Bulls Party in Crypto Despite Hotter US Inflation

The Lunar New Year appears to have significantly influenced the market again, with Bitcoin’s price movement closely mirroring historical trends observed during this period. Bitcoin surpassed the critical $47,000 resistance mark, currently trading at $52,000. It’s even shinier when it comes to ETH performance!

Aside from seasonals, the demand for Bitcoin spot ETFs, vastly outpacing the daily supply from mining by tenfold, has been another key factor in driving up prices. This occurred despite recent higher inflation figures in the US, which have reduced expectations for rate cuts in the market.

Ethereum, as said, is also gaining momentum as investors shift their focus back to it after Bitcoin’s substantial gains and in anticipation of upcoming events such as the approval of a spot ETH ETF or the Dencun upgrade in March. It’s worth noting that Ethereum’s perpetual futures open interest is at an all-time high on Deribit, highlighting where the speculative flows are now focused.

The supply constraints for both Bitcoin and Ethereum are evident, leading to increased investment in these assets. To start with, Bitcoin spot ETFs have seen record inflows, with over 100,000 Bitcoin, or 0.5% of its total supply, being bought since their launch, particularly in the last week, contrasting with about $2 billion outflows from Gold ETFs. This shift in asset allocation, further facilitated by ETF availability, suggests a growing investor preference for cryptocurrencies.

The recent increase in margin requirements by the CME has also played a crucial role in both Bitcoin and Ethereum’s performance, inducing volatility and closing of leveraged short positions, with CME volumes hitting a high of approximately $95 billion in January.

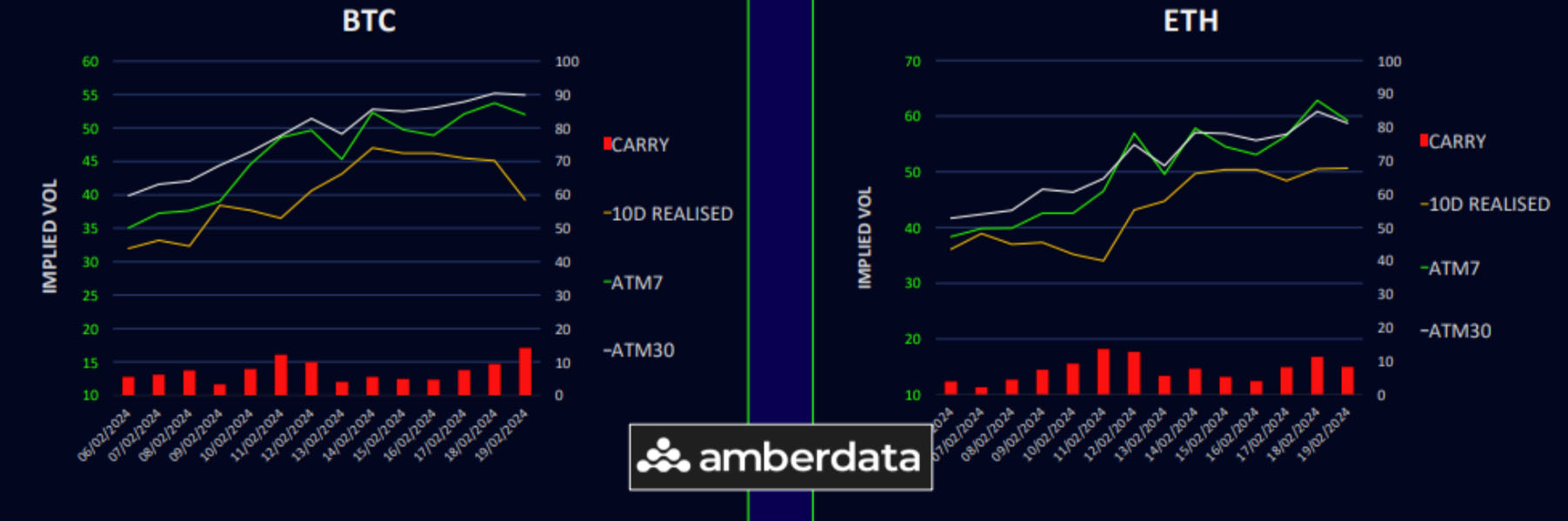

Realized and Implied Vols Up in Tandem

Crypto realized volatility increased this week, with Bitcoin surpassing $50,000 around Valentine’s Day and Ethereum approaching $3,000, pushing realized volatility to 50%.

Implied volatility has also risen consistently, reflecting the typical positive correlation between spot price breakouts and volatility in the crypto market.

Despite positive volatility carry, it has been challenging for those betting against volatility due to minimal market pullbacks. With Bitcoin’s price stabilizing around $52,000, we might see a period of consolidation and a potential decrease in volatility, especially in the near term.

Outside of NVIDIA’s earnings impact on the stock market, there’s little macroeconomic news this week. Cryptocurrencies have diverged from stock performance, driven by accelerating ETF inflows. If this inflow slows and stocks correct, cryptocurrencies might face short-term pressures.

