In this week’s edition of Option Flows, Tony Stewart is commenting on the market still being a mix of Risk Reduction, Capital Efficiency, and New Exposure.

November 22

The Options Market Flow still a mix of:

– risk reduction

– capital efficiency

– new exposure

as different clients have specific remits within the current Crypto crisis, and as DCG/Genesis resolves.

This mix of Flow deceives transparency.

Rare events are worth delving into.

2) During severe contagion or risk events such as the current situation the Crypto market finds itself, Funds have different objectives.

e.g.

Funds under duress need to be capital efficient and reduce risk exposure.

Funds that need to protect exposure must hedge.

MMs limit risks.

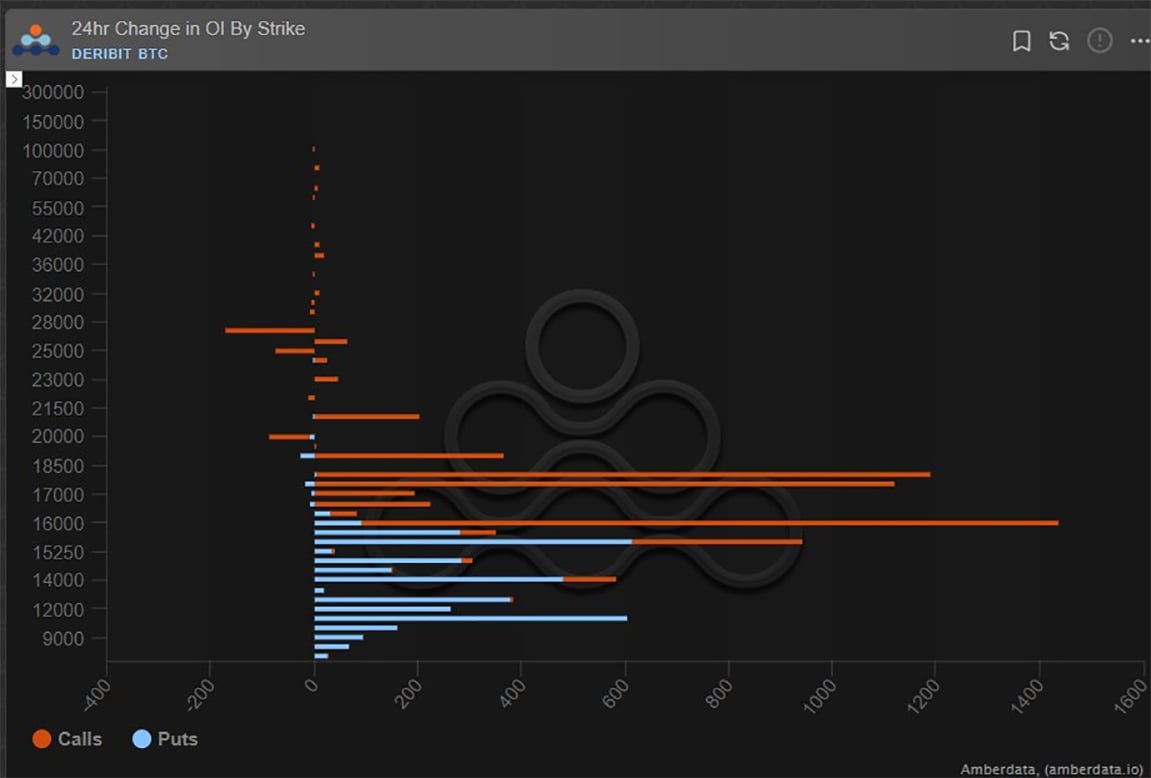

3) It is a simplification to assume that Funds or MMs can only trade the Strikes they have exposure to.

A Fund long a 15k Put bot when BTC Spot was 19k, can choose to sell the 15k Put or could sell an 11k Put to make the Put spread ~zero cost.

Former trade OI down, latter OI up.

4) A MM short gamma/vega can buy any Strike to reduce Net Risk.

Which Strike is often denoted by what is available if they are quoting, or if there is an aggressive DSOB offer.

If the aggressor, then the choice is less about direction, more about what fits their slide risk +-10%.

5) Type of trades gives us tells too.

A Fund trading a 500-point BTC put spread in Nov25 is very different from one trading in March.

The former is either sensible Strike risk-reduction to avoid Expiry risk, or TP and rolling.

