In the previous article we covered single leg positions i.e. just a call at one strike price or just a put at one strike price. Now we’ll move on to defining some multi-leg positions with different combinations of options in them, how to construct them and what they look like in terms of profit and loss (P/L).

Multi-leg option positions allow you to build some quite unusual looking but very useful positions. You can take advantage of sideways ranging markets, trade volatility without having to choose a direction and define your risk on what would otherwise be an undefined risk position among other things.

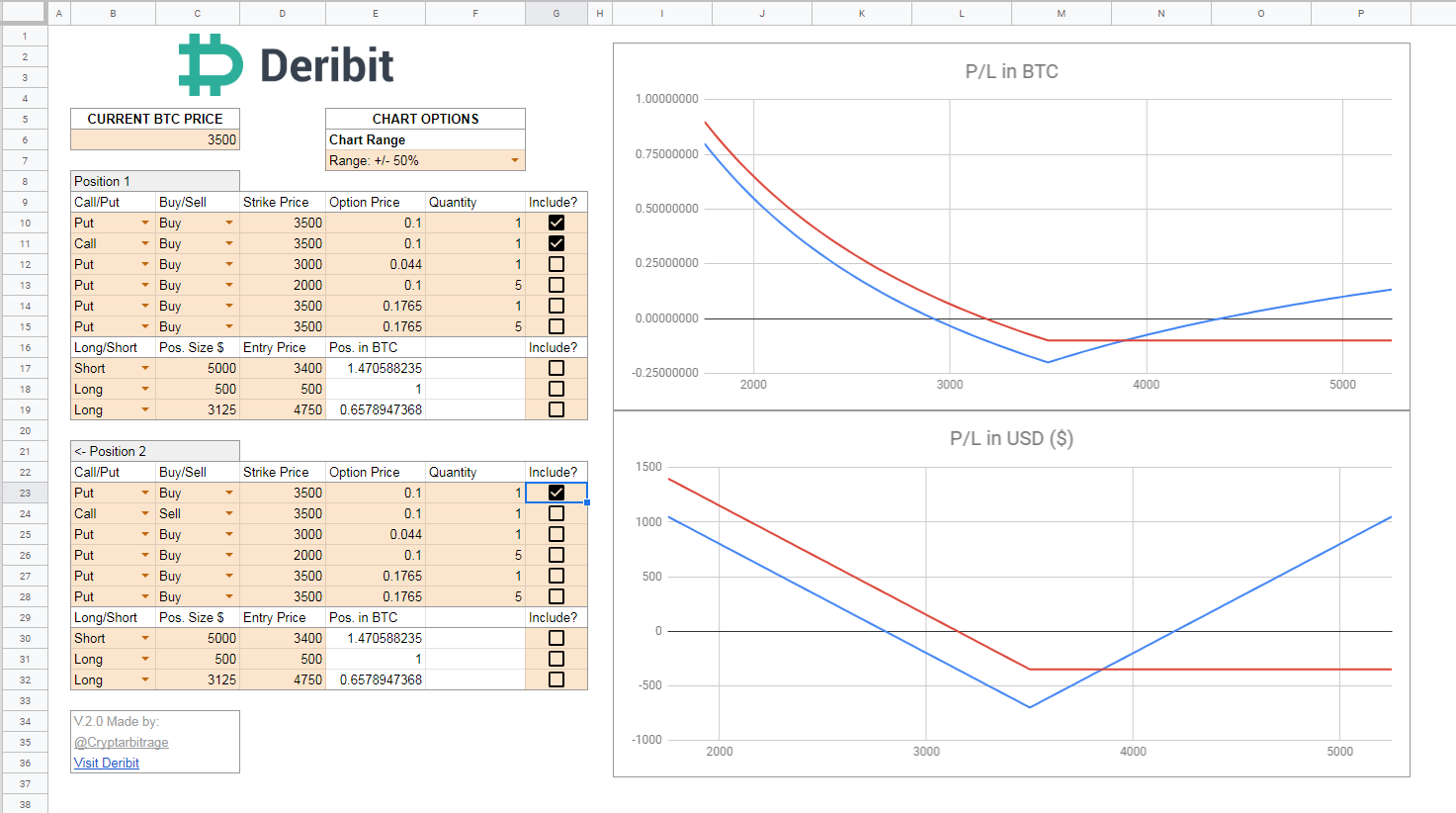

Before we jump into the straddles and strangles I’ve created a google sheet for building multi-leg options positions that also includes regular longs and shorts. This spreadsheet allows you to enter position combinations and then plots the profit and loss of those combined positions onto charts allowing you to visualise them immediately. It plots this in both Bitcoin and USD.

