Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

After a pullback earlier in the week, both BTC and ETH have bounced to $70k and $3.7k respectively. Future-implied yields have risen, whilst implied volatility for both majors remains within a tight range. Perpetual swap funding rates remain positive, but low. The term structure for BTC and ETH – which was previously inverted – has corrected, with implied volatility at short-dated tenors falling below the volatility at long-dated tenors, suggesting reduced demand for long volatility exposure at shorter tenors. Furthermore, the 25-delta put/call skew has increased for both majors, indicating that traders are less worried about buying protective puts to hedge possible impending downside.

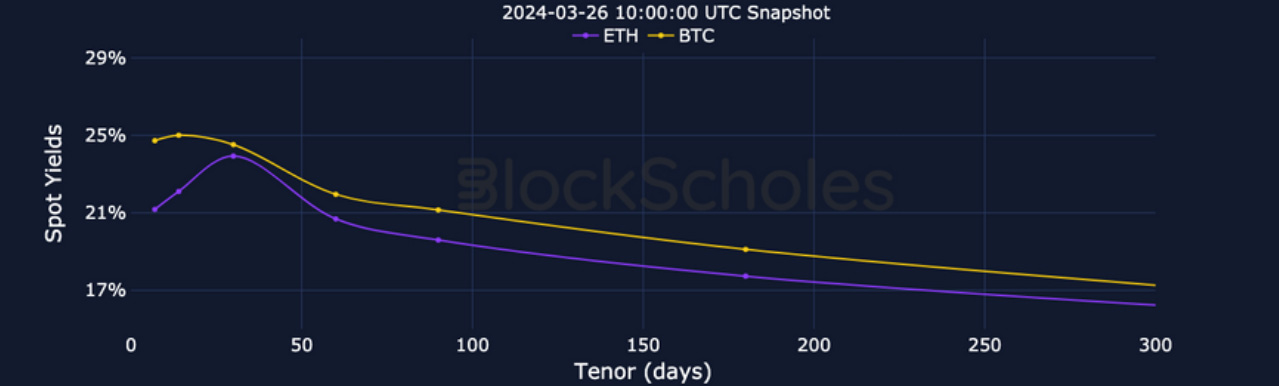

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

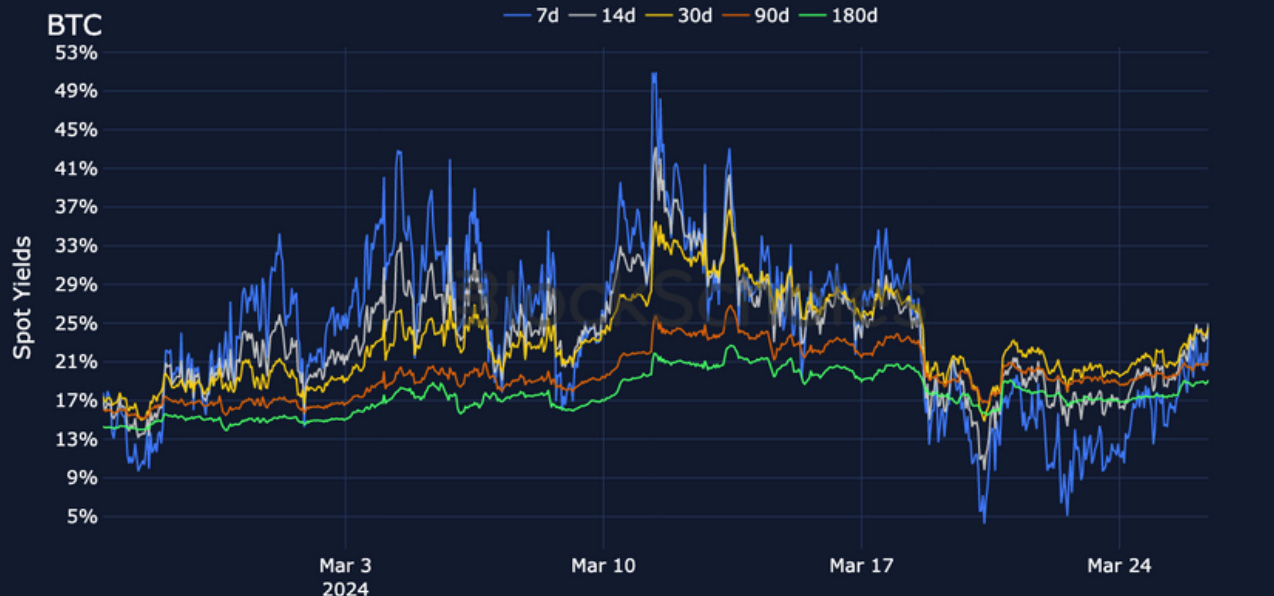

BTC ANNUALISED YIELDS – after reaching lows for the month, spot yields at short-dated tenors have risen.