The latter is more likely capital reduction of book.

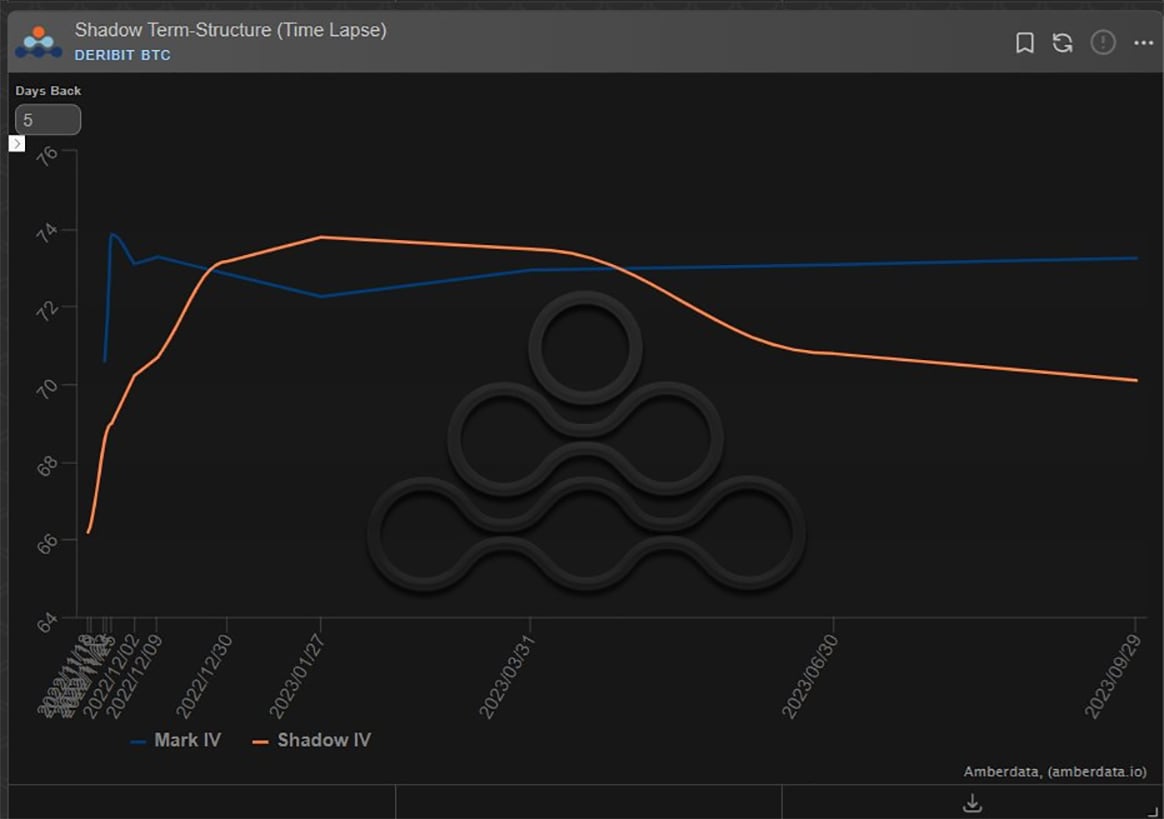

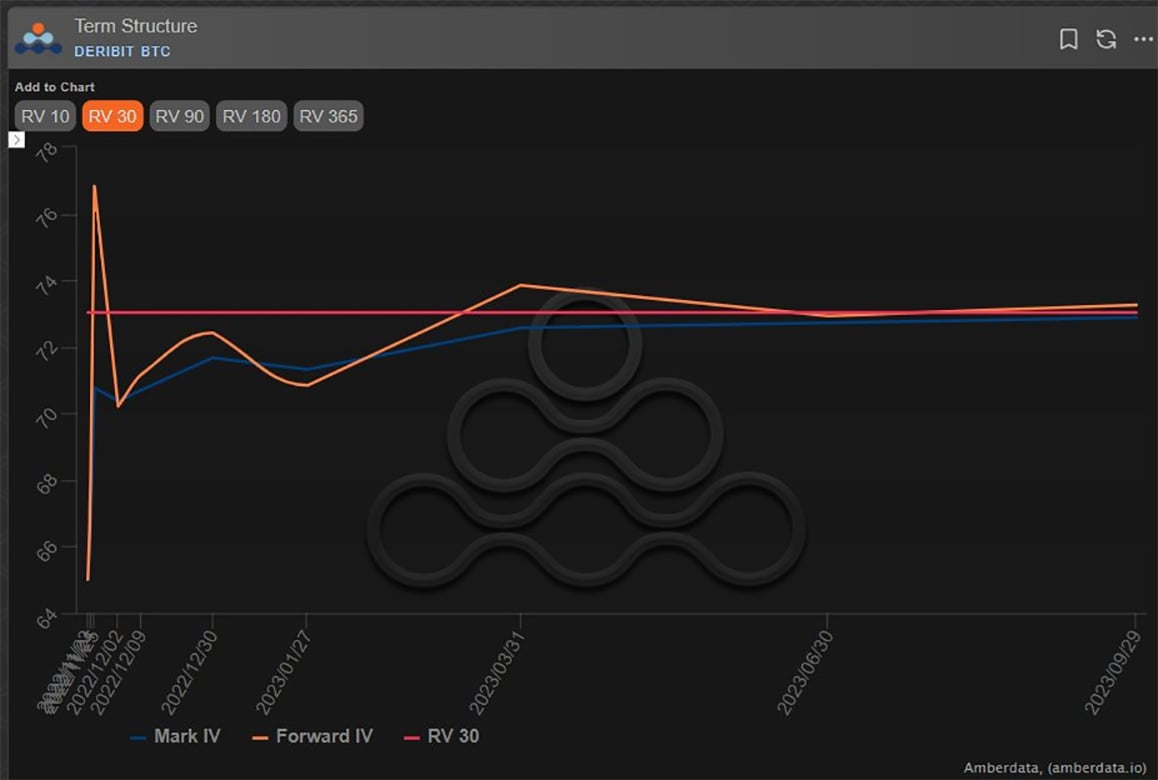

6) The Term-structure also gives us information.

If it is smooth, the Option’s market is working efficiently.

If a bump in one maturity it may be a sign of a large trade.

But if it’s a mess then there are other factors at play; often capital reduction and MM competitively unkeen.

7) If a Fund is under duress, it may wish to become more capital efficient, close Strike risk, close short vega/gamma/funding/delta positions.

