In this week’s edition of Option Flows, Tony Stewart is commenting on burning Man ending Summer an analogy for long-only accounts, and Crypto being dragged screaming by a theatre of Macro scenes.

August 30

Burning Man ending Summer an analogy for long-only accounts, with Crypto being dragged screaming by a theatre of Macro scenes.

But +ve Put Skew, -ve funding across ETH+BTC and little IV reaction to sudden Spot downdrafts suggest smart Funds been risk-off but +ETH Call spreads.

2) Some of the ETH -ve funding is due to POW fork speculation (maintaining long Spot, hedged short perp). The crowded play is becoming expensive.

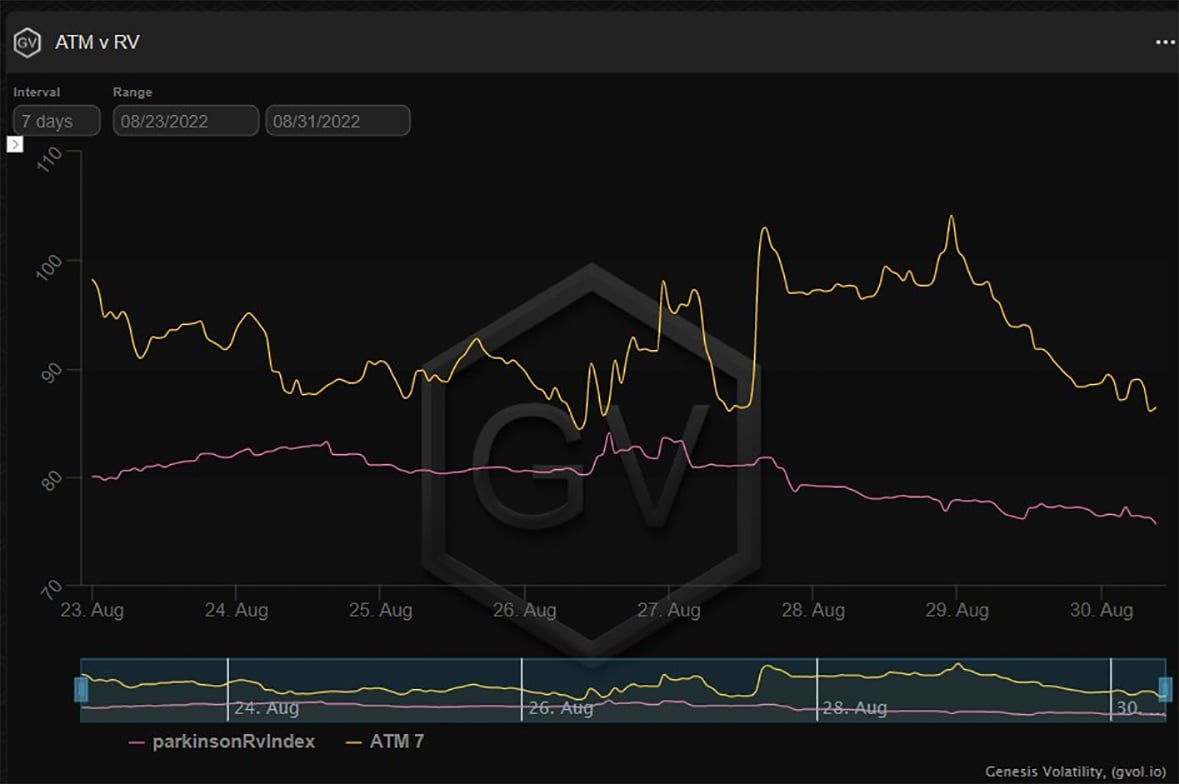

Likewise holding Long IV positions with RV trading 10%+ discount is an expression of Summer passiveness, nerves on Spot + Merge FOMO.

3) Put Skew is edging more +ve at the near-dates where frankly most Option flows have been taking place (larger players that trade 1m+ taking August break).

This is the fast money bearish or low premium hedging population.

