In lectures 12.2 – 12.5 we looked at vertical spreads. We looked at bullish and bearish vertical spreads using either puts or calls, and we also looked at the Greeks for each.

To put this theory into practice though, you need to know how to actually place a vertical spread trade. So, in this video we are going to show how to execute vertical spreads on the Deribit platform. We will do some live trading using both the combos feature (which allows us to trade the spread in a single order), and the individual order books for each leg of a spread.

Example 1 – Using the individual order books

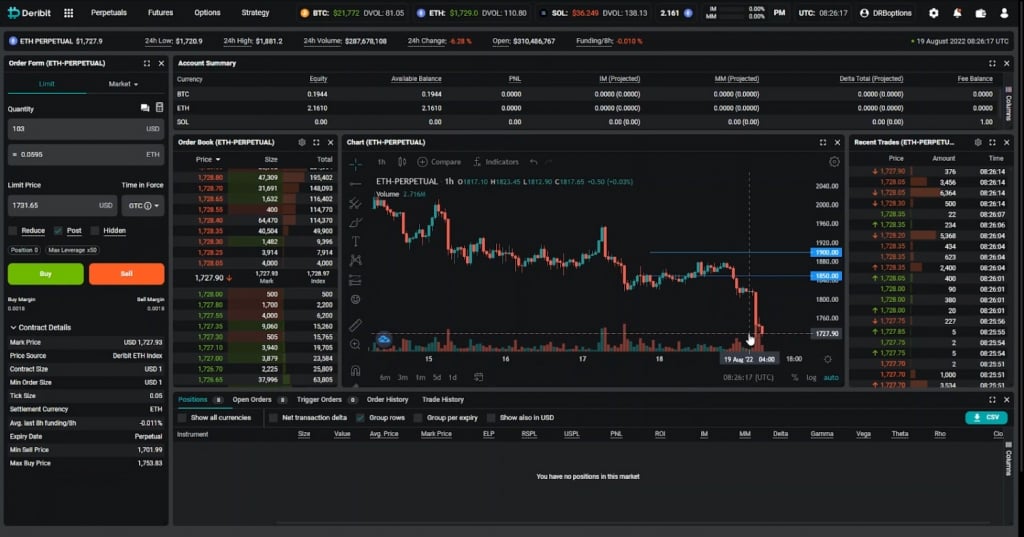

In this first example, let’s enter a bull call spread on ETH by using the individual order books for each of the two call options.

ETH is currently trading at about $1,840 and let’s say that we are bullish on the price over the next couple of days. We think the price of ETH is going to increase and we would like to benefit from that if it does happen by purchasing a bull call spread. We will use a position size of 1 contract, which is for 1 ETH notional.

If we navigate to the option chain for ETH, and specifically the options for August 19th, we can find the call options that expire in about 36 hours listed on the left.

We like the look of the 1850/1900 bull call spread, which means we want to purchase the $1,850 strike call, and sell the $1,900 strike call.

For the $1,850 call, we can see a best bid of 0.0215 and a best ask of 0.0225.

For the $1,900 call, we can see a best bid of 0.0115 and a best ask of 0.0120.

We want to buy the 1850-C and sell the 1900-C, so if we were to simply take the available prices, we would pay 0.0225 for the 1850-C and collect 0.0115 for the 1900-C. This would result in a net cost of 0.011 ETH (ignoring fees).

Instead of doing this though, let’s see if we can get a small price improvement on the 1850-C. The current bid/ask for this is 0.0215/0.0225, so let’s see if we can get a fill in between at 0.022 instead. To do this we open the order book for this option by clicking on it in the option chain, and then we place a limit order to buy the 1850-C at a price of 0.022.

Almost immediately after we submit the order, it is filled. We get a notification in the top right to let us know that the order was filled, and we can see our position size of 1 in the ‘Position’ column of the option chain.

We are now long the 1850-C, but we still haven’t sold the 1900-C so our bull call spread is not complete yet.

Unfortunately the best bid for the 1900-C has decreased from 0.0115 to 0.011. However, as we are already filled on the first leg, to avoid prices moving against us, let’s sell the 1900-C straight away for the new best bid of 0.011.

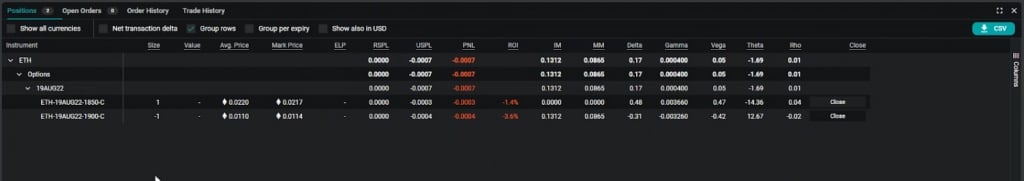

As we executed our order into the best bid, the order filled immediately, and we can now see both legs of our bull call spread in the positions table at the bottom of the page.

We paid 0.022 for the 1850-C, and sold the 1900-C for 0.011. This resulted in a net cost of 0.011 ETH, so despite getting a slight price improvement on the 1850-C, this was cancelled out by the bid for the 1900-C decreasing. In the end then, we paid exactly the same price as we would have done by taking the original best ask and best bid of the 1850-C and the 1900-C respectively.

