In this week’s edition of Option Flows, Tony Stewart is commenting on high leverage and funding during the CNY.

February 15

BTC >50k always going to be challenging the first time.

High leverage+funding during CNY+US long-wknd liquidity, significantly accelerated the drop to 46k.

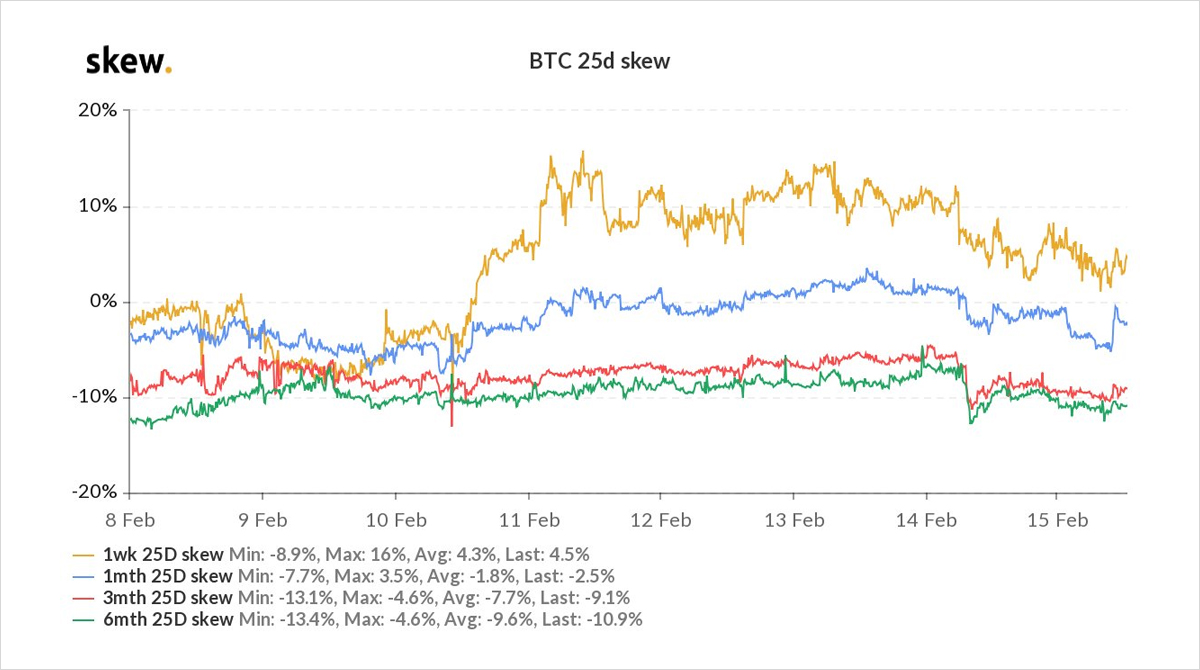

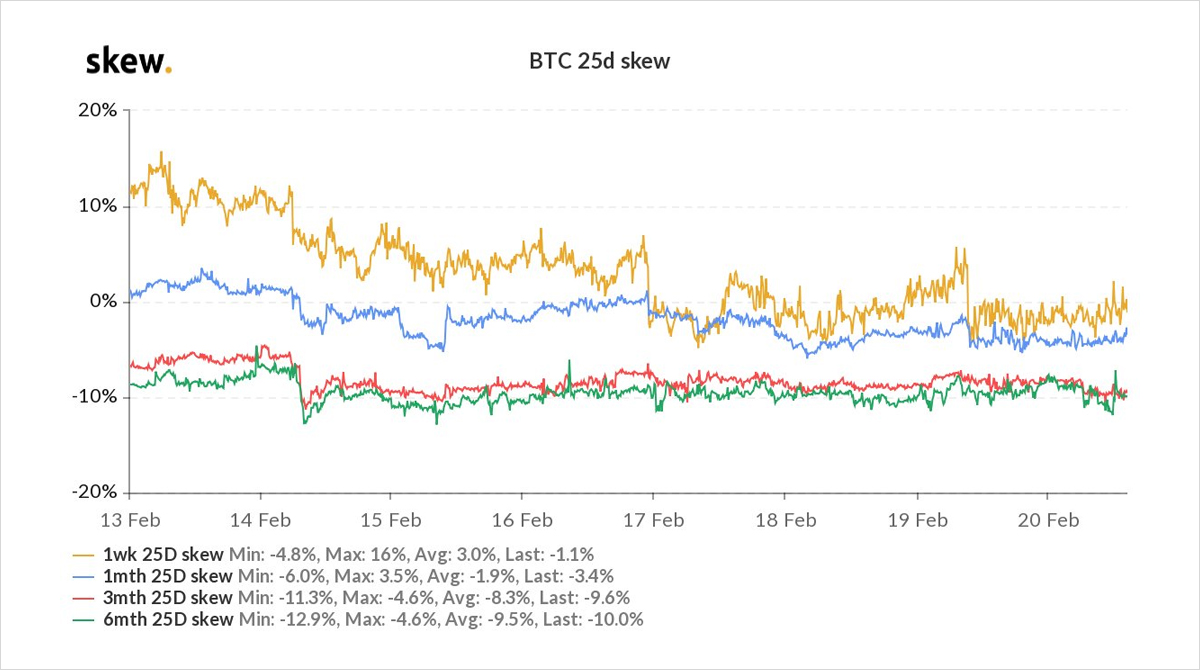

