Hopefully you’re beginning to internalise how a call option works by now. In this section we will be adding an extra layer to what you’ve learned so far by moving onto cryptocurrency call options.

We will be looking specifically at the cryptocurrency options available on Deribit. For the most part these cryptocurrency call options work exactly the same as the call options we’ve covered so far. The buyer of a bitcoin call option for example is purchasing the right to buy bitcoin, just like the call options we covered in Course 3.

There is one important difference though.

Collateral matters

The cryptocurrency call options on Deribit use the cryptocurrency itself as collateral, not dollars as in the previous section. This means that your account balance will be in bitcoin for example, rather than US dollars. Any profits or losses will also be paid and received in bitcoin.

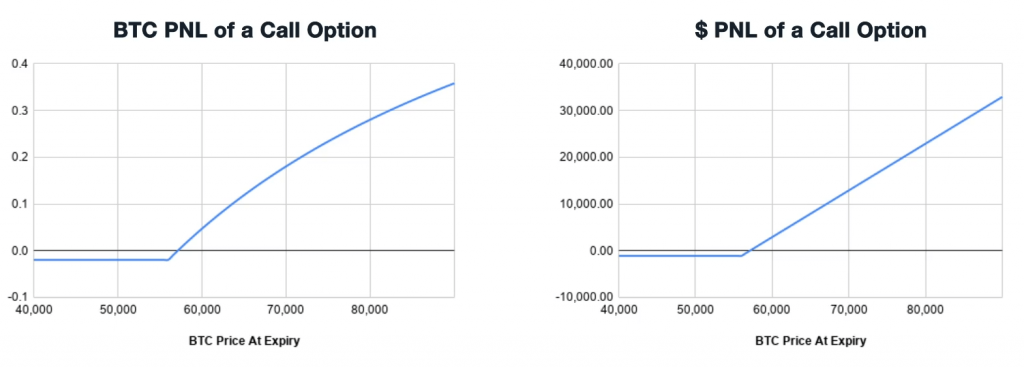

While this seems on the face of it to be a minor difference, it leads to an interesting difference in the profit/loss calculations of the options when calculated in bitcoin. The payoffs now have a curve to them rather than the previous linear payoffs. Don’t worry if you’re not sure what that means, we will explain how it works in this section, including some live examples.

Using the cryptocurrency itself as collateral, also leads to a difference in the breakeven point and maximum profit/loss calculations. It’s important to be aware of these differences, particularly when making the jump over to cryptocurrency options from options in traditional markets. To competently trade any instrument, you need to be fully aware of how and where you will make a profit, where your risk lies, and the magnitude of each.

These differences we’re going to work through in section 4, are not specific to bitcoin, or even cryptocurrency. They arise simply because we are using the underlying asset itself as the collateral, and any profit/loss is also paid in this same asset. The same formulas would apply if we were using Facebook shares as collateral for trading Facebook options, or Amazon shares as collateral for Amazon options.

Base currency and quote currency

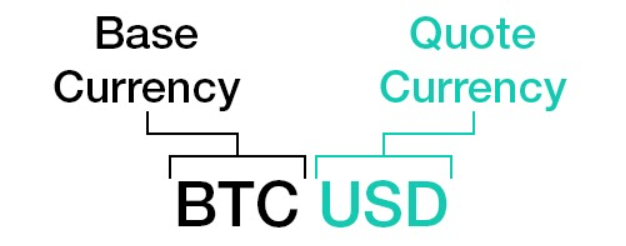

With the cryptocurrency options on Deribit, we are using the base currency for collateral and payments, rather than the quote currency. The profits are still calculated in the quote currency (USD), but they are paid in the base currency (BTC).

You can think of any tradable currency or asset pair as the price of the base currency, quoted as an amount of the quote currency. Or put another way, how many of the quote currency it takes to purchase one of the base currency. In the example shown here, how many dollars it takes to purchase one bitcoin.

In section 4 we will first work through each of the differences that arise due to this, showing you how to make the calculations precisely yourself. We will then move on to some live trade examples so you can see exactly how to place trades on cryptocurrency call options.