In this week’s edition of Option Flows, Tony Stewart is commenting on restrained Options and Low volumes.

February 21

Despite dangers, Crypto Option fear factors are restrained:

IVs in 60/70s (BTC/ETH)

IV<RV,

Skew elevated, not extreme.

Flow almost exclusively wary Fund restructuring +Fast money. Low volumes. ‘Meh’.

DOVs impact, but an abnormal incident lets us delve.

Let’s talk about MMs.

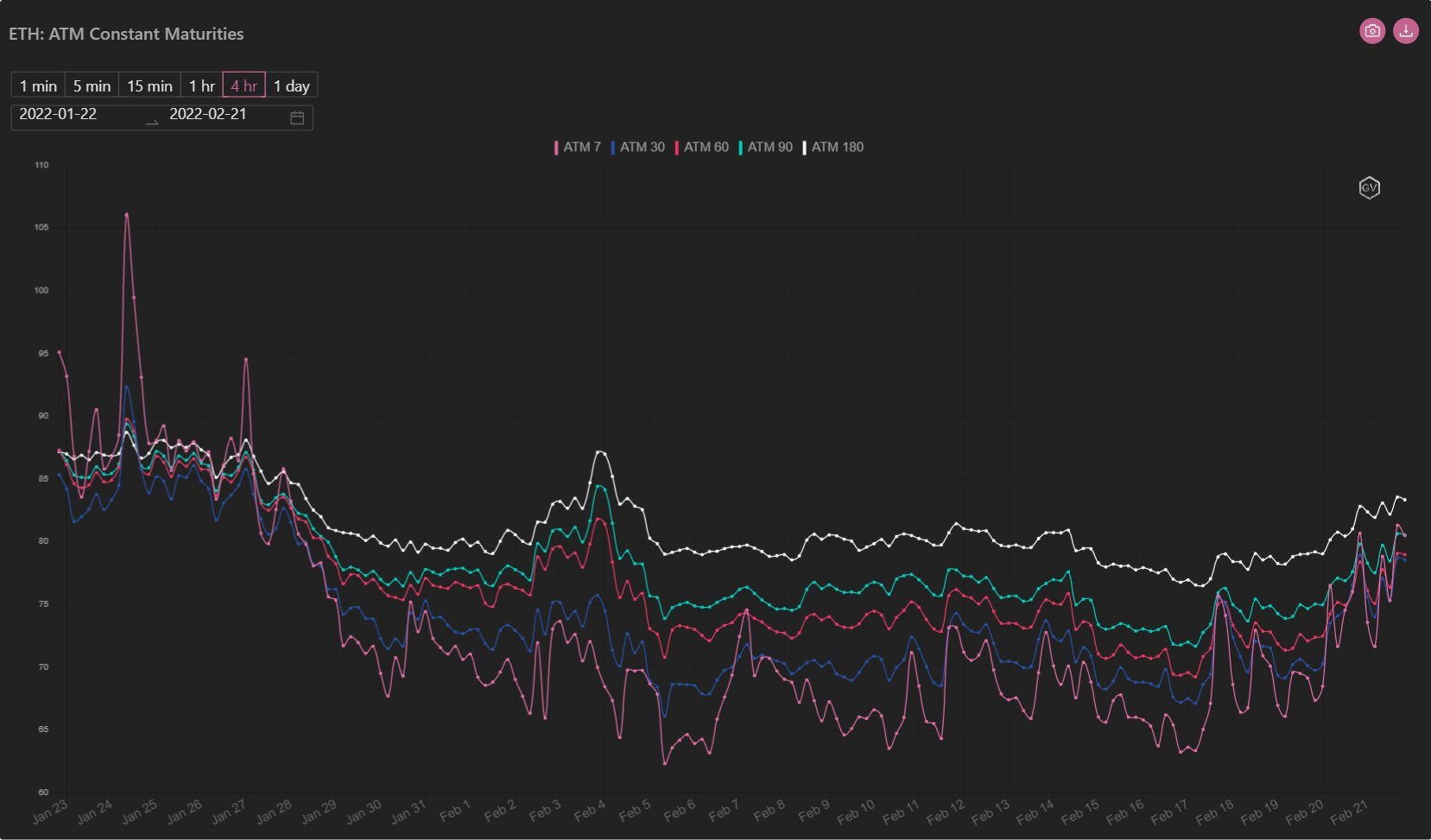

2) Over past weeks, we’ve highlighted the impact of DOVs and the consequential roller-coaster of Implied Vols on Deribit as MMs arb.

