In this week’s edition of Option Flows, Tony Stewart is commenting on succesful Taproot integration , influencer prompted-buying of ETH and more.

November 16

Successful Taproot rollout coincided with BTC 66k.

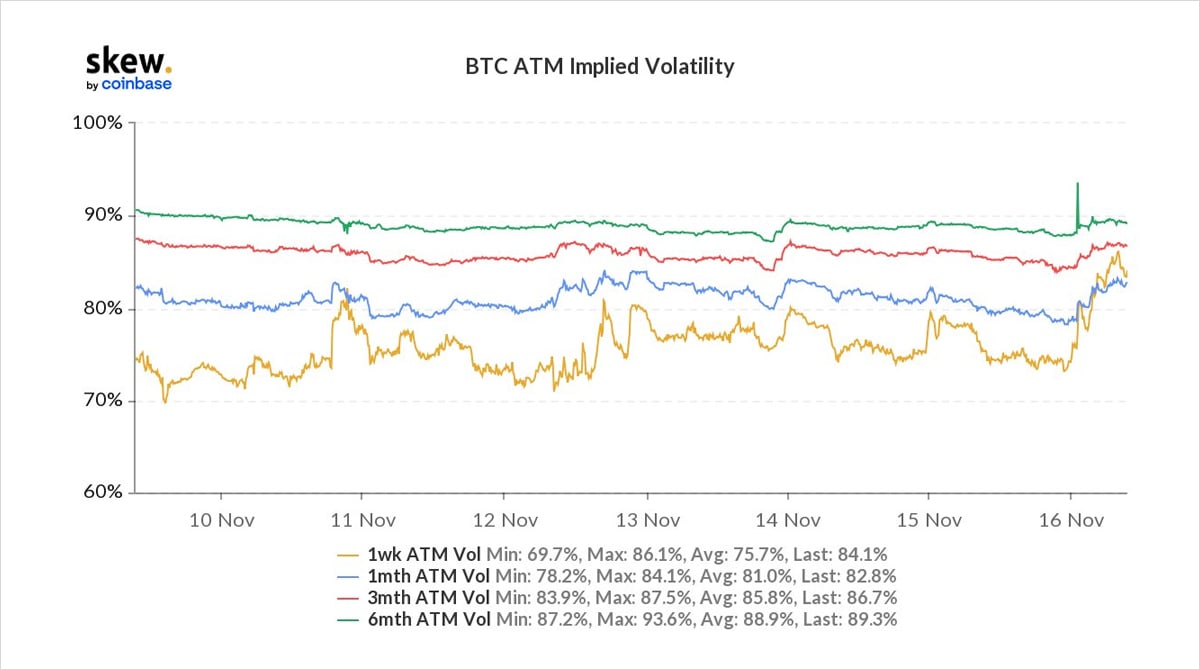

But since, Fund Option flow has been cautious.

Protective Nov 63-66k Puts bought last week still active, ETH March Risk-reversal (Put buyer) and change of heart in Dec 90k Calls, a consequence of challenging spot resistance.

2) Influencer-prompted buying of ETH Mar 15k Calls a couple weeks back pumped Mar IV + Call Skew.

So to hedge a Fund portfolio, buying elevated Vol would be inefficient, but buying Puts, funded by Calls (a Risk-Reversal) is opportunistic. ETH 3k+4k Puts bought, 8-10k Calls sold.

3) Some of these RRs were structured to be zero premium, ie Put premium, fully covered by Call premium, suggesting a spot hedge rather than a technically isolated Skew play.

