An option trading screen can be a little overwhelming for newer option traders. However, most of this is simply due to the sheer amount of information on display. Unlike with futures trading, the data for dozens of similar options is usually displayed on the page at the same time. Once you know where to look and click though, trading options becomes much simpler.

This step by step guide is aimed at breaking down the initial barrier of information overload. We will use a simple example to illustrate how to:

- Navigate to the option page on Deribit

- Locate an option

- Open the order form for an option

- Trade an option

- View open option positions

And if after this guide you still aren’t sure how to place an option order, there are additional resources to help, including a test version of the site where you can test things out completely free without risking any real funds.

Step 1

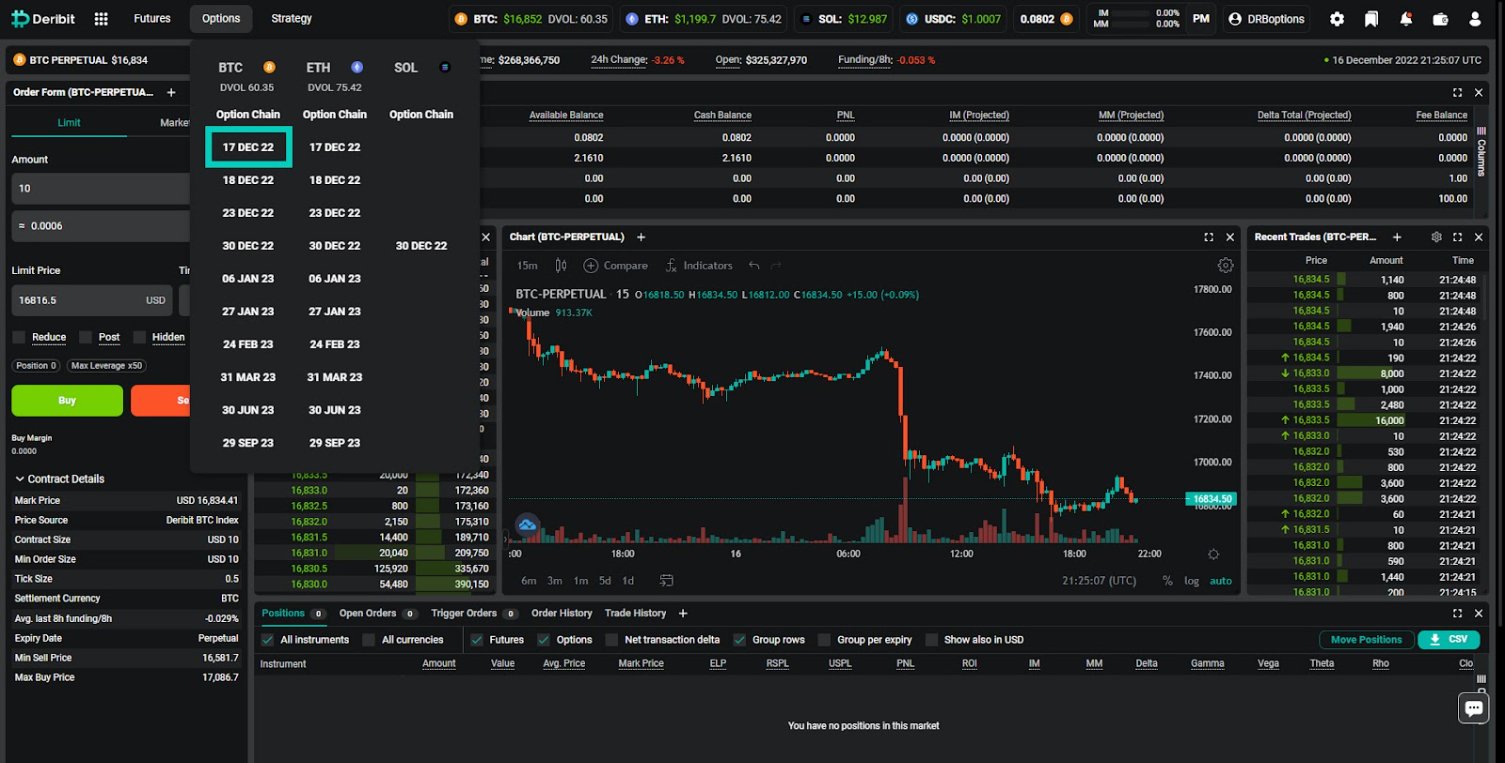

Once logged in to the Deribit website, navigate to the options page.

Go to Options in the top menu, then click on either Option Chain or a specific expiration date for the desired currency.

For example, if we want to look specifically at the BTC options that expire on 17th December 2022, we click here on 17 DEC 22 in the BTC column.

On the Option Page it is possible to show the entire option chain, or only show an individual expiry. This can be changed by selecting the desired view at the top of the chain.

Definition: The ‘option chain’ is a list of all available options for a particular asset, usually grouped by expiry date.