In anticipation, Puts+Skew firm, Calls unwound+sold, but Implied Vol unaffected and opportunistic Option flow on dips.

2) Particularly aggressive OTM Put buying on daily Option expiries in the lead-up, Feb11th-14th. All expired worthless but certainly gave concern as a sharp deleveraging wick seemed likely.

It was poor luck the buyer did not continue on the Feb15th expiry.

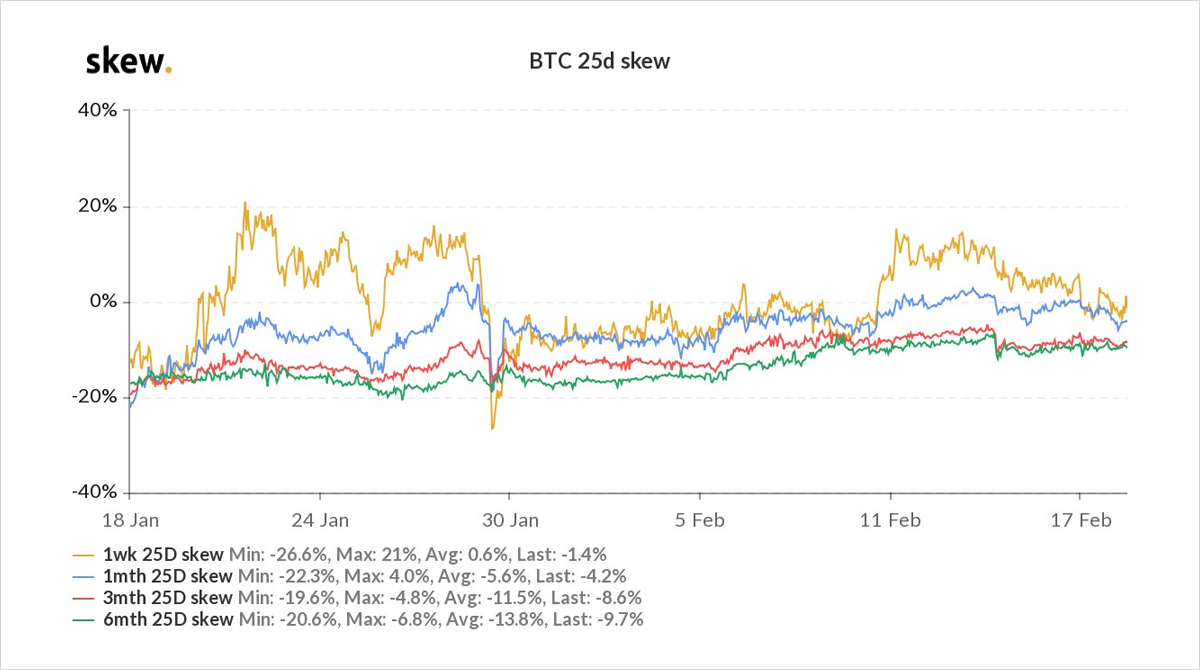

Put Skew remains firm.

