BTC Reaches $50k Milestone

Bitcoin’s price has been on a relentless ascent, momentarily crossing the $50,000 threshold. This surge is partly fuelled by increased investments in Bitcoin ETFs and a reduction in selling pressure from GBTC. However, the dynamics extend beyond ETF activities. A resurgence in global liquidity is bolstering both equity and digital asset markets, reflecting an uptick in the money supply.

The anticipation of the Bitcoin halving event, steady inflows into ETFs, record highs in U.S. stock markets, and encouraging monetary policies from both China and the U.S. are setting a favourable stage for cryptocurrencies. Moreover, expectations of lower interest rates this year, without a major economic slump, enhance this positive outlook. The last hot US CPI is, nonetheless, a fresh input to watch closely as it may keep a strong bid in the USD, even if crypto appears to dismiss it for now.

As Bitcoin nears the $50,000 mark, attention is gradually shifting to Ethereum, which is still about 50% below its all-time high, compared to Bitcoin’s 25%. Ethereum’s upcoming Dencun upgrade and the buzz around a potential Ethereum ETF are key factors to watch, along with the growing trend in ETH CME futures, as open interest nears record highs.

Surprisingly, despite Bitcoin’s significant price level, Google search trends suggest a low public interest, indicating that we might still be in the early stages of the crypto bull run. The $50,000 milestone might catch many off guard, highlighting the underappreciated momentum at the moment.

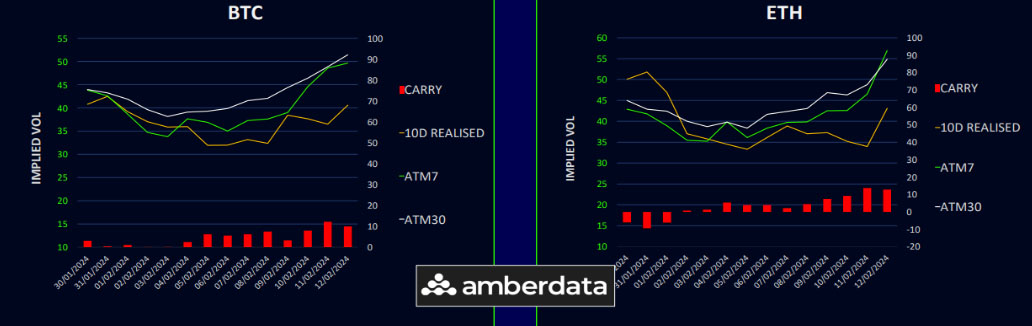

BTC Vol Carry Very Positive

This week, cryptocurrency volatility significantly increased, with a notable 10% rise in realized volatility as market prices surged. Bitcoin experienced a remarkable streak of eight consecutive days of gains. As a result, implied volatility also saw a sharp increase, driven by investors buying call options to capitalize on the upward movement.

The gap between implied and realized volatility has widened, with implied volatility trading at a substantial premium, indicating a very positive volatility carry of about 10-12%.

The upward movement in Bitcoin prices initiated a broader market rally and led to a significant covering of short positions in Ethereum options. This shift has neutralized the long gamma position of ETH dealers, removing the previous cap on ETH prices.

Currently, the market is in a short gamma position for BTC, explaining the high volatility carry as dealers seek to protect short exposure. Implied volatility is expected to decrease after the US CPI announcement, if the market stabilizes around the $50,000 mark for BTC, which is not a given.

BTC Term Structures Catches Strong Bid

The term structure in Bitcoin has seen a significant upward adjustment, with a noticeable increase across the board. The front-end volatility has risen by 10-15 points, aligning with expectations from a nearly 20% market rally over the week.

Similarly, long-term volatility also experienced an uptick, with a 5-point increase as substantial interest was shown in calls for the June to December 2024 expiries, amounting to around 400k VEGA, which is a significant clip.

The Ethereum term structure also adjusted upwards, with short-term expiries experiencing a greater increase than BTC, amplified by short covering. However, the increase in long-term volatility for ETH was less pronounced, concentrated mainly on February and March expiries.

