In this lesson I’m going to show an example of executing a variable rate cash and carry trade. We will also cover the difference between the fixed rate and variable rate versions of a cash and carry. Both are very easy to execute using BTC or ETH futures, and both result in us increasing the amount of dollars (or USDC) in our account.

A cash and carry trade, also known as a basis trade, is a popular way of making small but consistent and low risk gains. I have covered the fixed rate version in previous lessons, which you can see here.

The basic premise with a cash and carry trade is that we start with dollars, use those dollars to purchase an asset (such as bitcoin), and then short a futures contract for that same asset. By doing so, we lock in a premium, while remaining delta neutral on the asset. As the futures contract expires, the short position is either rolled to the next future to keep the cash and carry going, or the entire position is closed by selling all the remaining bitcoin back into dollars.

The ‘fixed rate’ version of the cash and carry, uses a dated futures contract for the futures short. Whereas the ‘variable rate’ version, which we will be trading today, uses the perpetual contract, which has no expiry date.

Fixed vs variable rate

Using bitcoin as the example asset, with the fixed rate version, we are using a bitcoin futures contract with an expiry date. These types of contracts will normally be trading at a price higher than the bitcoin spot price. This is important because we want to sell the futures contract at a higher price than we purchase the bitcoin for. When the futures contract expires though, it settles at the spot price (or to be precise, a 30 minute TWAP of the spot index), meaning there will no longer be any premium over the spot price. We are capturing the initial premium that we sold the futures contract for. So if we buy some BTC for $30,000, and then sell a futures contract at a price of $32,000, we can expect to capture this $2,000 premium. We can see what the premium is before even placing the trade, so we know the rate we will be receiving, hence the fixed rate label.

With the variable rate version though, instead of using a future with an expiry date, we use the perpetual contract. The perpetual does not have an expiry date, and will normally be trading much closer to the spot price. For example if bitcoin is currently trading at $30,000, the perpetual might be trading at say $30,020, or $29,980. This can vary somewhat, but the point is the price of the perpetual tracks the spot price much more closely.

So, if there is not much of a premium in the price of the contract itself, how can we make a profit by shorting the perpetual instead of a dated futures contract? The answer is the funding payments, which exist only on the perpetual contract. Briefly, when the perpetual is trading at a price higher than the index price, longs will have to pay funding to the shorts. Conversely when the perpetual is trading at a price lower than the index price, shorts will have to pay funding to the longs.

As we will be shorting the perpetual, we of course want the longs to be paying the shorts, and thankfully, this is the most common state for the perpetual funding to be in.

One important point to note is that the funding rate is updated constantly based on where the perpetual contract is trading relative to the index price. This means the rate we are being paid (or being forced to pay) varies constantly, hence why this is called the variable rate cash and carry. While we are in this trade, we hope that on average the perpetual is trading above the index, and therefore we are receiving funding payments for being short.

Opening the trade

Let’s move on to opening the variable rate cash and carry. We are using the same account as the previous lesson for the fixed rate cash and carry, where we turned 3,000 USDC into 3032 USDC. So our starting account value this time is 3032 USDC.

The bitcoin price has increased a lot recently, which is usually an environment where shorts on the perpetual are well paid, with the longs being happier to pay a little to hold their position, as the underlying price is increasing.

