In this week’s edition of Option Flows, Tony Stewart is commenting on IV-related Gamma spiked, Call Skew firmer, but medium-term IV+Skew steady.

October 26

A sharp release of the rangebound trade to the upside creating ~$1bn of Delta1 liqs, but very little in the Options space, and only limited new premiums put to work so far. Flows specific to Oct28 exp.

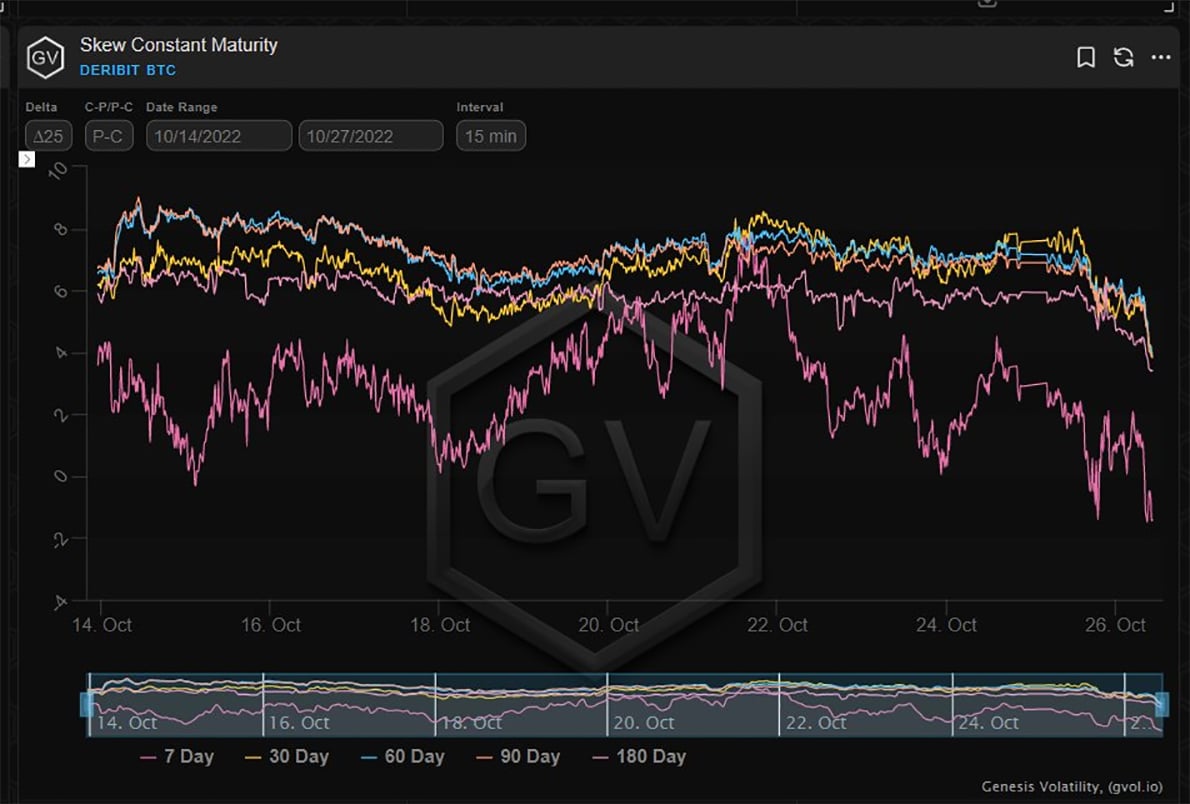

IV-related Gamma spiked, Call Skew firmer, but medium-term IV+Skew steady.

