In this week’s edition of Option Flows, Tony Stewart is commenting on Tesla’s announcement of $1.5bn Bitcoin Treasury allocation.

February 9

Tesla’s announcement of $1.5bn Bitcoin Treasury allocation sent spot surging >20% from 39k-48k.

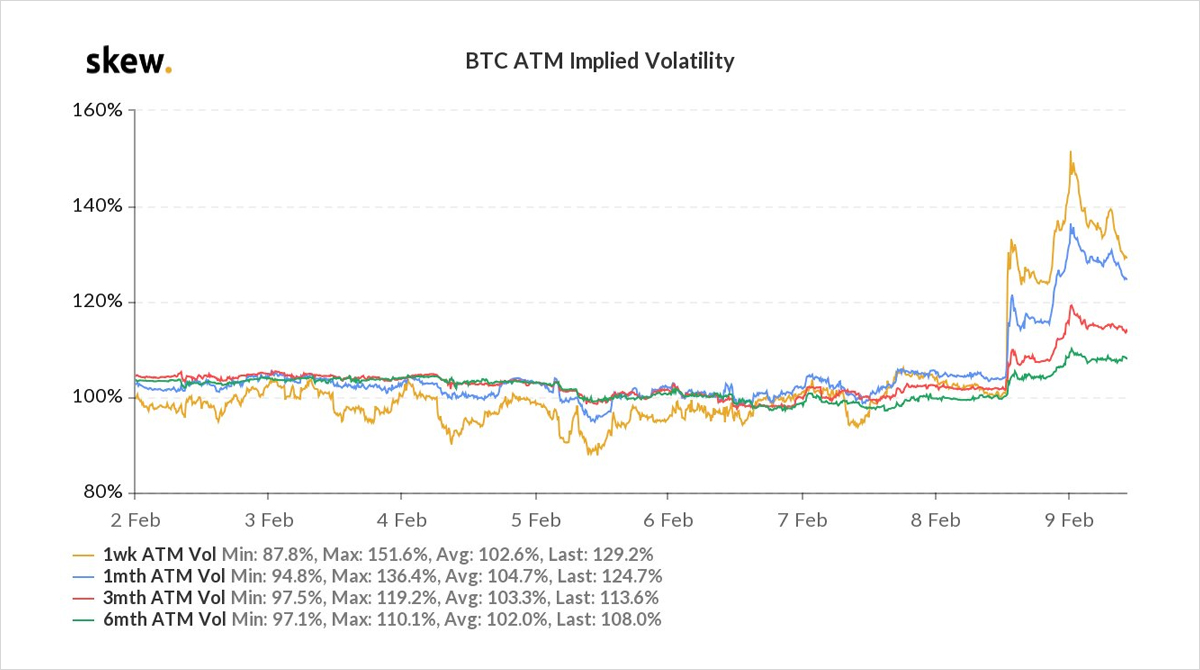

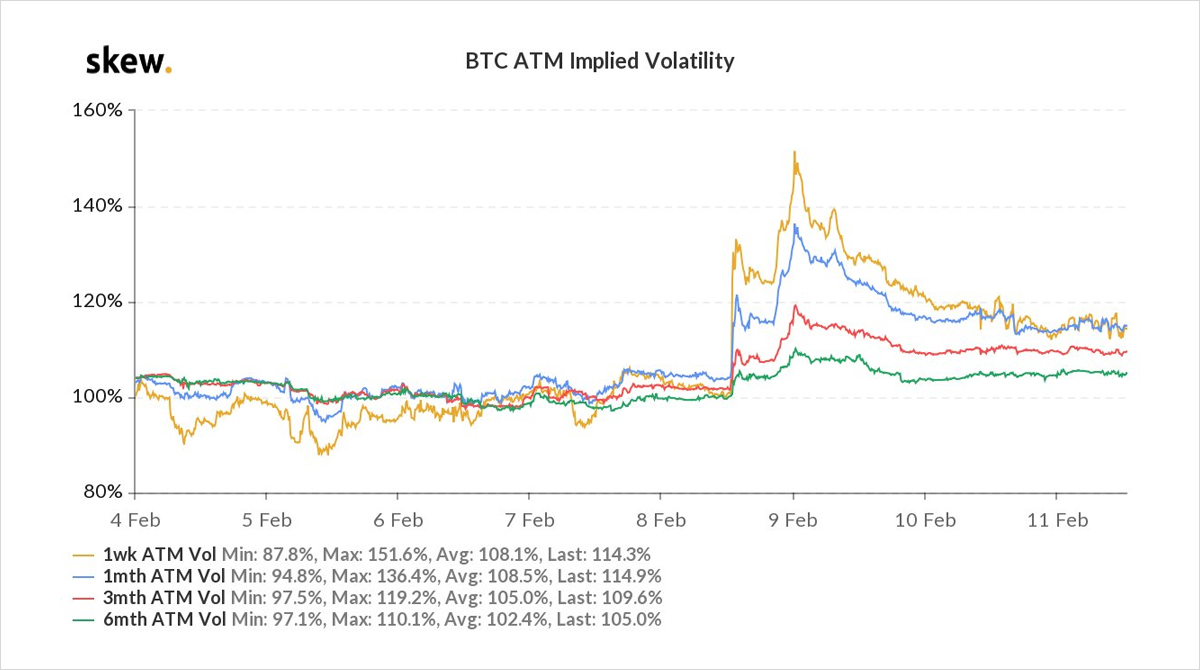

Short-term Option vol pumped in response.

Then as BTC broke 44k, large buyers x2.5k+ of Feb12-26 44k-52k Calls lifted offers, IV surging >150% at its peak before cooling overnight.

2) BTC 32-40k comfort zone was short-lived; so was <100% Implied Vol. The market needed an Elon-esque announcement to break ATHs and the Tesla news was it.

