In this week’s edition of Option Flows, Tony Stewart is commenting on Macro concerns, Crypto regulatory leak + Protocol Treasury ETH selling.

June 7

Replica to last week, where 1week Call buying preceded a 10% Core Spot rally on Monday, before crashing back. Last week due to Macro concerns; today due to US Crypto regulatory leak + Protocol Treasury ETH selling. Last week saw Put buying to hedge, yesterday not as fortunate.

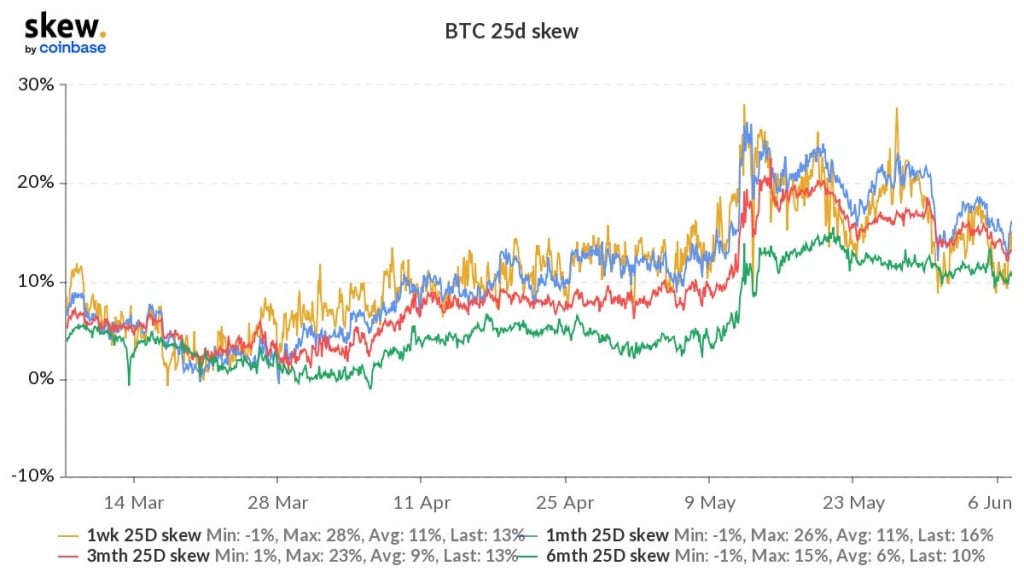

2) Some comfort in selling high Put Skew yesterday as BTC July+Aug Puts sold aggressively on-screen on the rally. Whereas June 32-36k Calls+Call spreads were bought, and Front Vol stayed firm suggesting MMs+Funds conscious of ‘BTC-maxi’ regulatory framework being released today.

3) But leaked documents relating to the legislative framework coincided with a large aggressive ETH sale in Asian hours, dragging everything indiscriminately lower. Ongoing concern spreading regarding Treasury holdings at different protocols to give teams runway having an impact.

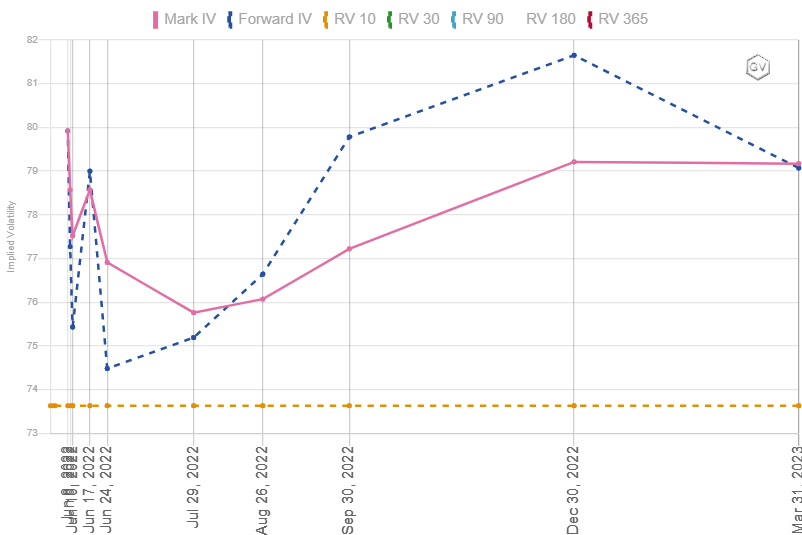

4) The spot sell-off was so quick, that IVs barely had time to react during a quiet activity time zone. Given IV sitting at RV levels, but overnight RV >7day RV, Gamma Risk-Reward decent in this uncertain environment. Term Structure currently reflects an unwillingness to short.

View Twitter thread.

AUTHOR(S)