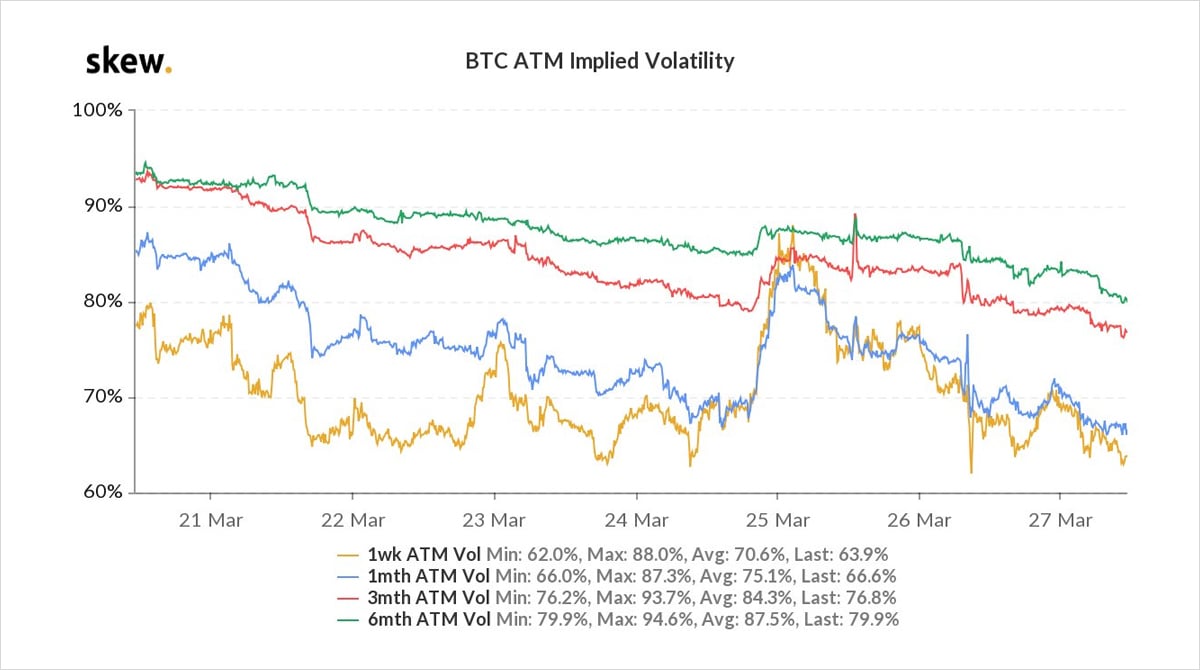

2) Implied vol barely picked up, inferring as stated before that Funds own protection vs Long BTC and no need to panic; as opposed to the $1bn delta1 liquidations in yesterday’s selloff.

Also, the IV downtrend signalling expectations of range, even with some large intraday moves.