Step 2

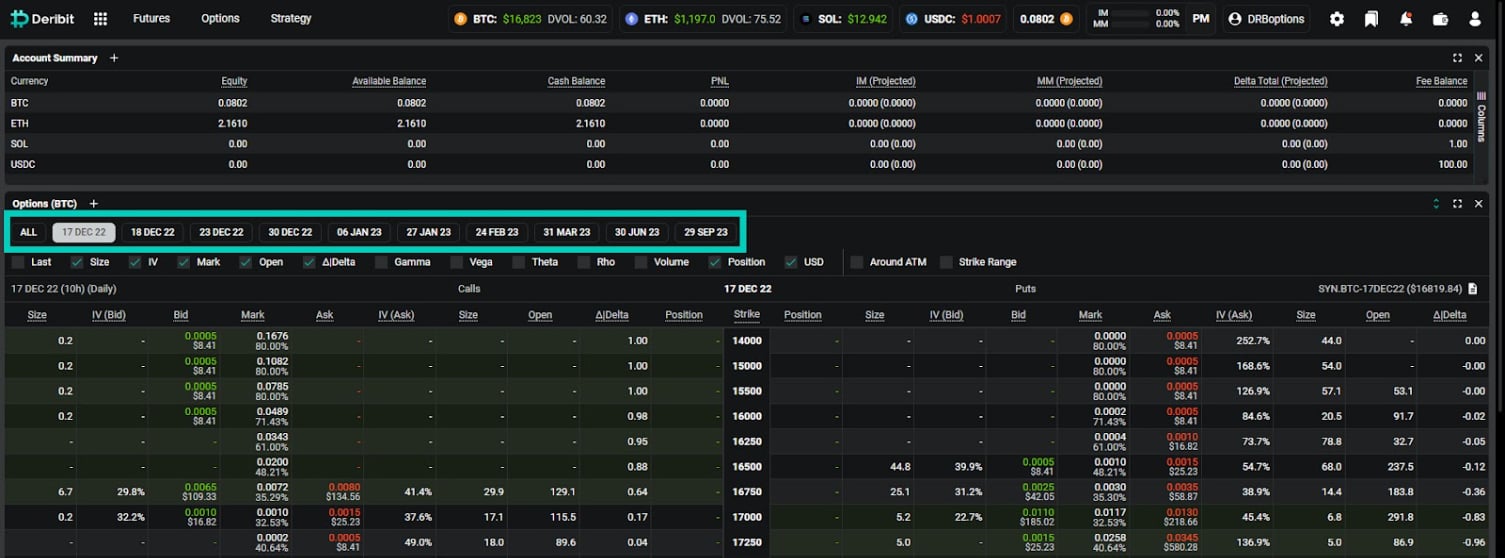

Find the option you want to trade.

Options are displayed with the strike prices down the centre column, with call options to the left of this, and put options to the right of this.

Tip: if you are new to options and would like more information on the different types of option, and much more, check out the free Deribit option course here.

If we want to trade the $17,500 call option that expires on 30th December, we select the 30 DEC 22 expiry at the top of the option chain, then find 17500 in the centre column, and look left to the call option details. (remember, call options are on the left, and put options are on the right)