Leaving limit orders can achieve better fills, but it doesn’t always. This highlights one of the main issues with entering into a multi-leg option position by entering into each leg separately. Once only part of the desired position has been filled, we are exposed to price movements until we fill the rest of the legs. There is a way to avoid this, which we will highlight in the next example.

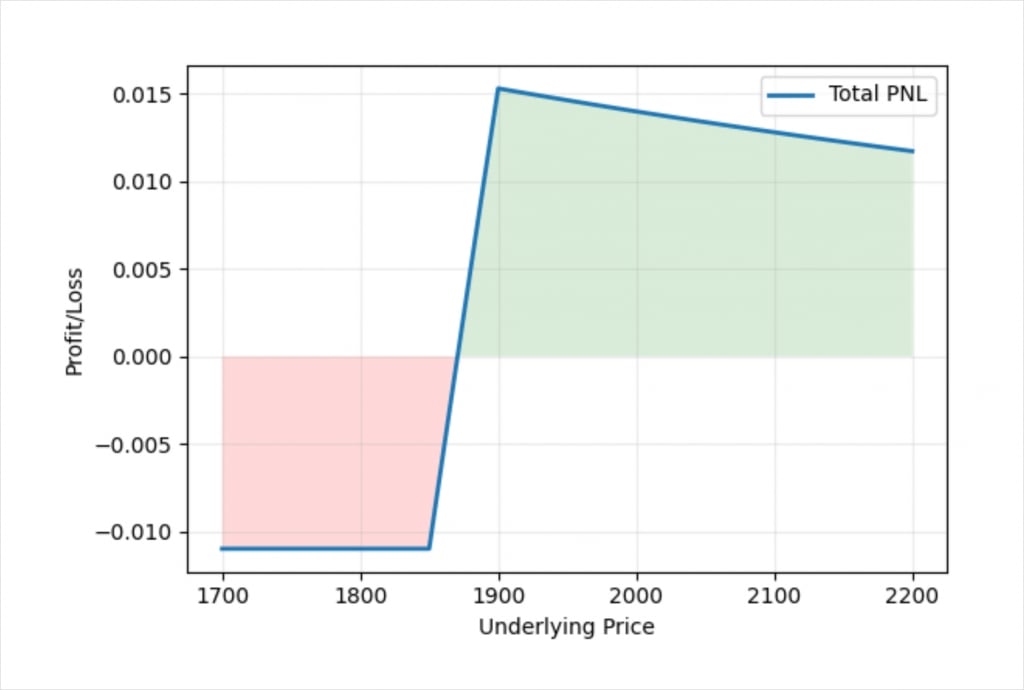

PNL of the bull call spread

To profit from our bull call spread we of course want the price of ETH to increase before the options expire. More specifically we want it to increase to $1,900.

This is the PNL chart measured in ETH.

At expiry, if the underlying price is below $1,850, both call options, and therefore the spread as a whole will be worthless. As we paid 0.011 ETH for it, this results in a net loss of 0.011 (ignoring fees).

For values between $1,850 and $1,900, the profit increases, until peaking at the $1,900 strike. You will also notice that the profit measured in ETH starts to decrease again slightly as the underlying price moves higher. For traders used to more traditional markets with linear contracts, this may not be what they are expecting. However, if you have already read the vertical spread lectures in section 12, in particular lecture 12.2 on bull call spreads, this will be no surprise to you at all. You will remember that when we are trading inverse option contracts, in order to fix the reward for the bull call spread in the base currency, we would need to adjust the position sizes of the legs. For more information on this topic, see lectures 12.2 – 12.5.

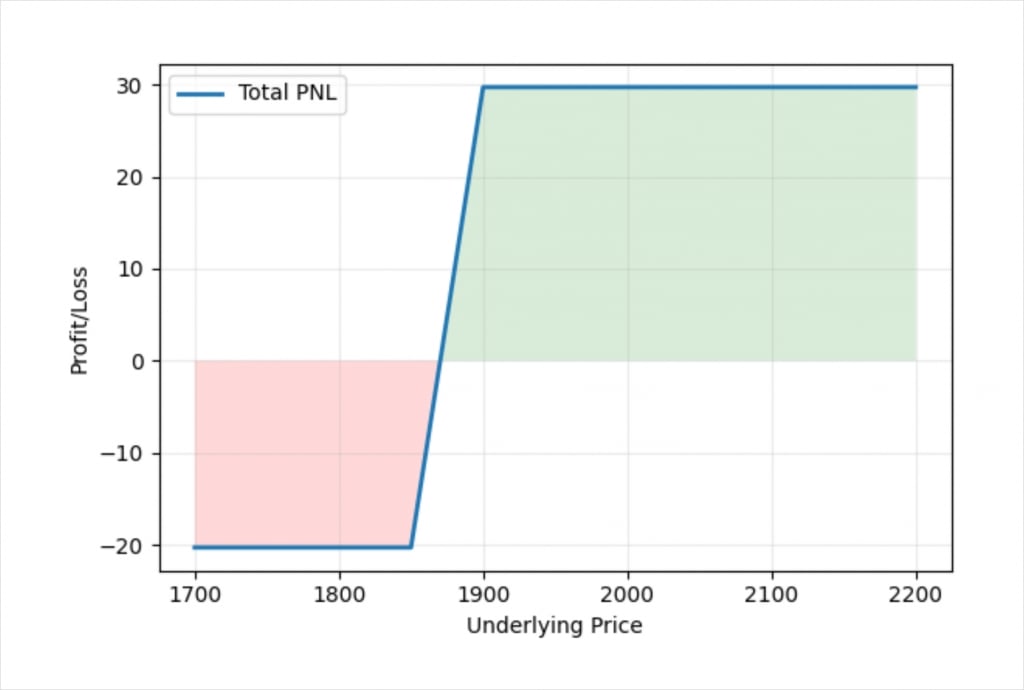

Though the premiums and any profit are paid in ETH here, this is what the dollar PNL looks like.

