In this week’s edition of Option Flows, Tony Stewart is commenting on Large players took advantage of Dec100k, BTC bounces and aggresive Call buying in 52k-72k.

January 11

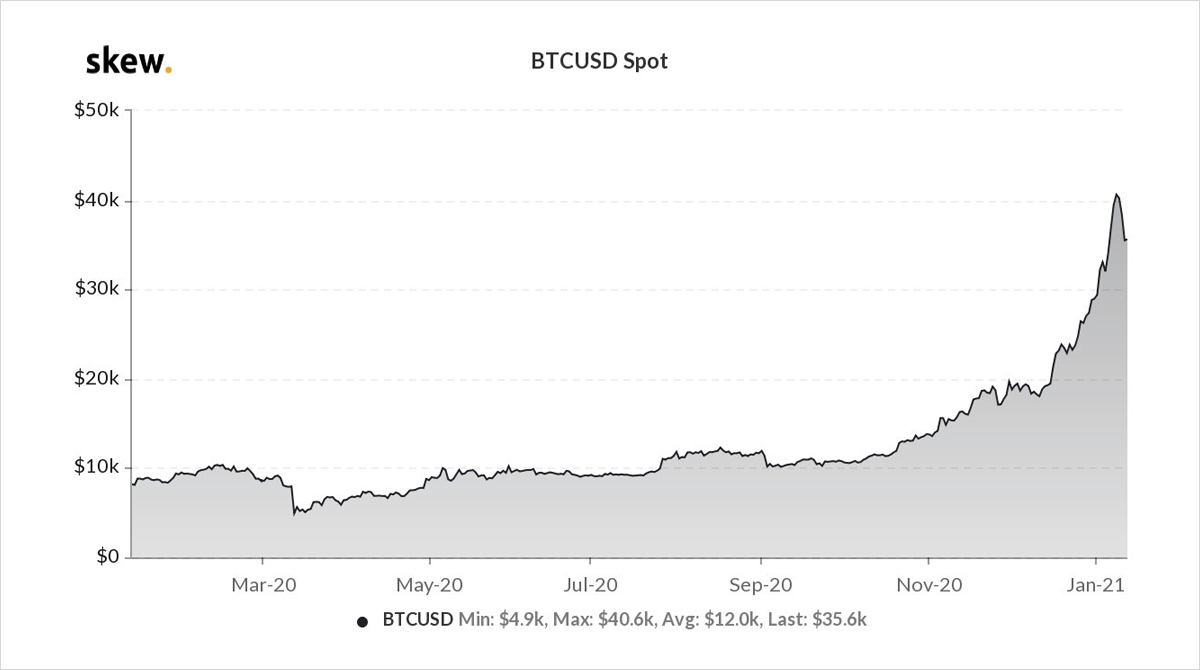

BTC 40k-32k. Back near the 36k strike; Poetic.

A technical options day:

Large players took advantage of the Dec100k+ Call buyer, using elevated levels to sell the Calls and buy Dec24+28k Puts. Short Sep Calls moved to Dec.

Jan32k Calls closed more shorts. Fast-money near-date.

