In this week’s edition of Option Flows, Tony Stewart is commenting on Oct-Dec Puts sold, Oct Calls bought, and both taking advantage of the elevated Skew.

October 4

Positivity with US market rallying strongly, and Crypto allowed to breathe on October Capital inflows.

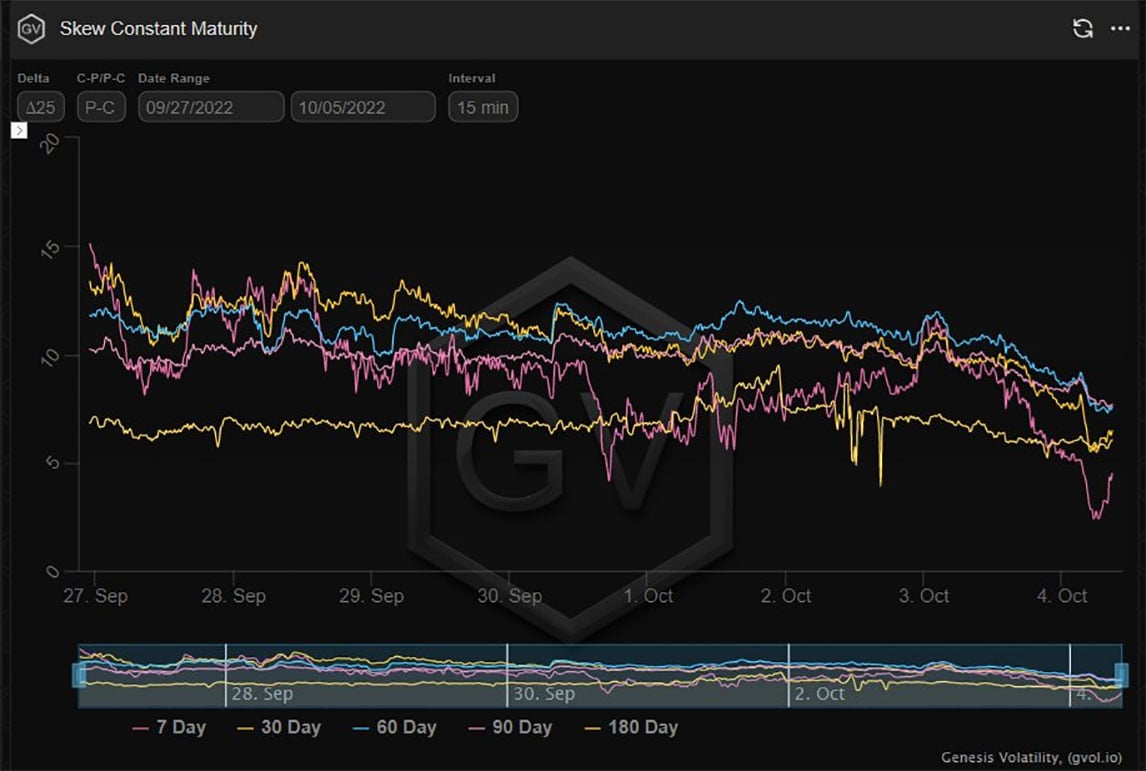

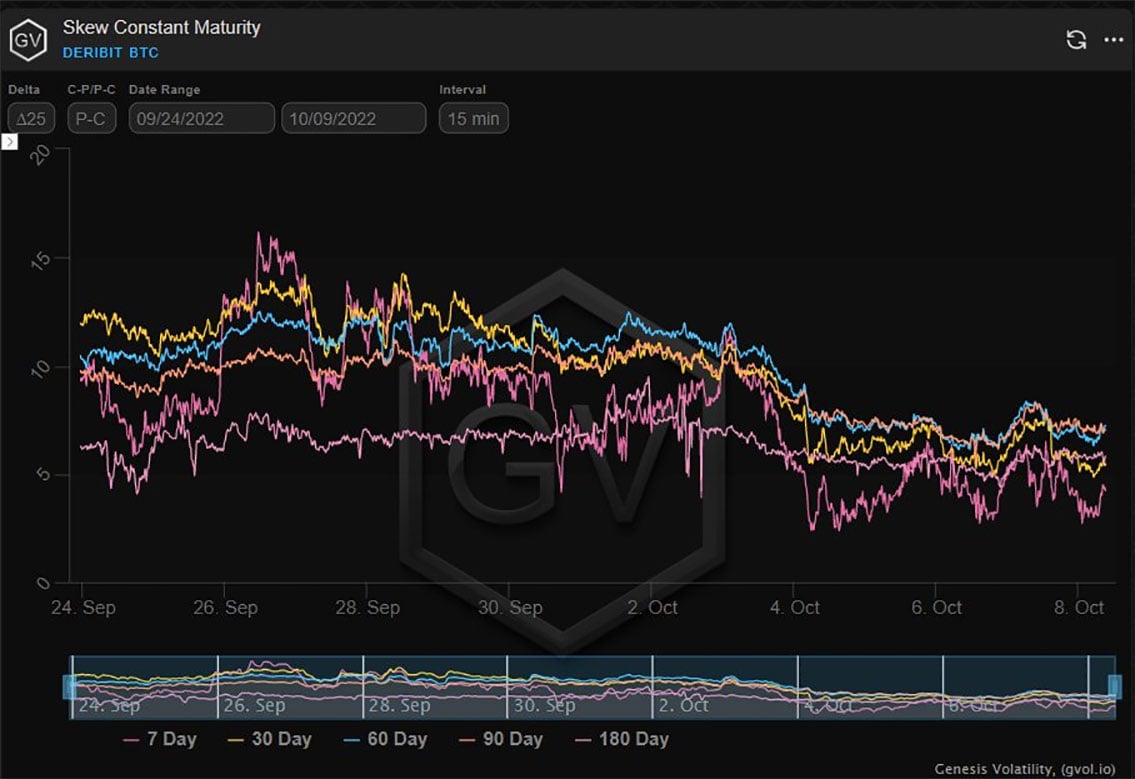