We paid 0.011 ETH for the spread, which at the time was worth about $20. This is the most we can lose. The most the spread can be worth in dollars at expiry is the difference between the two strikes, which is $50. Our maximum profit is therefore approximately $50 – $20 = $30.

Now our position has been established, we are going to let it expire so we can see how expiry works in the transaction log, and see how much profit or loss our bull call spread made.

We come back to our account just after the position has expired. The time is about 08:26 on August 19th and the position expired at 08:00.

I’ve marked our two strikes on the chart with horizontal blue lines. While the price of ETH did initially increase in the way we wanted, unfortunately for us the price then dropped dramatically before expiry. When the options expired less than an hour ago, the price of ETH was significantly below both of our strikes so both call options were worthless at expiry.

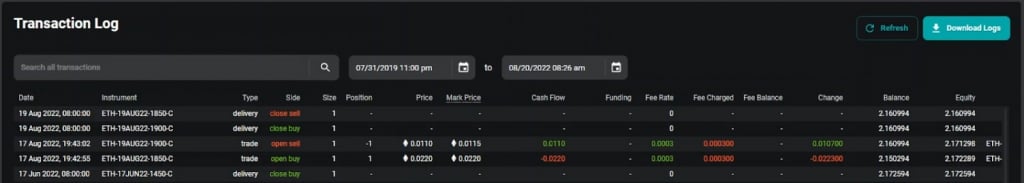

To see the transactions in more detail we can go to the transaction log. Here we can see the opening orders and the closing orders for our trade.

We can see on the entries for the opening orders that we paid 0.022 for the 1850-C, and collected 0.011 for the 1900-C. In both cases we paid a fee of 0.0003 ETH.

We held the options until they expired, so the closing orders were handled automatically by the delivery process at 08:00. As both options were worthless, we can see that there was nothing to pay or receive at expiry, so there is nothing more added or subtracted from our account. As the options were worthless at expiry there were also no further fees to pay.

Before we placed this trade, we had no other open positions, and we can see in the previous row that our balance was equal to our equity, which was 2.172594 ETH. After the trade was completed, we again had no remaining positions and so our balance is equal to our equity, which is now 2.160994 ETH. This is 0.0116 ETH lower than we started with. This is equal to the initial price of 0.011 ETH that we paid for the bull call spread, plus the 0.0006 ETH we paid in fees.

This trade was of course unsuccessful in that it lost money, but it was hopefully easy to understand and so should serve as a good example of how to execute a spread using the individual order books.

While using the individual order books was not too difficult to execute, we can dramatically improve on this execution process, making our lives much easier and possibly saving us some money as well. To do this we will utilise Combos.

Example 2 – Using a Combo

A Combo on Deribit is a way to combine an order for several instruments into a single order in a Combo order book. This allows us to execute a vertical spread all at once.

For this example let’s execute a bear put spread by using a Combo.

Bitcoin is currently trading at about $19,700 and let’s say that we are bearish on the price over the next couple of days. We think the price of BTC is going to decrease and we would like to benefit from that if it does happen by purchasing a bear put spread. We will use a position size of 0.5, which is a notional size of 0.5 BTC.