ETH ANNUALISED YIELDS – a similar reversal can be seen in ETH, although the fall to lows was not as severe as in BTC.

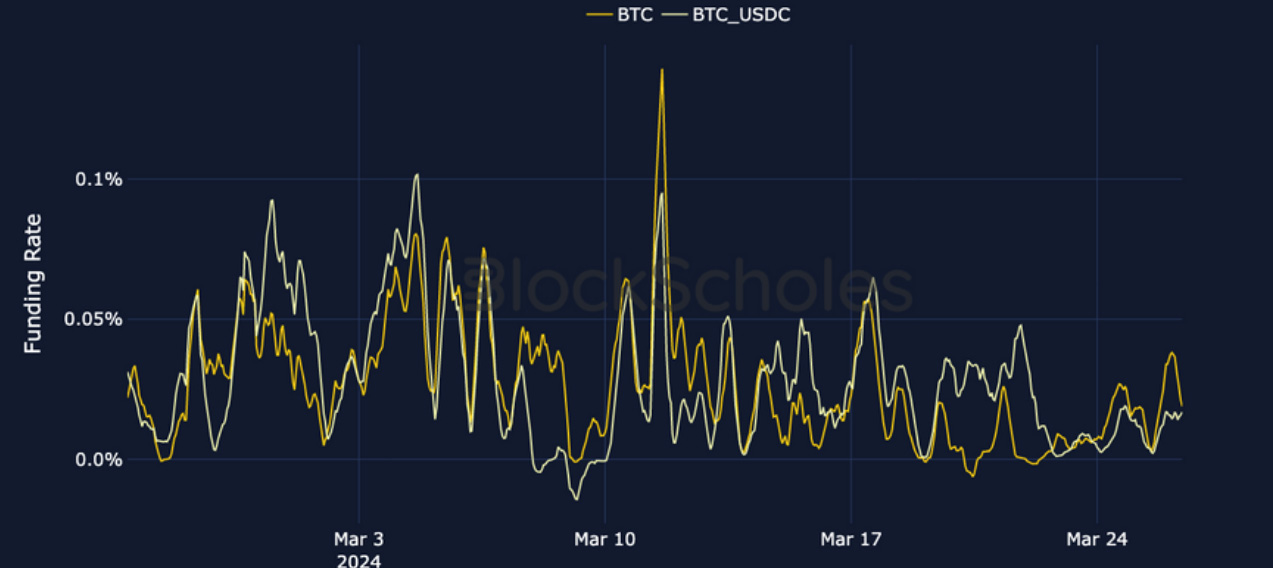

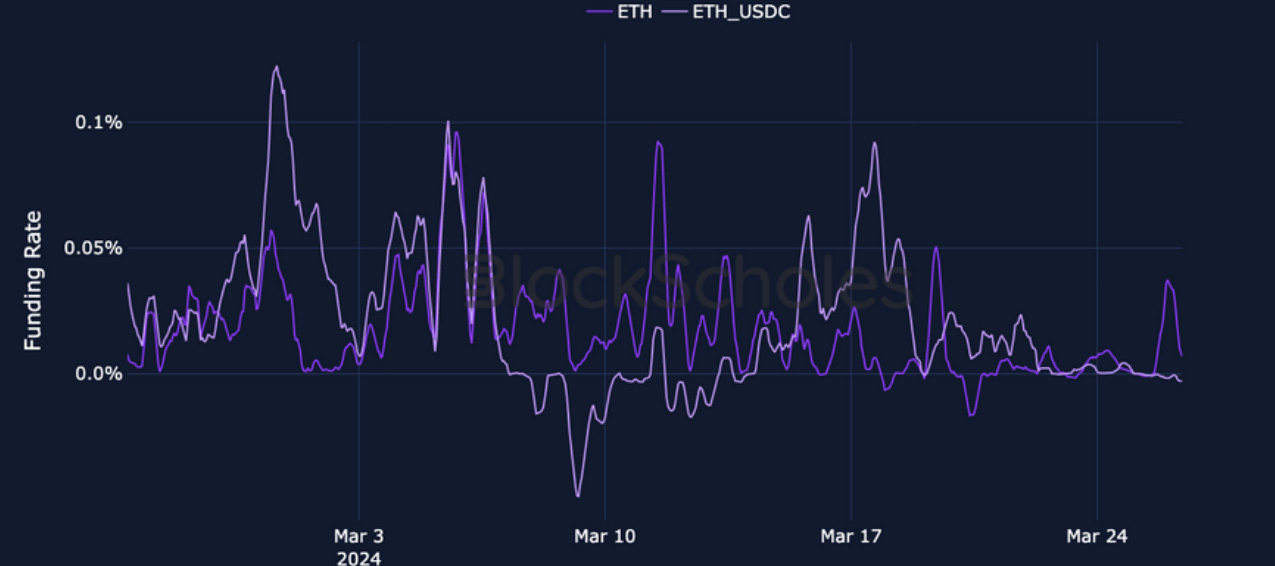

Perpetual Swap Funding Rate

BTC FUNDING RATE – has remained positive and low following a bounce in BTC at $60k, indicating continued demand for leveraged long exposure.

