A call option gives the holder the right to buy something. The same is true for a cryptocurrency call option. When a call option expires, it’s value will be equal to any amount over the strike price that the underlying price is. Again this is true for cryptocurrency call options, so why do we have a separate lecture for calculating the profit/loss of cryptocurrency call options?

The reason is that while the profit or loss is still calculated in dollars, the cryptocurrency options on Deribit use the cryptocurrency itself as collateral. This means that after calculating how many dollars the call option is worth at expiry, this amount must then be converted into the cryptocurrency. The premium paid for the option is also set in cryptocurrency, so when calculating the profit we need to subtract the amount of cryptocurrency paid for the option, from the amount of cryptocurrency received.

For this lecture we will be using bitcoin specifically as the cryptocurrency, but this applies equally to the ethereum contracts, or any other contract that uses the asset itself as collateral.

Calculating profit/loss in bitcoin

Example 1

Suppose bitcoin is currently trading at a price of $11,000. We expect the price to increase so we purchase a bitcoin call option with a strike price of $12,000. The price of this call option is 0.05 BTC, that’s 5 percent of a bitcoin.

At expiry, the price of bitcoin has indeed increased to $15,000, and we would like to calculate what our profit is. Remember the balances and profits are paid in bitcoin, so our end result will be an amount of bitcoin that we have made.

The first step is exactly the same as the steps we took in lecture 3.3, where we calculated the profit/loss of options that used dollars as collateral. We first calculate how much the option is worth in dollars at expiry.

The price of bitcoin at expiry is $15,000, and the strike price is $12,000, so to calculate the value of the option in dollars, we subtract the strike price from the underlying price.

$15,000 – $12,000 = $3,000

The option is therefore worth $3,000 at expiry. So, how much is this in bitcoin? We know the current price of bitcoin is now $15,000, so $3,000 has a value of 0.2 BTC. This is calculated as:

$3,000 / $15,000 = 0.2

This means that when the option expires, we will receive 0.2 BTC into our account.

There is one more step before we know our total profit/loss for the trade. We need to subtract the premium we paid. We initially paid a premium of 0.05 BTC for this option, so our profit/loss can be calculated as:

0.2 – 0.05 = 0.15 BTC

That’s it. Our profit on this call option is 0.15 bitcoin.

General formula

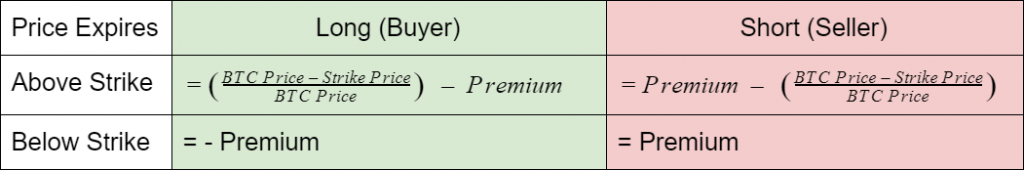

Before we work through some more examples, it’s worth expressing this process as a general formula. As with our calculations from section 3, if the call option expires out of the money, that is, the underlying price is below the strike price at expiry, then the buyer’s loss is equal to the premium paid for the option.

If the underlying price is above the strike price though, then we can calculate the profit or loss in bitcoin using this formula.

And of course, any profit for the buyer is a loss for the seller, and vice versa. So the formulas for the seller’s profit or loss are the negative of the formulas for the buyer’s profit or loss.

Armed with these formulas, let’s tackle a few more calculation examples.

Example 2

Suppose bitcoin is currently trading at a price of $14,500. We expect the price to increase so we purchase a bitcoin call option with a strike price of $15,000. The price of this call option is 0.08 BTC.

At expiry, the price of bitcoin has indeed increased to $20,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $20,000 is above the strike price of $15,000, so the option has some value, and we can use the formula in the top row.

= (BTC Price – Strike Price / BTC Price) – Option Price

= (20000 – 15000 / 20000) – 0.08

= 0.25 – 0.08

= -0.17

This long call option position therefore made a profit of 0.17 BTC.

Example 3

Suppose bitcoin is currently trading at a price of $14,000. We expect the price to increase so we purchase a bitcoin call option with a strike price of $15,000. The price of this call option is 0.075 BTC.

At expiry, the price of bitcoin has indeed increased to $16,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $16,000 is above the strike price of $15,000, so the option has some value, and we can use the formula in the top row.

= (BTC Price – Strike Price / BTC Price) – Option Price

= (16000 – 15000 / 16000) – 0.075

= 0.0625 – 0.075

= -0.0125

This long call option position therefore made a loss of 0.0125 BTC. Notice this time that the price still moved in the desired direction, and the option did have some value at expiry. However, this value was not large enough to make up for the premium paid for the option. This resulted in a small loss.

This highlights why it is not enough for the underlying price to simply move above the strike price. For the call option to make a profit at expiry, price also needs to move far enough to compensate for the premium paid. In other words to the breakeven point, which we will calculate later in Course 4.

Example 4

Suppose bitcoin is currently trading at a price of $14,800. This time, we expect the price to stop increasing so we sell a bitcoin call option with a strike price of $16,000. The premium we collect for this call option is 0.1 BTC.

At expiry, the price of bitcoin has actually increased to $18,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $18,000 is above the strike price of $16,000, so the option has some value, and we can use the formula in the top row. But we are the seller this time, so it’s the seller formula that we use.

= Option Price – (BTC Price – Strike Price / BTC Price)

= 0.1 – (18000 – 16000 / 18000)

= 0.1 – (18000 – 16000 / 18000)

= 0.1 – 0.1111 (rounded to 4 decimal places)

= -0.01111

This short call position therefore made a loss of 0.0111 BTC.

Example 5

Suppose bitcoin is currently trading at a price of $10,500. We expect the price to stop increasing so we sell a bitcoin call option with a strike price of $11,000. The premium we collect for this call option is 0.09 BTC.

At expiry, the price of bitcoin has decreased slightly to $10,400, and we would like to calculate what our profit or loss is.

The bitcoin price of $10,400 is below the strike price of $11,000, so the option has no value, and we can use the simple formula in the bottom row.

= Premium

= 0.09

This short call position made a profit of 0.09 BTC.

Example 6

Suppose bitcoin is currently trading at a price of $9,000. We expect the price to increase so we purchase a bitcoin call option with a strike price of $10,000. The price of this call option is 0.08 BTC.

At expiry, the price of bitcoin has decreased to $5,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $5,000 is below the strike price of $10,000, so the option has no value, and we can use the formula in the bottom row.

= – Premium

= – 0.08

This long call option position therefore made a loss of 0.08 BTC. It doesn’t matter that the price of bitcoin fell way below our chosen strike price of $10,000. The maximum a long call option position can lose is the premium paid.

This lecture should serve as a useful reference for checking how these calculations are made. You may wish to come back to it when we’re working through more examples later in the course, or when you’re calculating the profit/loss of your own option positions.

While it is useful to know how to do these calculations yourself, once you’re trading live you’re unlikely to want or need to do these calculations by hand every time. Thankfully you don’t have to. A simple spreadsheet or a handy tool like the Deribit position builder will do these calculations for you, and even show you the possible profit/loss at every price point. By plotting these PNL charts rather than manually calculating how much a position would make at various underlying price points, you can see at a glance exactly where your position makes a profit or loss, and how much. This is particularly useful when we come on to multi leg option positions.

Deribit Position Builder: pb.deribit.com

As we mentioned in example 3, it is also useful to know at what underlying price a cryptocurrency call option will breakeven. The next lecture will explain this.