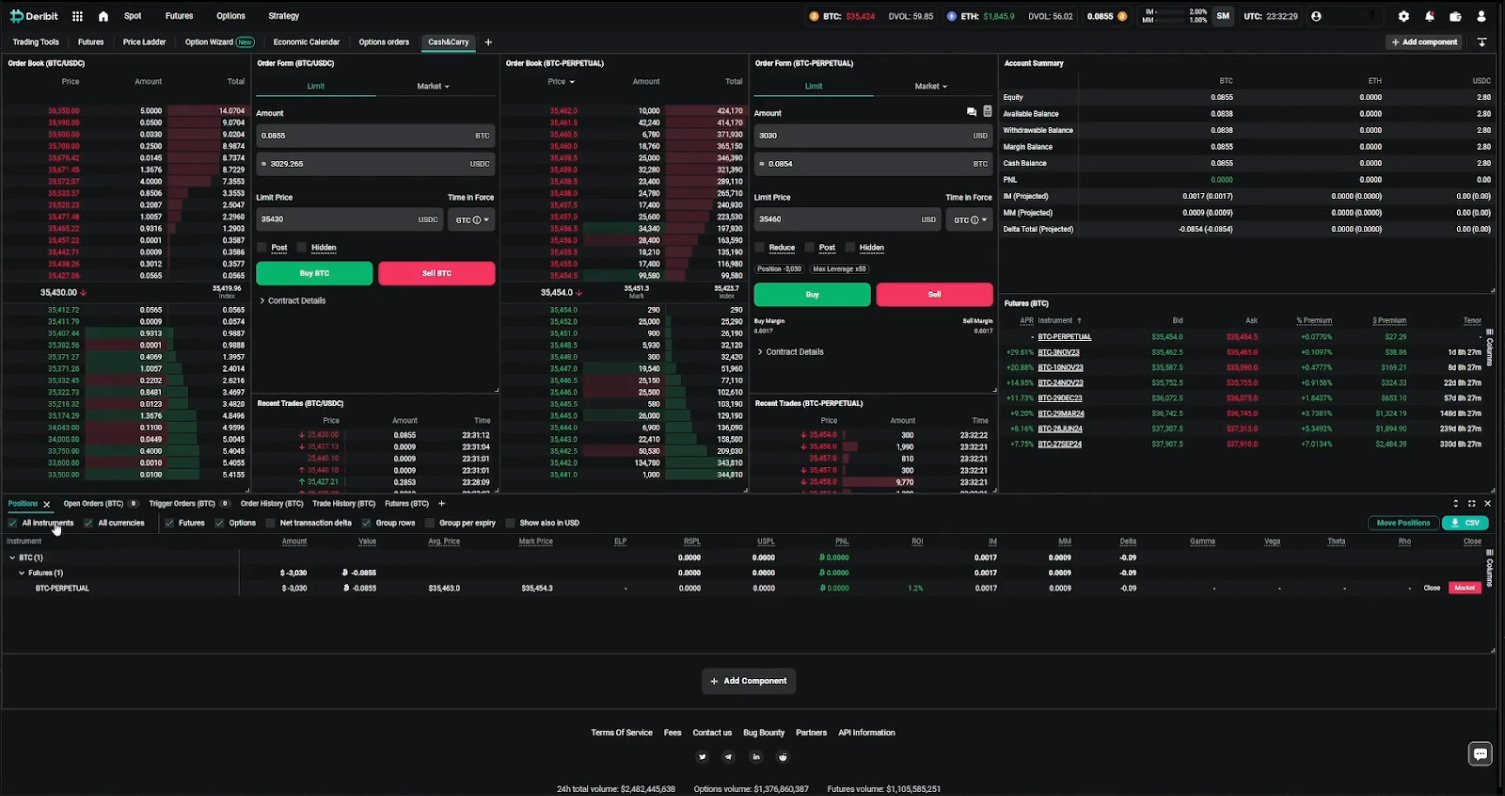

We have USDC in our account, so to execute the variable rate cash and carry, we need to buy BTC with our USDC, and then short the BTC perpetual. In this instance, we end up buying as much BTC as we can (roughly $3,030 worth) at a price of 35,430. We then sell the bitcoin perpetual at a price of 35,463, and with a position size of 3,030.

This results in us holding approximately $3,030 worth of BTC in our account, but also being short the perpetual for $3,030, leaving us delta neutral on bitcoin.

The variable rate cash and carry is now open. For the time being, all we need to do is continue to hold the position, and keep an eye on funding rates, to make sure they don’t turn the other way for too long. Once we have made enough from the funding payments, we may also want to make a small adjustment, which we will come to shortly.