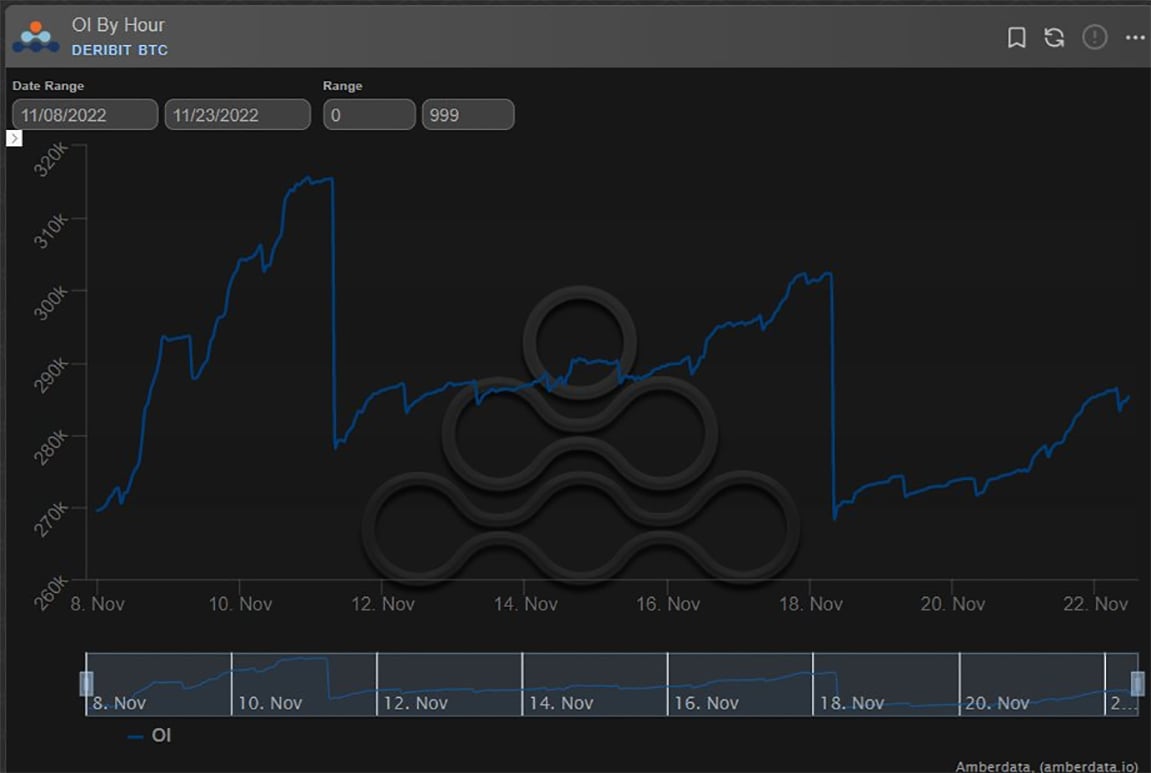

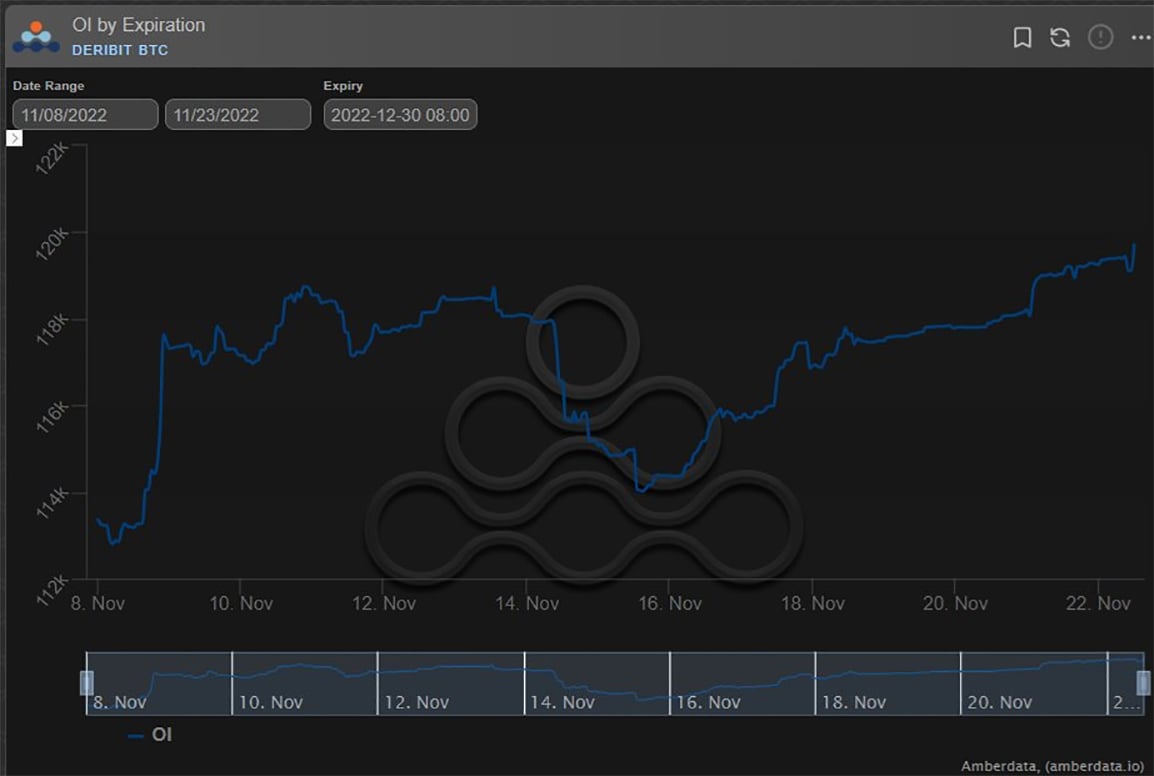

In Options, that can be observed big picture by OI.