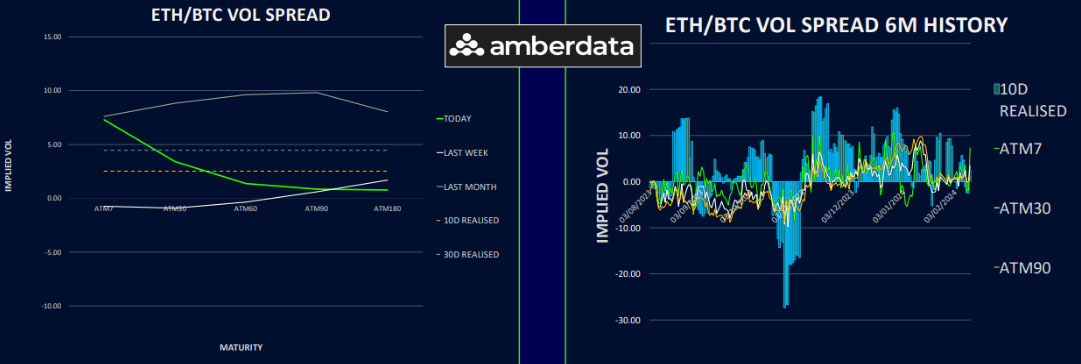

ETH/BTC Spread Very Well Bid In Front End Expiry

The volatility spread between Ethereum and Bitcoin has caught a serious bid, particularly in the short- term, as ETH surpassed the $2,500 mark, leading to a rapid covering of short positions.

Despite BTC initially leading the market, the realized volatility spread remains positive. The ETH/BTC spot spread saw a dip, testing the support level at 0.051, but recovered by 6% in the last 48 hours.

The recent surge in short-term call buying for ETH indicates traders anticipate a move towards $3,000, while $50,000 could act as a strong resistance level for BTC based on blockchain data.

The outlook for ETH remains bullish, driven by ongoing innovation and the potential approval of an ETF by summer, especially for the June to December 2024 period.

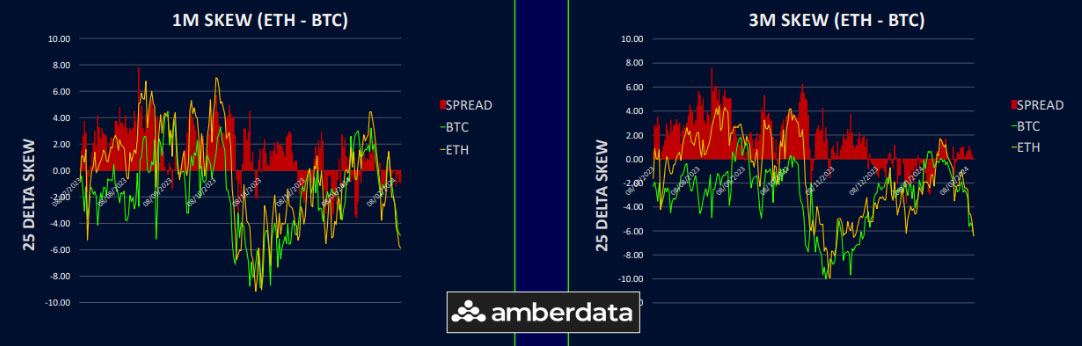

Call Skew Returns Across the Curve

The significant upward movement in spot prices has led to a return of call skew across various expiries for both assets, with a consistent 6-7 volatility call premium noted.

However, this call skew in the short-term may face downward pressure, particularly for BTC, should we observe profit-taking and a shift in exposure to post-halving periods.

The repeated impact on call overwriters could result in a sustained demand for ETH upside positions, given the reduced supply. This situation warrants close monitoring to re-evaluate future views.

Option Flows And Dealer Gamma Positioning

Bitcoin trading volumes have surged by 60% this week, fuelled by upward market movements that typically attract the flows. This includes significant short covering and strategic buys in near-term options. Notable transactions included April to June 2024 calls for 60-75k at nearly $10m in premiums, alongside the sale of in-the-money June 2024 40k calls.

In contrast, Ethereum trading volumes remained unchanged over the week, with activity only picking up in the last few days as ETH began to outperform. The trading focus was predominantly on calls, with significant activity in February to March 2024 calls for 2600-3000 and coverage of 2400-2500 short positions. Some April 2024 calls were sold, part of March/April 2024 call calendar strategies.

BTC dealer gamma positioning has returned to near -40 million, at the lower end of its range, supporting an increase in realized volatility. The primary position contributing to this is the 50k strike across February and March expiries. ETH dealer gamma has dropped to zero, moving from a strong long position as ETH surpassed the 2400 mark and call buying intensified, either for hedging or speculative purposes, as ETH began to perform well against BTC once more.

Strategy Compass: Where Does The Opportunity Lie?

The next leg higher in crypto appears to be on, as digital assets explode higher and crypto stocks also had enormous rallies. We think staying long calls, call spreads and ratios makes sense depending on your risk appetite. Those who have no hedges in place, may look to use the expensive call skew to enter bearish risk reversals or put spread collars for protection, but I would caution against selling too much upside in a market that is going parabolic!

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)