Progress check 1

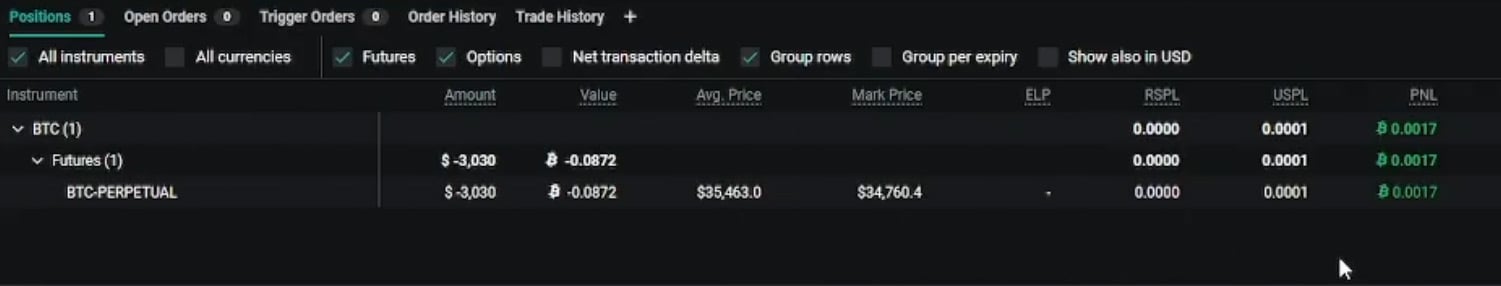

We come back into the account now a couple of days after opening the position. The PNL column in the positions table, which is currently showing a profit of 0.0017 BTC, can mostly be ignored for this type of trade. It will show the PNL of our short position in the perpetual, but not the dollar profit of our account as a whole, which is what we are actually interested in with this type of trade.

The funding chart shows that funding has remained positive over the last couple of days, so we do expect to have made a profit. To get an idea of how much profit our position is making each day, what we need to look at is the funding payments. To see the amount of funding for the current daily session (which starts and ends at 0800 UTC every day on Deribit) we can hover over the RSPL. RSPL stands for realised session profit or loss, and is how much profit has been realised since the current daily session started. Funding payments count as realised profit/loss, so when we hover over this column for the perpetual, it will tell us the amount of funding paid/received since 0800 UTC. In this case we have made 1036 sats since 0800 UTC, which was 5.5 hours ago.

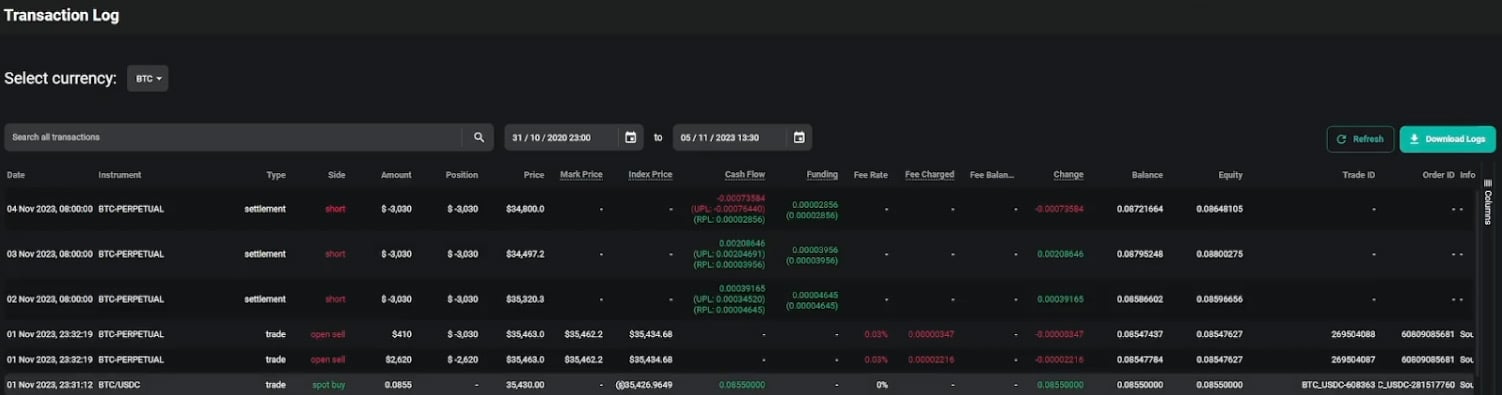

To see the totals for previous days, we will need to head over to the transaction log. Here we can see the daily settlement entries for our perpetual position. The total cash flow can be ignored, as this will include the daily profit/loss from price movements, which combined with the change in the value of our spot holdings, will cancel out to roughly zero. What we are interested in is the funding column, as this includes only those amounts paid or received in funding. Of course, we want to be receiving funding payments, as this is how we make a profit on this trade, and as we can see, we are indeed receiving a few thousands sats per day in funding. This amount varies depending on how far on average the perpetual has been trading above or below the index.