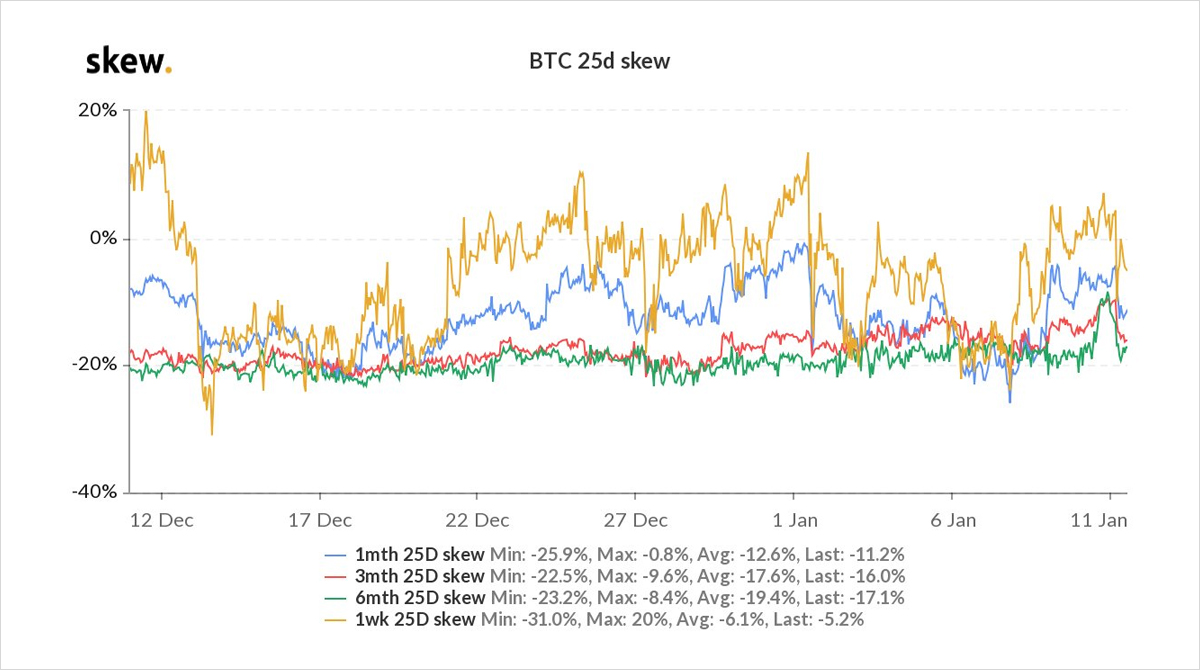

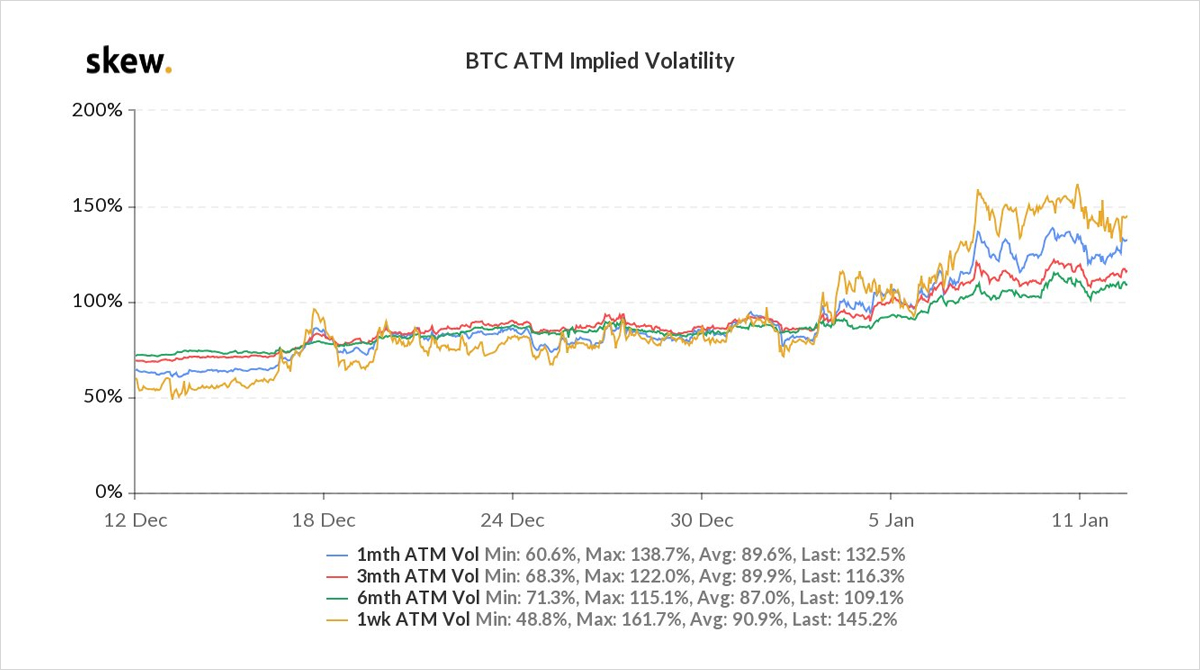

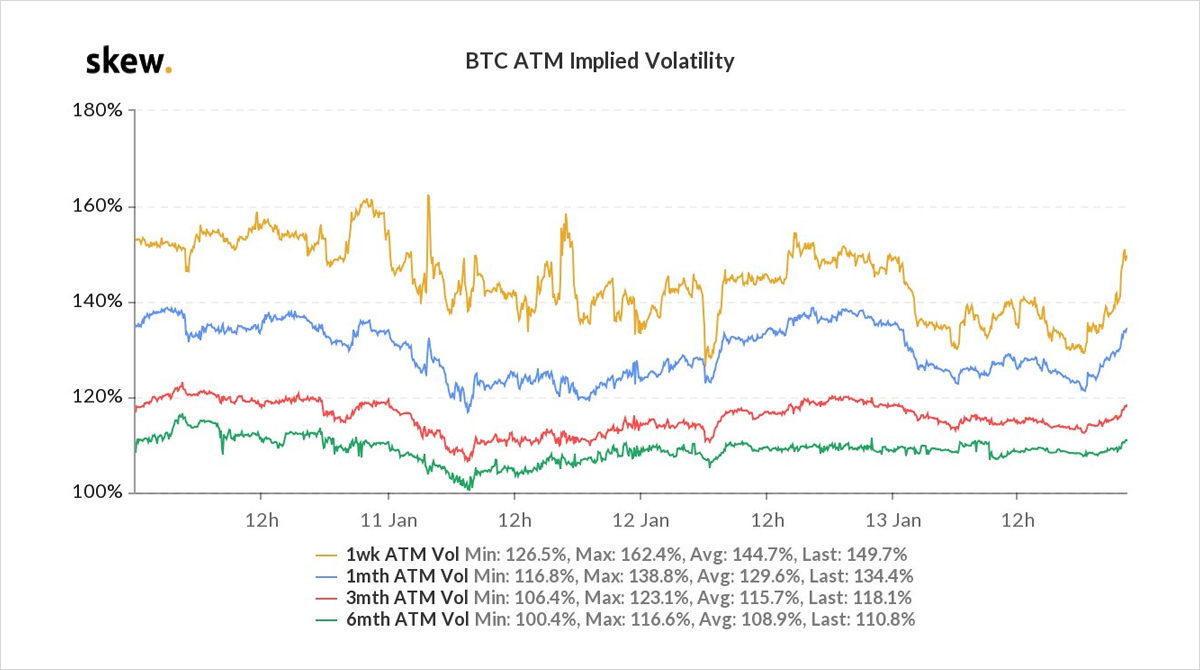

