Weekly recap of the crypto derivatives markets by BlockScholes.

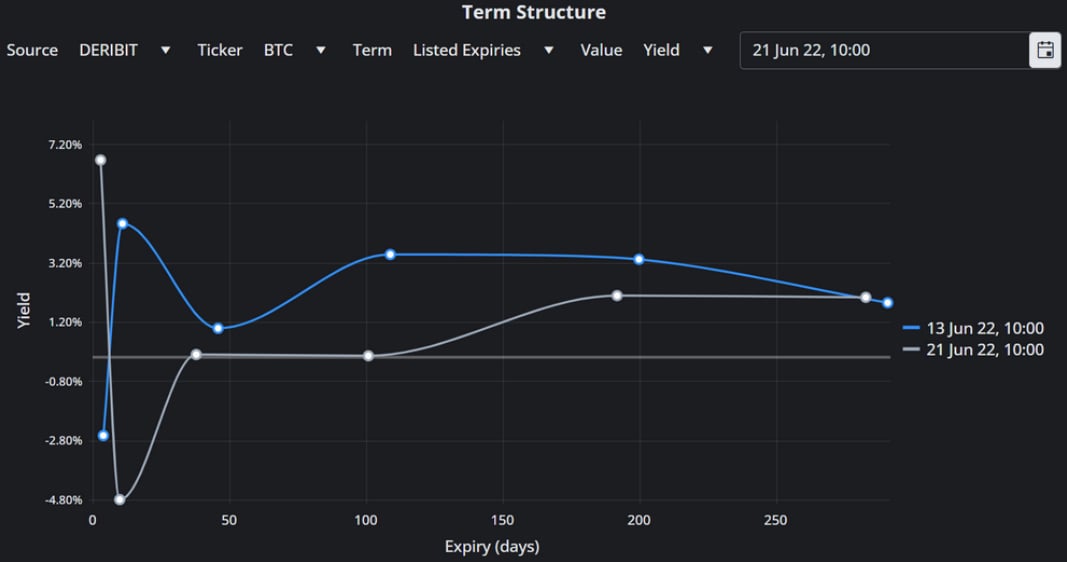

BTC futures term structure flattens and is negative at a 30-day tenor

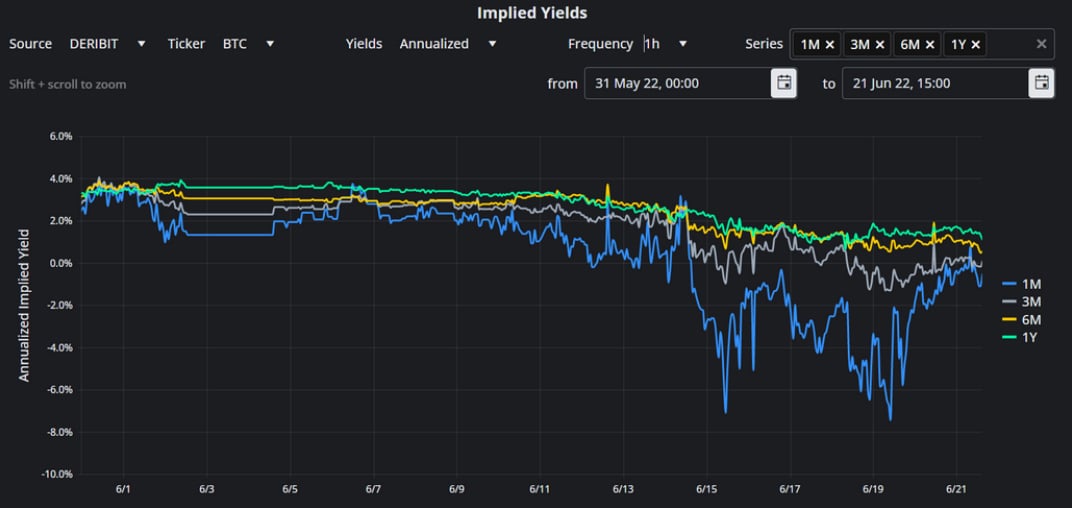

Annualised futures implied yields dropped significantly below spot at short term tenors