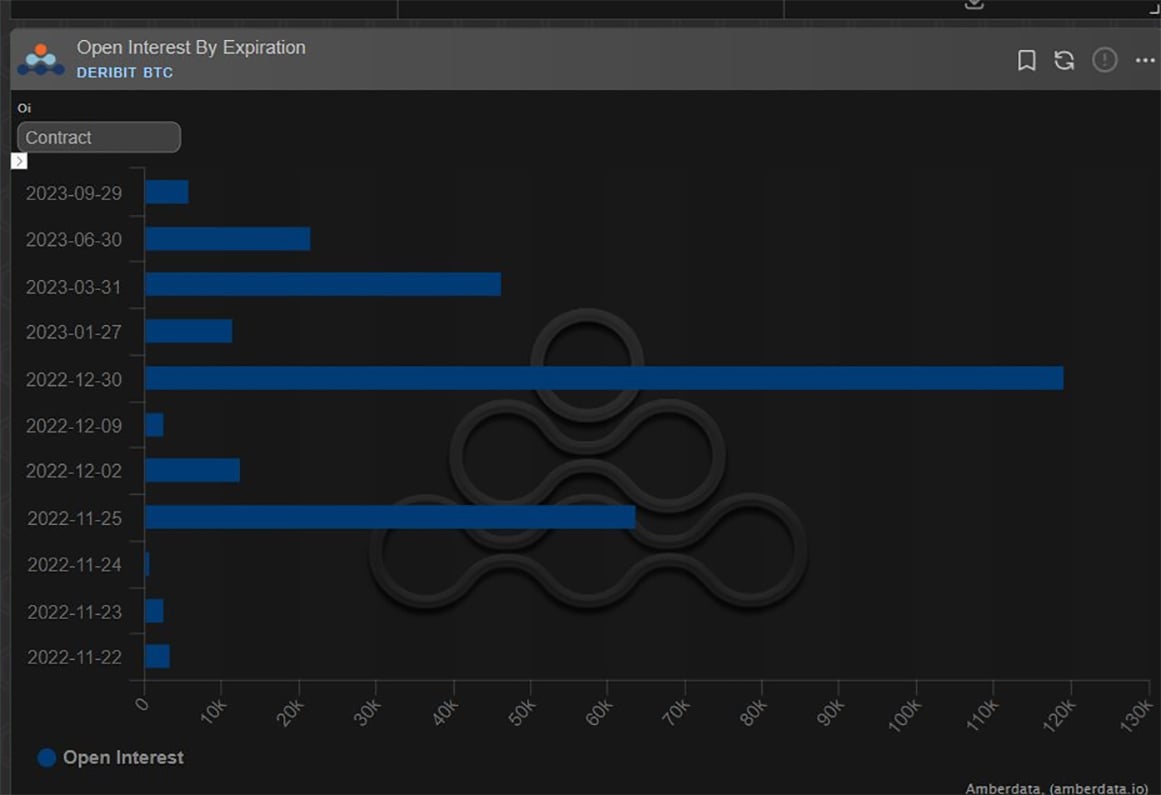

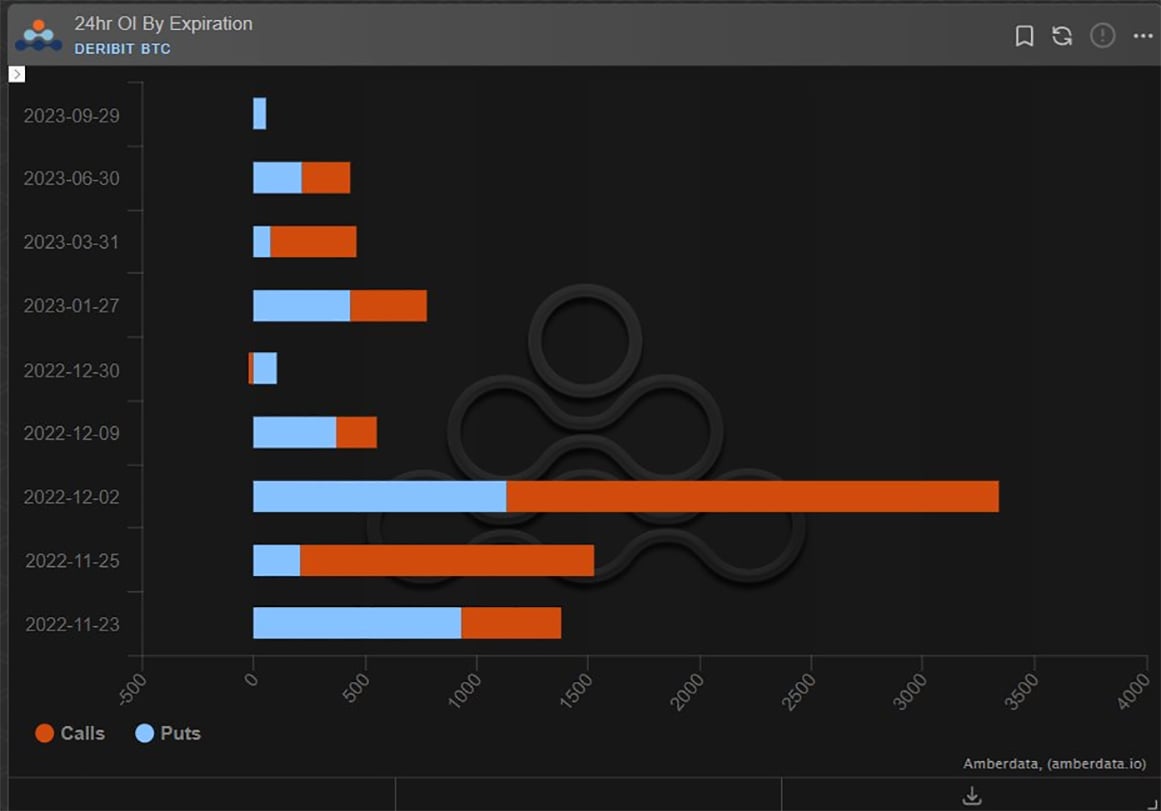

With FTX contagion+uncertainty rife, there was reduction in OI in Dec+Mar positions.

8) Execution style is a factor.

If a Fund wants to disguise its activities, then either quoting anonymously via a block, or processing directly on the DSOB are good tactics.

We’ve seen an increase in this activity.

But also if Fund wishes to show strength it could execute named.

9) So while it is very difficult to draw clear conclusions from directional Option flows that are more transparent in normal conditions, we can note a few interesting results:

10) While after each weekly expiry, OI has fallen (chart2 above) and there’s been some compression of OI in some large OI maturities (Dec30+Mar) with execution on DSOB, the recent opening of new exposure in new maturities implies some business normality.

eg Dec2 17+18k Calls bot.

11) A benign macro backdrop has allowed Crypto to be detached.