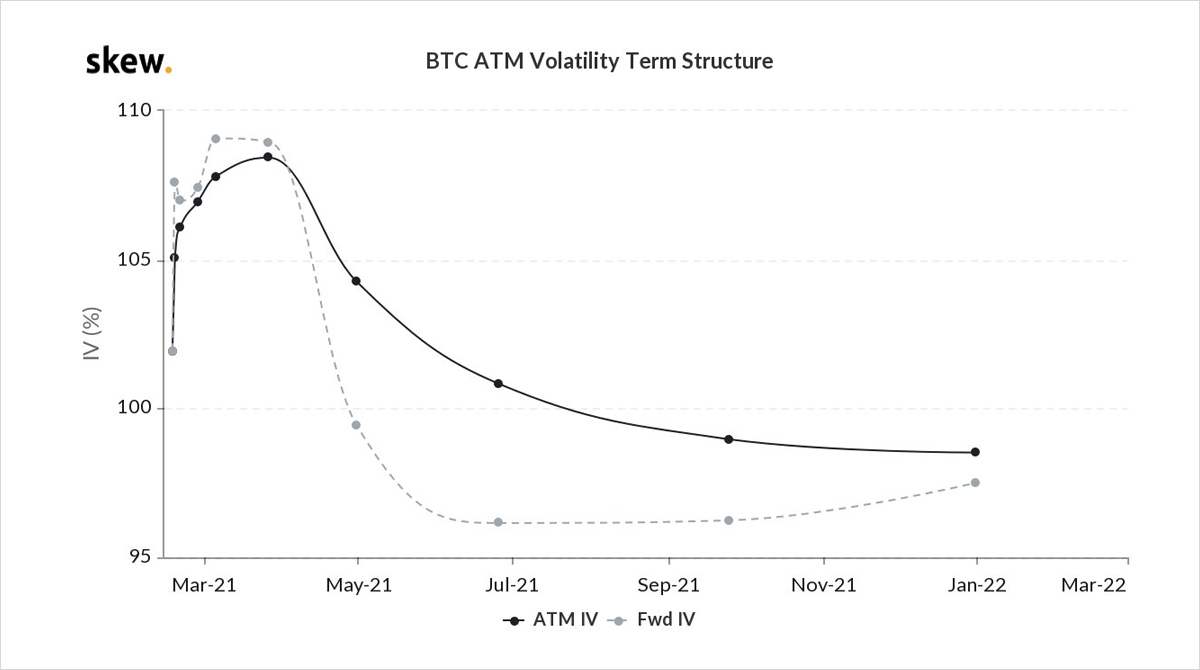

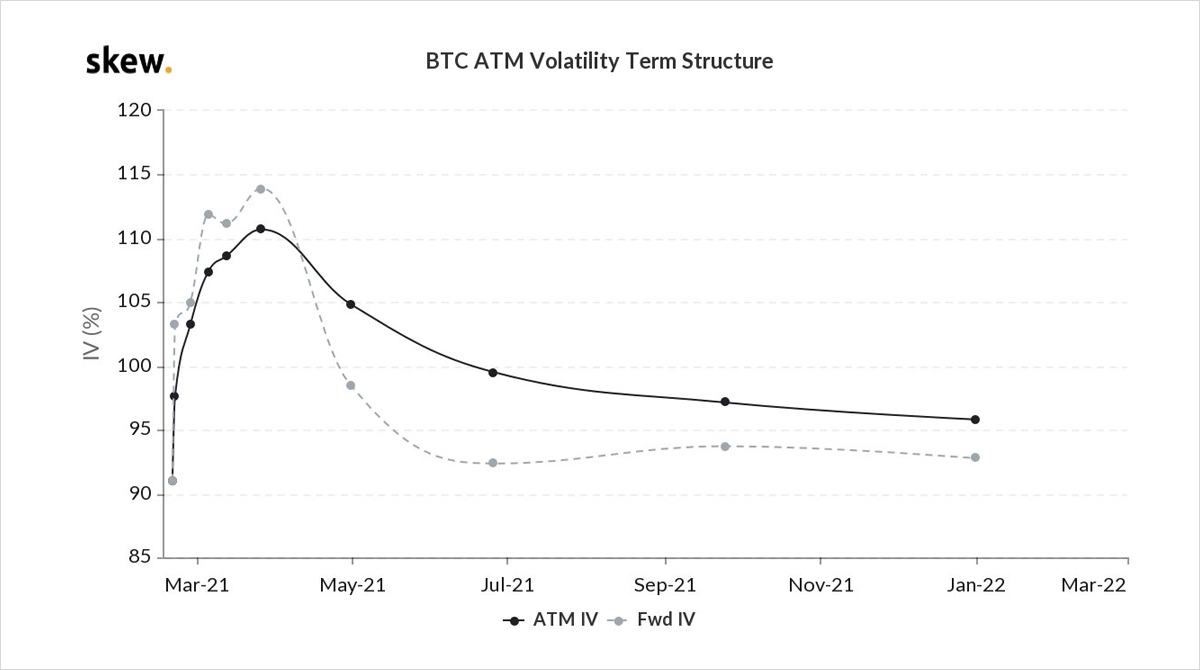

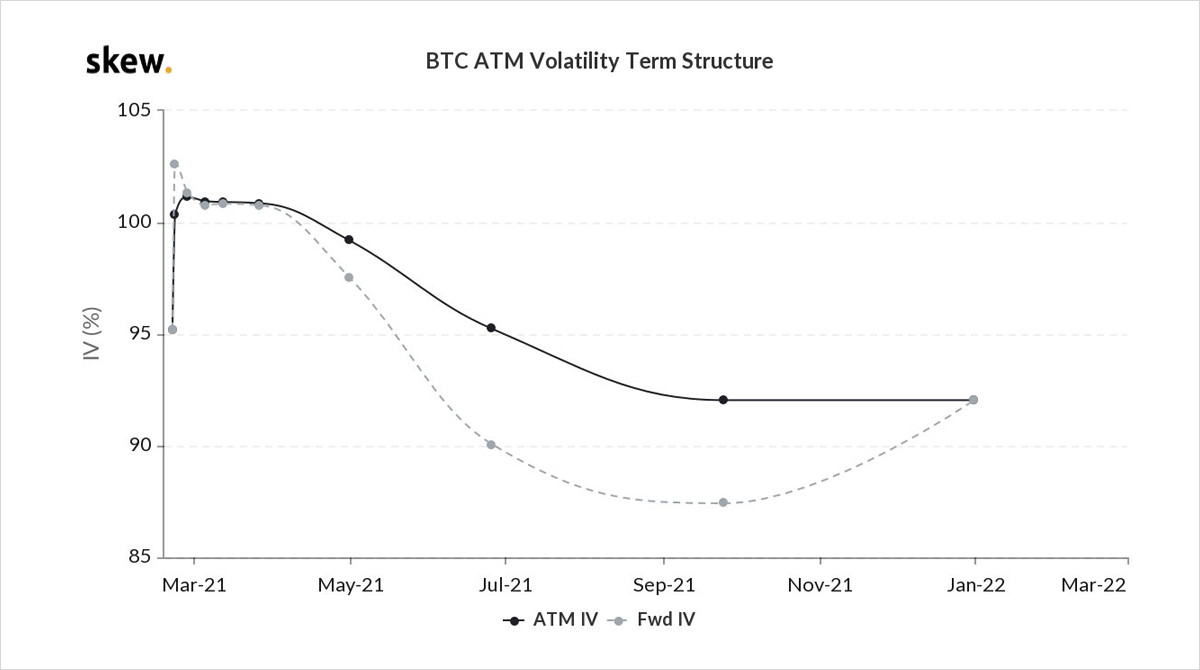

3) But whereas Skew has seen near-term action, there is still an absence of any institutional longer-term hedging. In fact, Funds continue (low volumes) to take advantage of selling Jun-Dec <+40k Put strikes. This flow has pressured longer-term IV, while fronts still trade 2-way.