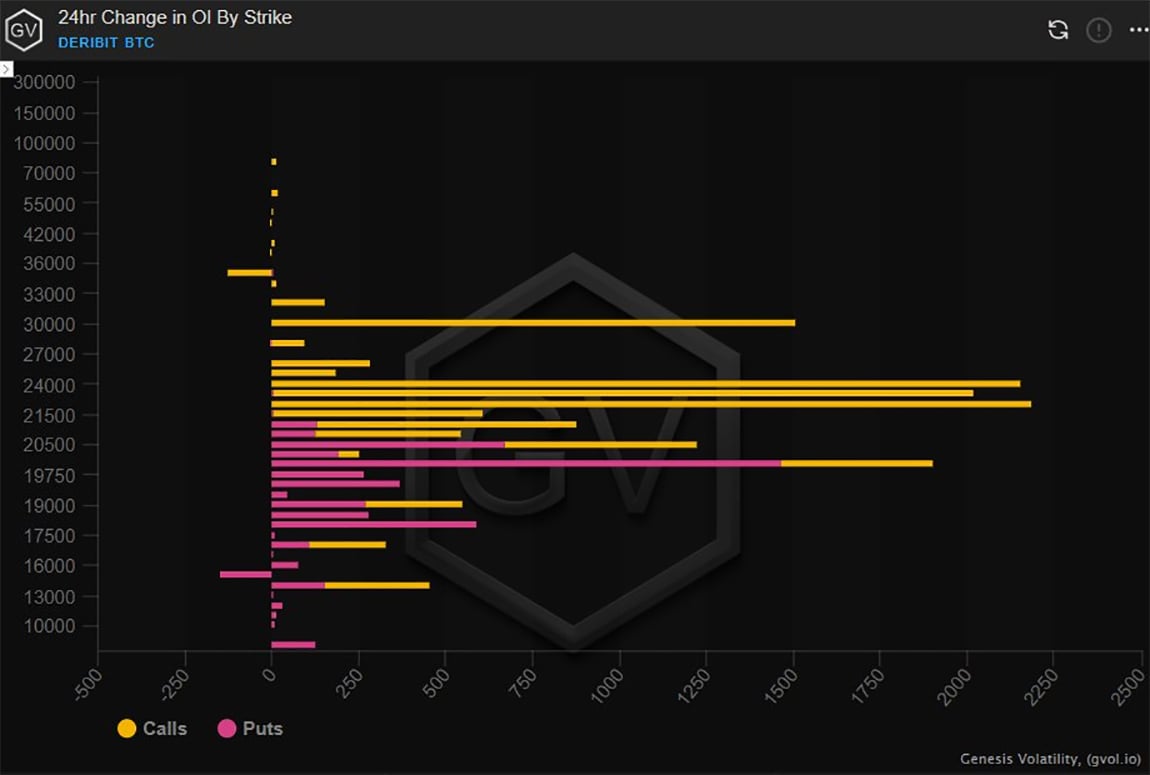

2) With the monthly expiry only a few days away, a surprise move from very low IV levels <45% created 2way Option flows, with heavy focus on the 20k Strike.

Block buyers of Oct28 20-21k Strikes, with 2-way flows on DSOB summarized a combination of short+long cover Gamma exposure.