Risky Put selling rewarded, but there is now a dilemma for those short Calls: large ITM and approaching OTM Short Strikes.

3) Straightforward opportunity for Long ITM Calls:

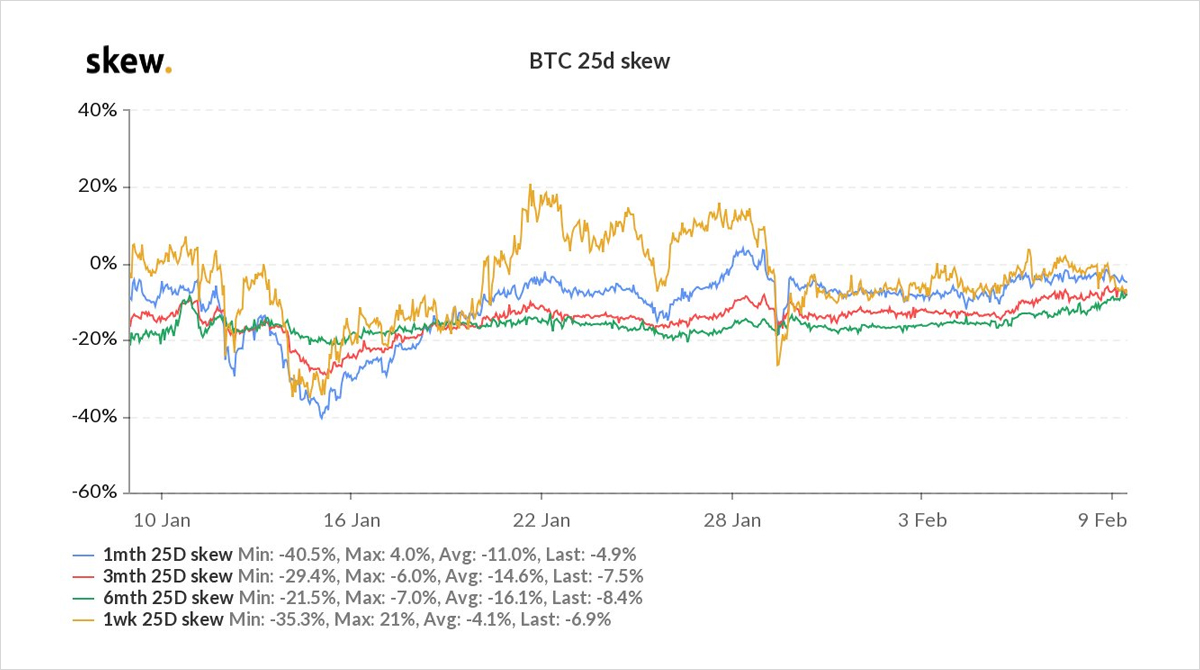

Prior ‘Yield enhancing’ sellers of OTM Calls >50k have created a surprisingly flat OTM Call skew given the ATH breach; MMs are saturated with upside Calls.

This presents an efficient way to take profits + roll-up Call exposure.

4) Asia-hours allowed a cooling-off period; BTC spot retrace from the highs and Implied Vols have drifted lower on relatively low Options volume.

