Summary: Bitcoin moves in 10,000-point increments, and the decisive break above the 30,000 level would project that prices would rally to 40,000 before they find the next significant level of resistance. Bitcoin’s 28,000 strike calls for the October 27, 2023 expiry – which we repeatedly recommended – have exploded in price, with roughly a 31x return within two weeks. As we wrote last week: FOMO is BACK. Do not miss out on this new bull market.

Analysis

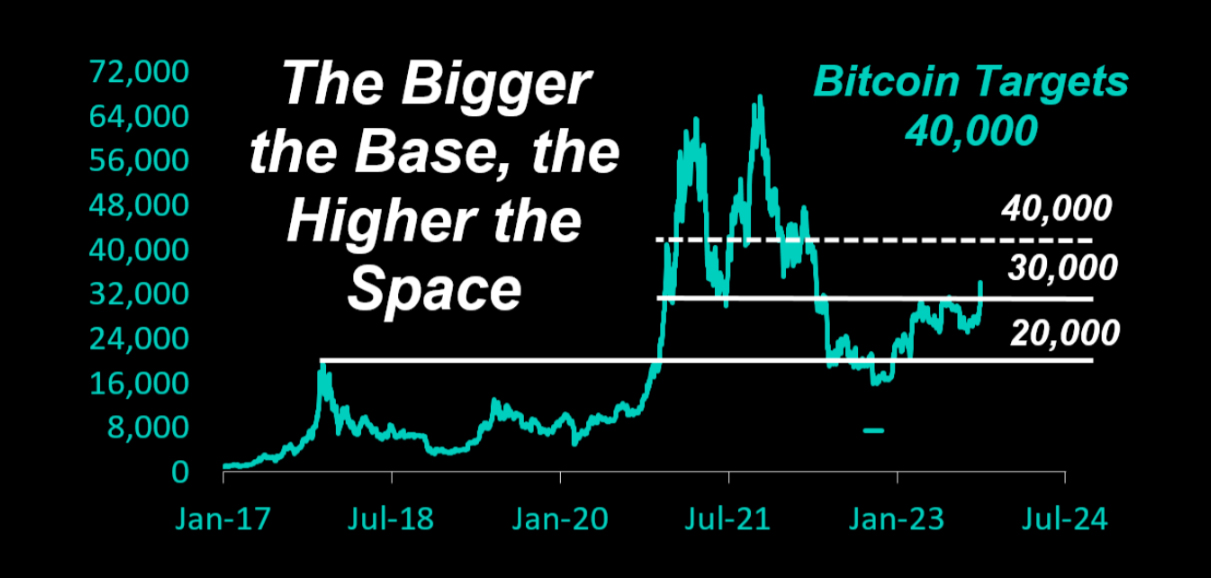

In the bigger picture scheme of things, Bitcoin moves in 10,000-point increments, and the decisive break above the 30,000 level would project that prices would rally to 40,000 before they find the next significant level of resistance. The old trader acronym, ‘The Bigger the Base, the Higher the Space’, comes to mind as Bitcoin consolidated between the 20,000 to 30,000 level during the last 18 months, and historically, those breakouts often predicted unbelievable upward momentum.

We would advise against fading this rally as Bitcoin could only have started to gather momentum – the pain trade is higher.

While we have been irresponsibly bullish into October (see our previous reports: October 20, October 17, October 3, and September 29), the perfect chart-technical setup would be to retest the 30,000/30,500 breakout level and shake out the weak hands – or the traders that bought on FOMO during the last 24 hours. The Bitcoin rally is far from over, and the big institutions are coming. There is no doubt about that. From the moment the BlackRock Bitcoin ETF gets approved to the day it finally gets launched, Bitcoin might make another meaningful climb higher. The blueprint was the 2017 Bitcoin Futures launch, which caused Bitcoin to rise parabolically.