You can download a free copy here.

(In Google sheets go to File > Make a copy)

Any examples we work through in this article I will leave in the sheet so you have them ready to go and can play around with them.

Straddle Option Positions

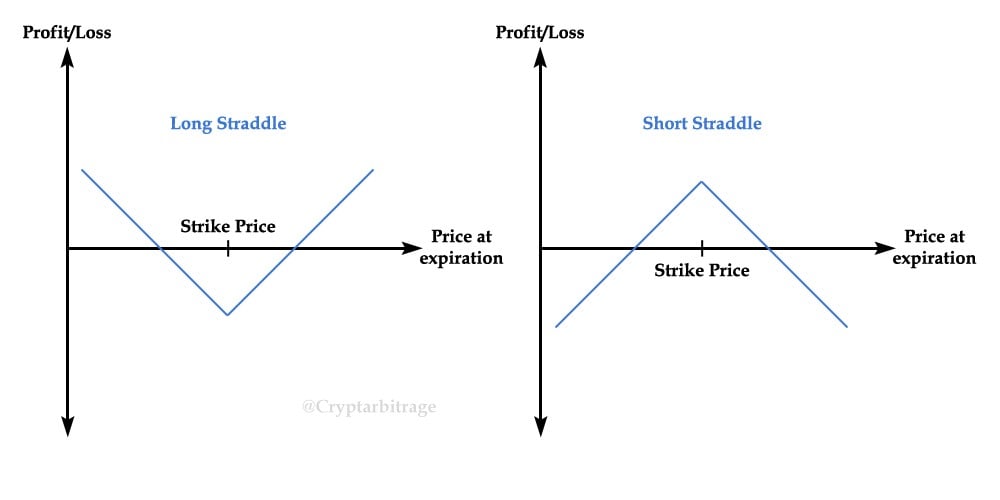

A straddle position consists of a call and a put at the same strike price and expiry date. A long straddle is buying both the call and the put, and a short straddle is selling both the call and the put. A straddle is one of the simplest ways to take a non directional trade using options.

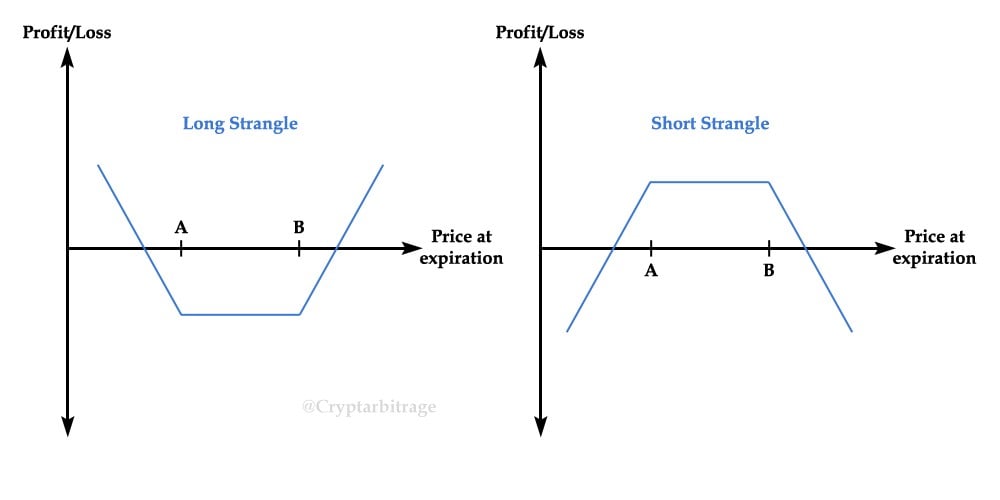

This is the basic structure of a straddle and how it looks on a profit/loss chart:

Opening a Long Straddle

- The current price will typically be at or near the strike price chosen.

- You are buying a call and a put at the same strike price and same expiry date.

- As you’re buying two options you’re paying more premium than you would if you were picking a direction.

- This moves your breakeven points further away from the strike price meaning you need a larger move, but of course now you have two breakeven points as you will benefit from a large move in either direction.