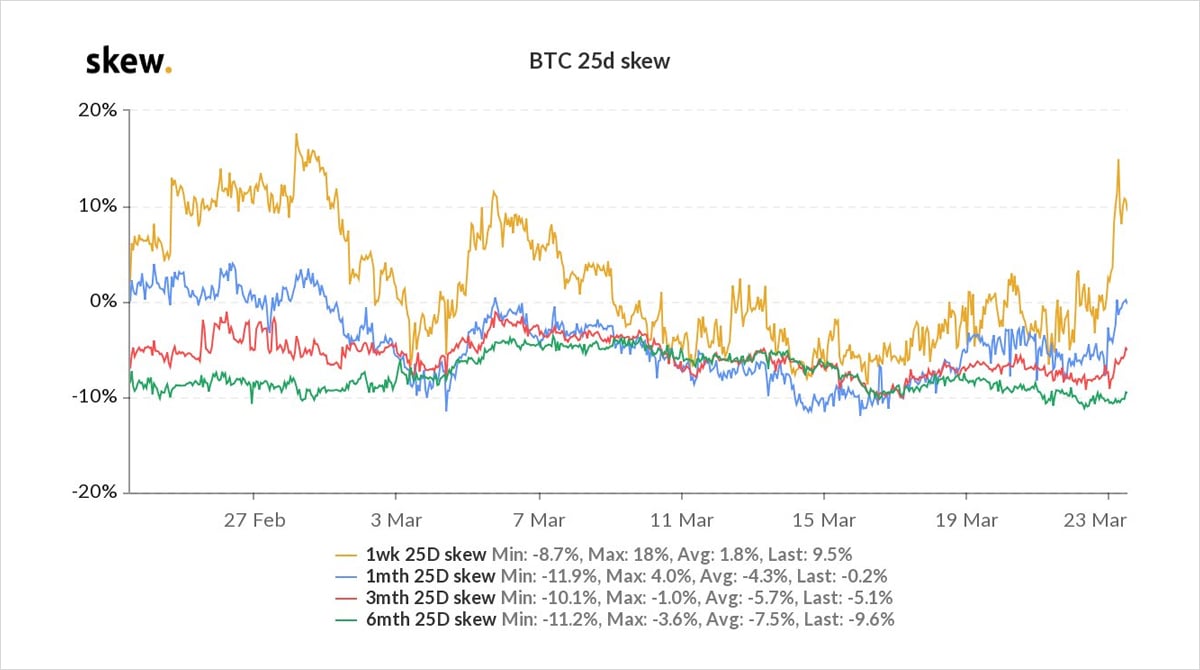

3) That said, there has been a noticeable move higher in Put:Call skew, which also occurred last time 50k came into view on the immediate downside.

Have seen smaller clips in <50k Puts; but this skew move also reflects Call 2-way flow of late, rather than persistent Call buying.

View Twitter thread.

March 24

Switch of Option dynamics again as Puts dumped on Tesla Bitcoin payment announcement, Apr 60-68k Calls 1k+ bought +continued accumulation Apr30 80k Calls; Skew flips Calls+ve.

But on day’s spot high, large Put buyers, Mar54k Put, Apr9 45-40k Puts 2k+; Call enthusiasm recedes.

2) IV drifting 1month+; slightly firming near months with gamma recognized in sub-RV choppy intraday mkts. Anticipated post-expiry flows factor.

Theme rolling Put+Call exposure from large OI exp to Apr. Mar56-60k Calls to Apr2/9 60-62k.

Possible Apr 40-45k extending protection.

View Twitter thread.

March 27

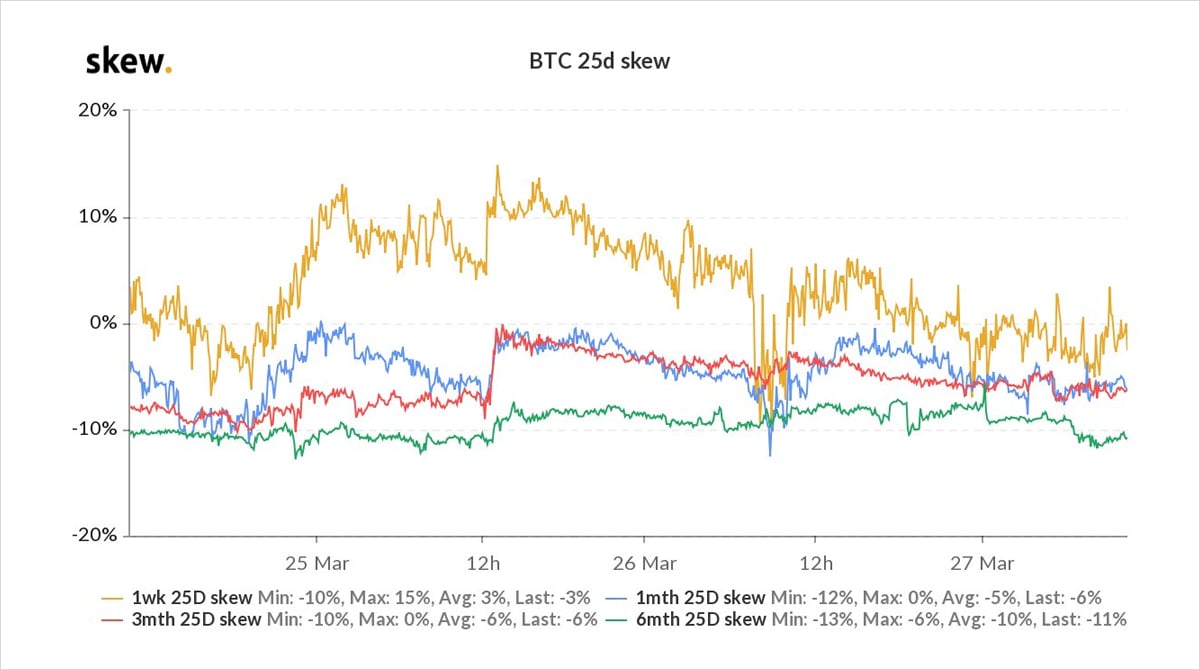

Put buying dominate post-expiry Option flows.