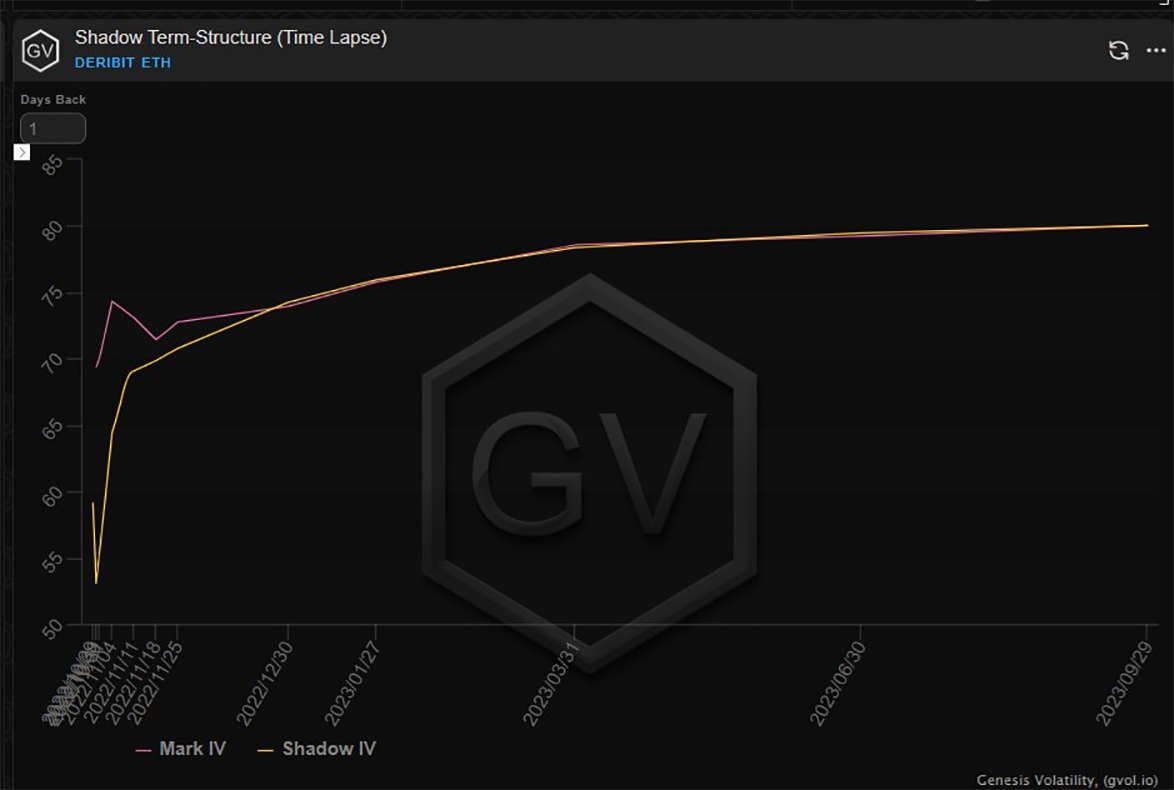

3) ETH was the outperformer in Realized Vol, and therefore spiked the most in terms of Gamma maturities, 7day IV up >20%. Longer maturities followed more than BTC, but this was a reaction to RV, rather than new Option flows.

We know about existing large ETH upside strategies.

4) Skew has been impacted by Put hedges prior to rally, so still remains positive to the Puts.

But the strong breakout, had some effect on the near-dates, just as it did with IV. Calls vs Puts in the near-date maturities now flat, on the 25delta measure.

Spot/leverage-led move.

View Twitter thread.

October 29

Traders couldn’t wait to dump Vol, with expectations of range being set >20-21k, 1.5-1.6k.

Puts sold on DSOB, Strangles+Straddles sold on blocks.

But as IV reached a low, Bulls bot Wknd+Nov4 21.5k Call, Nov Call spreads +funded BTC Nov 24k +ETH Nov 1.9k Calls.

Wknd momentum.

2) With Core Crypto being restrained within ranges recently, IV has sold off, and any spike has been sold into aggressively.

Furthermore, weekends have been dead, so the urgency to sell off long vol positions into and after the monthly expiry was strong.

Most of this was on DSOB.

3) But with corporate bad news being shunned, ETH narrative becoming louder, and Twitter purchase injecting some vibe into Doge-related protocols, a sense of positivity has returned.

This manifested in Alts rallying and strong buy side for Nov Calls in BTC+ETH.

Call Skew firmer.

4) Buyer of ETH Nov18 1.9k Call (funded by Dec 3k Call) x14k was the largest block on ETH.

Similar on BTC, buying the Nov25 24k Call x2k funded by Dec 30k.

Long-time readers will recognize the latter structure as a common way of selling higher IV+Strike, to fund primary Calls.

5) Also bullish were buyers of 1+2day Calls (into month end) x1k on BTC, and a buyer of Nov18+Nov 25 22-23 Call spread x1.5k. The latter is odd, given the tight spread; there is a chance it is exotic-option related.

All (inc Nov-Dec spreads) contributed to Gamma demand post-exp.

6) At first sight, a seller of ITM Calls to buy upside in Nov (19-22/23) and Dec 17-26 in BTC, appeared to either roll up Longs (taking profits, maintaining exposure), or take a spot retrace view.

But, execution was sophisticated. Speculation could also be Skew/forward related.

7) While BTC 7day RV is still at a (10%) premium to IV, ETH RV has now come back in-line, and ETH-BTC DVol widened out to 25%.

Eyes on Fed Nov2, to see any change in Powell’s language wrt future rate moves, after what the market sees will be an initial 75bps hike.

View Twitter thread.

AUTHOR(S)