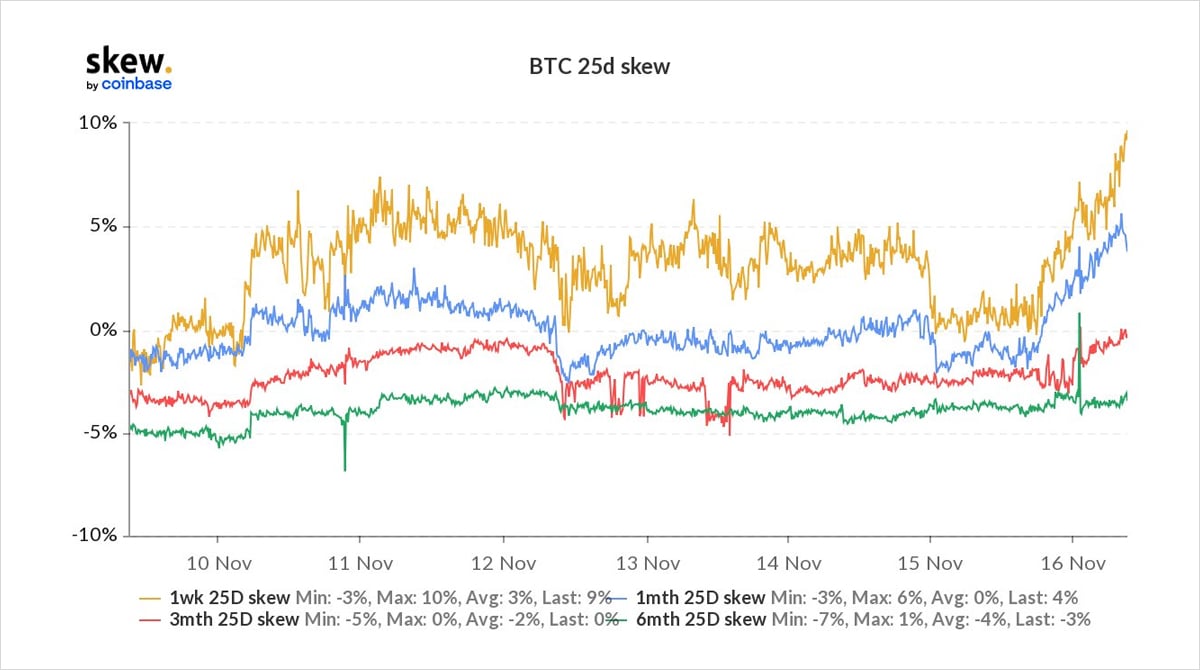

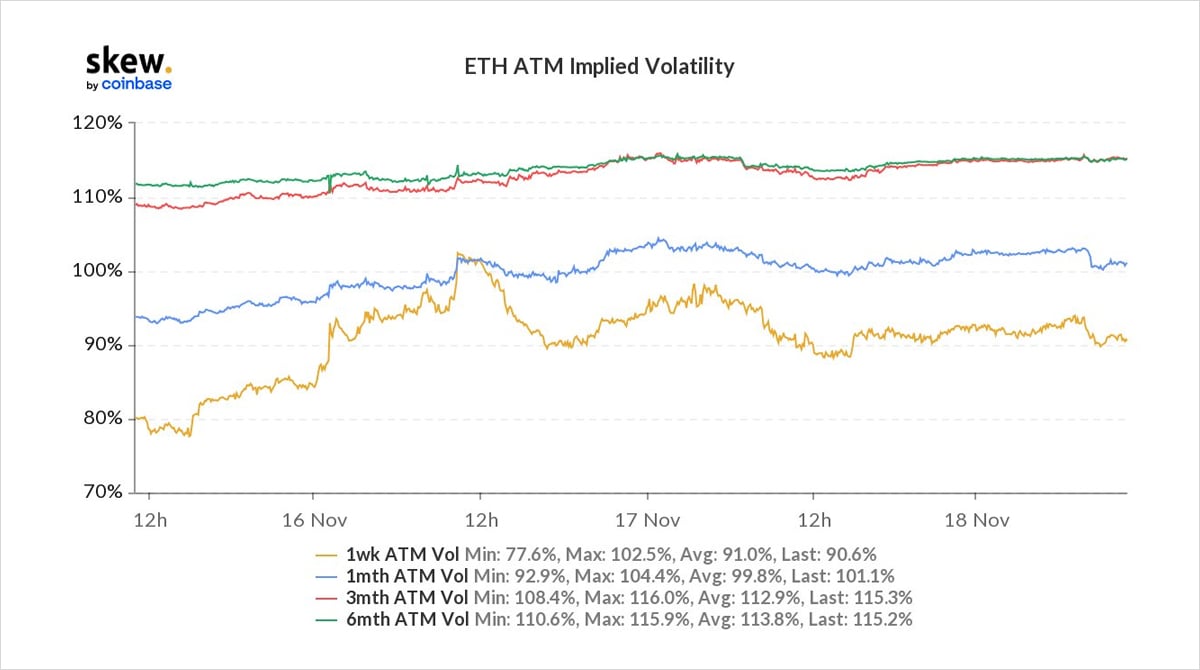

Note the 3-6m Skew (red+green) back to normal range, which is still fractionally positive for the Call.