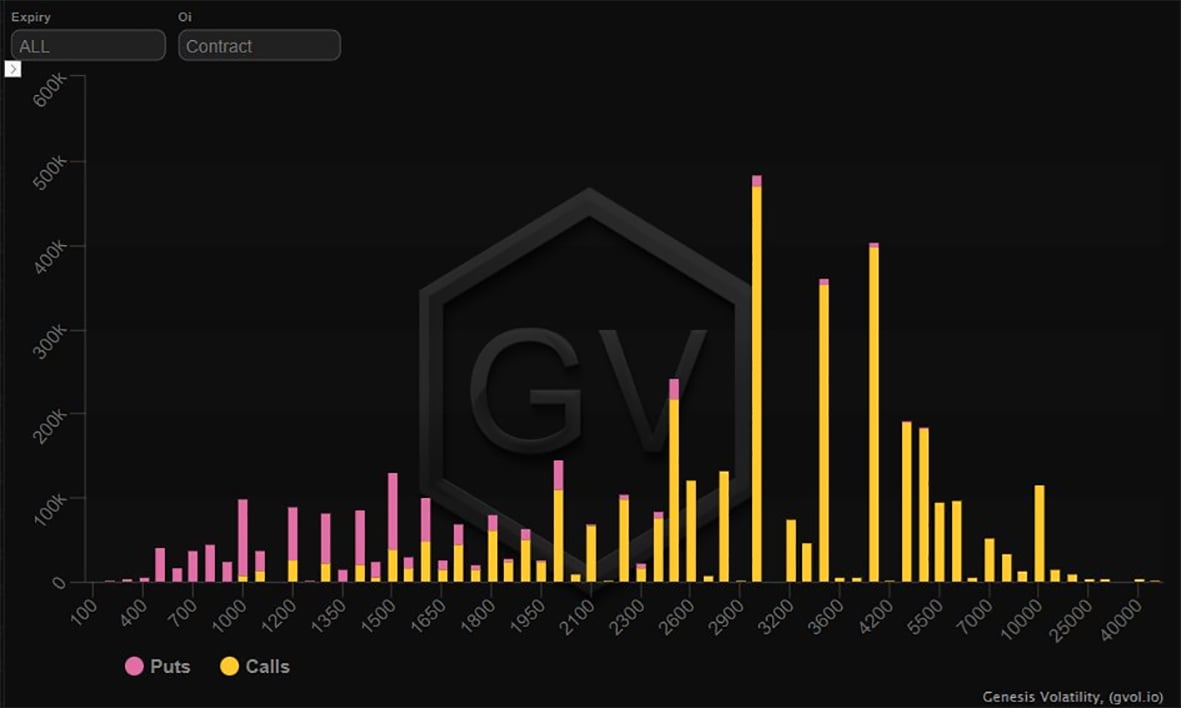

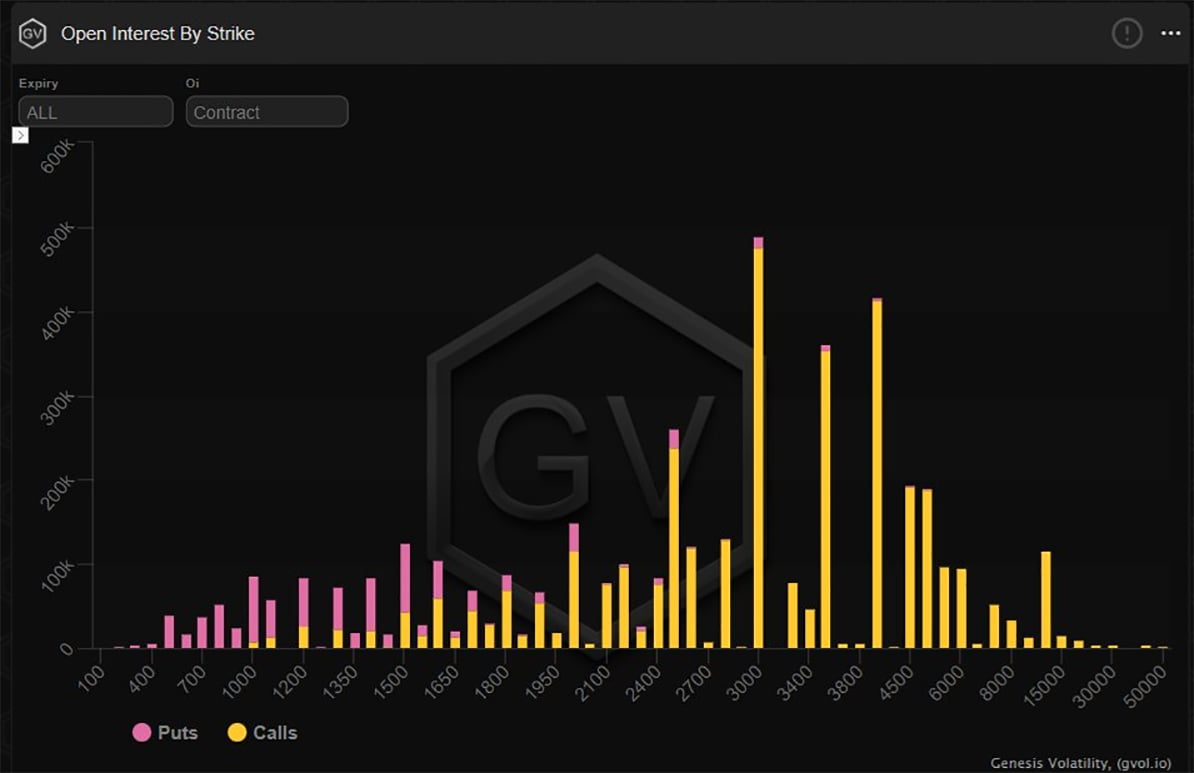

4) When looking at the Skew, there is little sign of an upcoming Merge which might be represented by huge demand for Calls.

But as mentioned before, many large Funds have avoided committing to naked long Calls (at expensive IV) in favor of Call spreads and Call flys.

OI picture.

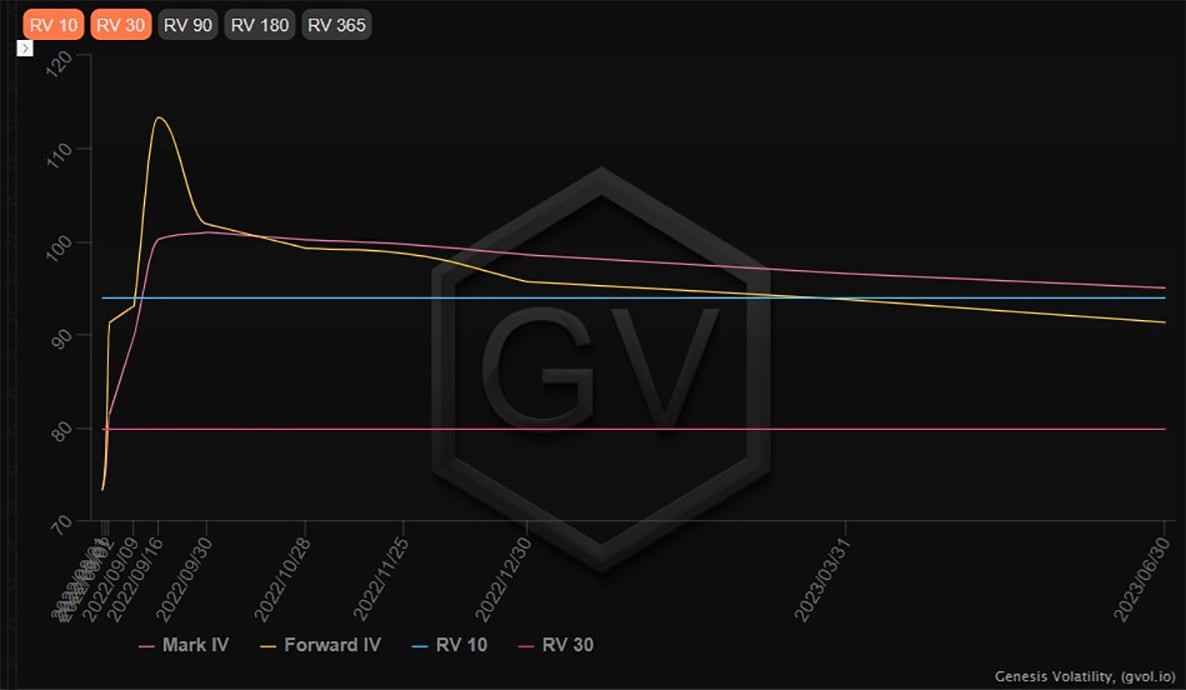

5) Also the bump around the current expected Merge date of Sep15 and longer maturities give away clues of underlying demand, despite IV drifting lower. ETH 1month DVol is 110%.

