In this lecture we will cover the maximum profit or loss of a bitcoin put option, measured in bitcoin, for both the buyer and the seller. It’s particularly important to be aware of how this differs to the calculations given in lecture 5.7.

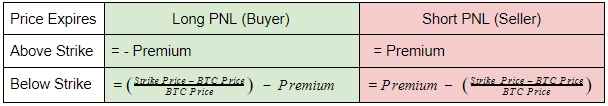

Firstly, this table shows how to calculate the profit or loss of a bitcoin put option position for either the buyer or seller. To keep things simple, we’ve left out the position size i.e. the number of contracts. To adjust for that you would just multiply by the number of contracts afterwards.

You may be able to see that this section of the formulas:

(Strike Price – BTC Price)/BTC Price

Will get larger and larger, as BTC Price gets smaller, given that the strike price never changes. Knowing this will help you see why the maximum profit/loss for the buyer/seller respectively, is unlimited measured in bitcoin.

Max profit/loss

It’s always useful to know the maximum potential profit or loss of any option position you’re thinking of opening.

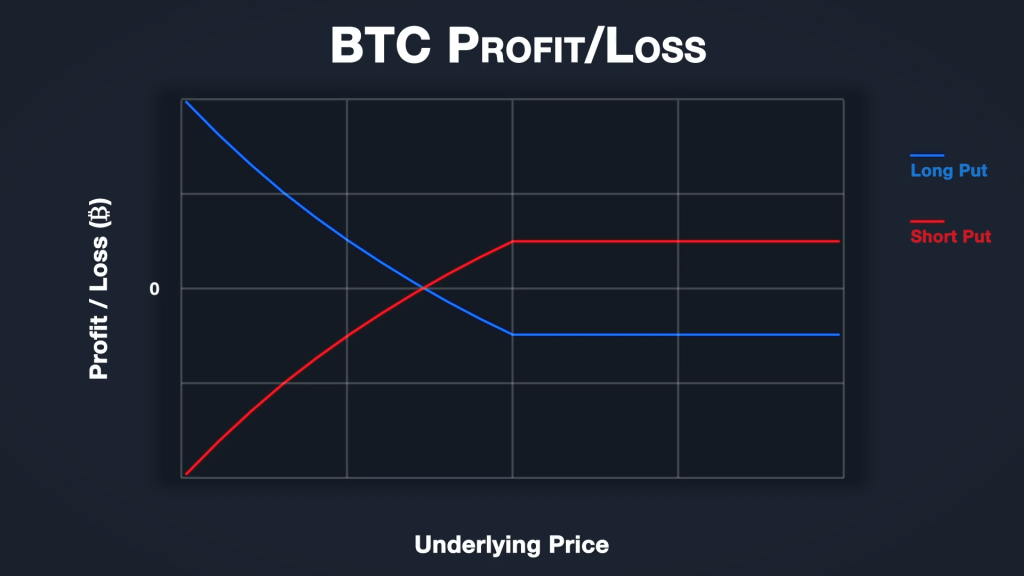

Here we can see the bitcoin profit and loss chart for a bitcoin put option. The buyer’s PNL is in blue, and the seller’s PNL is in red.

As usual with options, when the option expires worthless the loss for the buyer is fixed, as is the profit for the seller. For put options this happens when the underlying price is above the strike price at expiry.

However as price decreases, as you can probably tell just from this visual by noticing the increasing steepness of these payoff lines, the maximum profit in bitcoin of the buyer is unlimited. Similarly the maximum loss in bitcoin for the seller is also unlimited.

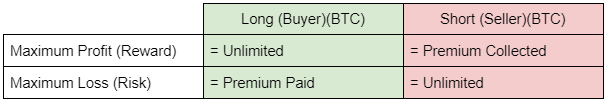

This results in these maximum BTC profit/loss formulas:

It’s worth noting again that if measured in dollars, these formulas for maximum profit or loss would be the same as the ones given in lecture 5.7.

It’s because we are measuring things in bitcoin here (the base currency) that they are different.

For the bitcoin put option buyer, their profit continues to increase for every dollar decrease in the underlying bitcoin price. Additionally, every time the bitcoin price decreases by a dollar, that means that more bitcoin is needed to pay each $1 of profit.

As an example, imagine we purchase a bitcoin put option with a strike price of $10,000. What is the option worth if the bitcoin price expires at $8,000?

The put option is $2,000 in the money at expiry, so is worth $2,000 at expiry. As the price of bitcoin is now $8,000, this $2,000 is paid as 0.25 BTC.

Now, what if the bitcoin price is another $2,000 lower instead, and expires at $6,000? The put option is now worth $4,000, so double the amount of dollars. However, as the price of bitcoin is now only $6,000, this $4,000 is paid as 0.6667 BTC (rounded to 4 decimal places). So the dollar value of the option has doubled, but because the price of bitcoin has decreased, the amount of bitcoin required to settle this has more than doubled.

Taking this to an extreme, imagine the price of bitcoin falls all the way to $1 per bitcoin. What is this same $10,000 put option now worth?

The put option is worth $9,999 because the price of bitcoin is now $1, but we have the right to sell it for $10,000 (which is $9,999 higher). As the price of bitcoin is now $1, this $9,999 is paid as 9,999 BTC. This trend continues if the price of bitcoin drops under a dollar as well.

Of course for the buyer this doesn’t pose a problem, they still get their pay out and they don’t have to worry about whether they have enough to support their long put position because they paid the premium up front. From the seller’s point of view though, they sold 1 bitcoin option and now have to pay out nearly ten thousand bitcoin to the put option buyer. In reality, the seller would likely have been liquidated long ago, surrendering the position over to a different trader once the losses on their position were larger than the amount they had in their account.

This last extreme example is of course extremely unlikely, however it’s vitally important to be aware of this relationship between the dollar and bitcoin profit when your collateral is stored in bitcoin. This is never more relevant than when a trader is naked short put options.

For some traders making the switch over to crypto options from traditional options, this is a point that can easily be overlooked, because they are used to the selling of put options having a cap on losses.

In summary

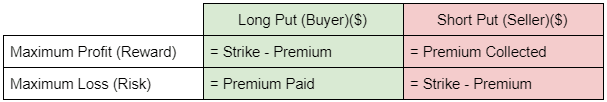

The buyer of a cryptocurrency put option on Deribit has a fixed risk. Their profit measured in dollars is limited to the strike price minus the premium paid, but when measured in bitcoin is unlimited.

The seller of a cryptocurrency put option on Deribit has a fixed potential profit. Their dollar risk is limited to the strike price minus the premium collected, but measured in bitcoin this risk is unlimited. For this reason the seller of a put option will normally either be hedged in some form from the start, or at least have a plan of under what circumstances they will either hedge or exit the position.

While the put option calculations in dollar terms are the same as section 5, when measured in bitcoin they are quite different. This difference is particularly important to familiarise yourself with if you are used to using dollars as collateral for options on things like stocks or commodities, and are making the move over to cryptocurrency options on Deribit for the first time.