Step 3

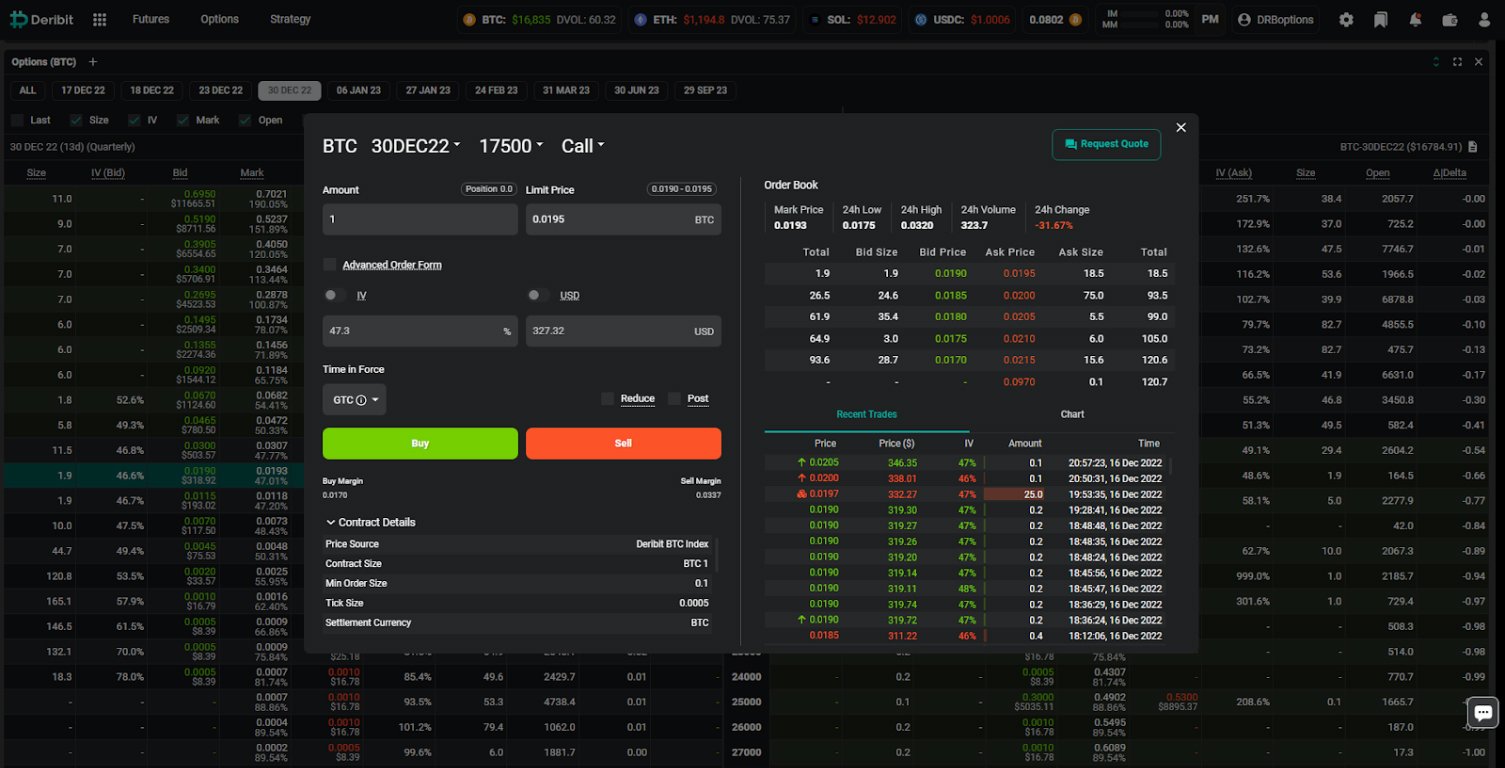

Open the order form for the chosen option.

To open the order form for a particular option, click twice on that option in the option chain. For more details on Order Form, you may refer to this link.

Step 3.b (Optional)

Alternative setup.