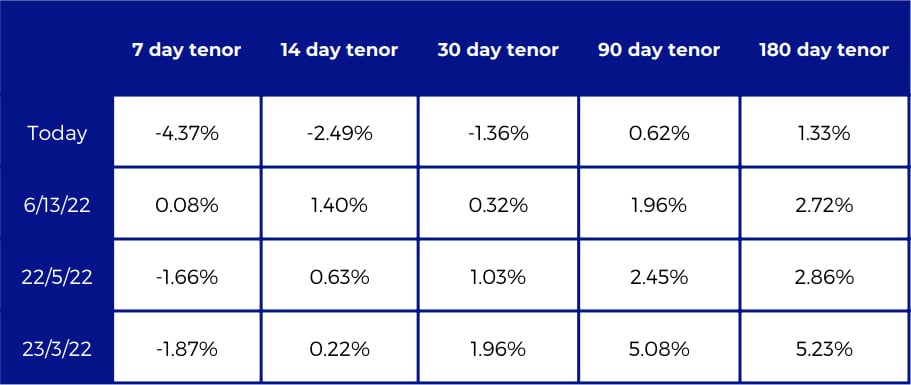

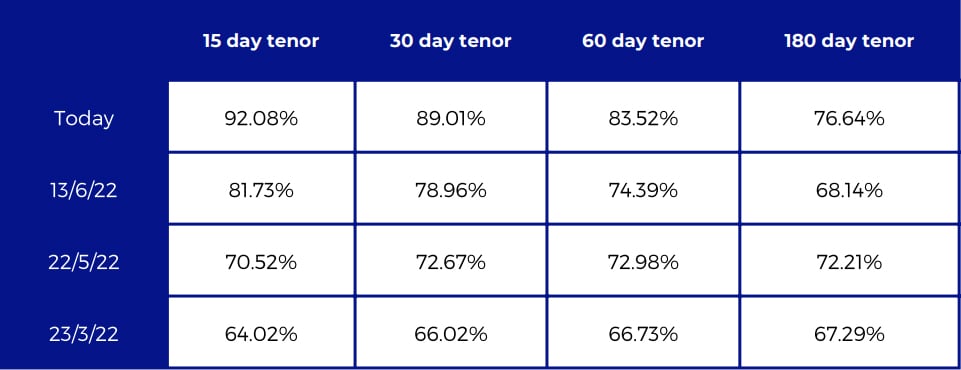

Annualised Futures Implied Yields Table

Bitcoin Volatility Metrics

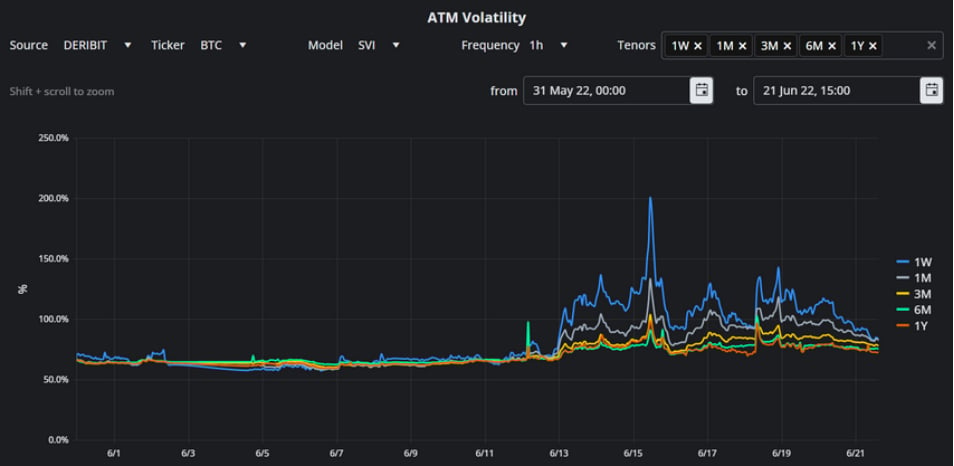

Spike in ATM implied vols at the beginning of the week has subsided to an inverted vol term structure