Oct-Dec Puts sold, Oct Calls bought, both taking advantage of elevated Skew previously highlighted.

OTM Call butterflies bot.

Calls +ve exposure, but environment cautious.

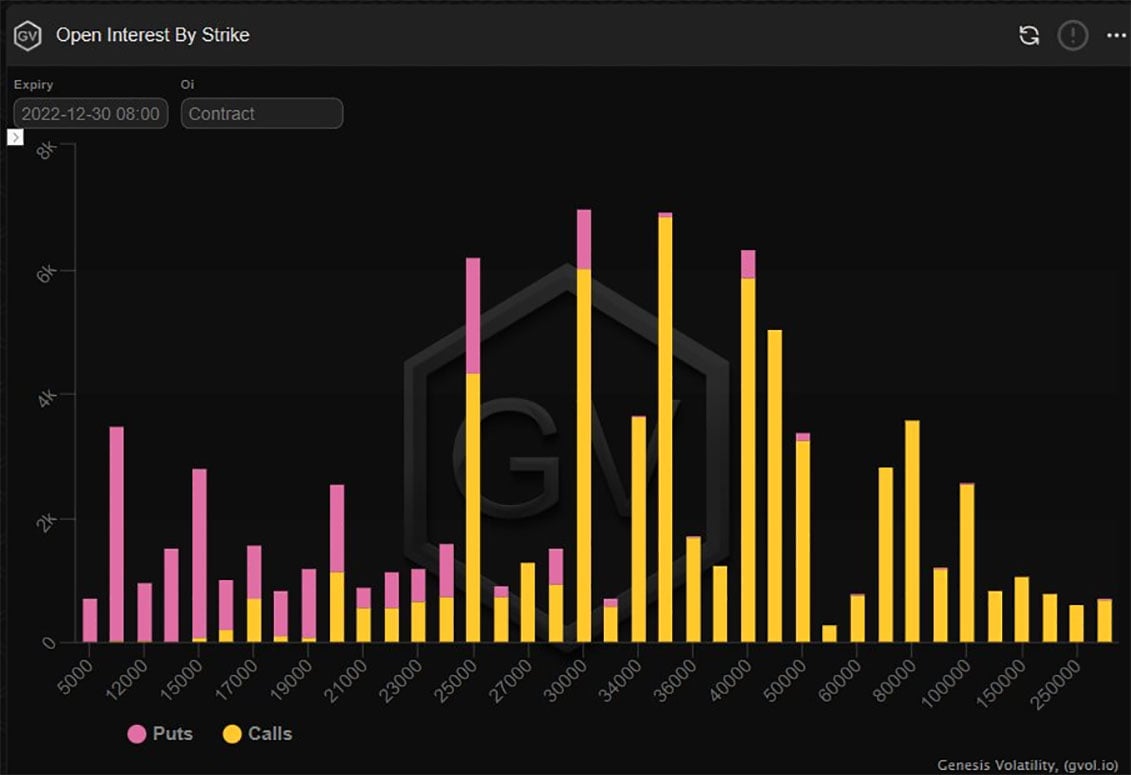

2) Oct28 17+18k Puts, Dec 14k Puts sold later yesterday, Oct28 22-24k Calls bot in the last few hours blocked and on DB order-book screens.