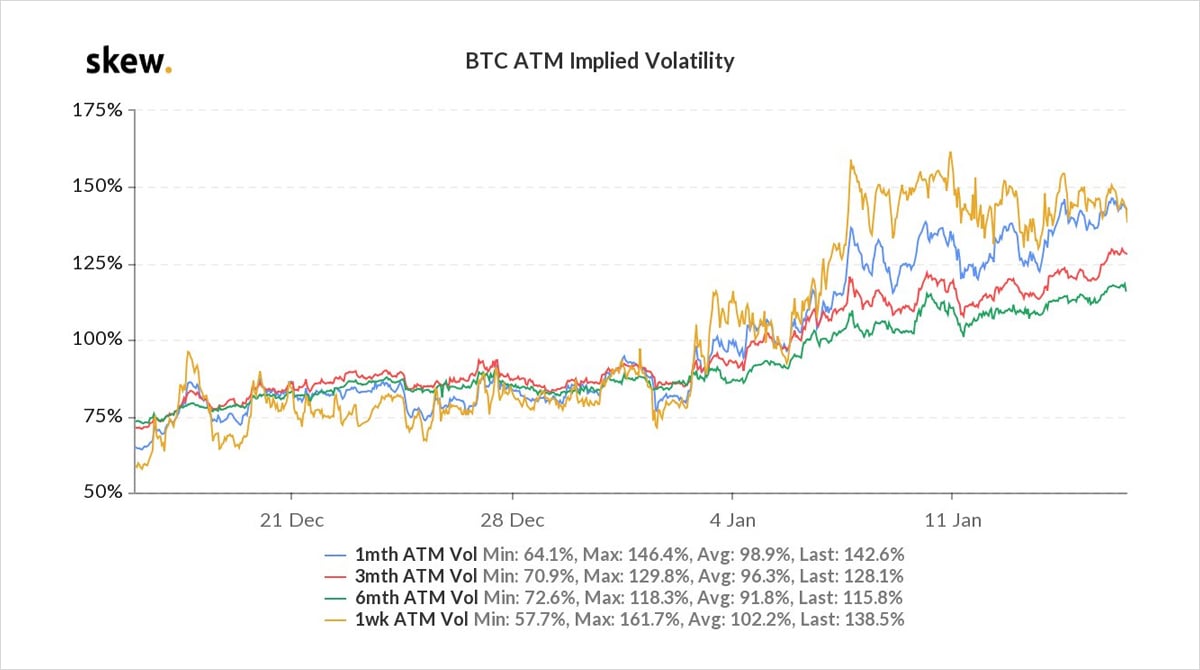

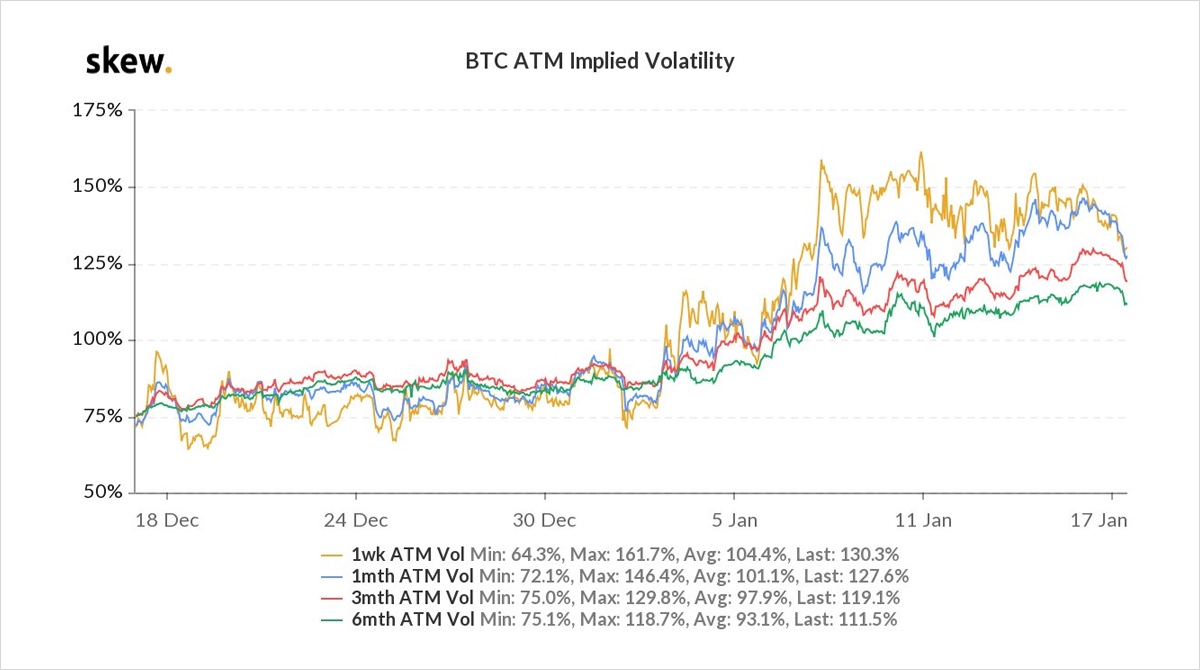

2) With Implied Vol already at extremes, even the huge underlying moves could not pump it any higher. In fact, IV slightly softened.