- The position is fixed risk, so your maximum loss is the premium you have already paid to open the position.

- You are longing volatility. You want implied volatility to increase once the position is opened as it will increase the value of your options. You want the price to move, the more the better, and it doesn’t matter which direction.

Opening a Short Straddle

- The current price will typically be at or near the strike price chosen.

- You are selling a call and a put at the same strike price and same expiry date.

- As with a long straddle the breakeven points are moved further away from the strike price, but as you are selling this works in your favour.

- The trade off here is that your risk is not defined in either direction, so your maximum loss is potentially unlimited. For this reason you should avoid shorting straddles until you are more comfortable with options (or you can define the risk by turning it into a butterfly position which we’ll cover in part 2)

- You are shorting volatility. You want implied volatility to decrease once the position is opened as this will decrease the value of the options you have sold. A sideways ranging market would be ideal for you.

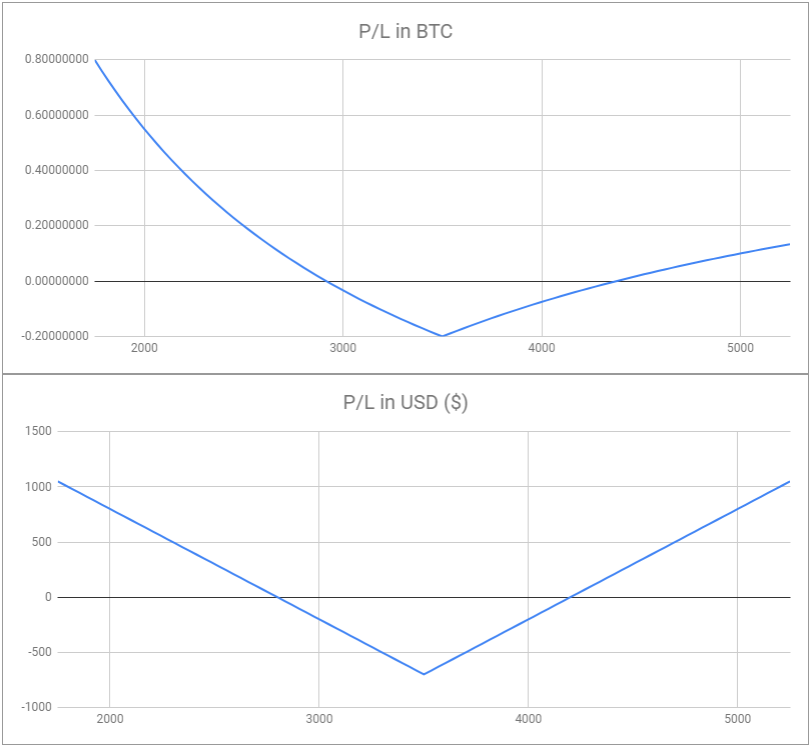

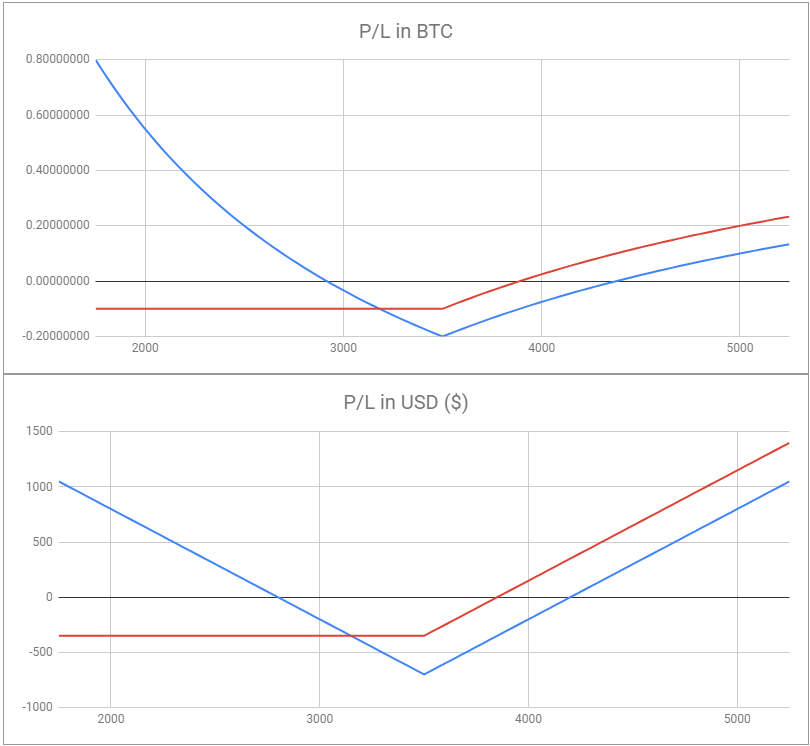

Bitcoin Straddle Example

Using the spreadsheet provided I have constructed here an example of a long straddle at a strike price of $3500, and also assuming a current BTC price of $3500. For this example I’ve assumed both the put and the call cost 0.1BTC each.

