In this week’s edition of Option Flows, Tony Stewart is commenting on cautious trading and light profit taking/rotation.

November 24

Not just kids wondering if Santa made it through the pandemic, as Call Bulls still await traditional Xmas spurt.

Options flow biased cautious, Dec3+10 52k Puts & Mar 40-100k RR bought.

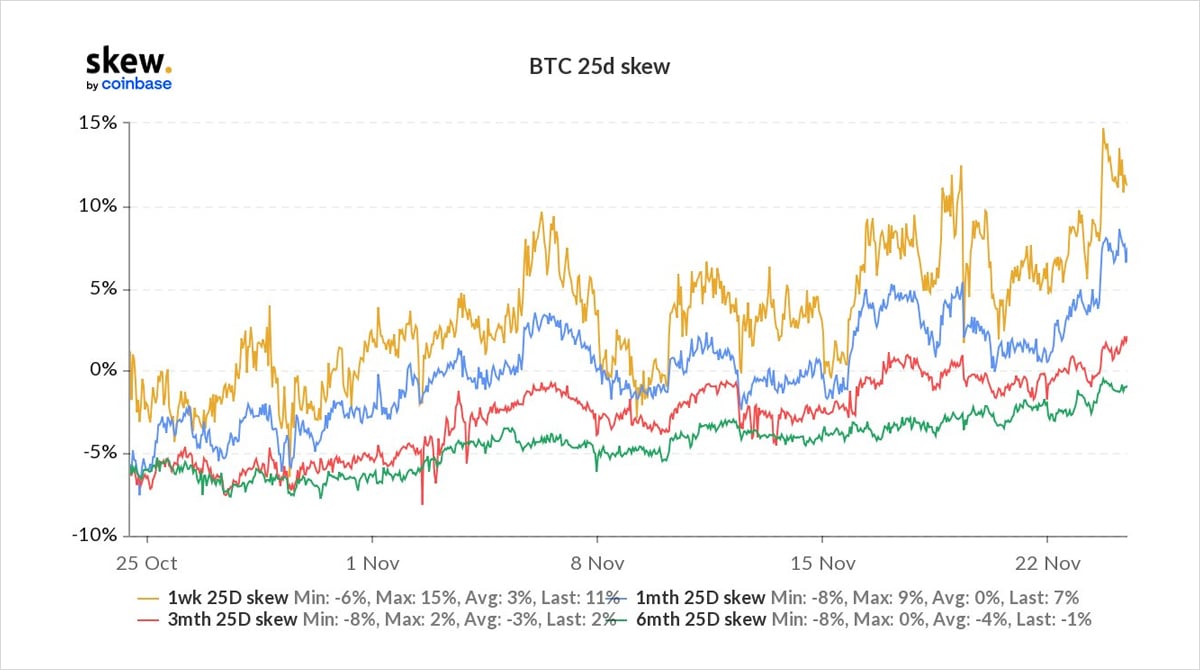

Put Skew firming.

Light profit-taking/rotation on existing Put hedges.

Thanksgiving ahead.

2) Outright Put buying Dec21 + Risk-reversal accumulation Jan-Mar22, combined with the sale of a Dec 60k-48k-36k Put fly has re-inforced firming Put Skew across the curve;

3-6month Skew flat/constructive, but short-term nerves/sentiment weak, whether protecting or bearish stance.

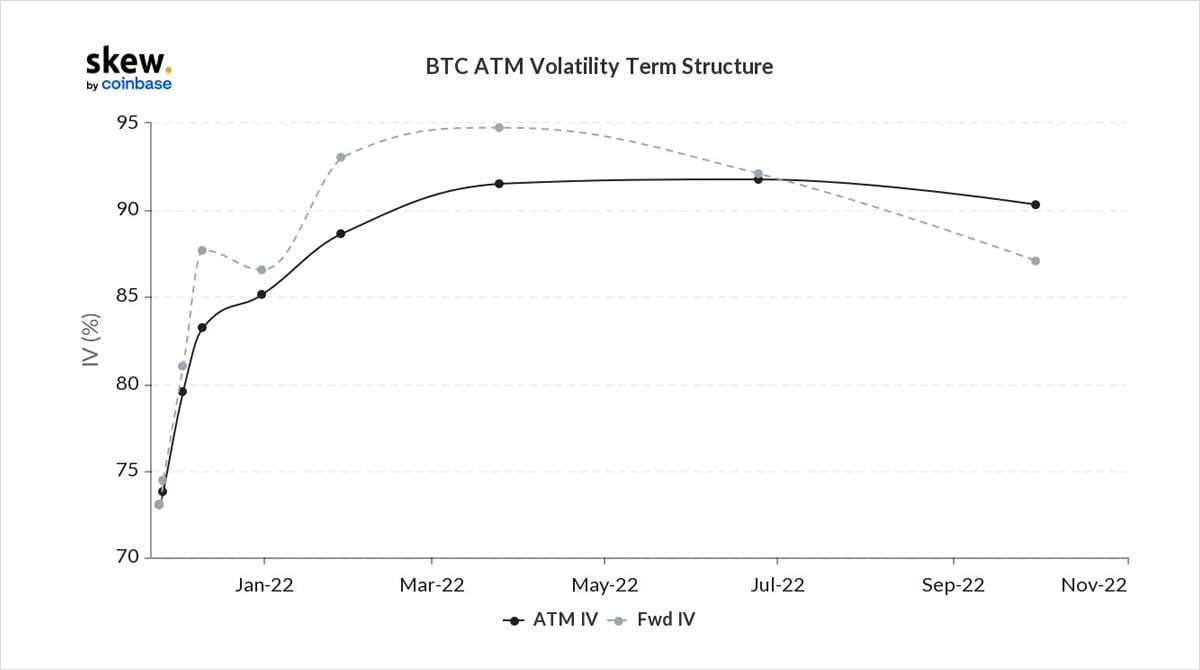

3) IV lacklustre, responding to flow supply/demand, but conflicted ahead of Thanksgiving long weekend.

In legacy mkts, often see IV crushed as theta burden heavy and markets close.

But in crypto, markets open; less liquid – can be dead or wild.

Consequence – steepening contango.

View Twitter thread.

AUTHOR(S)