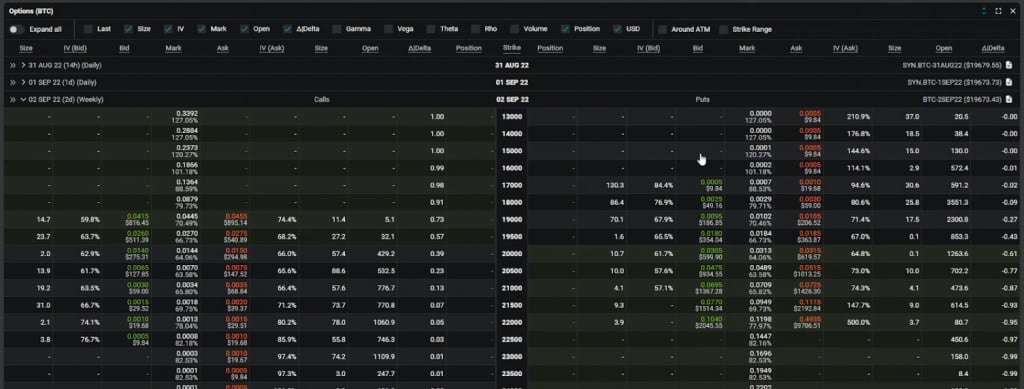

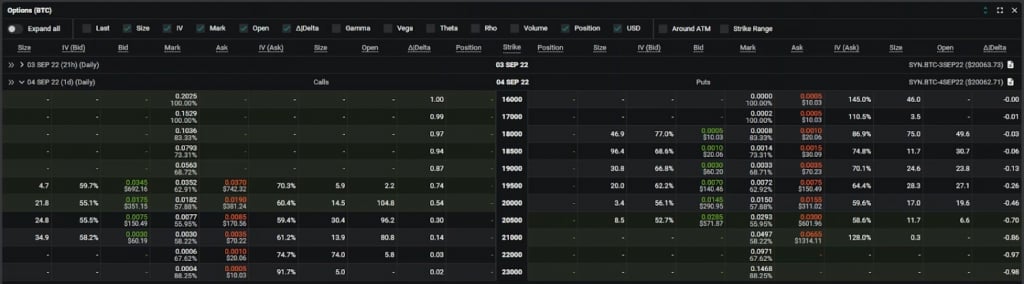

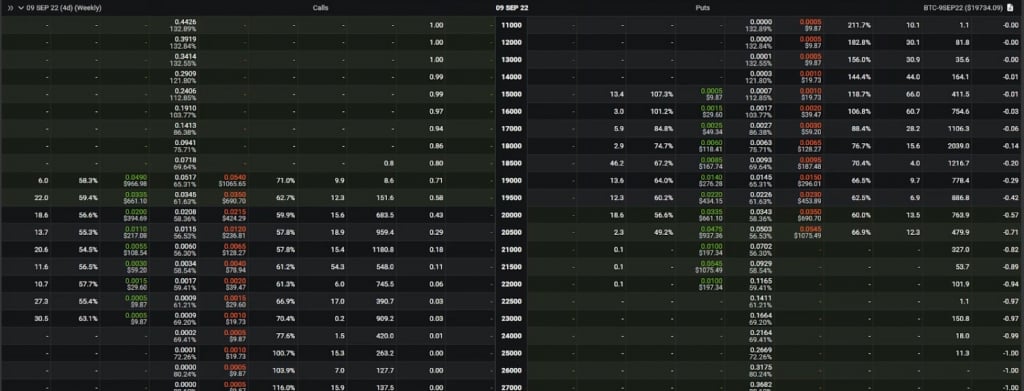

This is the option chain for BTC, and we are looking at the options that expire on September 2nd. We can find the put options that expire in about 2.5 days listed on the right.

We like the look of the 19500/19000 bear put spread, which means we want to purchase the $19,500 strike put, and sell the $19,000 strike put.

For the $19,000 put, we can see a best bid of 0.0095 and a best ask of 0.0105.

For the $19,500 put, we can see a best bid of 0.018 and a best ask of 0.0185.

The resulting bid/ask for the put spread is then 0.0075/0.009.

We want to buy the 19500-P and sell the 19000-P, so if we were to simply take the available prices in the individual order books, we would pay 0.0185 for the 19500-P and also collect 0.0095 for the 19000-P. We would need to use two separate orders to achieve this, and it would result in a net price of 0.009 BTC (ignoring fees). Though as we are using a position size of 0.5, we would only pay half of this.