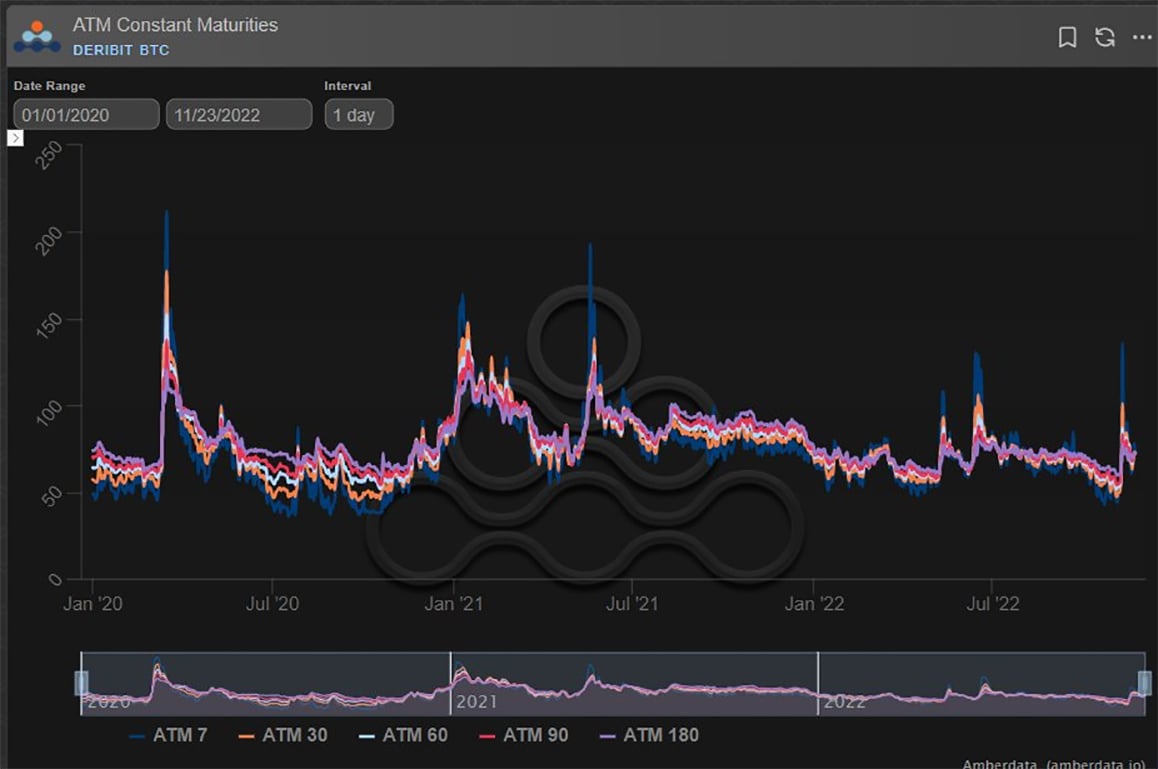

IV has fluctuated but not extremes such as in Mar20.

Currently pricing is above 7day RV due to unknown resolution of the DCG/Genesis situation.

Controlled IV likely due to subdued RV, but also negative funding -delta.

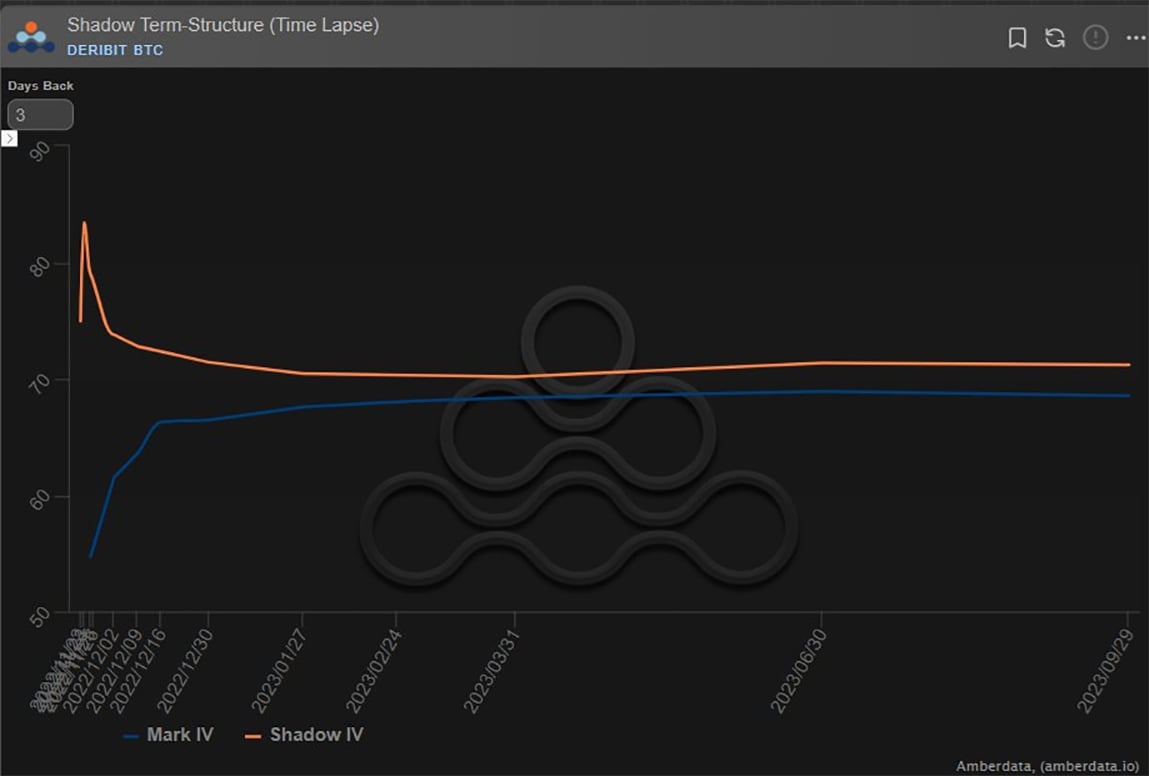

12) Term-structure is still bumpy but in a narrow range, around 30day RV [BTC]. There is backwardation at the front-end which shows a desire for gamma (or unwillingness to aggressively short) which is expected.

If normality returns to the Options market, then opportunities here.