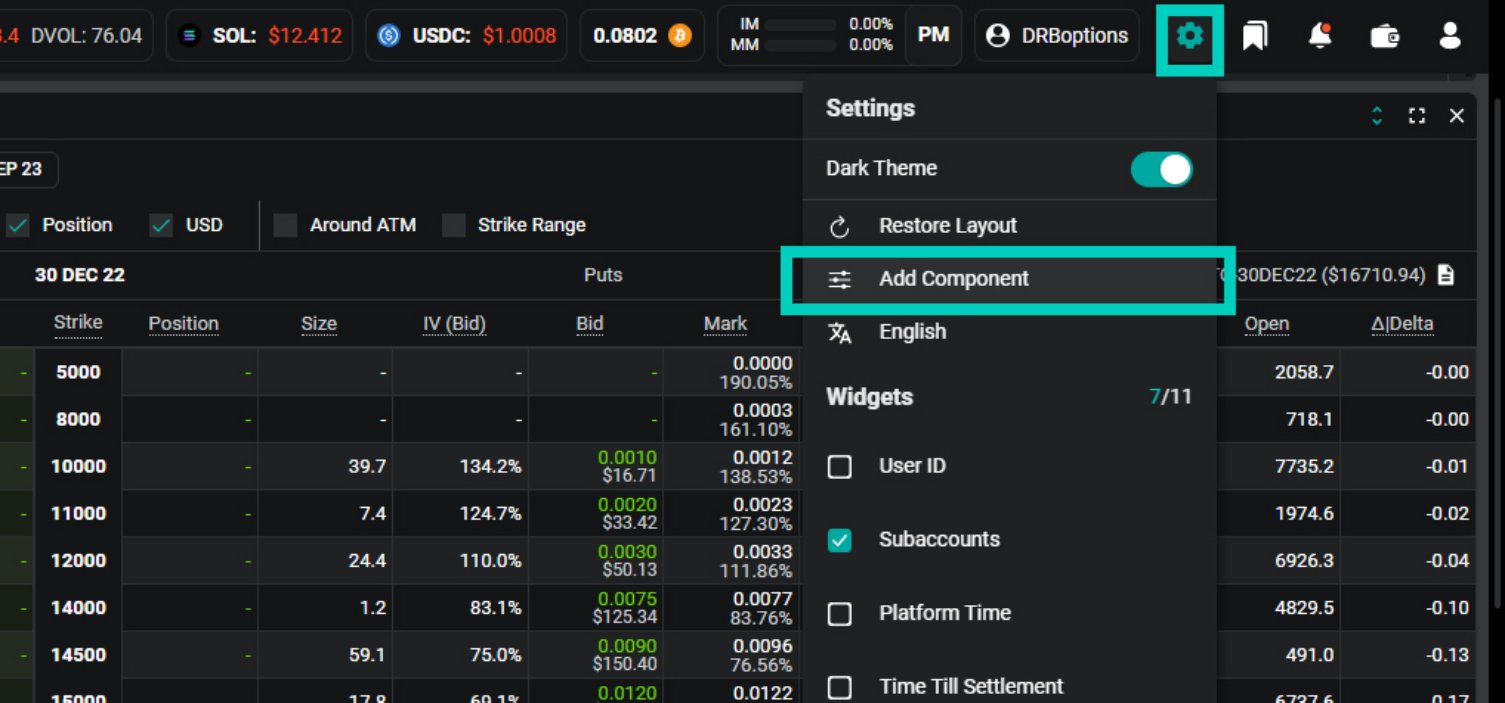

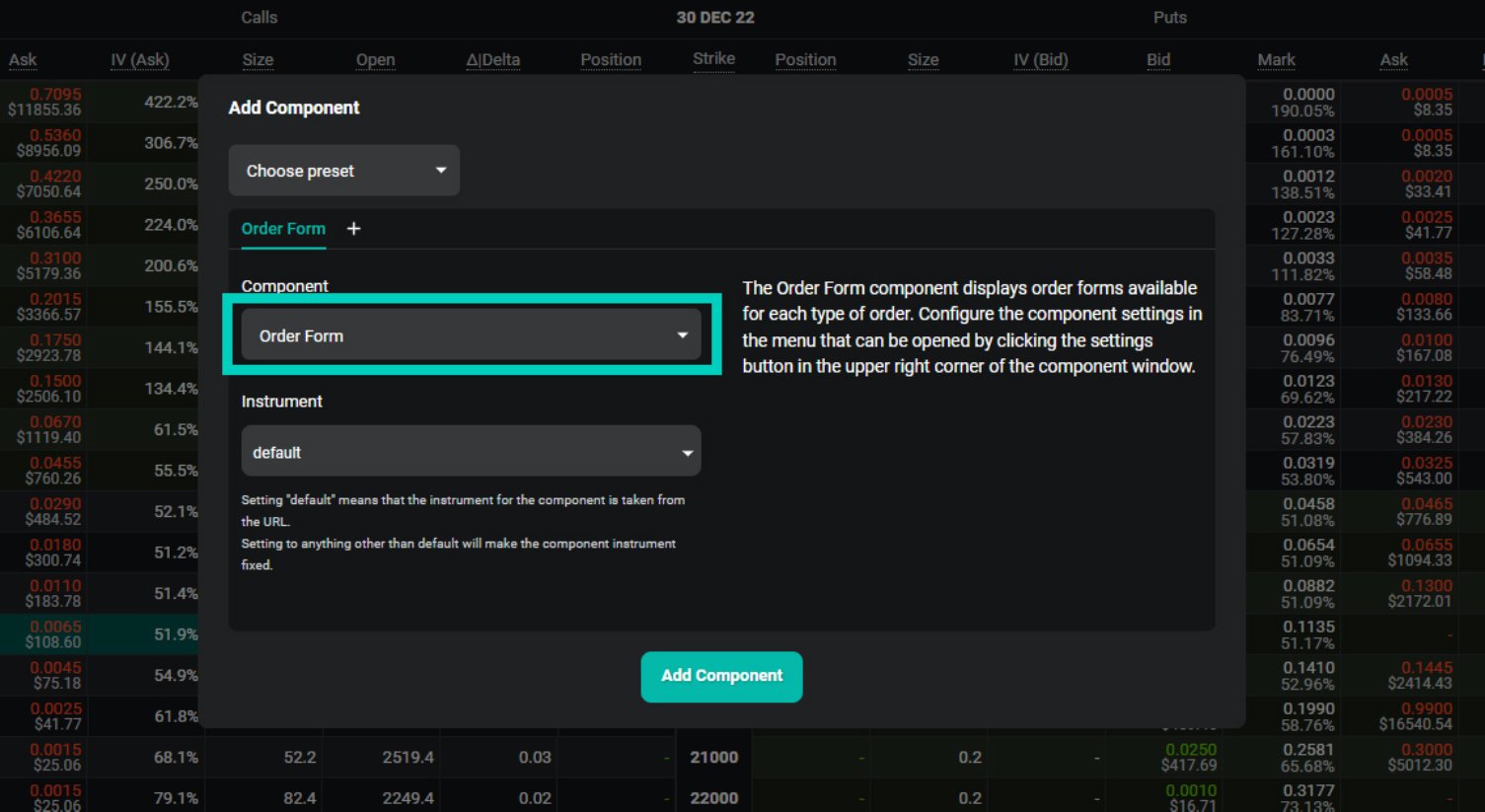

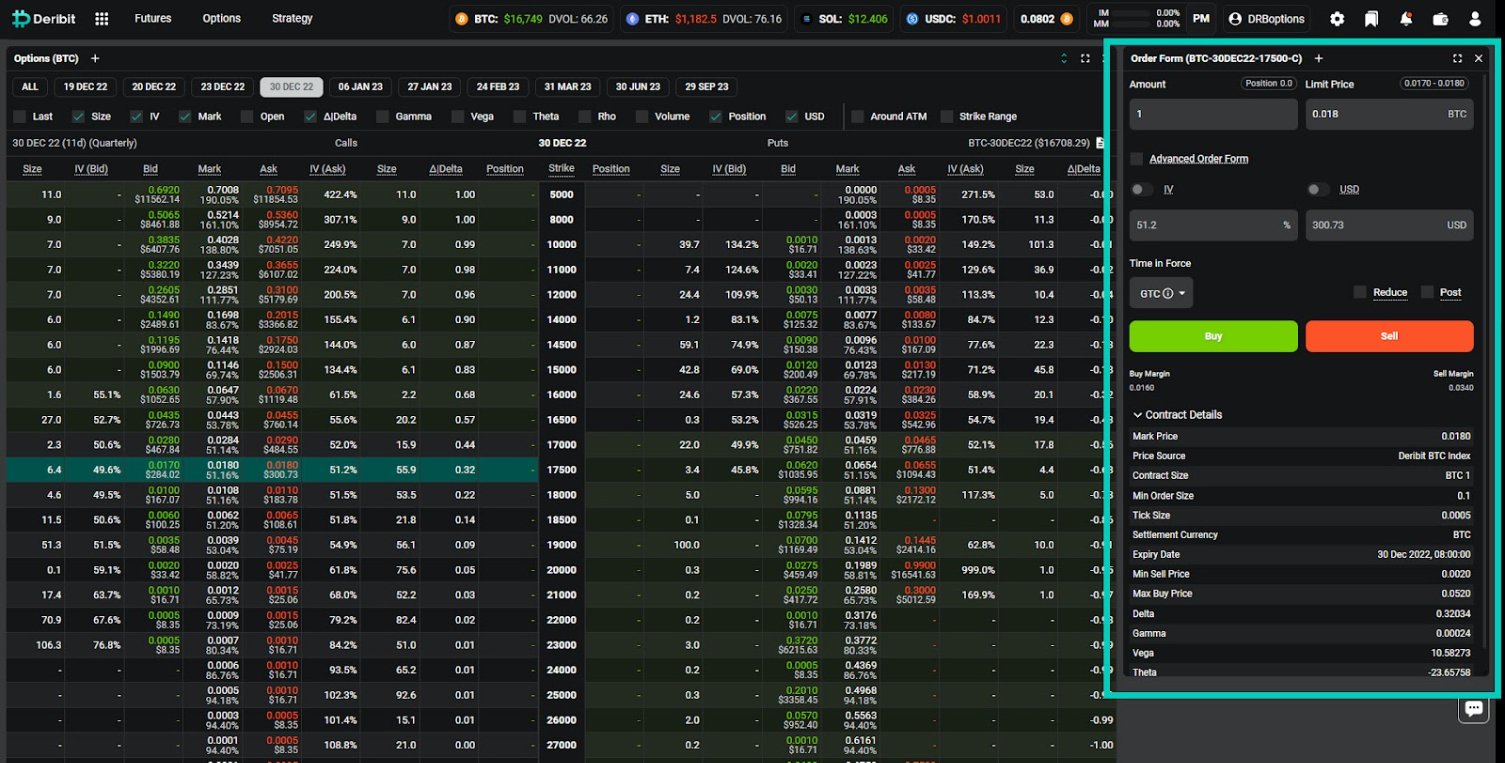

If you would prefer to have the order form always shown on the page for whichever option is selected, this can be done by adding the Order Form component to your layout.

To do this, go to the cogwheel menu at the top of the page, then click Add Component.

Select the Order Form component from the dropdown menu, then click Add Component.

The component can then be positioned in the layout according to personal preference.