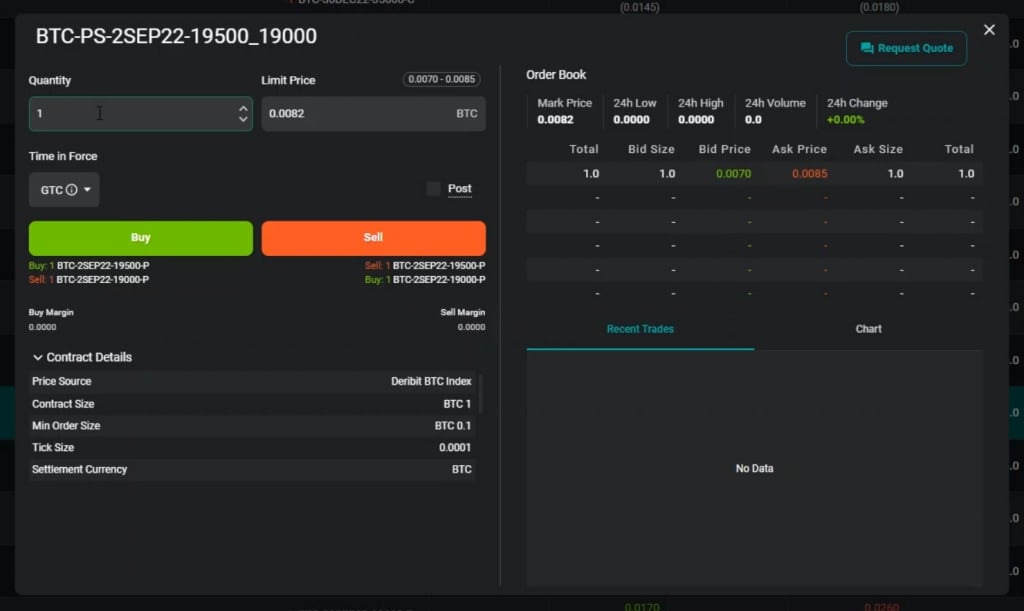

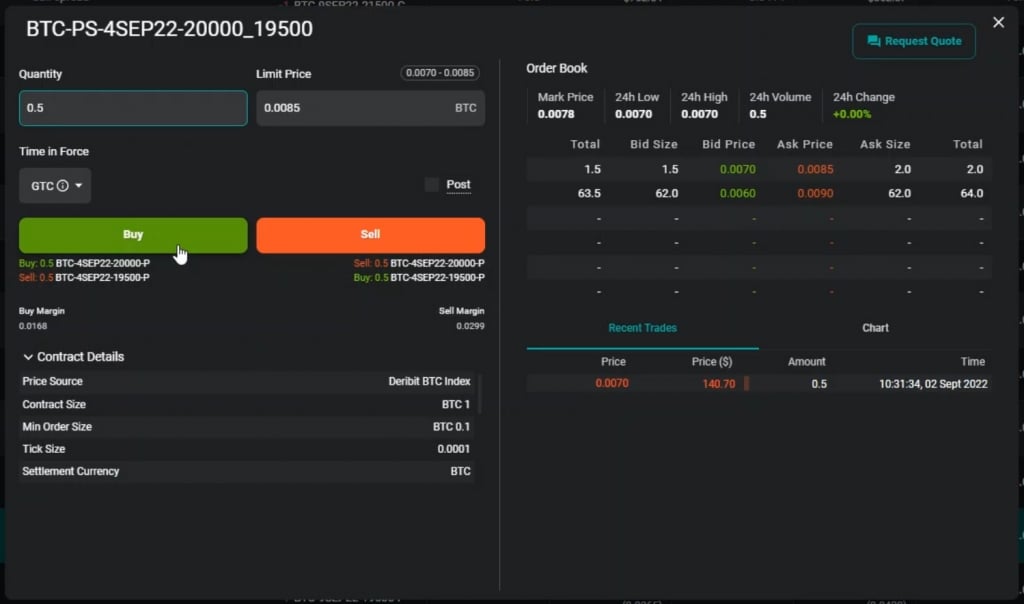

Instead of doing this, we are going to head over to the Combos page, where we can use a single order book for both options. Once on the Combos page, in the vertical spread section, we can see that there is already a Combo for our desired put spread with strikes of 19500 and 19000, and an expiration date of September 2nd. The order book for this Combo shows a bid of 0.007 and an ask of 0.0085.

We want to buy this combo, which we can confirm by looking under the Buy button to see which direction each leg will be executed in. The best ask of 0.0085 for the Combo is actually slightly better than the price we would get in the individual order books, so let’s just buy into this order.

Note that the best bid is actually slightly worse than the price we could get in the individual order books, so if we were selling this spread instead, we may wish to leave a limit order in the Combo book, or use the individual order books instead.

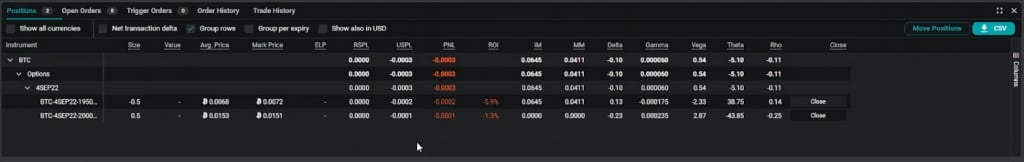

Once our order to buy this spread with a quantity of 0.5 has been filled, we can see our position in the position table at the bottom of the page. Even though we executed the spread as a single Combo order, the two separate options are listed separately in our account. We are still free to trade each leg individually if we choose to. For this example though, we will hold both legs to expiry.

We can see that the difference between our average price for each leg is the 0.0085 price of the spread. As we only bought a quantity of 0.5 though, we of course only actually paid half of this amount (plus fees).

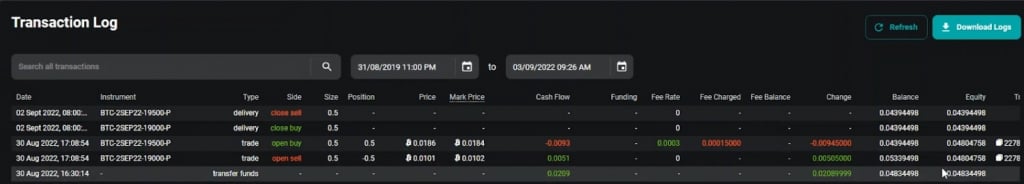

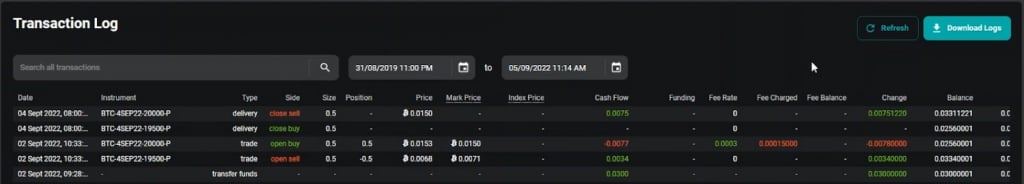

We can see more detail in the transaction log.

Before we opened this put spread, we had no other positions open, and we can see our balance and equity were 0.04834498. Now we have executed the spread, our balance has reduced to 0.04394498. Therefore we have spent a total of 0.0044 BTC to open this put spread. This includes the fee of 0.00015 and 0.00425 for the spread itself. The cost of 0.00425 for the spread is calculated as our quantity multiplied by the price of the spread (0.5 * 0.0085).

We come back to our account here a couple of hours after the position has expired. I’ve marked our two strikes on the chart with horizontal blue lines.