Whether protecting longs or speculative indefinite; imo tells infer former.

Apr16 40k+45k buyer x2k, Apr30 50k buyer 1k+, +Put spreads activate if 48-52k broken.

Opposing flow with Apr16+30 50k strikes sold as spot holds support.

2)Apr 16 40k+45k Puts adds to Apr 9 40k+45k bought earlier in the week (possibly same buyer), and Jun 40k Puts (different buyer).

The former being tail-risk don’t register on commonly used Skew metrics and are often well absorbed by MMs.

Near Skew has actually drifted lower <0%.

3) Call flows exhibiting patterns too.

Observed buyers of Apr 56-62k strikes for a rally, but sellers of 65k+ doubting the magnitude and/or selling covered Calls for yield.

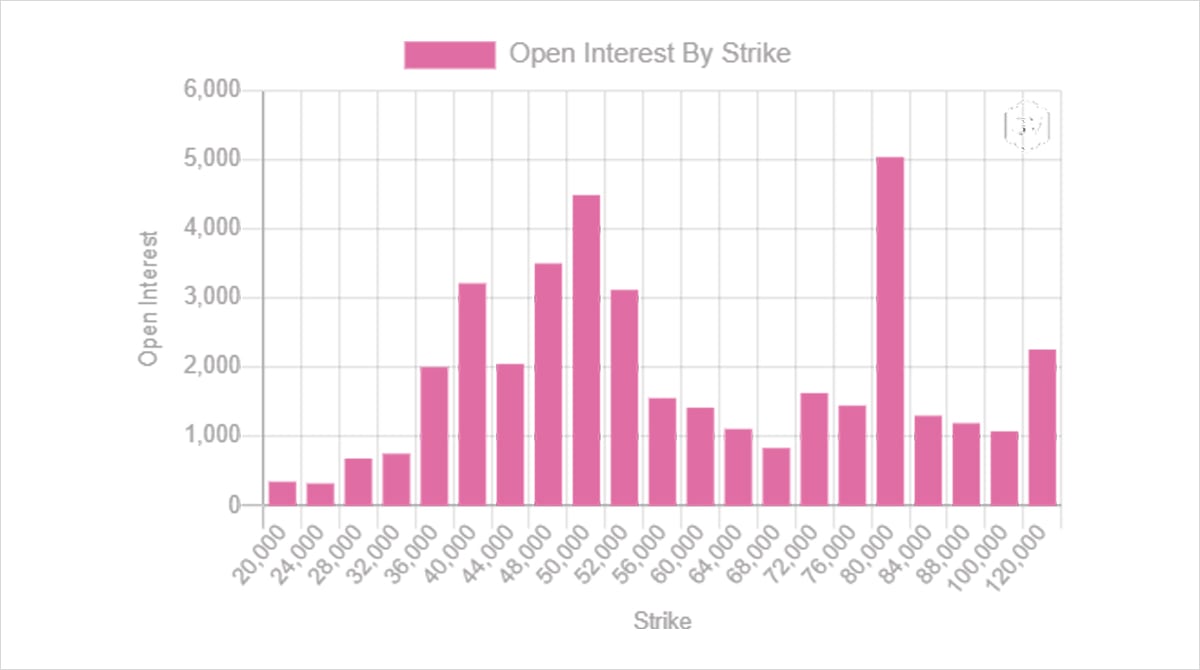

Conspicuous has been consistent accumulation (likely one large originator) of Apr 80k Calls, now OI> 5k.

4) Conjecture preceding the main March expiry and attempts at 50k critical support briefly pumped gamma demand.

Once rejected, Implied Vols started to retrace and near-term has now reverted in-line with Realized vols at 65%.

BTC to 55k has pushed us back into the comfort zone.

View Twitter thread.

AUTHOR(S)