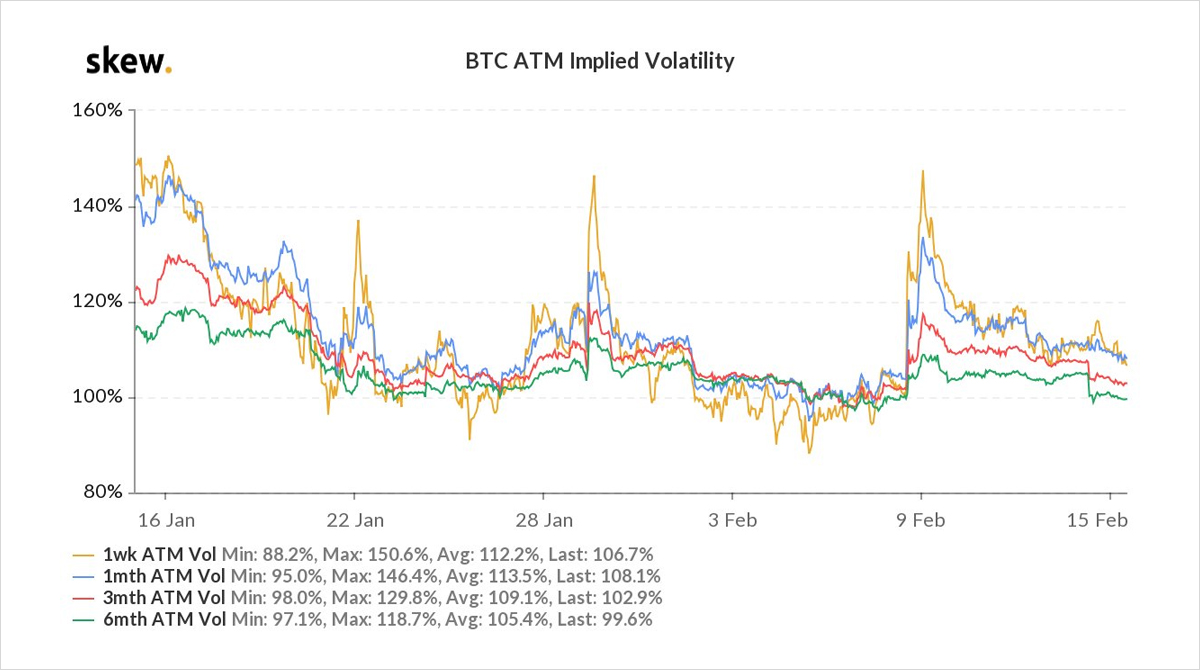

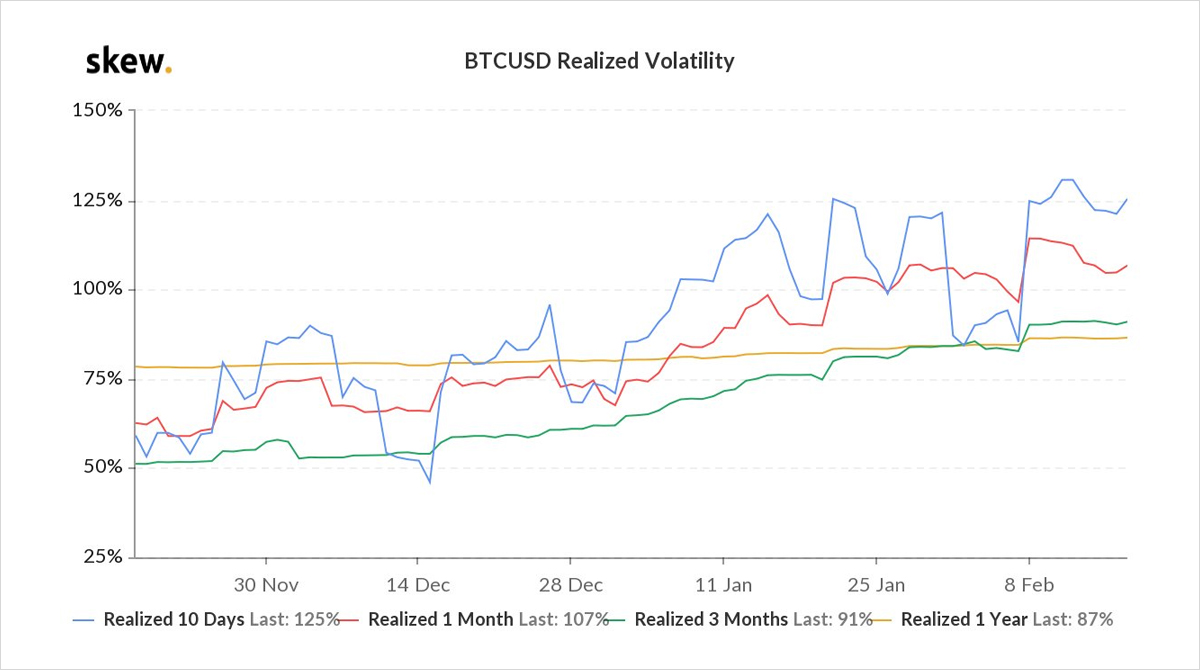

4) The lack of any IV spike on the drop from 49k-46k, and bounce to 48k as I write this, suggests comfort and consolidation in the mid-40s to 50k BTC trading zone.

The term-structure in backwardation (+firm Put Skew) suggests caution, but Feb rolling-over implies not imminent.

View Twitter thread.

February 18

MSTR $1bn convert, Blackrock ‘dabbling’, ETFs submitted.

50k flipped resistance to support.

Option flows at key levels often roll exposure, expressed again on large volume day.

ITM Calls moved to higher Strikes +longer maturities.

But only limited fresh buying; Puts 2way flow.

2)Feb19th 46k Long Calls moved up+out to Feb26th 48k+50k Calls, Feb26th 44k Long Calls moved up+out to Feb 26th 54k, Mar5th 56k+58k increasing exposure. Limited buying in OTM Mar+Apr 64k-100k Calls.

Option rolls + Feb19th 52k aggressive activity (bought then sold) crush Feb IV.

3)The Put side was also active in the same manner. Rolling of Feb19 46 to Feb26 50k Puts, buying of Feb26 50k-44k Put spreads; 50k not surprisingly a key big number.

Repetitive Far OTM Puts also bought aggressively in Feb+Mar5th.