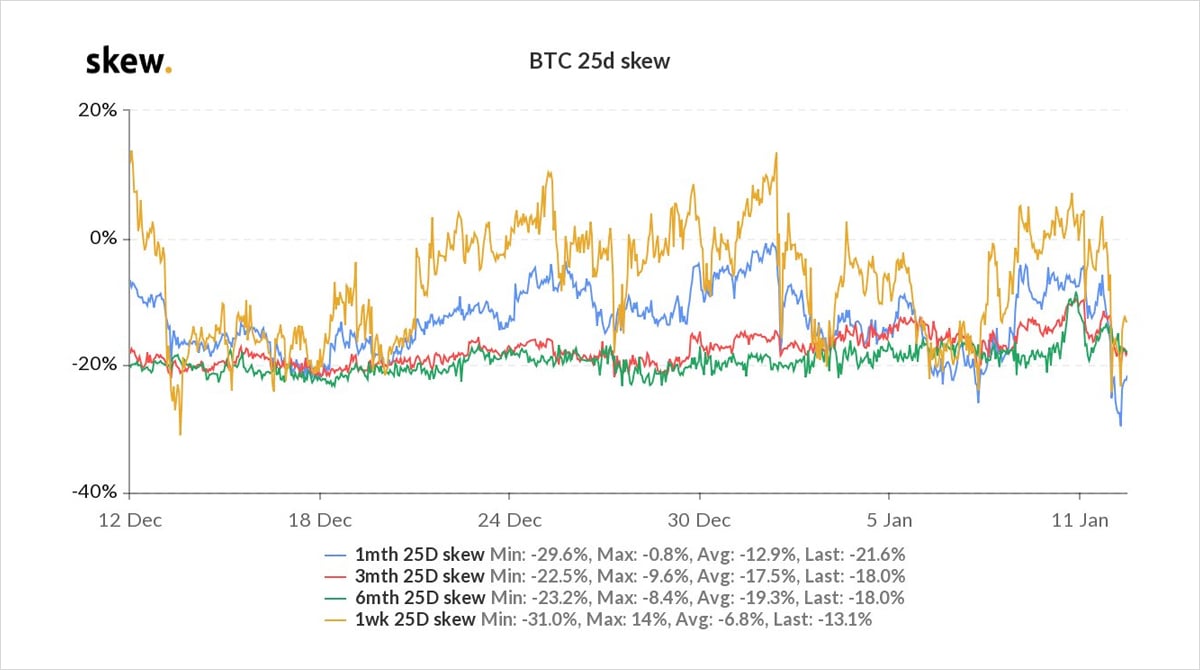

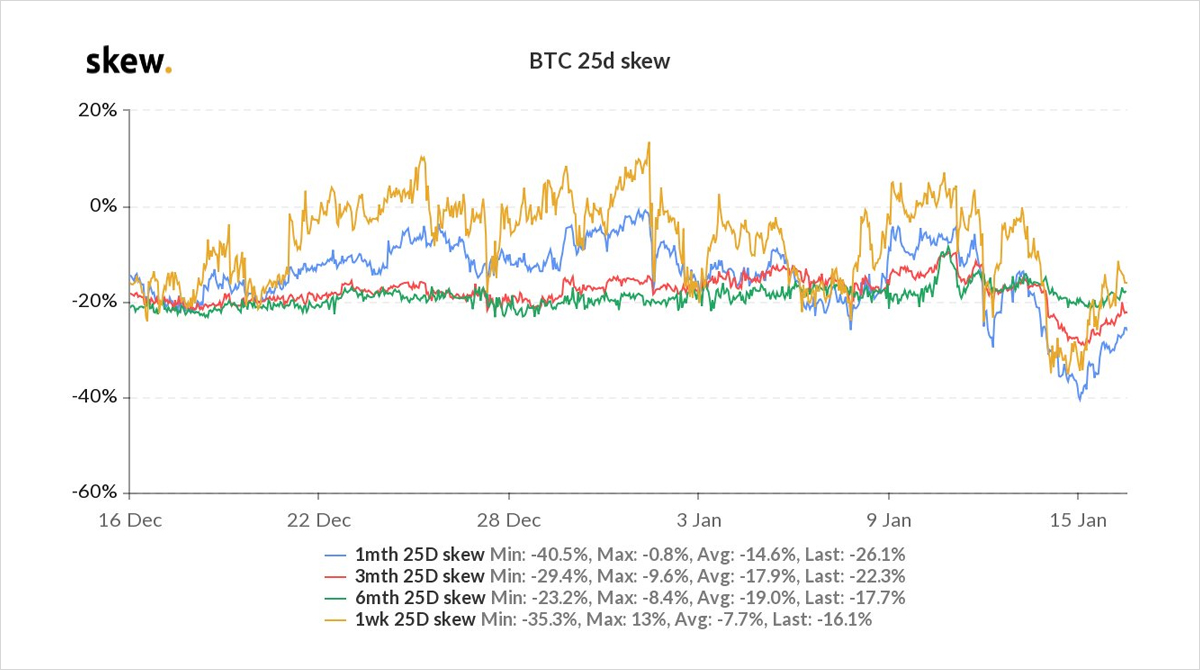

Hit most was Put skew. Put skew had been pushed higher by OTM Put buyers (+ITM short Call covering).

OTM Calls remain firm + exhibit subtle demand.

View Twitter thread.

January 12

BTC 40k-30k-36k!

Jan29th 32k+36k Call Long flinched first, 15k+ unwound, profiting ~$50m.

But positivity shines bright in this man’s eyes, using some proceeds to buy 10k+ Jan29th 52k-72k Calls.

Unwinds very close to ‘marks’, both sides axed to purge huge ATM uncertainty+risk.

2) Significant % closure thought to be bilateral with original CP. Other LPs had opportunity to price, but the CP was axed to unwind ATMs.

IV barely impacted, despite the massive size.

Other short-vol players anticipating the unwind disappointed – IV has squeezed higher since.

3) Inventory shift to upside 52k+ adds to large OI.

This is where tension now lies, all-be-it seemingly a mighty distance away.

Call skew already firm; the BTC plunge created a demand for upside Calls, considered less risky than catching ‘spot’ knives.

Compound. Call skew pump.

4) Impact of the trade is to shift significant risk (CP delta + gamma +P&L) from the ATM strikes.

The remaining positions ATM are big but not outsized.

The Gamma impact will therefore be less, and will further diminish as the end of Jan approaches….unless BTC breaks new highs.