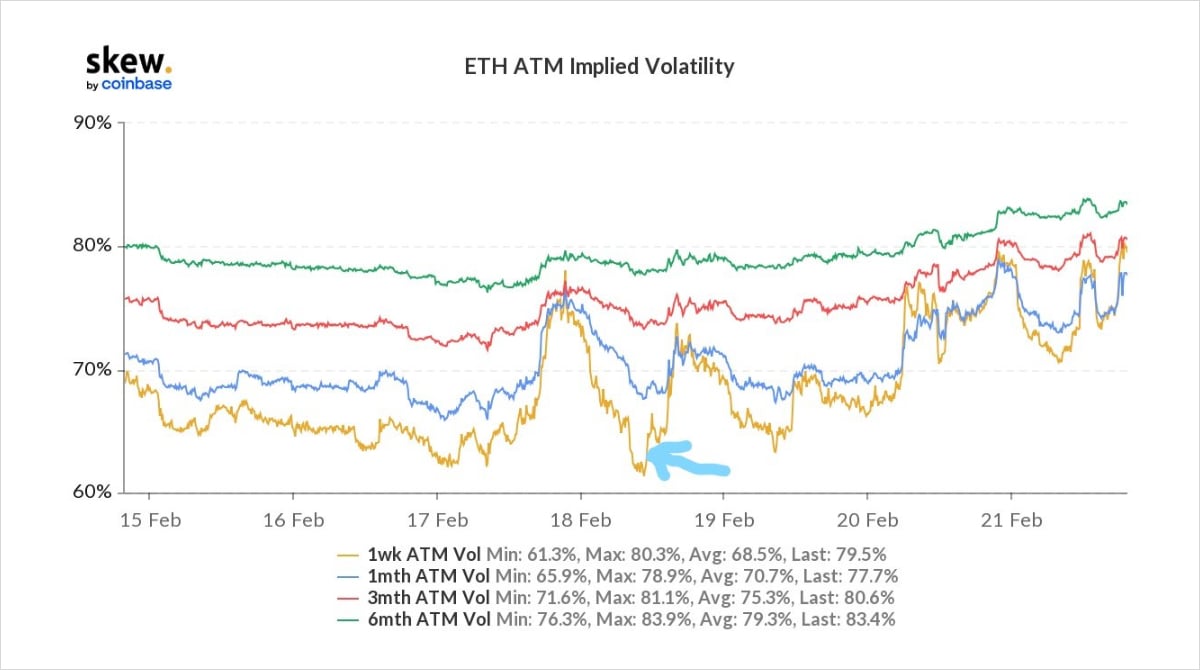

But what happens when an auction goes wrong?

What happens to IVs if MMs have front-run supply and can’t bid vaults?

More info here.

3) Clearly not a legal appraisal, but simplistically front-running is permitted when information is freely available.

Ribbon, the largest TVL DOV protocol discloses times+sizes of auctions transparently so buyers can prepare collateral.

MMs are the largest buyers of DOVs.

4) While some Option MMs do have prop positions, many just try and keep relatively flat and provide liquidity for bid-offer spreads.

So MMs with DOV information have a preference to front-run: sell first, buy vault Options during auctions at a discount for almost certain profit.

5) But how do MMs front-run if all the MMs know about the Vaults; who do they sell to?

Normally an aggressor would use @tradeparadigm to execute large blocks, but there is a dual goal for MMs:

1. Sell Options

2. Lower IV as much as possible.

6) MMs take a risk and can start selling Options up to 12hours before the vaults.

The DOVs are not the only seller at expiry, so there is some security that guarantees IV pressure.

Of course, if the Spot market moves the MM will be short gamma and be at risk, so never a sure bet.

7) MM sell some Options via natural demand, some via blocks, but much on-screen where MMs and large Fund Liquidity providers are required to maintain orderly markets.

But because bids are not keen, sellers have to be aggressive and can therefore force IV lower, until Vaults sold.

8) The ETH vaults have become large – 30k 10delta Puts and Calls sold every Friday by Ribbon alone.

This week a new Ribbon UI was rolled out, but unfortunately, there was a technical incident that prevented some of the large MMs from bidding.

9) The auction was still processed, but at a price much lower than fair value.[Ribbon is correcting the price to vault seller via MM good faith and DAO funds].

However, the big MMs that would normally have won the auction, could not participate, so then likely short Option risk.

10) We can see prior to the auction, IV sold off.

When large MMs were unable to cover their short-option risk via the Vault they were forced to try and cover their short exposure on Deribit.

We see slight pump, then pause as the incident was reviewed, then 10% IV surge off lows.

11) It didn’t help MMs that were now short gamma that the market started reacting to macro events and Spot sold off.

We’ve also seen that the Vaults’ timing tends to coincide with the low of IV.

In the past few weeks this has been acutely seen by Friday pm market-moving events.

12) Those MMs that don’t position themselves ahead of the DOV auctions are unable to be as aggressive on their bids.

But DOVs suffer from this selloff in IV prior to auction times.

13) Many of the DOV protocols have been active behind closed doors to find a solution to this and enhance their yields, as TVLs increase and the challenge grows in response.

Changing the times, randomizing, smoothing the auctions are some tactics being discussed and implemented.

14) But there is interesting game theory to consider:

As one protocol adjusts, pressure is released off others.

Time zones of the different MMs (and interested parties).

Relationships with MMs, particularly those with a vested interest.

Liquidity.

Plans should smooth IV impact.

15) MMs have alot of control at the moment.

But there is an overlooked collateral risk to be Long Vault Options and Short Deribit Options, aggressively so if Spot moves through the Strike.

Some DOVs have evolved to allow anyone to bid, not just MMs. The large Funds are looking.

View Twitter thread.

AUTHOR(S)