For the moment then, the trade is doing what we want it to. It is generating a small income each day. As the funding rate is still positive, and we have no other reason to close the position, we will simply leave it open for now, and come back to check up on it again in a few days.

Hedging the funding payments

Another three days have passed, and the transaction log shows we are still receiving a few thousand sats a day in funding payments. The funding payments we are receiving are amounts of BTC, however this is really a trade focused on making more dollars (or USDC in this case). This means that we will want to hedge the BTC that is being received as well.

Thankfully, doing this is simple, as we can just add the amounts to our short position on the perpetual.

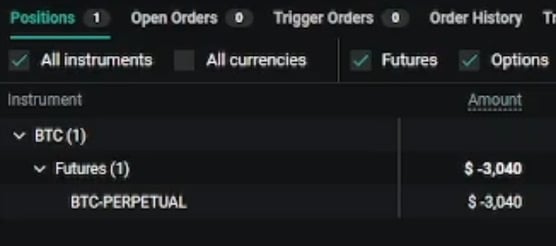

By hovering over the equity at the top of the page, we can see that the value of the bitcoin we are holding has increased from the starting point of around $3,030, to around $3,040. This is thanks to the extra BTC we have received via the funding payments. The short position in the perpetual is still only $3,030 though, so to include this extra BTC that we have earned, we need to sell an extra $10 of the perpetual.

We could just market sell into the bid to fill the order immediately, but we’ll use a limit order today. The limit price is set at 35,405.50, which is below the best bid when we place the order. However, because we have also selected Post, our order will not act as a taker order, and is instead placed one tick above the best bid when the order is placed.

This results in our limit order sitting in the order book at a price of 35,410.50. The perpetual initially starts trading lower, away from our order, threatening to make us regret using Post. It soon comes back though, and our order is eventually filled. Our short position in the perpetual now has a position size of $3,040.

As well as hedging our previously received funding payments, this process also has a compounding effect on the amount of funding we will receive in future. The next funding payments will now be calculated using the new position size of $3,040. Once we receive around another $10 worth of funding we can add that to the short perpetual position as well, further increasing the position size that our funding payments are calculated from.

How to close

If we wanted to close this position entirely, we would first close the perpetual short position, and then sell all the remaining BTC in the account back into USDC. We may for example want to close the position entirely if the funding flips in the other direction for a sustained period. However, for the moment, the funding remains in our favour, so let’s leave this position open, and check in on it again in a future lesson.