We needed the price to decrease, however the price of bitcoin stayed above our two strikes for the duration of the trade. When the options expired about two hours ago, the price of bitcoin was above both of our strikes so both put options were worthless at expiry.

We can see the transactions in more detail in the transaction log.

We held the options until they expired, so the closing orders were handled automatically by the delivery process at 08:00. As both options were worthless, we can see that there was nothing to pay or receive at expiry, so there is nothing more added or subtracted from our account.

Our loss is limited to the net premium we paid for the spread, plus the fees. As we executed this spread via a Combo, our fees were also reduced because we paid no fees on the cheapest leg.

Example 3 – Another Combo

Let’s execute another vertical spread with a Combo. For this example let’s again execute a bear put spread.

Bitcoin is currently trading at a little over $20,000 and let’s say that we are bearish on the price over the next couple of days. We think the price of BTC is going to decrease and we would like to benefit from that if it does happen by purchasing a bear put spread. We will use a position size of 0.5, which is a notional size of 0.5 BTC.

This is the option chain for BTC, and we are looking at the options that expire on September 4th. We can find the put options that expire in about 2 days listed on the right.

We like the look of the 20000/19500 bear put spread, which means we want to purchase the $20,000 strike put, and sell the $19,500 strike put.

For the $19,500 put, we can see a best bid of 0.007 and a best ask of 0.0075.

For the $20,000 put, we can see a best bid of 0.0145 and a best ask of 0.0155.

The resulting bid/ask for the put spread is then 0.007/0.0085.

We want to buy the 20000-P and sell the 19500-P, so if we were to simply take the available prices in the individual order books, we would pay 0.0155 for the 20000-P and also collect 0.007 for the 19500-P. We would need to use two separate orders to achieve this, and it would result in a net cost of 0.0085 BTC (ignoring fees). Though as we are using a position size of 0.5, we would only pay half of this.

Instead of doing this though, we are going to head over to the Combos page, where we can use a single order book for both options. Once on the Combos page, in the vertical spread section, we can see that there is already a Combo for our desired put spread with strikes of 20000 and 19500, and an expiration date of September 4th. The order book for this Combo shows a bid of 0.007 and an ask of 0.0085.

So in this instance the Combo book doesn’t offer a tighter spread than the individual order books. However, because the spread is exactly the same as for the individual order books, it is still worth using the Combo as it gives us the convenience of executing the two leg spread with a single order. We will also benefit from the cheapest leg having no fee.

We want to buy this Combo, which we can confirm by looking under the Buy button to see which direction each leg will be executed in. We will buy into the best ask of 0.0085 BTC.

Once our order to buy this spread with a quantity of 0.5 has been filled, we can see our position in the position table at the bottom of the page.

The two options are listed separately in our account and we are still free to trade each leg individually if we choose to.

We can see that the difference between our average price for each leg is the 0.0085 price of the spread. As we only bought a quantity of 0.5 though, we of course only actually paid half of this amount (plus fees).

We will hold this bear put spread to expiry and analyse the result.

We come back to our account here about three hours after the position has expired. I’ve marked our two strikes on the chart with horizontal blue lines.

We needed the price to decrease, and it has. Ideally we would have liked the price to reach our short strike, but when the options expired the price was at least below our long strike of $20k, so this option will have had some value that will have been paid to us at expiry. To know exactly what price is used to settle the options every day, we can check the indexes page.

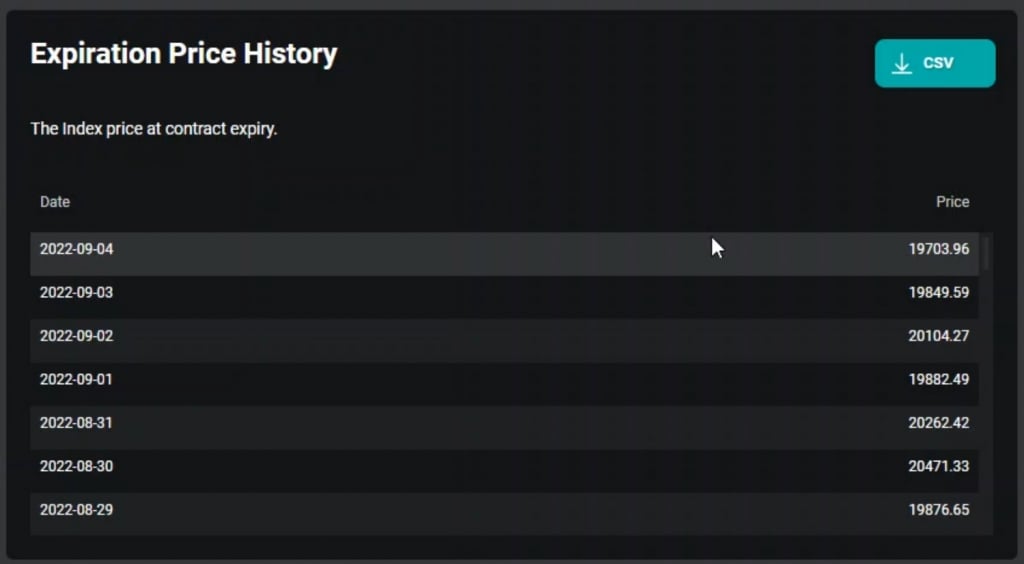

On this page we can see the Expiration Price History list at the bottom. For today’s expiration, the settlement price is $19,703.96. This is the price that is used to settle all bitcoin options and futures that expired this morning.