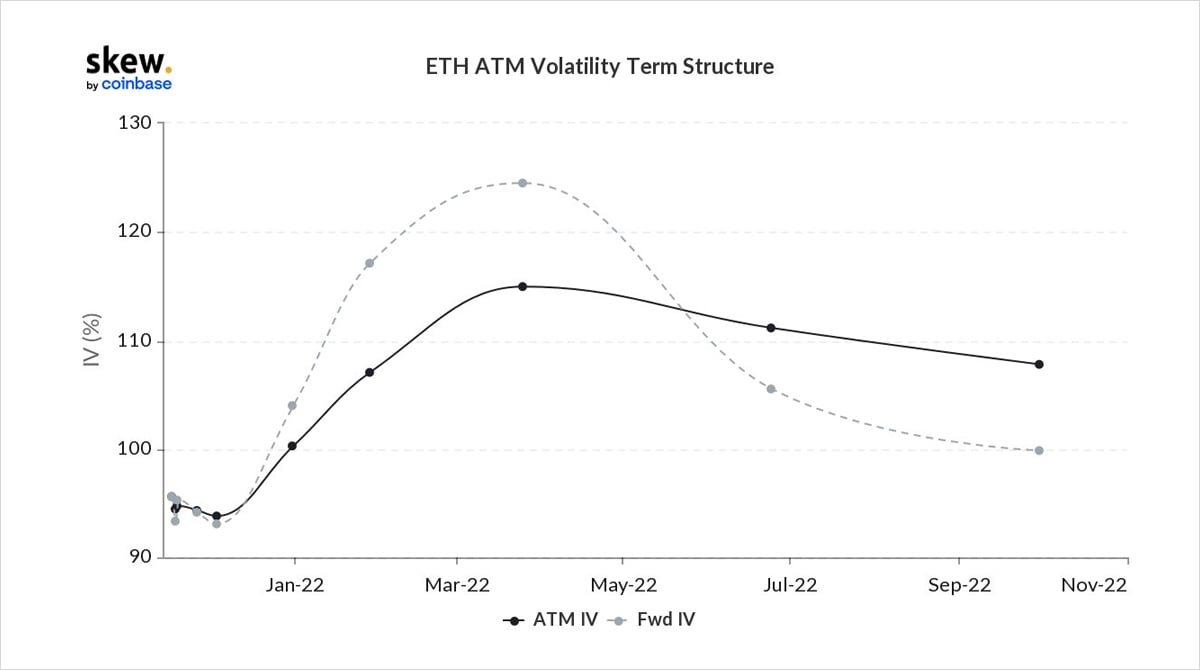

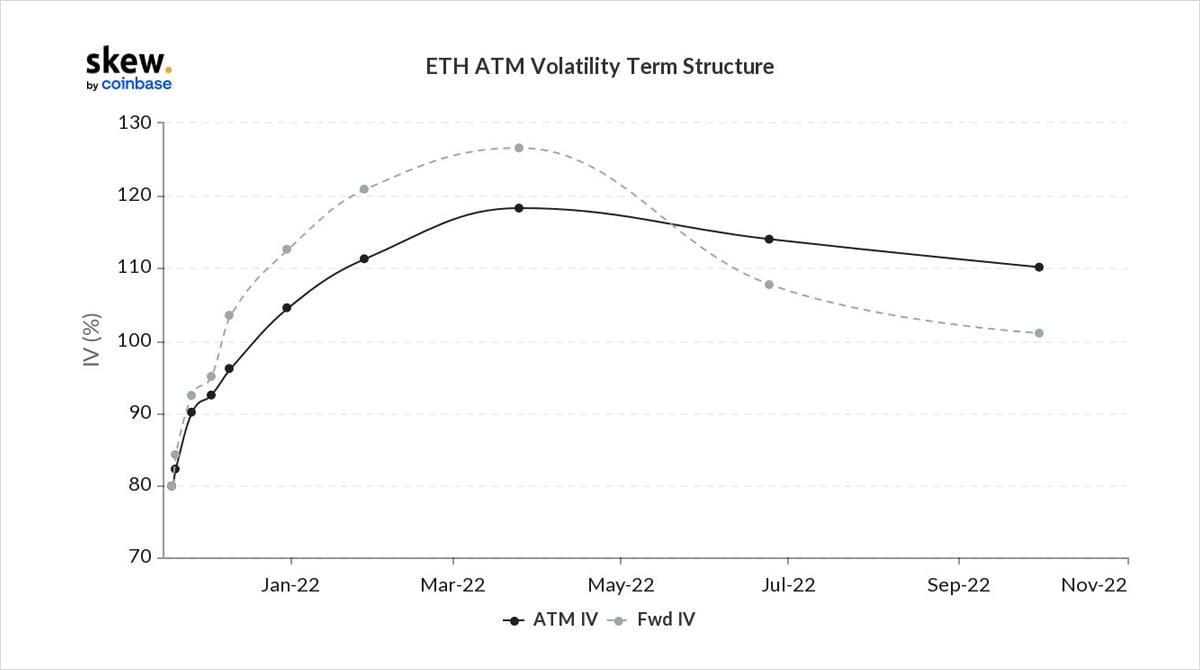

4) Note also, the bump on ETH March22 (above), as evidence of the past Call buying.