Fixed rate vs variable rate

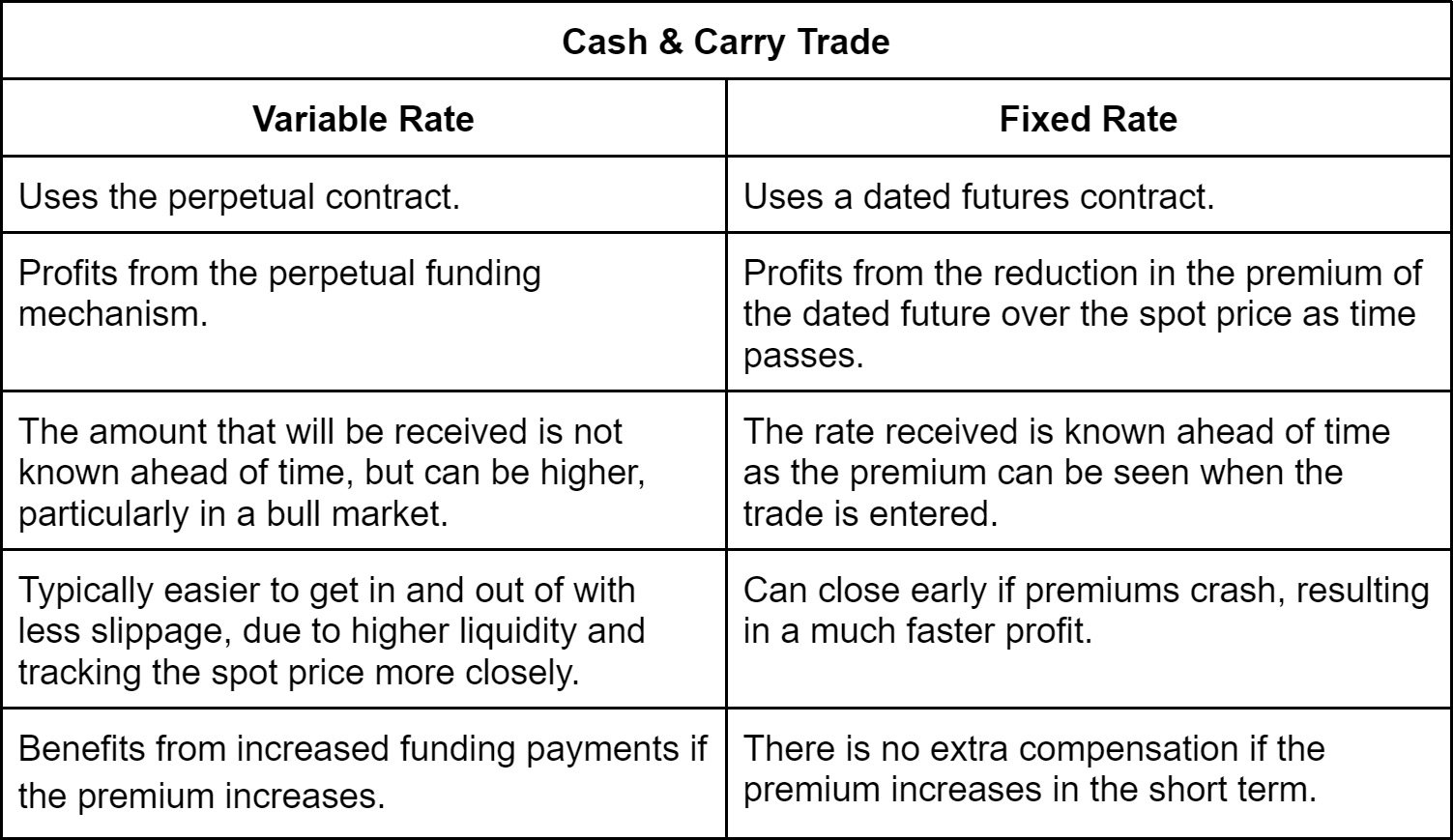

Let’s end this lesson by reminding ourselves of the differences between a variable rate cash and carry (like the one we have covered in this lesson), and a fixed rate cash and carry (like we’ve covered in the previous lessons).

We use the perpetual contract to obtain a variable rate, and a future with an expiry date to obtain a fixed rate.

While they are very similar trades, the source of profit is slightly different. The profit for the variable rate comes from the funding mechanism of the perpetual contract, whereby we are paid small amounts regularly. The profit for the fixed rate though, comes from capturing the premium of the futures contract over the spot market.

The funding payments received will vary over time, and there is no way to know for sure how much these will be ahead of time. Whereas the premium we lock in with the fixed rate can be seen even before the trade is opened.

Perpetual contracts are hugely popular in cryptocurrency derivatives markets, and as such usually have the best liquidity. This, coupled with the fact that they usually track the spot price much more closely than the dated futures, means that it is usually easier to get in and out of positions in the perpetual without much slippage.

If the premiums of the futures contracts and perpetual continue to increase after the cash and carry trade is opened, the variable rate version will actually benefit from increased funding payments. This is in contrast to the fixed rate version, which will be looking at an unrealised loss while it simply waits for the premium to come back down. Both the variable rate and the fixed rate versions will eventually make a profit in this scenario, however the variable rate actually gets paid extra to be underwater in the short term.

Outro

This lesson should serve as a good example of how to execute a variable rate cash and carry trade on Deribit, as well as a useful comparison of the two different types of cash and carry. We will come back to the example executed in this lesson in a future lesson, but for a start to finish example of the fixed rate version, including fully closing the position, see the previous lesson here.

AUTHOR(S)