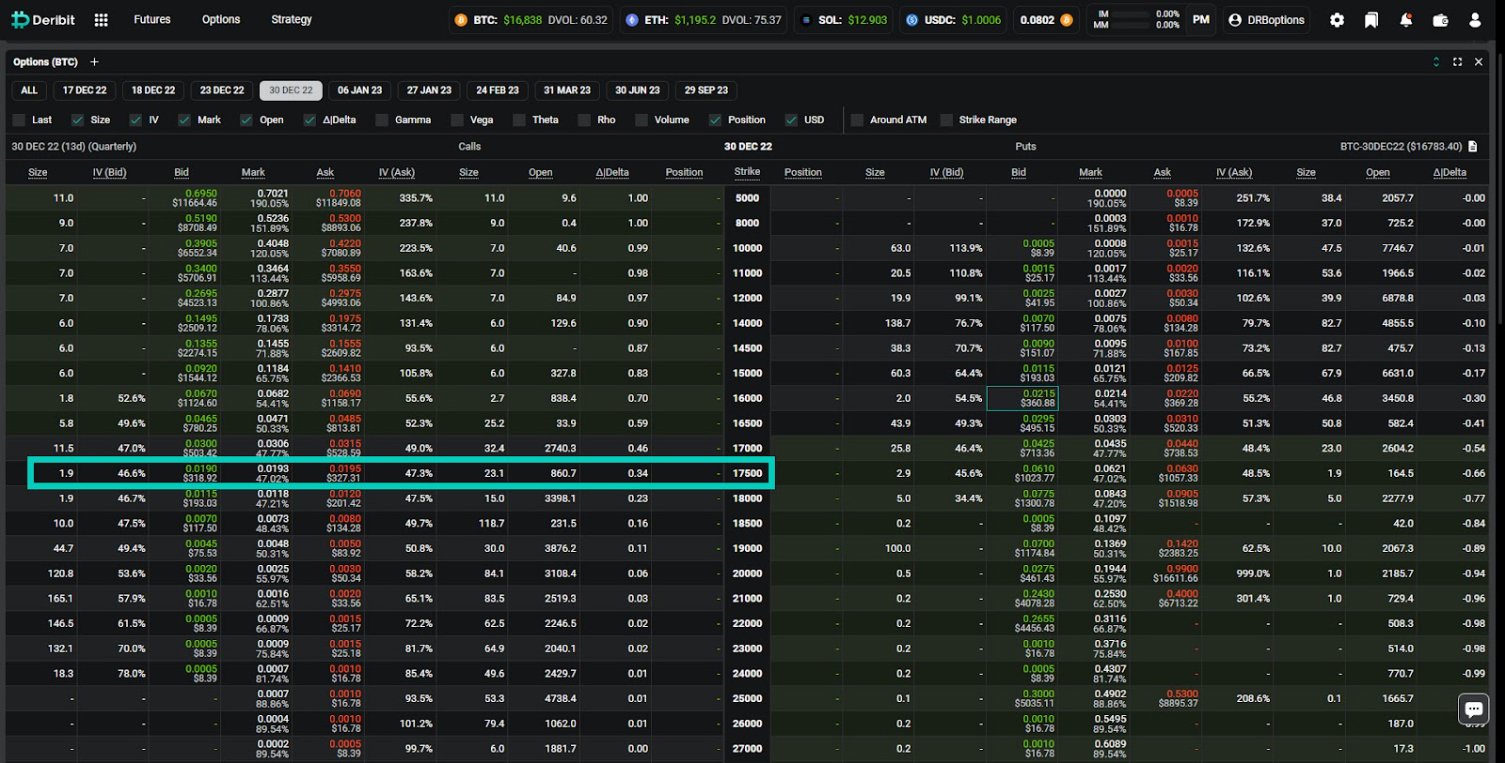

Step 4

Enter the order details.