So this position is:

+1 call with a strike price of 3500

+1 put with a strike price of 3500

You will notice the USD profit/loss on the bottom looks exactly the same as the basic structure picture for straddles given earlier but the BTC chart looks quite skewed. This is due to the collateral and profit for the option also being paid in BTC. We’ll cover this in more detail in a separate article about the asymmetry of bitcoin profit/loss.

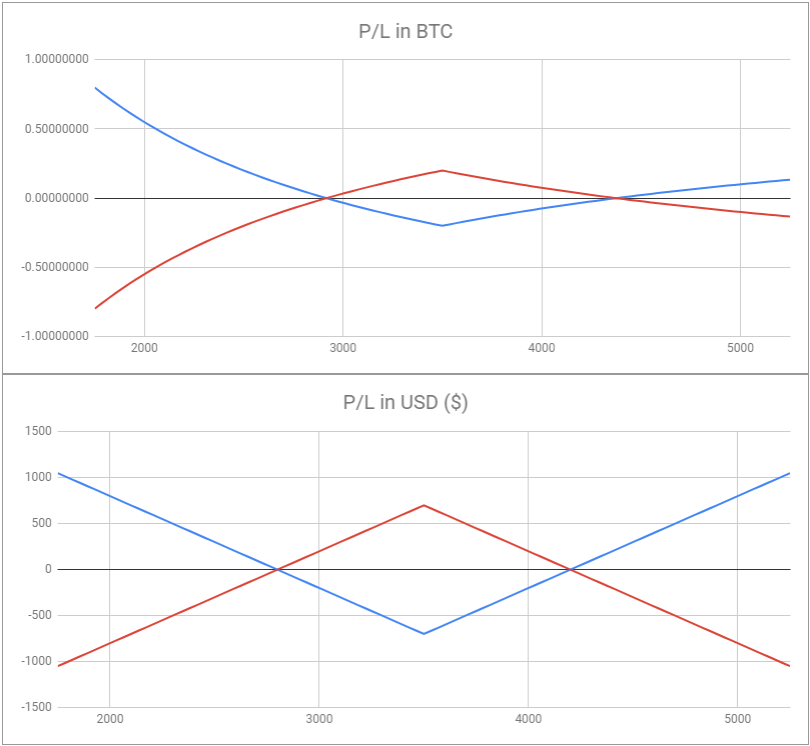

Now let’s add on to the same chart the sellers P/L, i.e. a short straddle with the same parameters:

-1 call with a strike price of 3500

-1 put with a strike price of 3500

The long straddle here is still in blue, with the short straddle added in red.

As a seller’s P/L is just the buyer’s P/L multiplied by minus 1, you can think of this visually as flipping the P/L around the x axis. And so as you can see the breakeven points (where the lines cross the x axis) are the same for both buyer and seller.

The above example will be left in the downloadable version of the sheet under the name ‘Straddle’. Feel free to download a copy for yourself and have a play around with the parameters.

Comparison

Let’s take a quick look at how a straddle compares to a single leg. The following is the same long straddle as above compared with just the call leg, all strikes at 3500.

With the single call (in red) you have chosen a direction so you need the BTC price to increase to profit. With the long straddle (in blue) you can now benefit from a move in either direction but the trade off is the extra premium you’ve paid for the put has dragged the whole P/L line down the chart by the amount of that extra premium, meaning you need a larger move to get to breakeven.

Any increase in the total premium paid will move the P/L line down for option buyers and up for option sellers. We will go into much more detail about this and about option pricing in general in a separate article.

As straddles are normally created with at the money options the premiums can be expensive. A cheaper way to put on a similar position is to move the strikes for the call and the put out of the money. This instead creates a strangle.

