Vega is a measure of the sensitivity of the option price to changes in implied volatility. The implied volatility level will itself have an effect on the vega.

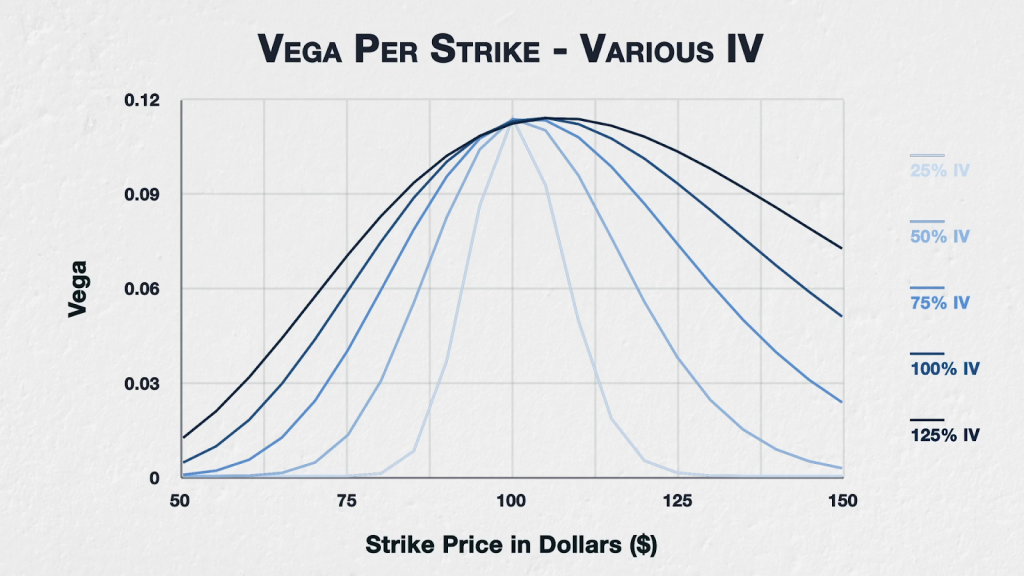

This chart shows the vega for all options of a fictional asset with a current price of $100, 30 days to expiry, and varying levels of implied volatility (IV). The strikes range from $50 to $150.

This is very similar to the first chart we looked at in the previous lecture, except instead of looking at a single IV level of 40%, we have included a separate line for five different IV levels from 25% up to 125%.

For each of these lines, the only parameter that has been changed is the value for IV. All other parameters like the strike price, time to expiry, and underlying price, remain the same.

As you can see, as IV increases, the vega of almost all the options increases. The only exception to this in this example is with the ATM strike of $100, where the vega remains almost the same at all IV levels. The characteristic of the most vega being concentrated around the ATM strikes, and then decreasing in both directions, still holds as IV increases. However, as you may have noticed, when we get to much higher IV (at 100% and 125%) the peak is actually pushed a little higher in price than the ATM strike of $100, and the line is a little less symmetrical.

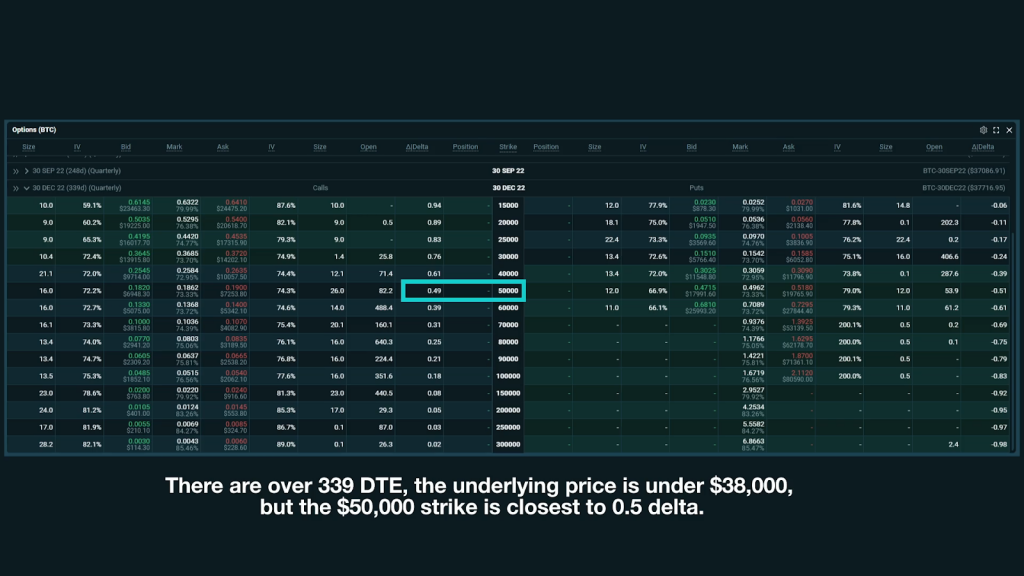

This is a common phenomenon in option theory. As either IV or DTE are increased, several values drift higher in price. For example in lecture 9.3, we briefly mentioned that this also happens to theta. Something similar occurs with delta as well. You may notice when looking at the bitcoin option chain on Deribit for example, that the option with close to a 50 delta is close to ATM for very short dated expiries, but is considerably higher for longer dates.

In summary

For ATM options, vega is relatively stable even with relatively large changes in IV. For OTM and ITM options though, an increase in IV means an increase in the option’s vega.

For options with low IV and low DTE, the peak vega will be for ATM options. Vega then decreases in both directions away from the current underlying price.

As IV and/or DTE are increased significantly, the peak will shift higher in strike price, such that it is higher than the current underlying price.