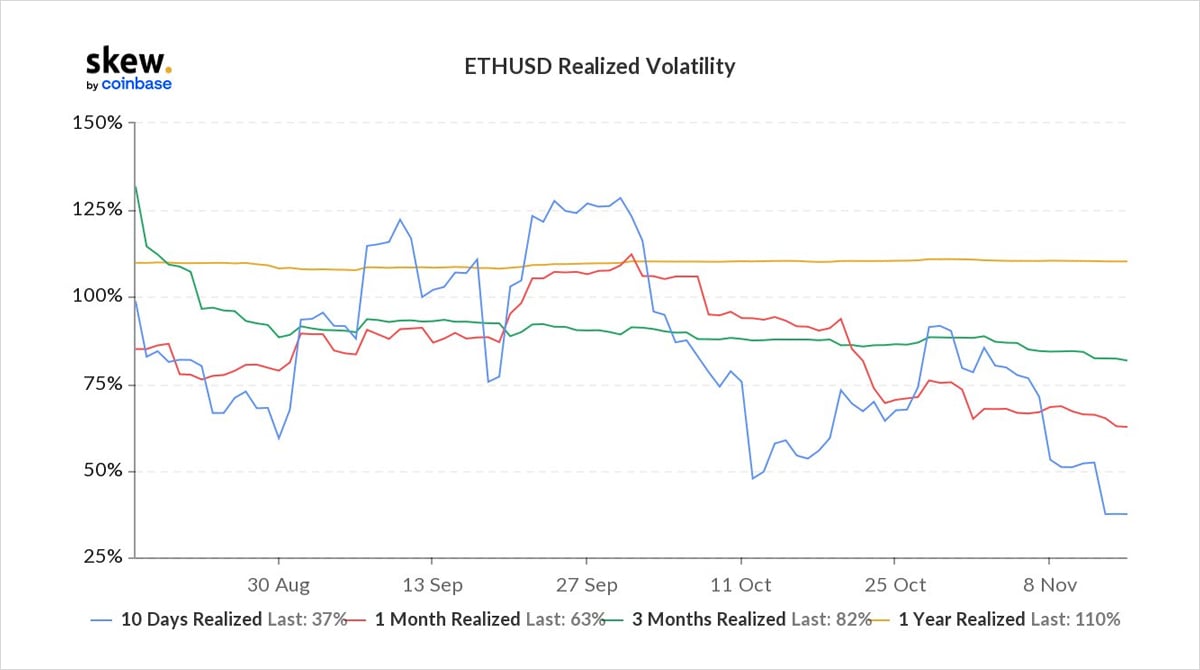

In fact, the whole curve is at a premium to Realized Vol (see below), as every day there has been buying of very near-dated ATM Options (Put+Call) which compounds with medium-longer dated buying.

5) On BTC, Dec 90-100k Call buying preceding Taproot added to a generally positive OI bias, but a lack of spot follow-through near ATHs and subsequent aggressive pullback led to a partial unwind of Dec 90k Calls yesterday and re-emerging nervousness re 60k test, lifting Put Skew.

6) Despite IV trading at a premium to RV (significant 20% near-term), traders with short gamma are being tested as a few days of calm are intertwined with a large move, whether testing ATH or retracing back to key support.

As always, be wary and/or opportunistic at boundaries.

View Twitter thread.

November 18

From last week’s caution to new optimism, as large Dec Call purchases made in ETH 5k+6.5k & BTC 64k+75k strikes.

Timing+block style suggests one Fund looking at premium spend to outperform peers, whether contemplating current spot levels as support or an upcoming Santa rally.

2) $10m total premium allocated to 12k ETH 5k Calls, 10k ETH 6.5k Calls, 500 BTC 64k Calls, 400 BTC 75k Calls, all expiring 31st Dec21.

Executed via @tradeparadigm as blocks with likely 1, perhaps 2 counterparties only, allowed the buyer to get filled and seller to contain IV.

3) Trades were executed vs 60k BTC, 4250 ETH. This outright purchase of Calls, at what we have already discussed as an elevated premium to the current Realized Vol environment, means that theta decay will be a significant burden and therefore buyer is proposing a dramatic rally.

View Twitter thread.

AUTHOR(S)