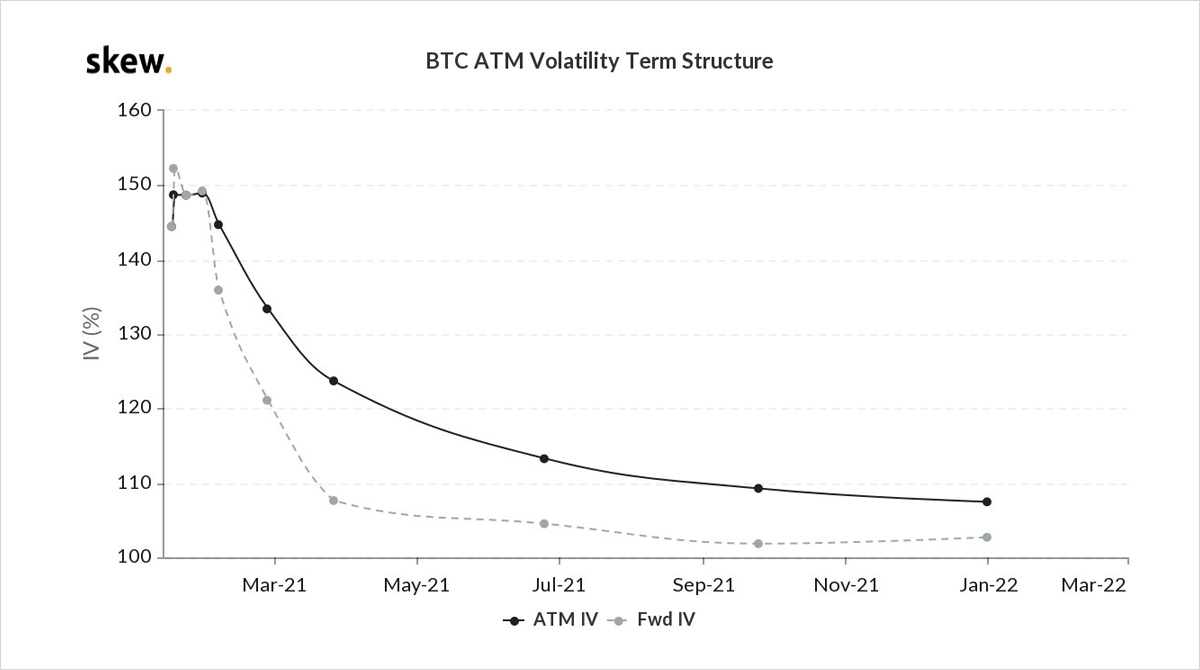

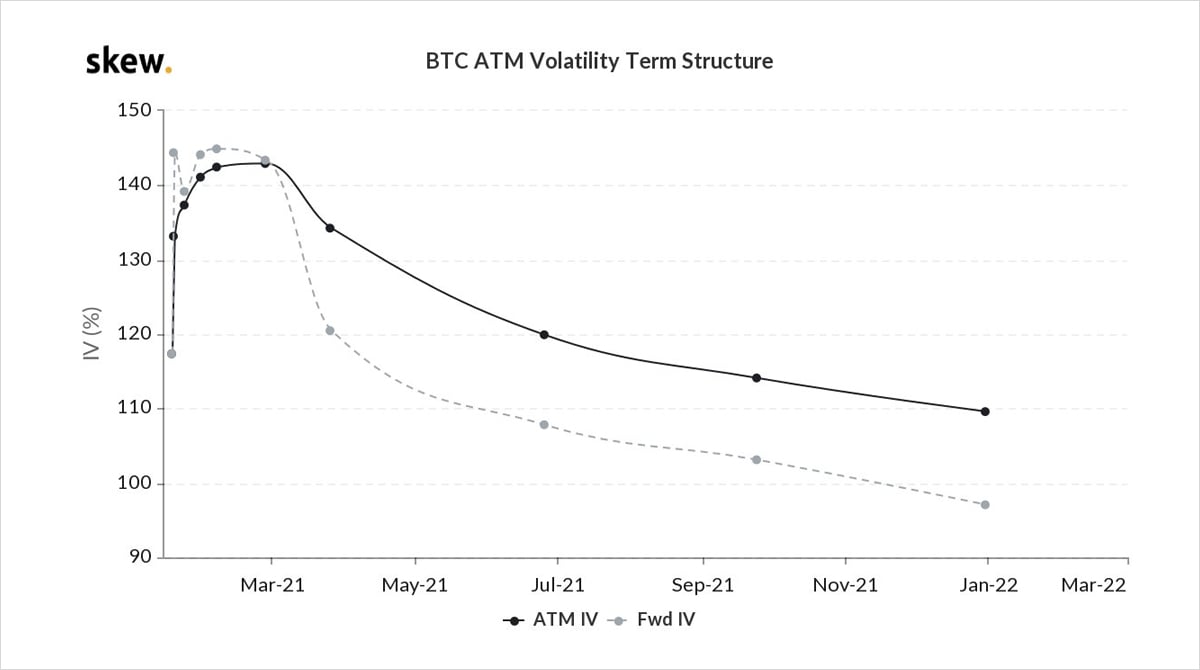

5) Because Implied Vol is so high, the probability of reaching what appears out of reach right now, is not dismissable.