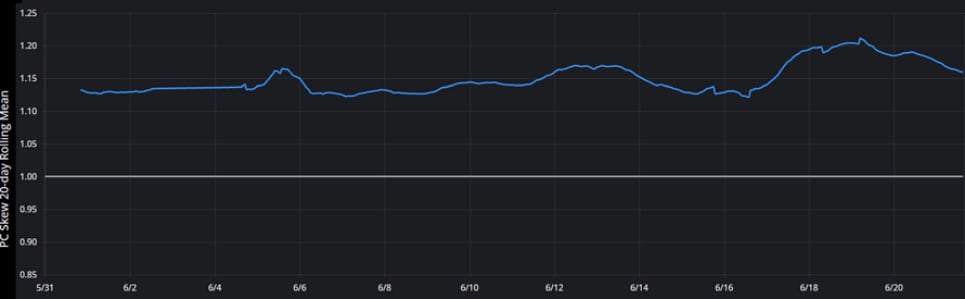

Skew towards puts remains very high as the market anticipates further selling

ATM Implied Volatility Table

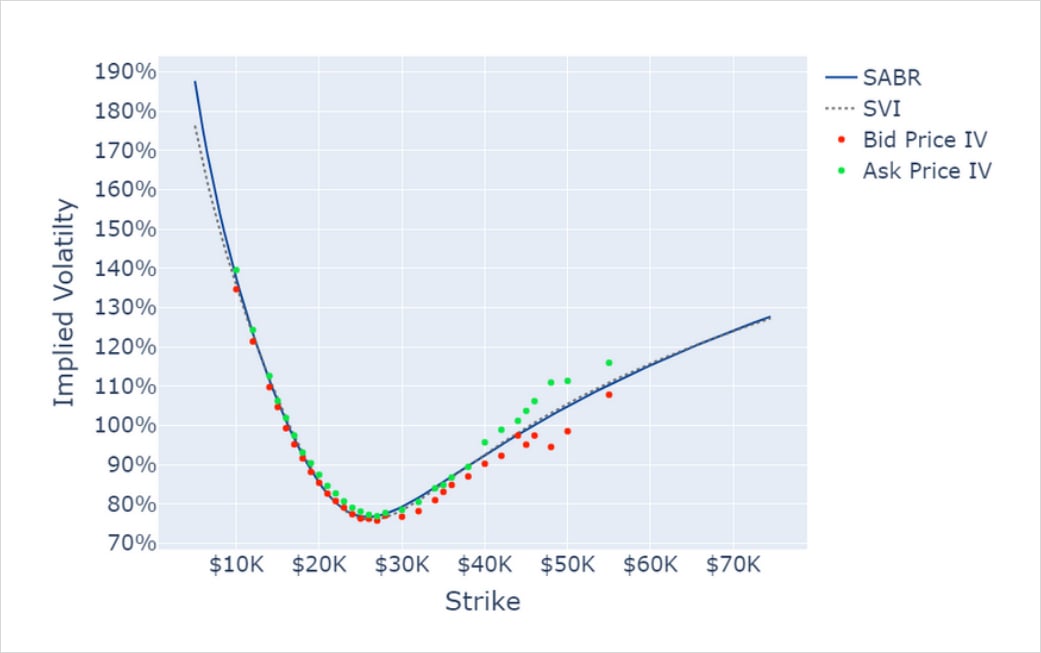

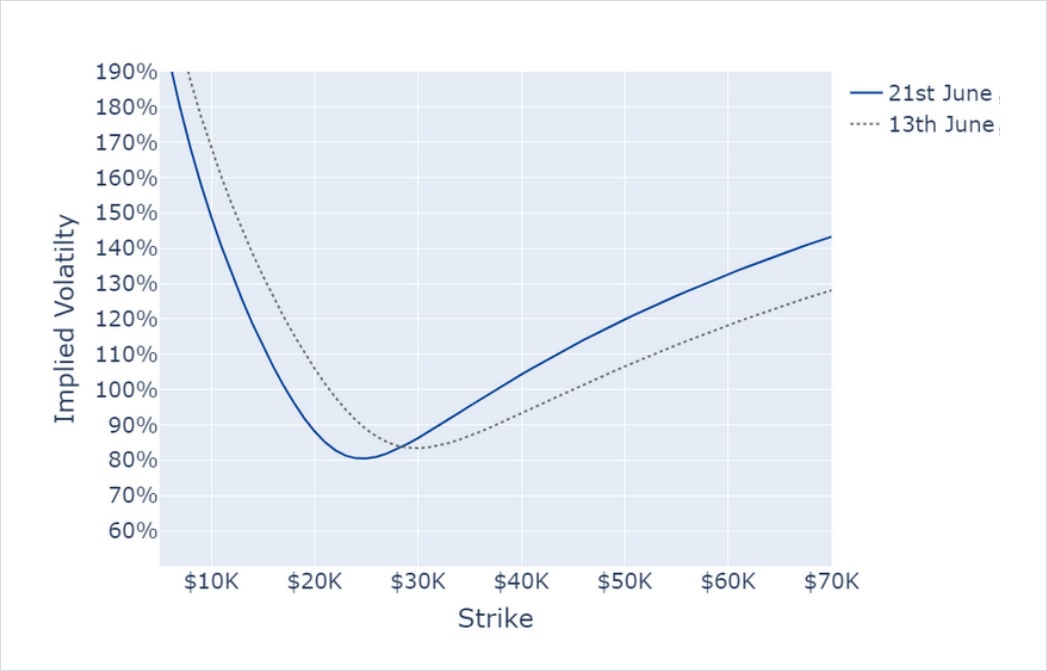

BTC 29th July Expiry smiles

SABR and SVI Smile Calibrations.

The smile remains elevated, steep, and skewed towards puts at the new spot level near $20.5K

1 Month SABR Implied Vol Smile.

AUTHOR(S)