In this week’s edition of Option Flows, Tony Stewart is commenting on CPI numbers created market tension, listed Deribit block trades and the ranges lows has been tested properly.

January 12

US CPI numbers created market tension, but on reveal any excitement fizzled quickly. While the market rallied, recent Jan Call buyers dumped exposure in Jan28 42k+46K strikes hitting IV 8%, followed by a sale of the Feb40-50k ratio Strangle to buy 3x Mar 30-70k ratio Strangle.

2) The listed Deribit block trades have printed so far a sale of 450x Feb 40k Puts and 550 Feb 50k Calls, to buy 1350x Mar 30k Puts and 1650 Mar 70k Calls, ie in a 1×3 ratio, slightly lop-sided. The 1×3 ratio allows a flat premium exchange, to buy OTM wing convexity and net vega.

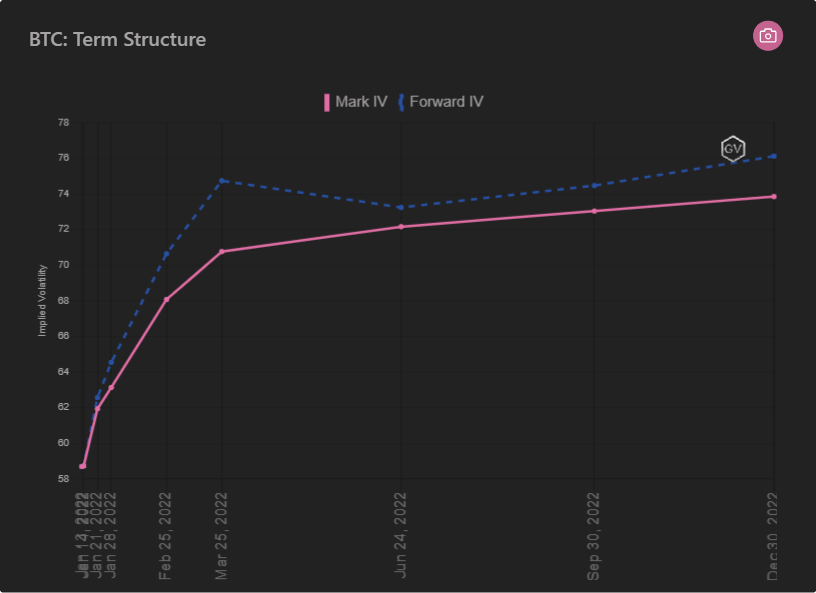

3) Impact of these flows is to steep contango the term-structure, indicating a wish to avoid recent theta decaying option scenarios not helped by end-of-week DOVs. <65% Jan, <70% Feb BTC presents opportunities again for those wanting convexity exposure; perhaps Feb sweet-spot.

4) Now that the range lows have been tested properly, a sudden break of 40k or a rally >46k+ will be needed to firm IV significantly as structural supply in Jan options, in particular, is dampening pumps. 1m+ Options with less natural supply+theta more likely to be buyers choice.

View Twitter thread.

AUTHOR(S)