To counter this, Sats collection Mar28-Dec Puts.

4) From the Skew chart above, Puts starting to soften vs Calls. There are mixed views of those wanting to protect long spot, countered by those seeing massive institutional support as a ‘free’ Put. Neither side is sizeable in terms of Option flows. Limited speculative Put buying.

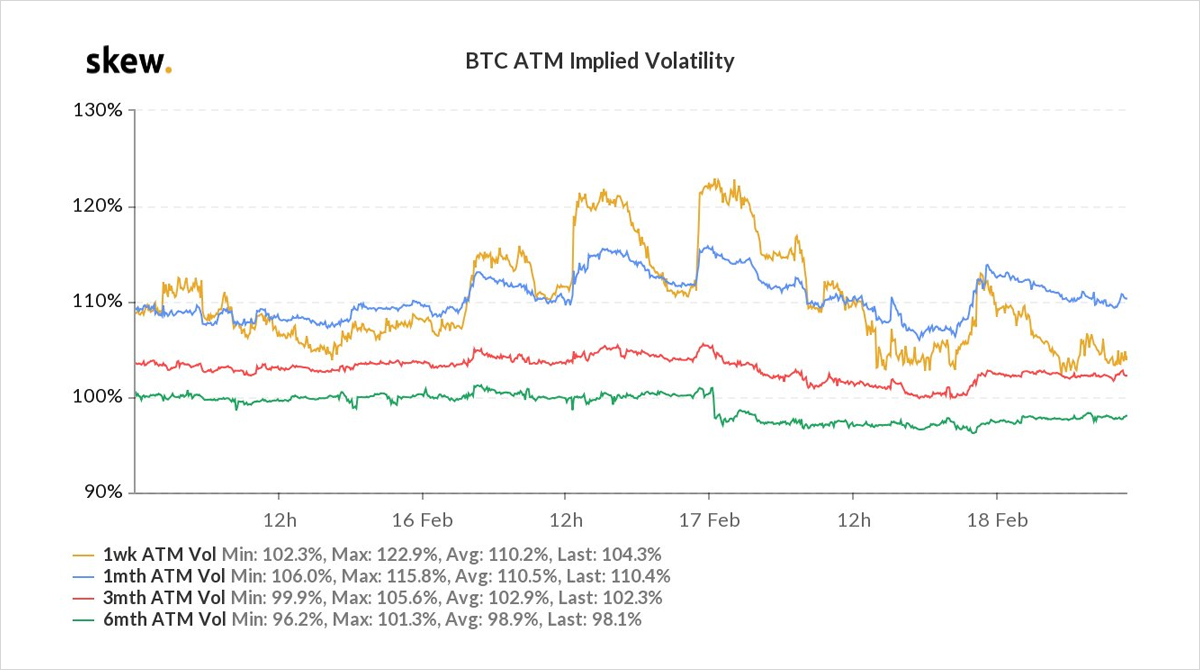

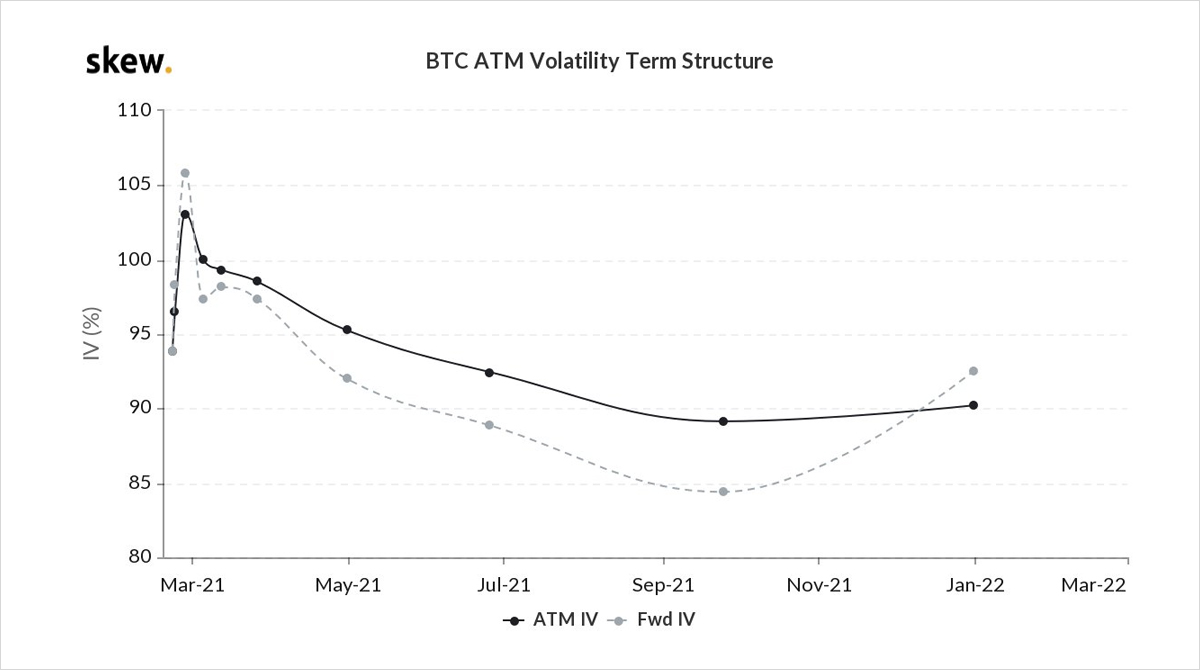

5) Key analysis in this thread is the movement in IV.

Normally at ATH we would see increased IV due to uncertainty and Funds buying options to either protect, leverage upside exposure, or even short-cover.

The chart shows the attempted spikes in Implied Vol over the last 3days.

6) IV Spikes short-lived.

Predominantly market positioning; some exhaustion.

The exhaustion comes from leverage deriv longs trying to front-run institutional money that will T/VWAP and repeatedly getting washed out prior.