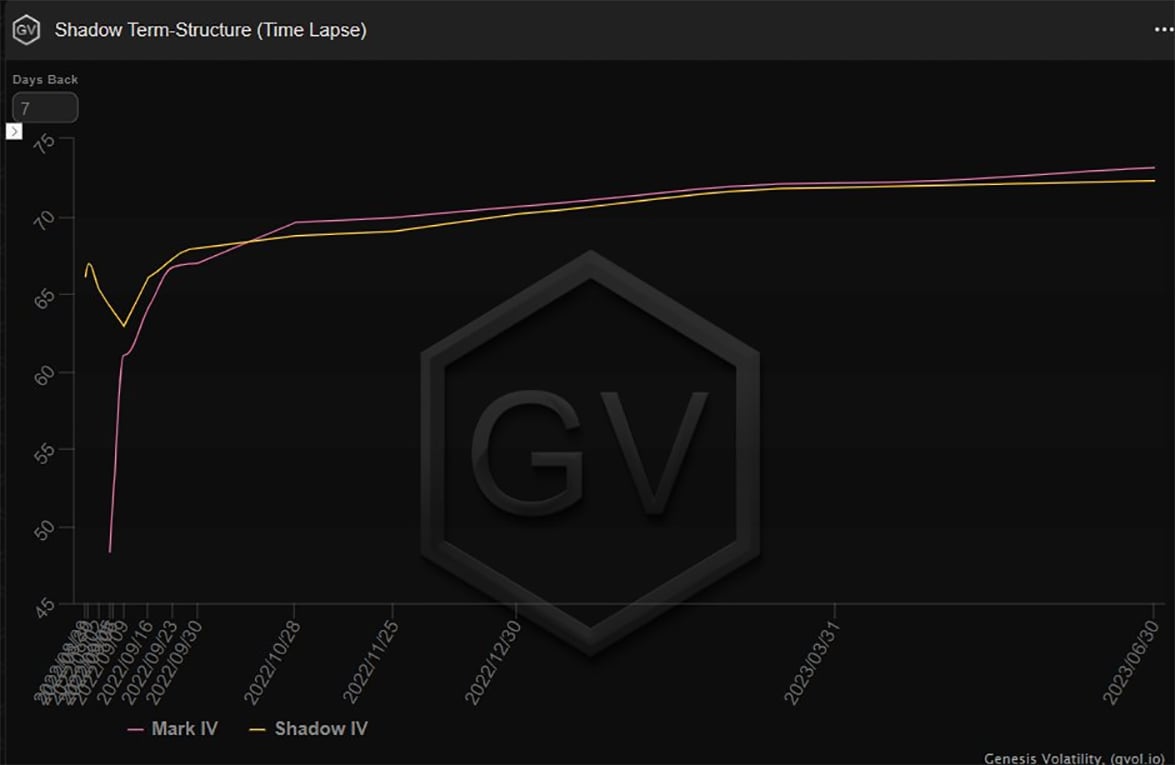

The BTC term structure, by comparison, is fully Contango (low Gamma demand), with 1month BTC Dvol 72%.

6) The trade every Fund likely wants to do in the pre-Merge ETH Options space is to buy the low Call Skew at an IV that is reflective of RV, ie not at such a premium as currently exists, but taking advantage of Call skew impacted by downside fear and Call Spread buyers.

Unlikely.

View Twitter thread.

September 4

NFP provided no shock, and global risk markets continue to suppress optimism.

Merge-related ETH Option positions are still open, but little evidence of exuberant additions.

In BTC, Put Skew has been steadily rising with Sep9 18k Puts bot 1.5k and Dec 10k-15k Puts bot 2k+.

2) The ETH Sep Call Flys we saw bought a couple months back no doubt hoped for a pre-ETH rally and immediate positive reaction.

ETH needs a 2x in < 4weeks to bring ITM success.

The Dec+Mar Call Flys allow time for the market to see success and for the narrative to be fulfilled.

3) But recently, some hesitancy in ETH Merge euphoria – ETH Dec 800 Puts bot, plus shorter-term Calls sold.

One buyer of Oct Wide Strangles betting movement one way or the other by buying OTM Puts + Calls.

ETH Dvol trades >35% over BTC Dvol.

Short-dated maintains premium.

4) With BTC trading at IV discount to ETH, this is where Macro+Core Crypto is being hedged, and Vol bought.

Sep 9th 18k Puts bot x1.5k at the Friday US close.

Also observing an accumulation of Dec 10k Puts x1.5k over a couple days, and Dec 15k Put.

RV weak, Dec firm. Contango.

5) On Spot dips to 19.5-19.7k there has been a buyer of BTC Dec 17-28k and 17-30k Call spreads, countering delta being sold.

Note that the 17k Calls are ITM, therefore technically a synthetic Put.

Put Skew is being lifted by buyers of Sep Puts, Dec Puts and the Dec Call spread.

View Twitter thread.

AUTHOR(S)