Strangle Option Positions

A strangle is very similar to a straddle in that it is non directional and consists of one call and one put, but the call and put are at different strike prices, generally both out of the money. This has the effect of lowering the premium (good for buyers, bad for sellers) and widening the range (good for sellers, bad for buyers).

Opening a Long Strangle

- The current price will typically be between strike A and B.

- You are buying a put at strike A, and buying a call at strike B

- As you’re buying two options you’re paying more premium than you would if you were picking a direction, but as both options are OTM this will be cheaper than a straddle.

- As both your options are OTM you ideally want the price to move significantly but it does not matter which direction.

- The position is fixed risk, so your maximum loss is the premium you have already paid to open the position.

- You are longing volatility. You want implied volatility to increase once the position is opened as it will increase the value of your options. You want the price to move, and move a lot, but it doesn’t matter which direction.

Opening a Short Strangle

- The current price will typically be between strike A and B.

- You are selling a put at strike A, and selling a call at strike B.

- The range you now profit from is wider than with a straddle, however you will also receive less premium.

- Your risk is still not defined in either direction, so although the range is wider your maximum loss is still potentially unlimited. For this reason you should avoid shorting strangles until you are more comfortable with options (or you can define the risk by turning it into a condor position which we’ll cover in part 2)

- You are shorting volatility. You want implied volatility to decrease once the position is opened as this will decrease the value of the options you have sold. A sideways ranging market would be ideal, but you do have a little wiggle room depending on which strikes you choose.

- If the price expires between A and B you get to keep the whole premium you received.

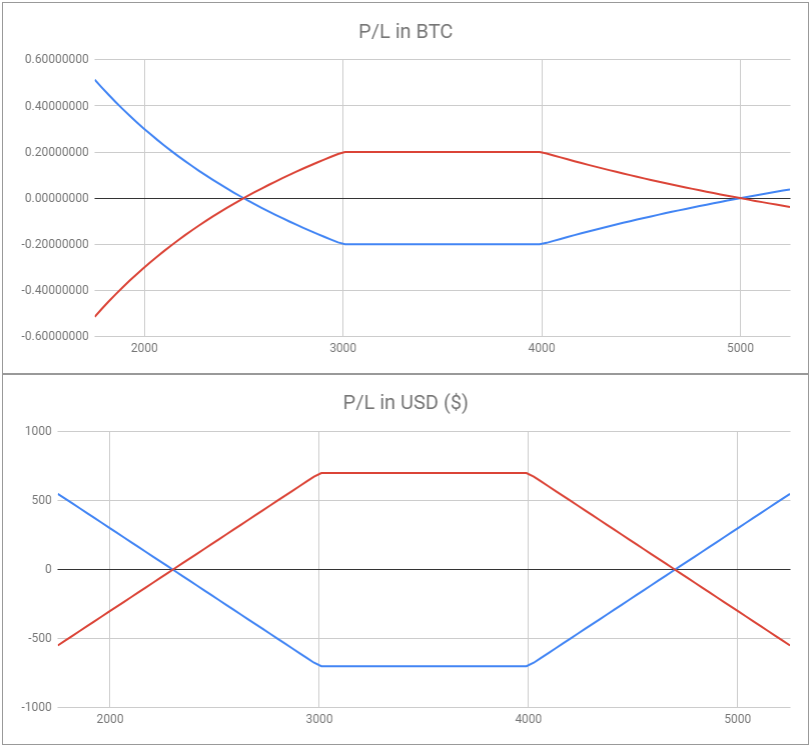

Bitcoin Strangle Example

Using the spreadsheet provided I have constructed here an example of both a long strangle and a short strangle . Again for ease I’ve assumed both options are priced at 0.1BTC but you can adjust the prices and strikes in the sheet to suit your needs and current conditions.

The long strangle contains the following options:

+1 put with a strike price of 3000

+1 call with a strike price of 4000

And of course the short strangle contains the following options:

-1 put with a strike price of 3000

-1 call with a strike price of 4000

This example will be left in the downloadable version of the sheet under the name ‘Strangle’. I would encourage you to have a play around with the examples as it’s a great way to learn. Change the prices, add other legs or just enter a totally different position in the second section to see how it compares to the first.

In part 2 we’ll move on to positions that use additional legs to define risk (for sellers) and define reward in exchange for cheaper positions (for buyers). This includes call spreads, put spreads, butterflies and condors.

See part 2 here.

AUTHOR(S)