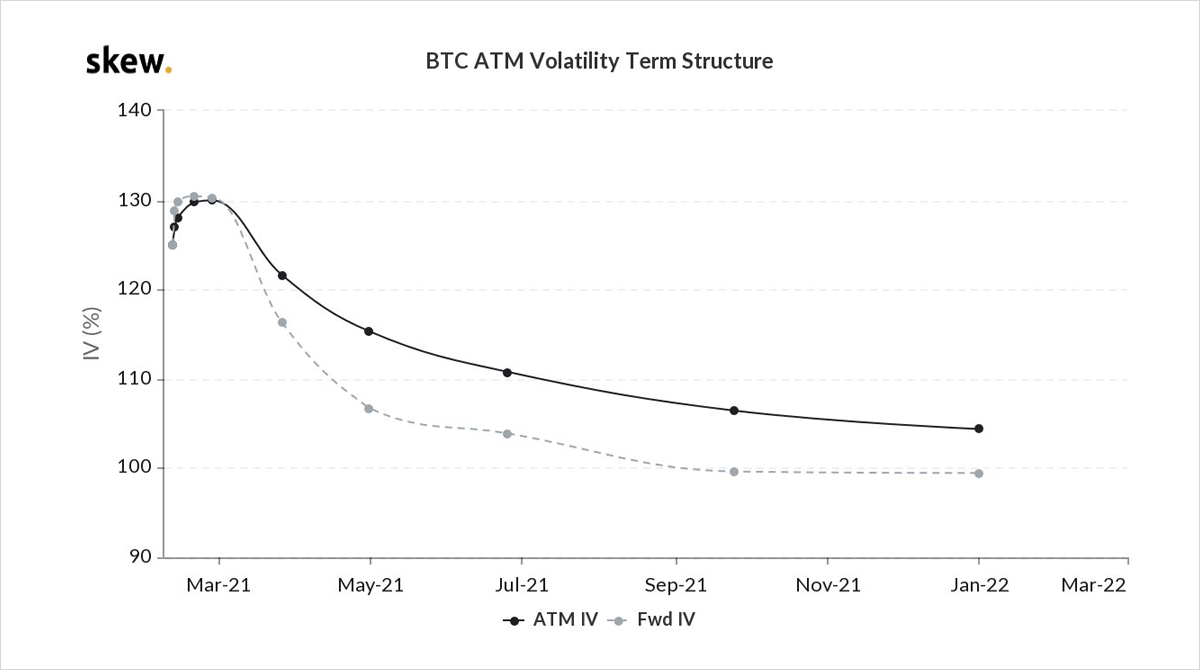

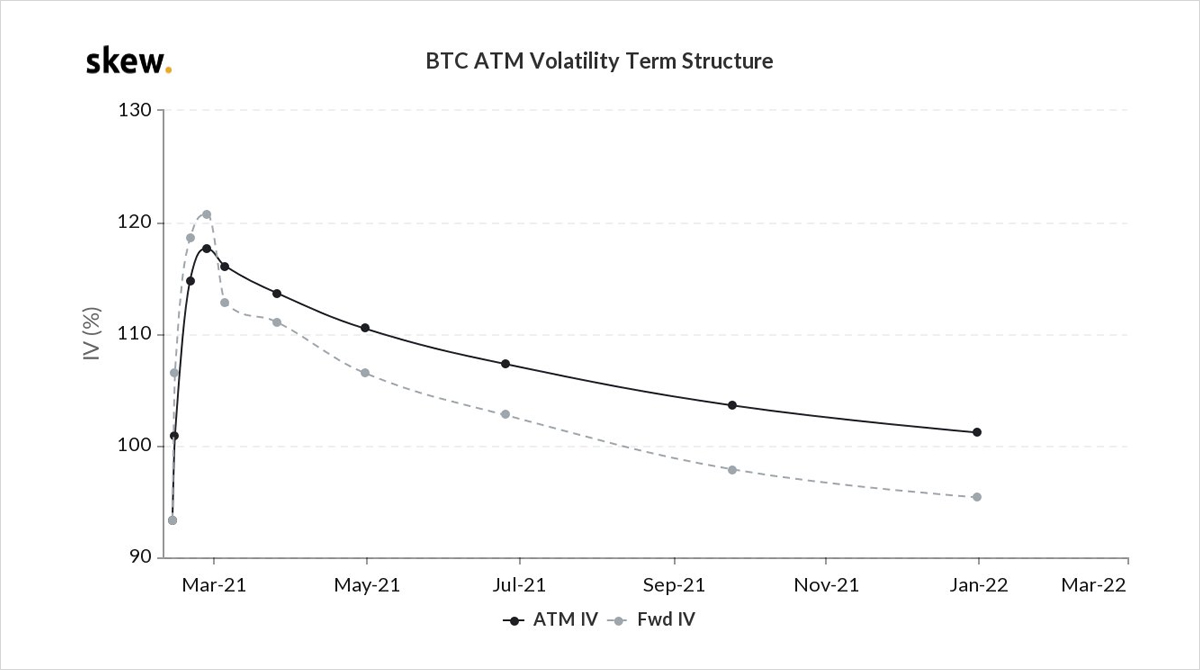

Options term-structure remains in backwardation, expecting further moves in-line with 10d Realised Vol >125%.