Breaking 52k by the end of Jan priced at 15%+ chance.

Huge moves experienced yesterday should adjust future expectations.

Call Long dreams big, sleeps well.

View Twitter thread.

January 13

13th Jan, 3stages:

-BTC <33k in Asian hours. Jan29 32k Call long gets spooked, sells 1k+. Near-vol off 10%.

-BTC bounces then ranges, vol drifts. BTC settling? CME fund(s) dump 1.5k Jan29 35k Calls

-52k Calls added through day accelerates as BTC>35k+. Buys 2k+. Vol+Calls pump.

2) As BTC breaks >37.5k, Vols return to day’s high.

Easy to conclude 52k+ end of Jan is too high for sane men to envision. Then a 5k bounce +surge from the lows and the clouds part…above is clear blue sky.

Probability 20%. 80% lunacy?

Mentality shifts; IV+Call Skew squeeze.

View Twitter thread.

January 16

Extremes.

Aggressive 52k-72k Call buying continued; OI>33k.

Strike IV spiked, new levels; 52k>225%, 72k>245%.

But also crash Puts sought, Jan 20-25k Puts. 200%+ IV.

At such IV, neither perform without a massive burst move.

10%+ spot swings ubiquitous. 10d RV 125%. ATM IV>140%

2) 52k-72k Call buying clips of x50-100, some ‘at market’.

Interesting to note:

a) OI suggests not all ‘The One’ buyer; possible copy cats + spooked short-covering.

b) Aggressive buying stopped as BTC fell <37k; reduces ‘he knows something’ speculation.

Fri Jan ATM peak 150%:

3) Assume 52k+ Calls unhedged. 2weeks left.

At these extreme IVs, Calls perform if:

-BTC>52-72k+

-Underlying market surges in 6-10%+ jumps

-Shorts squeezed.

Due to option dynamics, don’t need to breach strike, but as expiry nears, Theta could manifest into ancient Greek ‘death’.

4) Extreme Call Skew retraced as signs of The Buyer giving up at BTC<37k and flow of Crash Puts being bought, firmed up Put skew.

Aside from Crash Puts, there is still limited material Paper hedging, Put skew remains negative.

30k Institutional support? Upside narrative persists.

5) With 10d RV 125%, additional intra-day significant intraday swings and large buying of options, this forced MMs to snap up any initiated selling flow (profit-taking Jan40-44k Calls).

Volumes were focussed in Jan, but the RV+IV squeeze dragged up the rest of the term-structure.

6) No initiated active pre-weekend dump of Theta-decay for longs; ample opportunity in natural trading, so IVs remained at highs until the end of Friday.

Only a quiet Saturday so far and an absence of aggressive buyers has allowed the near-dates to soften and Jan-Feb roll-over.

View Twitter thread.

January 17

A frenzied 10minutes buying of Jan 52-72k Calls x1k+, BTC trading 35k, spiked Strike Vols +25% but barely registered on data charts; sellers absorbed and slammed prices back.

Owner of Dec 100k Calls reduced notional + Strike down to the 64k Calls, utilizing a clever 1×1.5 x1k.

2) Less fear now to sell Jan 52k+ Calls, many realizing opportunities for Call ratios, Ladders, Flys etc.

Dec 64-100k Call 1×1.5 trades 1k at ~flat, great optics for a buyer, but this buyer is rolling lower his 100k longs; less optimistic?

Impact: Vol sale. IV lower across term.

View Twitter thread.

AUTHOR(S)