The positioning comes from the market being long+right.

7) Feb19 option activity has offered MM plentiful gamma. A large buyer of Feb19 52k Calls on the MSTR $600m initial announcement, then appeared to dump the Calls as BTC dropped back <50k. Extra pressure in Feb18th daily expiry reduced appetite for Feb26.

Positioning cf 100%+RV.

8) The market wants to be certain 50k is defendable support before we see additional Call (+spread) buying; no need to ‘ape’ at the moment?!

The acceleration observed at 20k, 30k, 40k has been less aggressive on the move through 50k.

MM long, Yield sales short Call Strikes above.

View Twitter thread.

February 20

19th Feb, BTC 50k support holds. 24hrs later 6k higher.

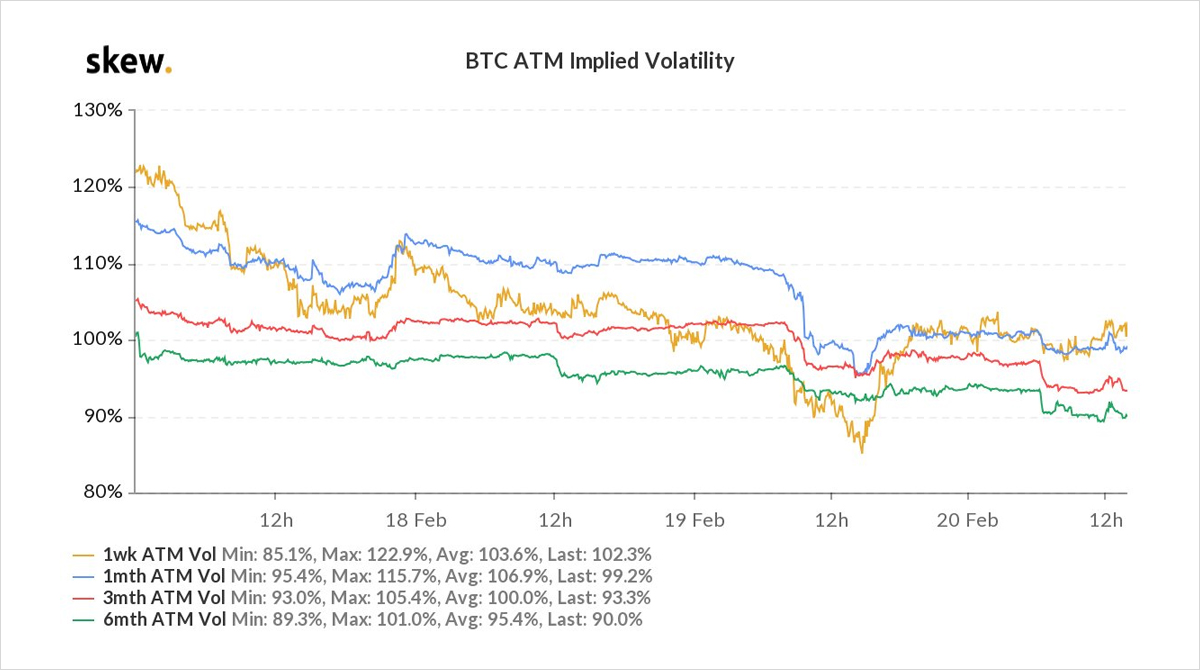

Conspicuous plunge of BTC options.