We can see the resulting transactions in more detail in the transaction log.

As in the previous examples, the 19500-P is worthless at expiry, so there is no further adjustment needed for this option. However, our 20000-P expired ITM, so we receive a credit equal to its value at expiry.

This put expired ITM by $296.04. Any value is paid in bitcoin though rather than dollars, so we need to divide this value by the expiration price of $19,703.96. This gives us a BTC value of 0.01502439. Our position size was 0.5, so we received 0.5 multiplied by this BTC value. We can see the amount of 0.0075122 that we received in the Change column.

As we initially paid a total of 0.0044 for the spread including fees, this means our net profit after the trade is 0.0031122 BTC. If we compare our balance before and after the trade, it has increased by this amount.

So far, we have held each of our vertical spreads to expiry. Let’s look at an example where we close the position early.

Example 4

In this final example, we will open another bear put spread, but this time we will close the position before it expires. We will do so by using the same Combo order book that we use to open it.

Bitcoin is currently trading at around $19,700 and we would like to purchase a bear put spread. We will use a position size of 1, which is for 1 BTC notional.

This is the option chain for BTC, and we are looking at the options that expire on September 9th. We can find the put options that expire in a little under 5 days listed on the right.

We like the look of the 19500/18500 bear put spread, which means we want to purchase the $19,500 strike put, and sell the $18,500 strike put.

For the $18,500 put, we can see a best bid of 0.0085 and a best ask of 0.0095.

For the $19,500 put, we can see a best bid of 0.022 and a best ask of 0.023.

The resulting bid/ask for the put spread is then 0.0125/0.0145.