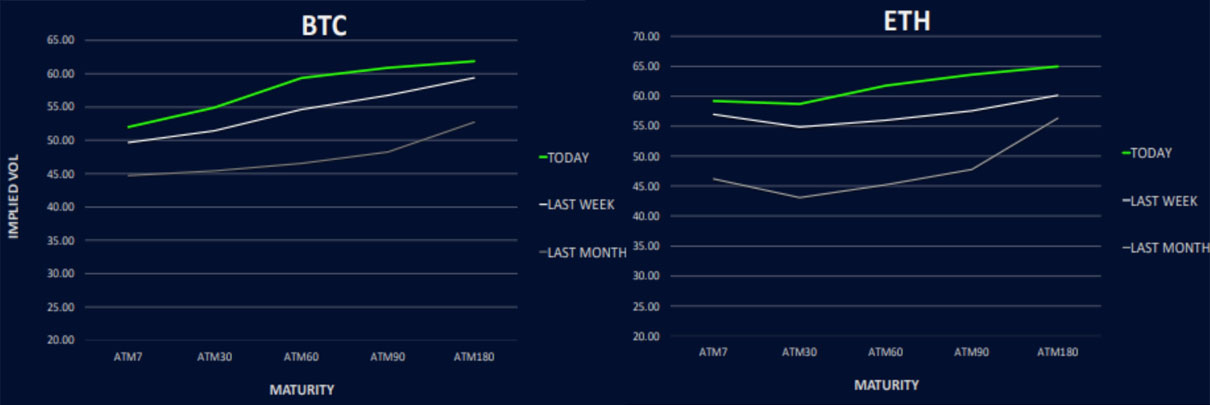

Term Structures Shift Higher

Bitcoin’s term structure has adjusted upwards as its price broke through the $50,000 resistance, with most expiry contracts seeing a 1-3 volatility increase, especially between April and June 2024. This week’s expiry saw a 2-point drop though. The skew curve is becoming more pronounced, with short- term call skews fading faster than those for June 2024 and beyond.

Ethereum’s term structure caught a solid bid as its price hit the next logical target at $3,000, with gamma buckets firmer as realised outperformed in ETH. There has been a 3-5 volatility increase across the term structure. Long-term call skews for June 2024 and beyond have risen by 3 vols, while short-term call skews faded as anticipated.

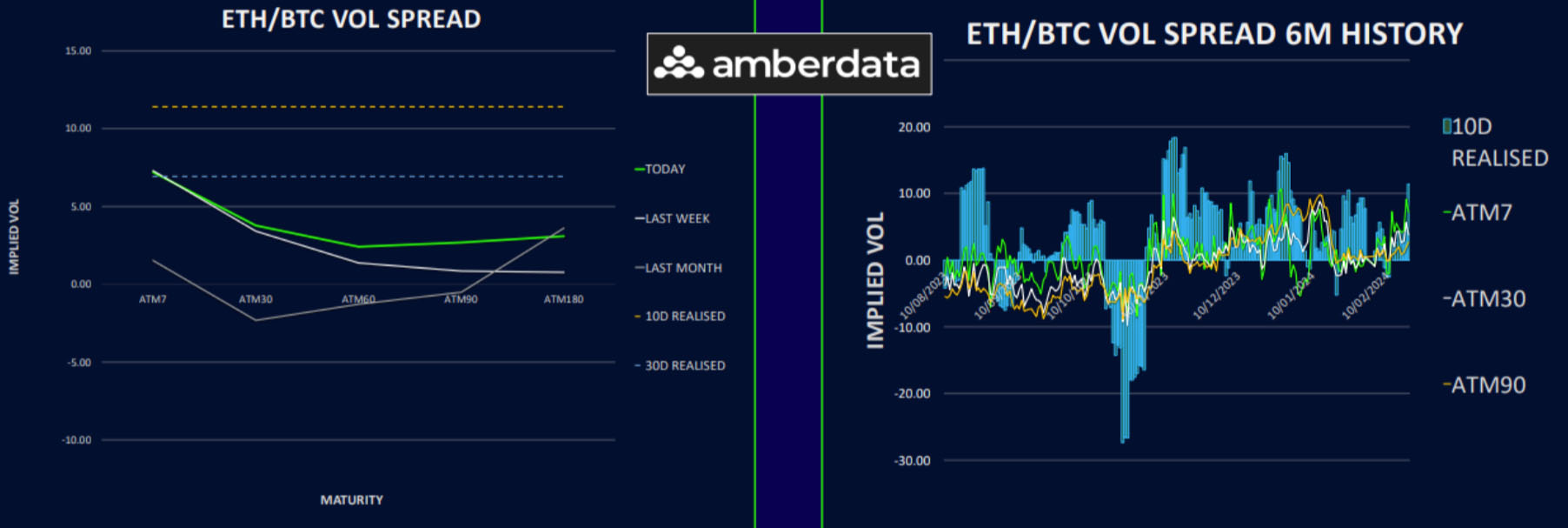

ETH/BTC Vol Spread Solidifies its Premium

The volatility spread between Ethereum and Bitcoin has maintained its premium, further increasing for long-term Ethereum volatility. The realized volatility spread has also risen above 10 as Ethereum’s price approached $3,000.