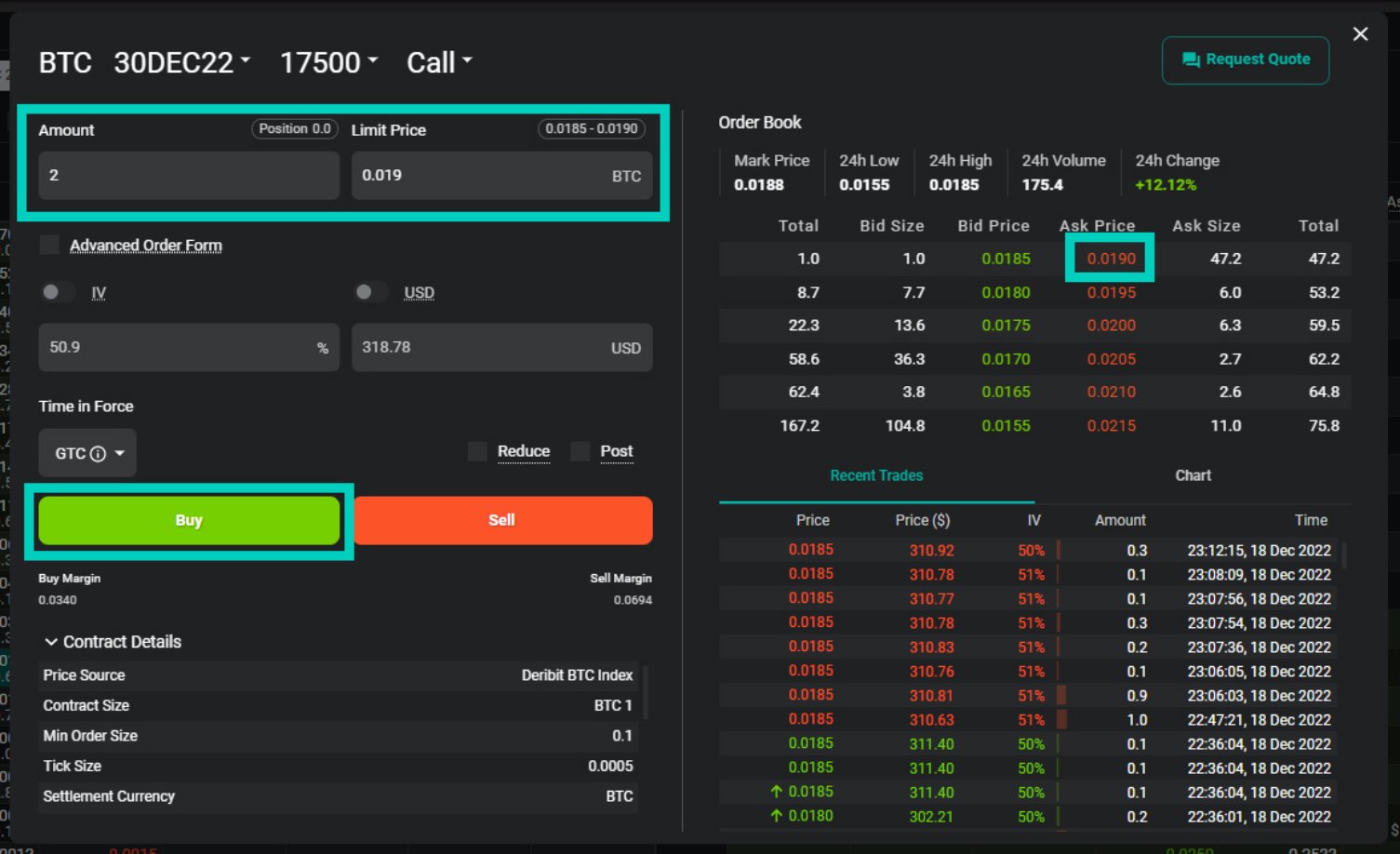

For example,we have chosen the option BTC-30DEC22-17500-C. This is a bitcoin option that expires on 30th December 2022, which has a strike price of $17,500 and is a call option.

If we want to buy two of these call options for a price of 0.019 each, we enter an Amount of 2, and a limit price of 0.019 BTC. In the order book on the right, we can see an existing order to sell this option at a price of 0.019, so our order to buy at 0.019 would execute immediately.

Step 5

Send the order.

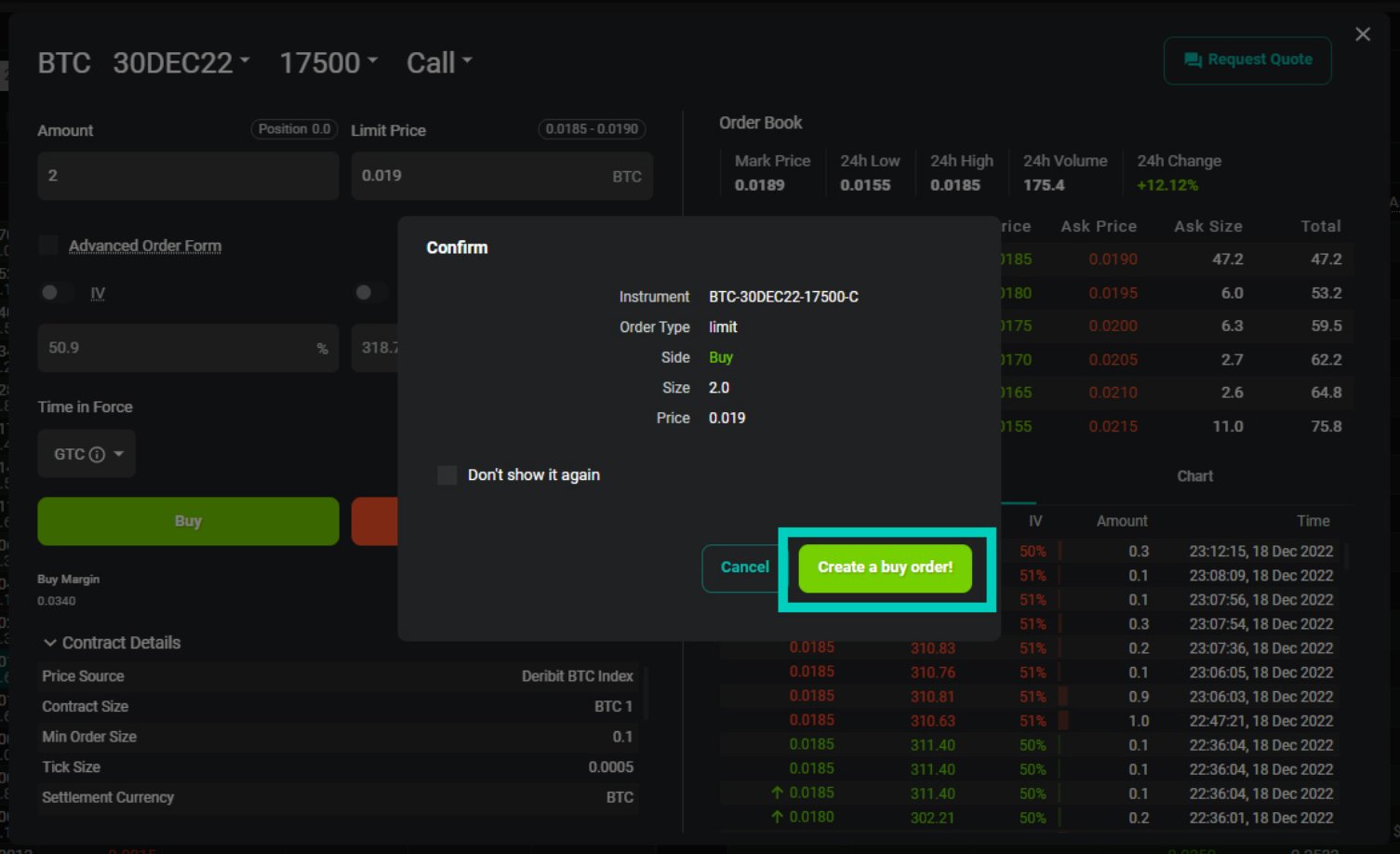

To place the order, click the Buy button. This will bring up the confirmation screen where the order details can be checked.

