In this week’s edition of Option Flows, Tony Stewart is commenting on the current data starting from the rally off 17.5/900 BTC/ETH.

June 27

Significant amount of ITM Put hedges have now TP.

While some rolled exposure down to OTM Puts, these were mostly short-dated; many already expired in Jun, the rest BTC 10-16k strikes, ETH 600-1k decaying in Skew+IV terms, as the rally off 17.5/900 reduces their consideration.

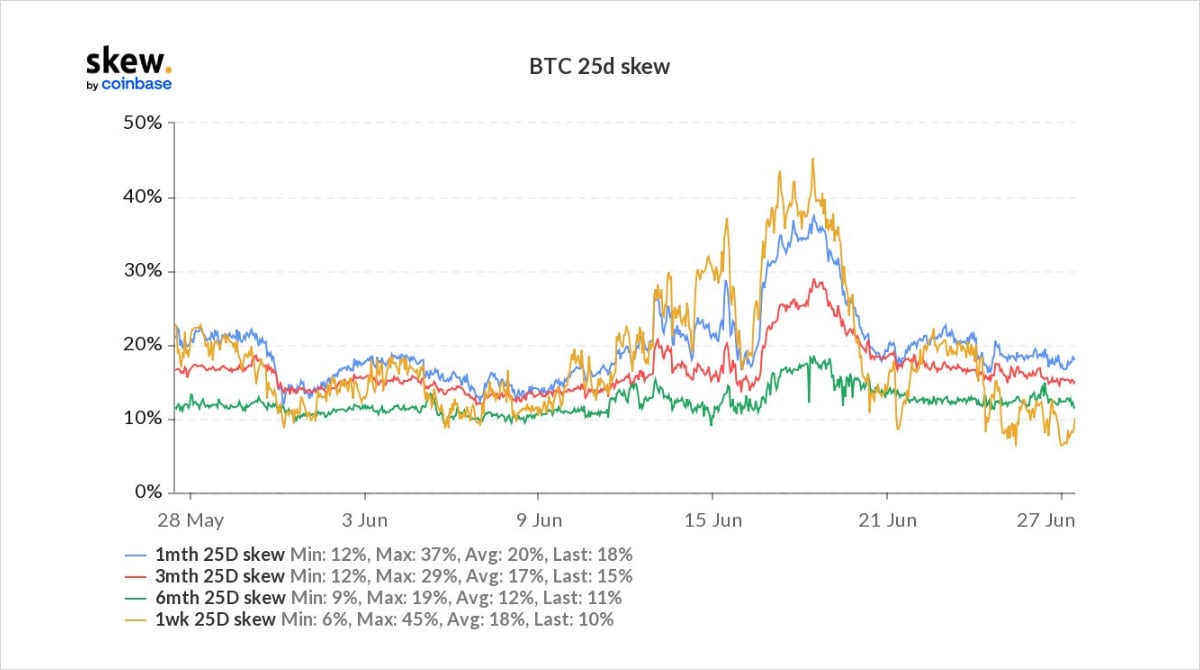

2) Skew, therefore, has plummeted, most at the near dates which are more elastic.

One trade of influence was a screen buyer of Jul1 ~23k Calls, funded by selling ~18k Puts, flat premium, bullish play.

Other Call buyers timed Spot well, but not IV, buying July 24-26k strikes.

3) The Call buying shows the relevance of IV.

When Spot was 18k/1k, the use of Options to buy Calls rather than D1 is a ubiquitous way of getting exposure with fixed loss.