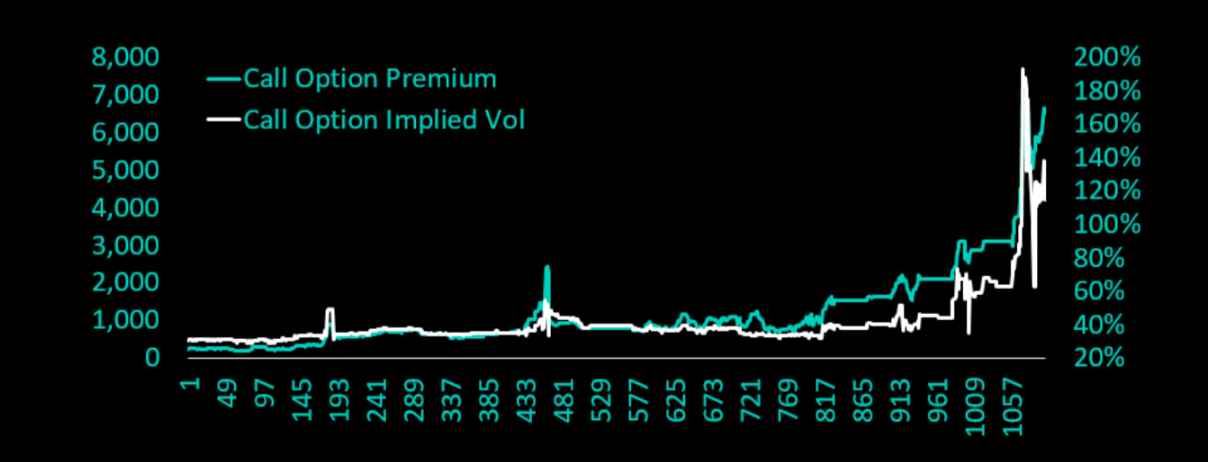

As expected, the Bitcoin 28,000 strike calls for the October 27, 2023 expiry have exploded in price. A few weeks ago, those calls traded between $220 and $400 when we repeatedly recommended them, as their implied volatility was as low as 30%. As Bitcoin entered the October period, we tended to be extremely bullish. With the expectations rising that a BlackRock Bitcoin ETF would be approved, those calls traded as high as $6,961, and implied volatility was priced at 188%. This is roughly a 31x return within two weeks.

On Friday, October 20, 2023, we warned that ‘FOMO is back! Crypto Traders Are Panicking,’ and today we saw the funding rate blow out for Bitcoin and Altcoins, notably Ethereum and Solana. Panic was hitting the market. By some estimates, $310m worth of Bitcoin shorts were liquidated after news was published that the Depository Trust & Clearing Corporation (DTCC), which clears and settles ETFs through its automated creation and redemption process, had listed the BlackRock iShares Bitcoin Trust. This signified that SEC approval could be imminent for BlackRock’s Bitcoin ETF.

In that Friday, October 20, note, we also wrote that Bitcoin would jump 10-20% whenever the approval materialized, and the only way to capitalize properly was to use upside call options. Leverage and convexity is your friend when the market moves.

Bitcoin is up +10.6% during the last 24 hours on massive volume. The Crypto market cap jumped to $1.25trn and 24-hour volume increased to $82.5bn – a +97% increase from the week before. Bitcoin itself traded $47bn, a +61% increase from the week earlier, and Bitcoin’s dominance has continued to jump forward and now accounts for 53% of the overall crypto market. Bitcoin’s perpetual futures funding rate jumped to a multi-year high of +39% (annualized), indicating that longs are willing to pay shorts. This is FOMO – as we predicted a few days ago.

The smart traders will now roll their upside calls into call spreads. This would remove some of their exposure through lower delta exposure and lock in PnL. The relative strength index (RSI) prints at 99, the highest level we have seen as Bitcoin exploded relatively quickly. Some consolidation could be ahead, and call spreads are the appropriate strategy to keep upside exposure but lower the capital at risk. Do not miss out on this new bull market.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)