The Size is shown as 2, and the Price is shown as 0.019. This price is per unit though. The total price paid would be the Size multiplied by the Price, which in this case is 0.038 BTC.

Once the details have been confirmed, click Create a buy order to send the order into the market.

Tip: The Deribit test site is an excellent place to practise placing orders first, without risking any real funds. The test site is free but requires a separate account and can be found here.

Step 6

Viewing open positions.

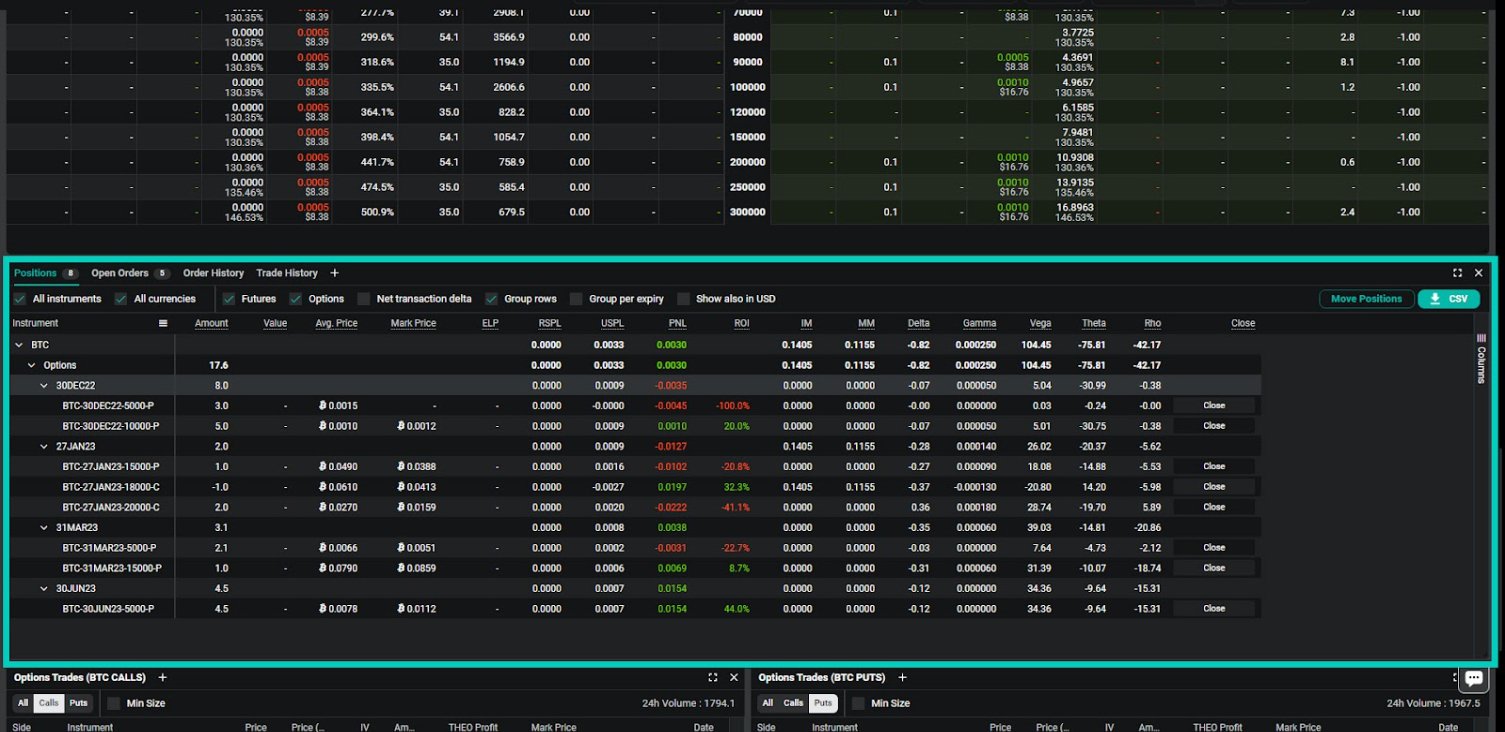

All open positions can be viewed in the positions table.

Step 7

Closing positions.

Options can be held to expiry. When held to expiry, any profit or loss will be paid automatically as soon as they expire.

Note: Options on Deribit are cash settled rather than physically settled, see the option course for more details.

Alternatively, option positions can be closed early, before they expire. This can be done by either using the close button in the positions table, or by executing an opposing order in the same option. For example, if a trader is long 2 contracts of Option A, this position would be closed by selling 2 contracts of Option A (reducing the position to zero). Similarly, if a trader is short 5 contracts of Option B, this position would be closed by buying 5 contracts of Option B (reducing the position to zero).

Useful Links

If you would like to learn more about options, and how they work on Deribit, bookmark the following links:

Deribit Option Course.

Deribit TestNet.

Knowledge Base for Options.

AUTHOR(S)