Solitary pre-expiry buyer Feb 52-48k Put spread,

…and then dump of options on screens.

Cross-maturities.

Puts <=52k, base set.

ITM Calls, profit-taking.

OTM Calls >60k Mar-Jun Yield.

2) Normally see post-expiry selling flows at the near-end,; often large volumes post-quarterly-expiry.

But this was just a weekly expiry.

Unsurprising Put sellers once 50k base firmed, but unexpected profit-taking in ITM 48+52k Calls without rolling +yield sales, with MSTR ahead.

3) Market-makers absorbed the majority of flow.

To many, this was adding to a saturated upside, and may explain the severity of the drop in Implied Vols.

Additionally, there were no large block initiators on the demand side.

Ahead of the weekend, the 1wk-1m terms took the brunt.

4) Implied vols hit a low at around 2:30pm UTC, BTC 53k.

Soon after BTC started rallying hard, perp funding was contained, but futures basis significant.

MSTR made their expected $1bn+ announcement soon after.

If it was MSTR accumulating, they were not the only large buyer.

5) Then a flurry of Option quotes to grab upside; also some to close shorts.

Noticeable that despite MMs being long vol and desperate for movement, responses to quotes were slow – no-one was keen to sell out their vol on the lows.

Demand for 54k+ Calls

Implied Vols+Gamma bounced

6) Despite massive notional volume day and movements in vol, there were few outsized prints.

Activity in Mar5th+12k 40k Puts came from 3x mkt buys (perhaps product orientated) +2x sales.

A late bullish print was buying the Feb26k 60k Calls, funded by selling the 50-44 Put spread.

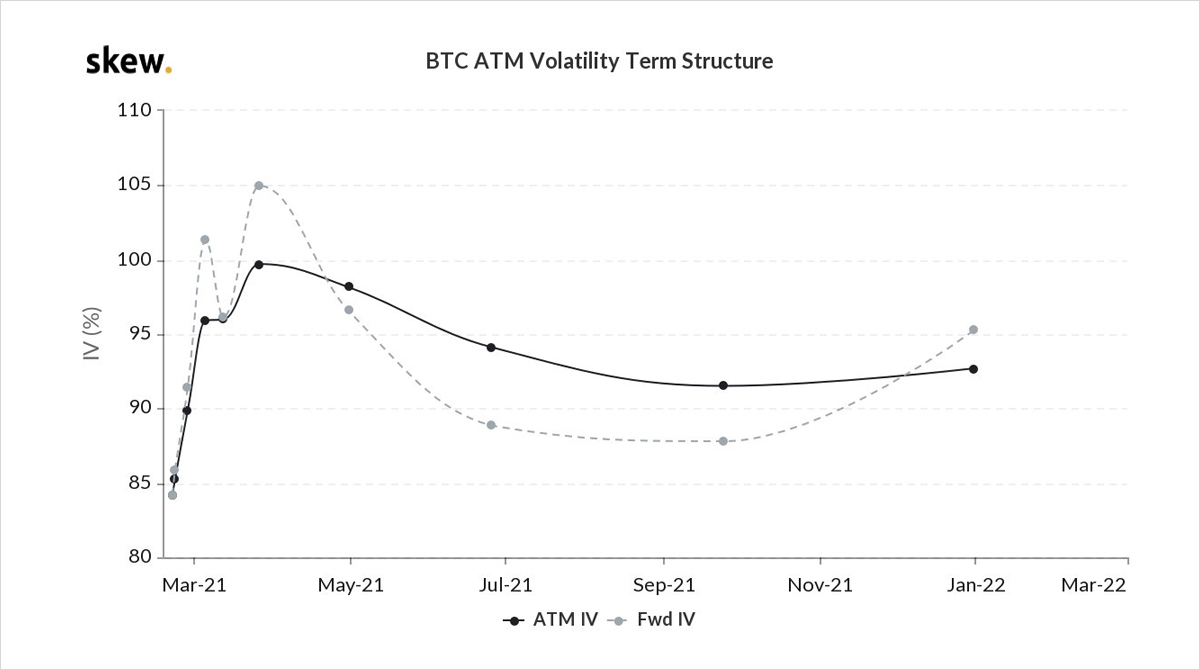

7) Unusual weekend activity pushing BTC >57k has flipped the Term-structure from near-term contango to full backwardation.

A hesitant supply of Gamma, with many players preferring a headache-free weekend to the temptation of +ve theta vs potential unknown impacts of another ATH.

View Twitter thread.

AUTHOR(S)