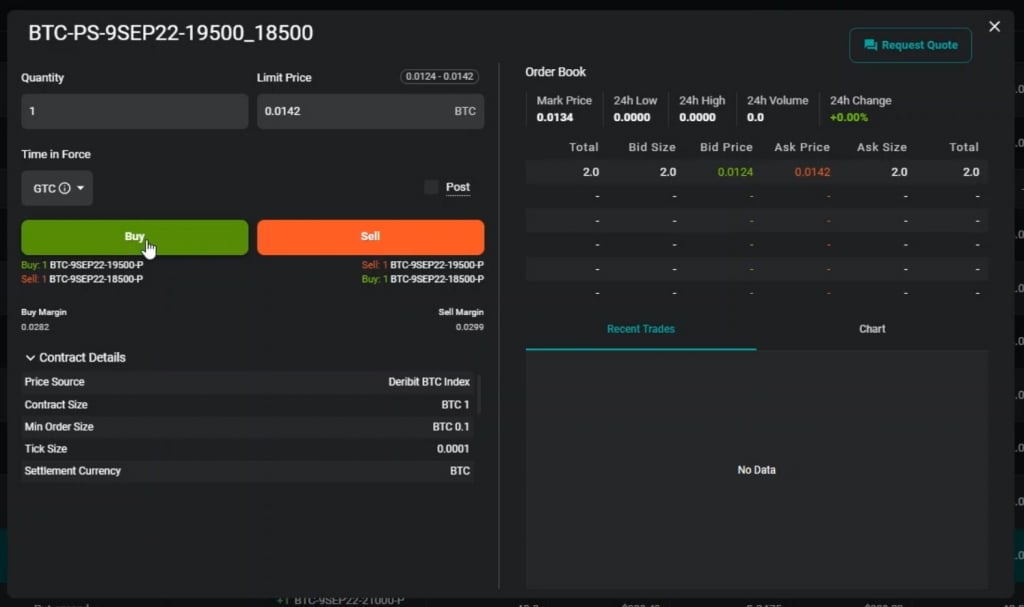

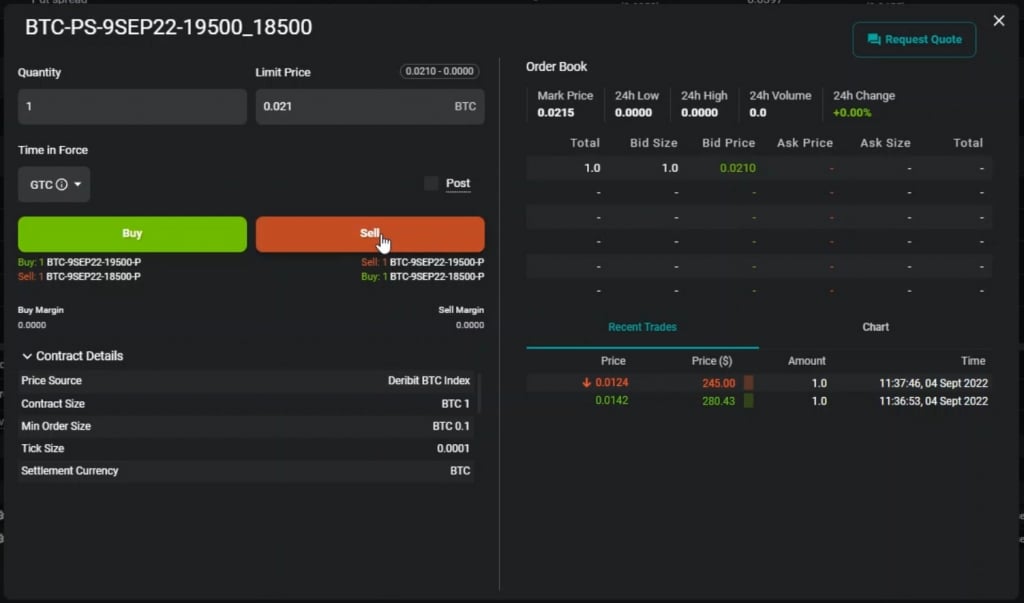

Let’s head over to the Combos page, where we can use a single orderbook for both options. Once on the Combos page, in the vertical spread section, we can see that there is already a Combo for our desired put spread with strikes of 19500 and 18500, and an expiration date of September 9th. The order book for this Combo shows a bid of 0.0124 and an ask of 0.0142.

We want to buy this Combo, which we can confirm by looking under the Buy button to see which direction each leg will be executed in. We will buy into the best ask of 0.0142 BTC.

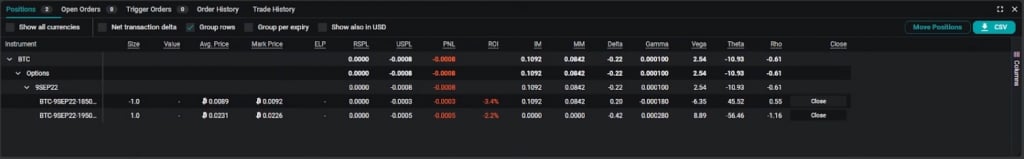

Once our order to buy this spread with a quantity of 1 has been filled, we can see our position in the position table at the bottom of the page.

We can see that the difference between our average price for each leg is the 0.0142 price of the spread.

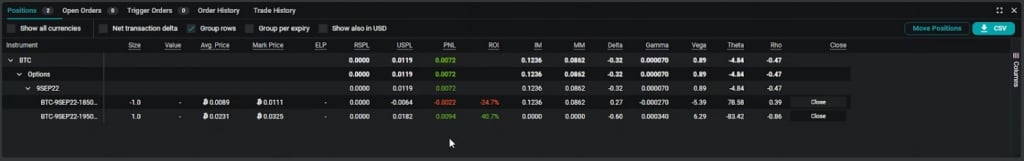

This time we will hold the position for a while, but then close it before the options expire. We come back to our account here a couple of days after opening the trade.

For this trade to make a profit we need the price of bitcoin to decrease, and as we can see, the price of bitcoin has just dropped sharply.

If we go to the position table, we can see that overall our position is currently worth more than we paid for it.

Both put options are currently worth more than they were initially. We sold the 18500-P so this increase in value represents a small loss for us currently. However, this is more than made up for by the larger increase in the value of the 19500-P.

In the PNL column we can see that overall the bear put spread is worth about 0.0072 BTC more than we paid for it, which is 0.0214 BTC. This figure is calculated using the mark price for each instrument.

We would like to lock in this profit by closing the bear put spread completely now, rather than waiting for expiry. To do this, let’s go back to the same Combo order book that we used to open it.

When we opened the spread, we bought it. We are currently long the 19500-P and short the 18500-P. To close the spread we need to do the opposite, so sell the 19500-P and buy the 18500-P. We need to sell this spread then, which we can double check under the sell button.

We will sell directly into the bid with a price of 0.021. This is a little bit lower than the mark price, but not by too much.

Once our order is filled we can see that our position has been completely closed and has disappeared from the position table.

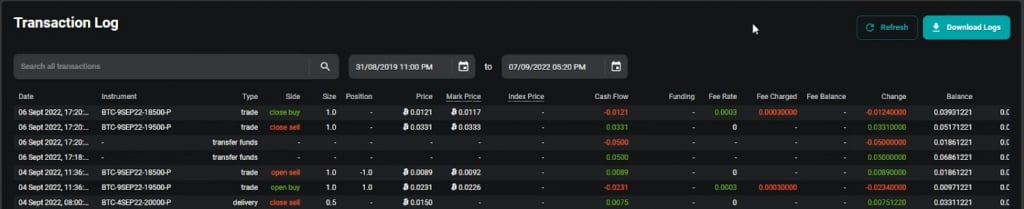

If we navigate to the transaction log we can see all the transactions.

Before we opened the bear put spread we had a balance of 0.03311221 BTC, and now after we have closed the bear put spread we have a balance of 0.03931221. This means our trade has made a net profit of 0.0062 BTC, including all fees.

Summary

In this lecture we have seen four practical examples of executing a vertical spread on the Deribit platform. For more detailed information on vertical spreads as an option structure, refer back to section 12 of this course.

We have used both the individual order books and the Combos for our examples. At time of writing the Combo order books remain separate from the individual order books, and until such time as they are linked, it will be a good idea to check both to make sure you’re getting the best possible price. If you can get a better price on the individual order books, it makes sense to take advantage of this. Otherwise, Combos offer a great way to execute both legs of a vertical spread in a single order.

It’s also worth bearing in mind that the Combo you want to trade may not already exist, meaning you would have to create the Combo book yourself, and then wait for quotes to appear. If this is the case and you’re looking for an immediate execution, the individual order books may be the most attractive. It’s a good idea to give both execution methods a try and see which you prefer.