Adds to previous Oct Calls bot, funded by Nov 28ks.

Small IV impact, as Puts sold offset by Calls bot, but Put Skew moved materially lower.

3) Call butterflies, once the domain of pre-Merge ETH, now making some presence in BTC in the Dec maturity.

Over the last week Dec 3-3.5-4k bot 2k.

This morning Dec 2.5-3.3.5k bot 1k.

Relatively small outlays, betting on a high reward-risk ratio should an EoY rally materialize.

View Twitter thread.

October 8

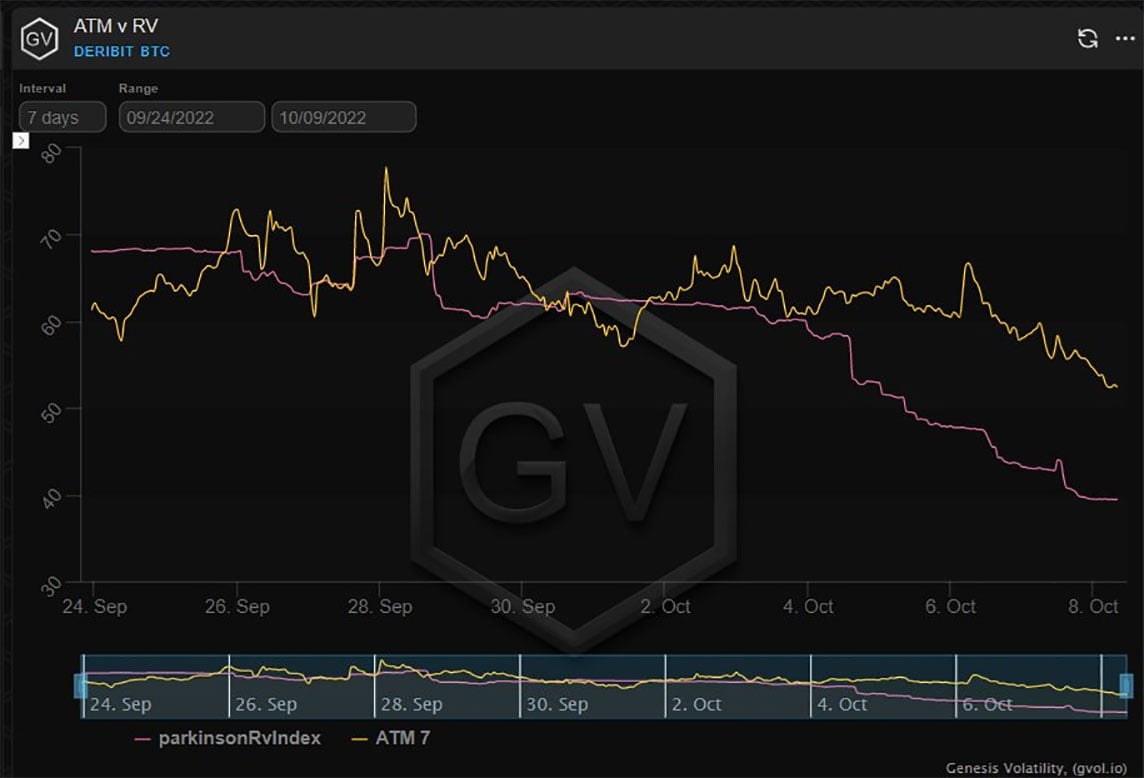

Risk premiums (IV+Skew) hit hard, as Core Crypto Beta fell relative to historic and shrugged off large moves in US risk indices.

2day IV <35%, 1week IV 50% seem paradoxical within the Macro narratives but IV>RV and Option dumping yesterday support adverse Gamma+Hedge unwinds.

2) Low volume Option Block buys disguise the bigger picture impact from Deribit Screen Order-Book (DSOB), as 20-24k Calls (Dec x1k) dumped on rallies, Oct-Dec 16-18k Strike Puts sold on the breaks, combined with range of smaller Blocks.

Long Gamma holders fed up with performance.

3) On Spot breaks where we have seen Put buying before, now there is an urge to cut losses on Long Put exposure and less appetite to buy as the downside [BTC 19k, ETH ~1.3k] seems so well supported despite US indices taking a 4% bath.

Put Skew hit, down from highs; but positive.

4) IV trading a premium to RV at the short end.

Term-structure Contango makes absolute sense.

Longer-dates are also being dragged down.

BTC EoY ATM IV 65%.

ETH Dvol > BTC Dvol now down to 15% from 40% pre-Merge.

Put/Call spreads become alternatives to outrights if IV unsure.

View Twitter thread.

AUTHOR(S)