The Ethereum to Bitcoin spot price spread has risen, now 10% higher than its low on February 12, with another 10% increase needed to reach the January 12 highs following the Bitcoin ETF approval.

While still favoring call switch trades in the long end of the curve where the volatility spread is manageable, the current bullish market dynamics support direct investments in Ethereum calls or call spreads for June 2024 or later maturities.

Despite the potential for short-term market consolidation, $50,000 and $2,700 should now serve as support levels during pullbacks.

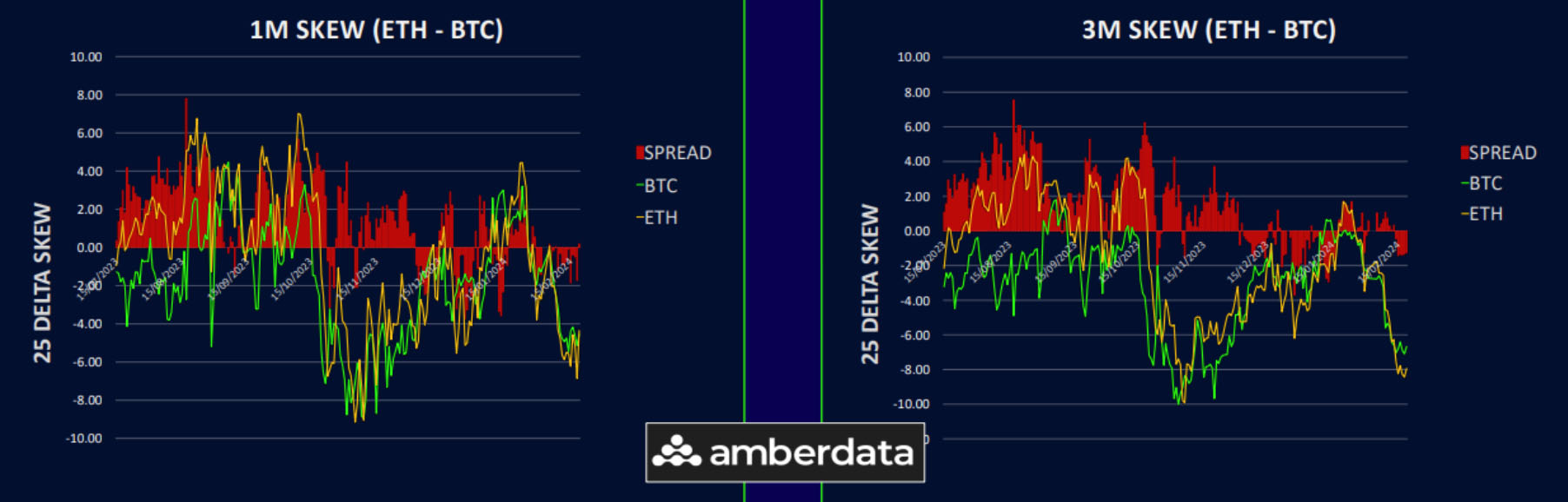

Skew Goes Deeper into Call Premium

With the market trending upwards, skew has deepened into call premium, notably for Ethereum, which has surpassed Bitcoin in call skew for maturities beyond two months.

Bitcoin’s short-term call skew has eased since the significant rally on February 14, now at around 3 vols for weekly options and increasing to 7 in the longer term.

Ethereum’s skew curve is more pronounced, with a 2 vol call skew in the short term and 8-9 vols in the longer term. This reflects a structural trend driven by short-term call selling from staking and overwriting, with long-dated calls remaining in demand for speculative trades and Ethereum ETF flows.

Option Flows And Dealer Gamma Positioning

Bitcoin option volumes have surged by 40% this week as Bitcoin exceeded $50,000, attracting more call option buyers. Key trading activities included rolling up in-the-money calls for February or March and securing protection after the rally to $53,000. March saw the purchase of 65,000/75,000 call spreads and short March/April calendar trades, with June calls bought in the 60-80,000 range.

Ethereum’s trading volume increased by over 100% to nearly $4bn as the price hit $3,000, with a focus on calls in Feb and March for gamma exposure. Transactions included covering in-the-money calls for Feb 23 at 2,800 and selling higher strikes. March saw the buying of 3,000/3,500 call spreads and selling of March/April call calendars, a similar strategy to that used for Bitcoin.

In terms of Bitcoin’s dealer gamma positioning, it has become more negative as the price rallied, largest open interest strikes around the $50,000 and $52,000 marks for this week’s expiry.

Ethereum’s dealer gamma returned to positive after a brief dip into negative territory, with short-term call selling concentrated above $3,000, indicating a more neutral positioning. The significant short strike is at $3,000 for Friday’s expiry, marking a key target for the recent uptrend.

Strategy Compass: Where Does The Opportunity Lie?

Those looking for crypto markets to take a breather after hitting key upside targets may want to call overwrite against existing holdings.

To speculate on pullbacks to 50k(BTC) and 2700(ETH), we also like the look of 29Mar put ladder structures, especially for those who have lightened up exposure and are happy to re-engage on a 15- 20% drop, should it materialise.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)