Beware the unexpected.

View Twitter thread.

February 11

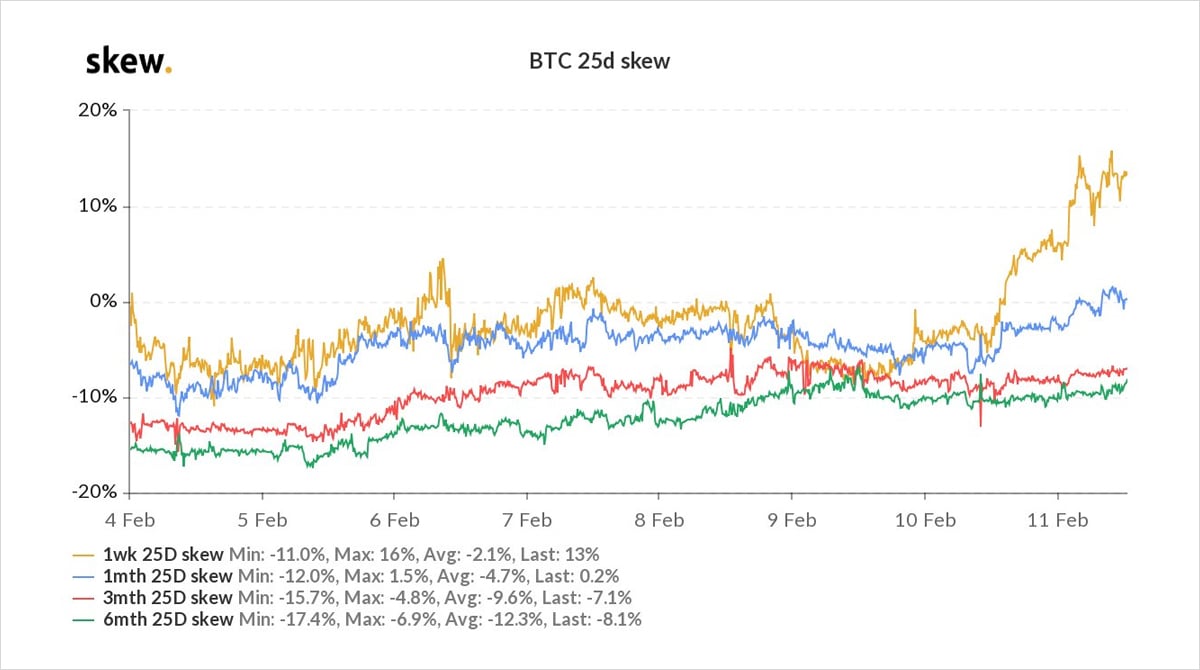

While BTC pulled back 10% from ATH, Feb Implied Vol pruned, suggesting gamma impacted players flat-long post-Tesla news.

Options volumes exploded in Asian hours: Calls unwound, buyers near-OTM Puts x3k, bearish bias as BTC<45k.

But MC +BNYMellon news has flipped bias +ve >46k.

2) While BTC pulled back 10% from ATH, Feb Implied Vol pruned, suggesting gamma impacted players flat-long post-Tesla news.

Options volumes exploded in Asian hours: Calls unwound, buyers near-OTM Puts x3k, bearish bias as BTC<45k.

But MC +BNYMellon news has flipped bias +ve >46k.

3) Then came the rolling exposure as Feb12th Options moved to Feb19th expiry. First, 42k Puts; then large blocks of Feb12 40k Call long moved to the Feb19 46k x700 taking profits and maintaining upside notional.

But this flow was offset by Feb26 44k x600.

Net impact: vol steady.

4) Given the large moves in the underlying, it’s not surprising to see Term Structure in backwardation still, although the initial drift in IV was likely a consequence of market positioning and active Feb12th expiry unwinding, which has dragged Feb19th lower too ahead of wknd.

View Twitter thread.

AUTHOR(S)