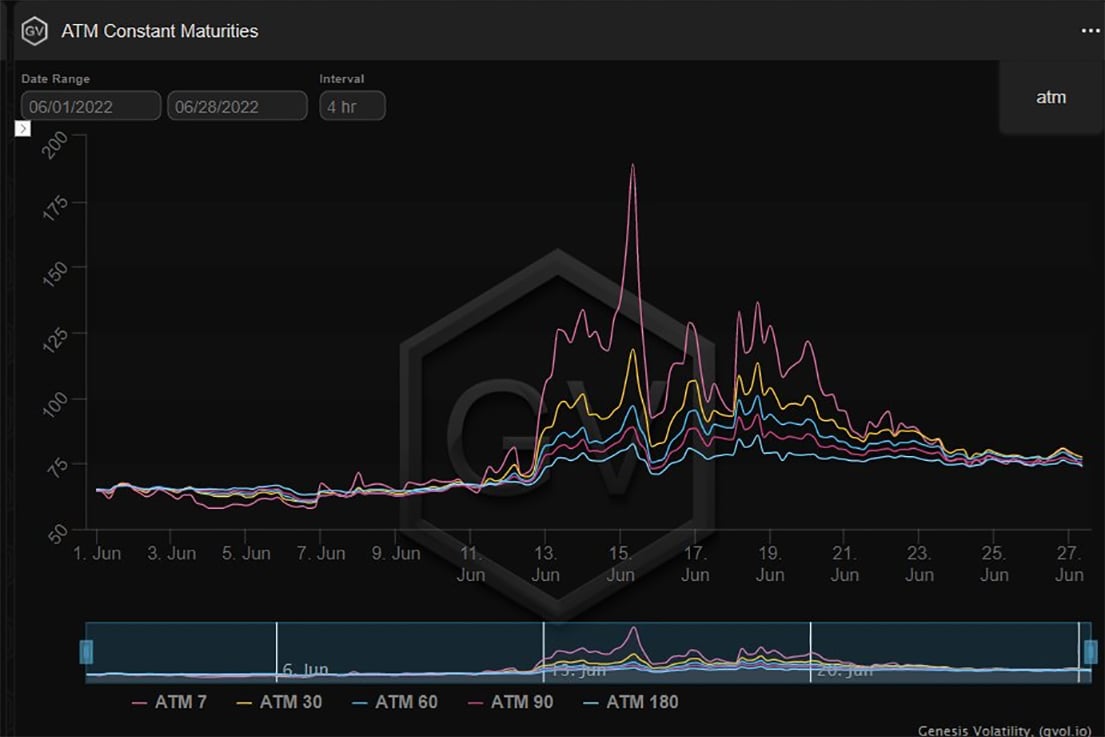

But on those Spot lows, IV>125%, so the Calls while appreciating from delta+gamma have been crushed by IV.

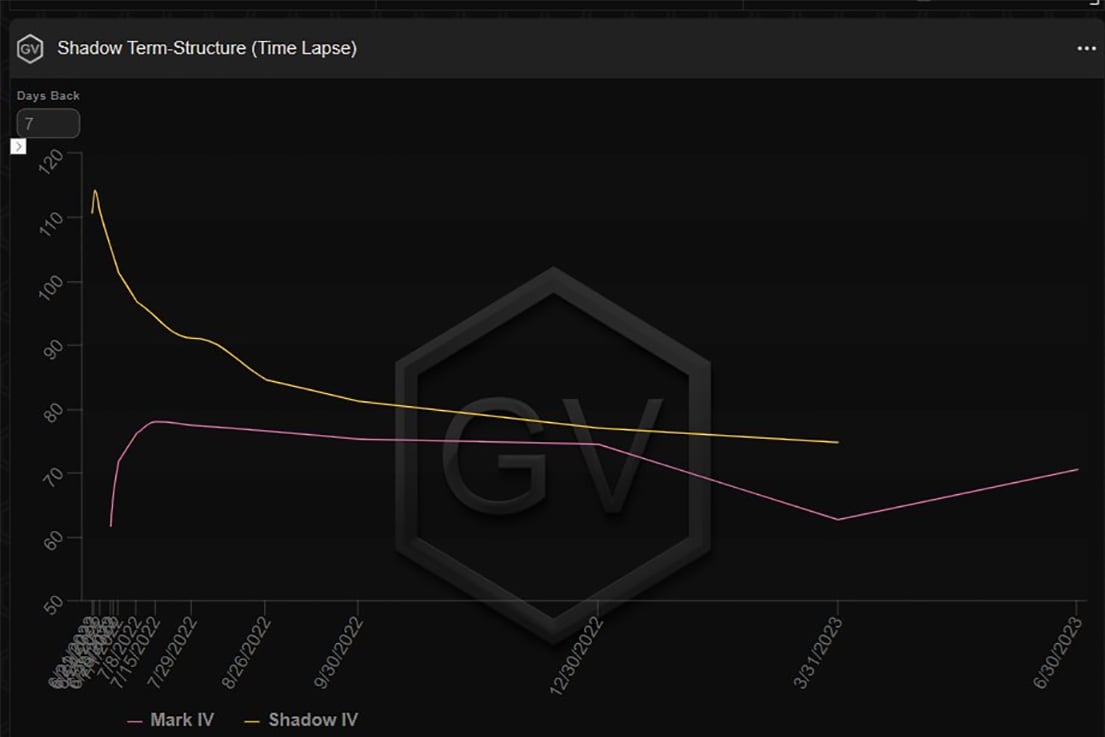

4) Therefore we have observed other upside acquisitions via Call Flys (negligible IV) and ratio Call spreads which either reduce or sell IV.

They of course suffer from lower delta, but in high IV environments can be useful.

A higher delta play can be achieved via Call spreads.