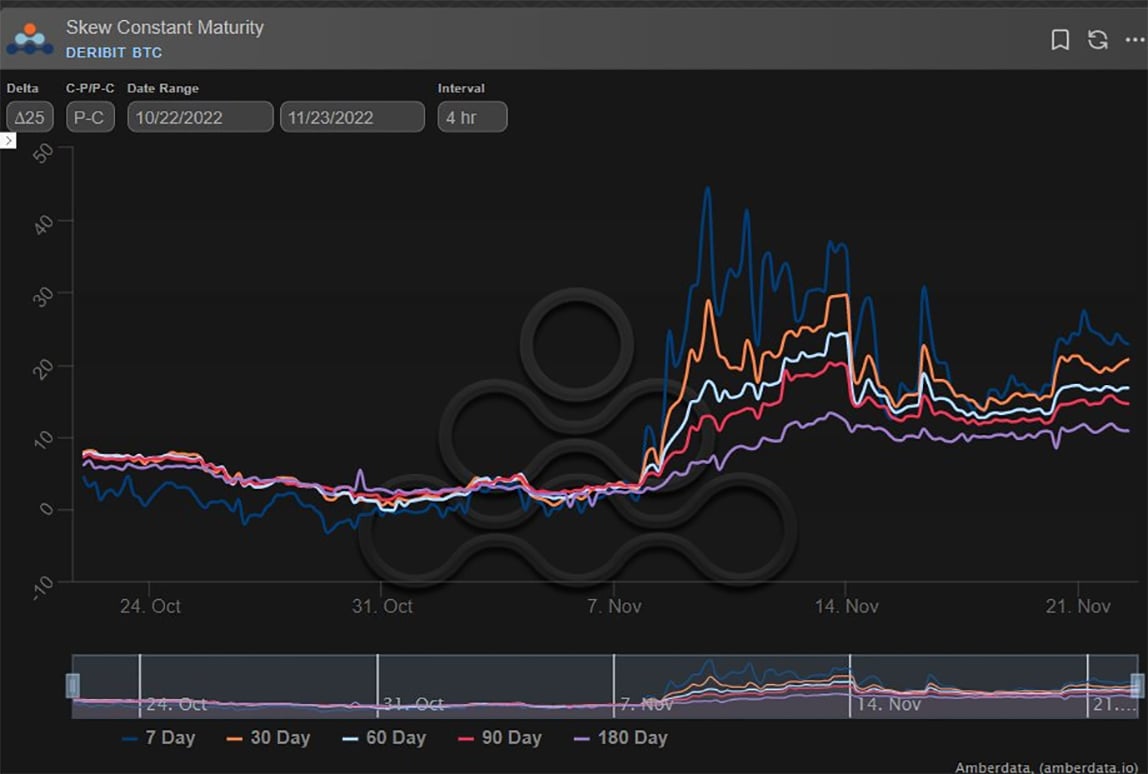

13) Skew has been erratic.

Pre-FTX fiasco, Calls had firmed to make Skew ~flat.

This was a huge opportunity for those that wanted to fade the stability, but not bet on IV; and still is but at less optimum levels.

Put Skew retraced from extremes but now still highly elevated.

14) While the Option market is acting orderly, even under some individual Fund and MM stress, the IV behavior is following previous crisis spikes.

The question of course, is this the same or different?

Institutions are under pressure, and contagion is unprecedented.

Keep Safe.

View Twitter thread.

November 24

Some improvement in sentiment as the market absorbs the DCG response, and we enjoy a reprieve.

Spot markets bounce, and if we strip out expiry+risk reduction flows, the Option market sees a continuance of Call buying Dec2 17+18k, Dec30 18+19k Strikes x2k+ into the US holiday.

2) With the uncertainty+fear in the market, manifesting itself as high Put, low Call Skew, the Call buying takes advantage of this upside relative cheapness.

But it’s also interesting to note the choice of Dec2 Calls which may well decay fast over the long Thanksgiving weekend.

3) With Skew relaxing a touch, the news flow reprieve has also allowed implied vol to retrace from a high-tension backwardation a few days ago, to a more normal contango term structure.

IV premium to 7day RV, more in line with 30day RV.

4) Even some Puts got offloaded on the rally, as a block seller of Dec30 14k Puts combined with DSOB sellers giving some supply back to needy MMs.

Whereas the Call flow was heavily one-way, the Put flow is 2way, one unfinished buyer of Dec30 10k Puts on DSOB a reminder of fears.

View Twitter thread.

AUTHOR(S)