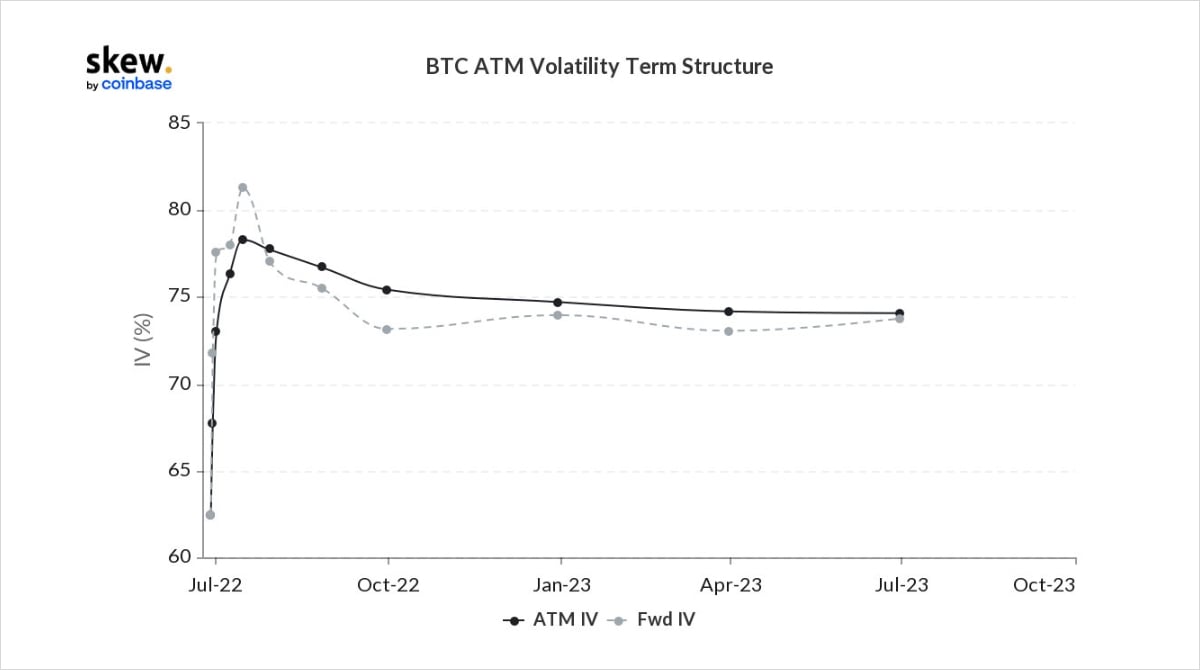

5) A large trade post 24Jun expiry was a buyer of Jul1+8+15 (most) ~24k Calls and fund this with selling IV in the July29 28k and 32k Calls (x2 ratio).

Using the far OTM Call (which tend to be priced at higher IV is an interesting method).

Note also created a Jul15 fwdATM bump.

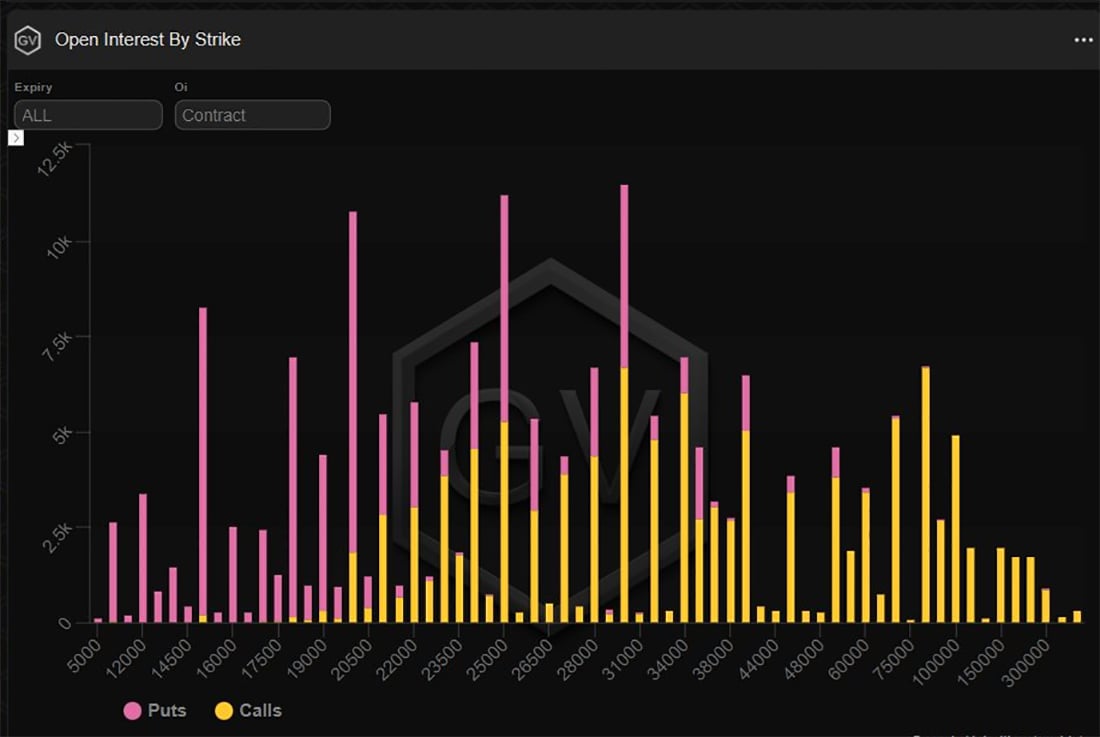

6) So although sentiment has improved from the depths, consider the OI positioning still geared towards a positive Put Skew.

An Aug 18k Put buyer x500 (screen) reminded the market that a straight recovery to bull-market is hampered by macro, and there are still unknowns lurking.

View Twitter thread.

AUTHOR(S)