ETH FUNDING RATE – remains near zero for USDC-margined contracts, whilst token-margined contracts remain low relative to BTC, as well as in absolute terms.

BTC Options

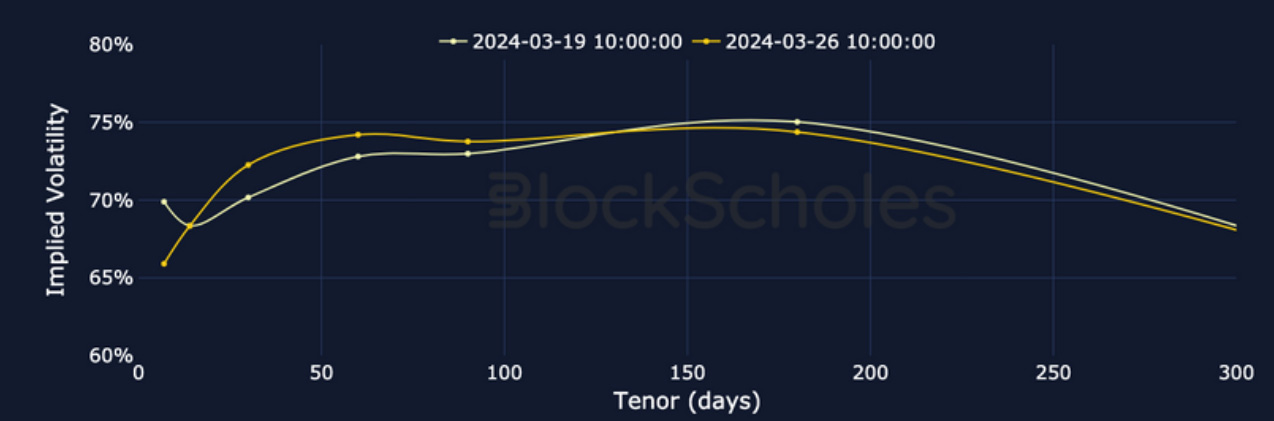

BTC SABR ATM IMPLIED VOLATILITY – less volatile than previous weeks following the term structure – which was inverted – correcting itself.

BTC 25-Delta Risk Reversal – although slightly skewed towards puts at short-dated tenors, the skew has increased during the spot rally to $70k.

ETH Options

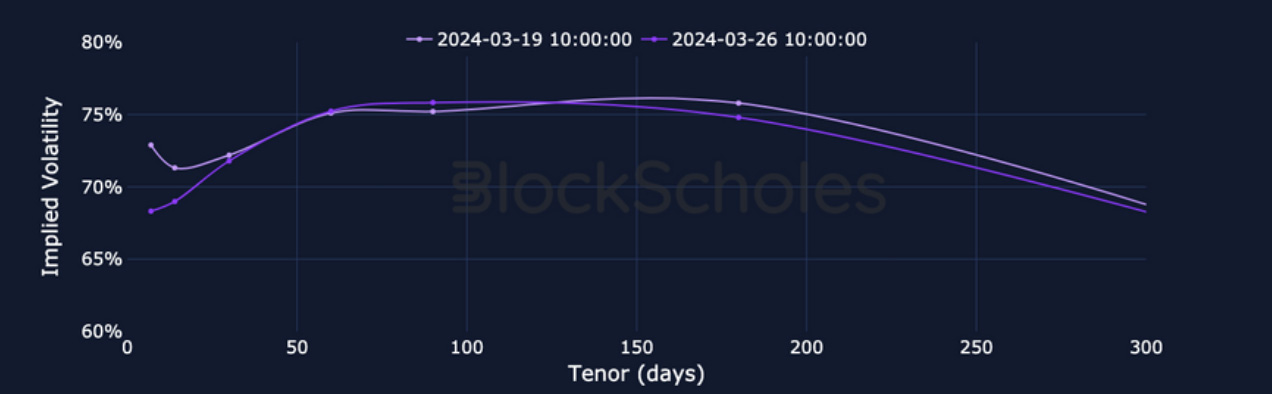

ETH SABR ATM IMPLIED VOLATILITY – remains range bound between 70% – 80%, but is more volatile compared to BTC.

ETH 25-Delta Risk Reversal – has increased significantly at short-dated tenors whilst spot has recovered following a pullback earlier in the week.

Volatility Surface

BTC IMPLIED VOL SURFACE – less inverted than previous weeks, whilst vol at long-dated tenors remains high relative to its recent values.

ETH IMPLIED VOL SURFACE – Vol at the back end of the term structure remains high relative to recent values, whilst vol at the front end has fallen.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

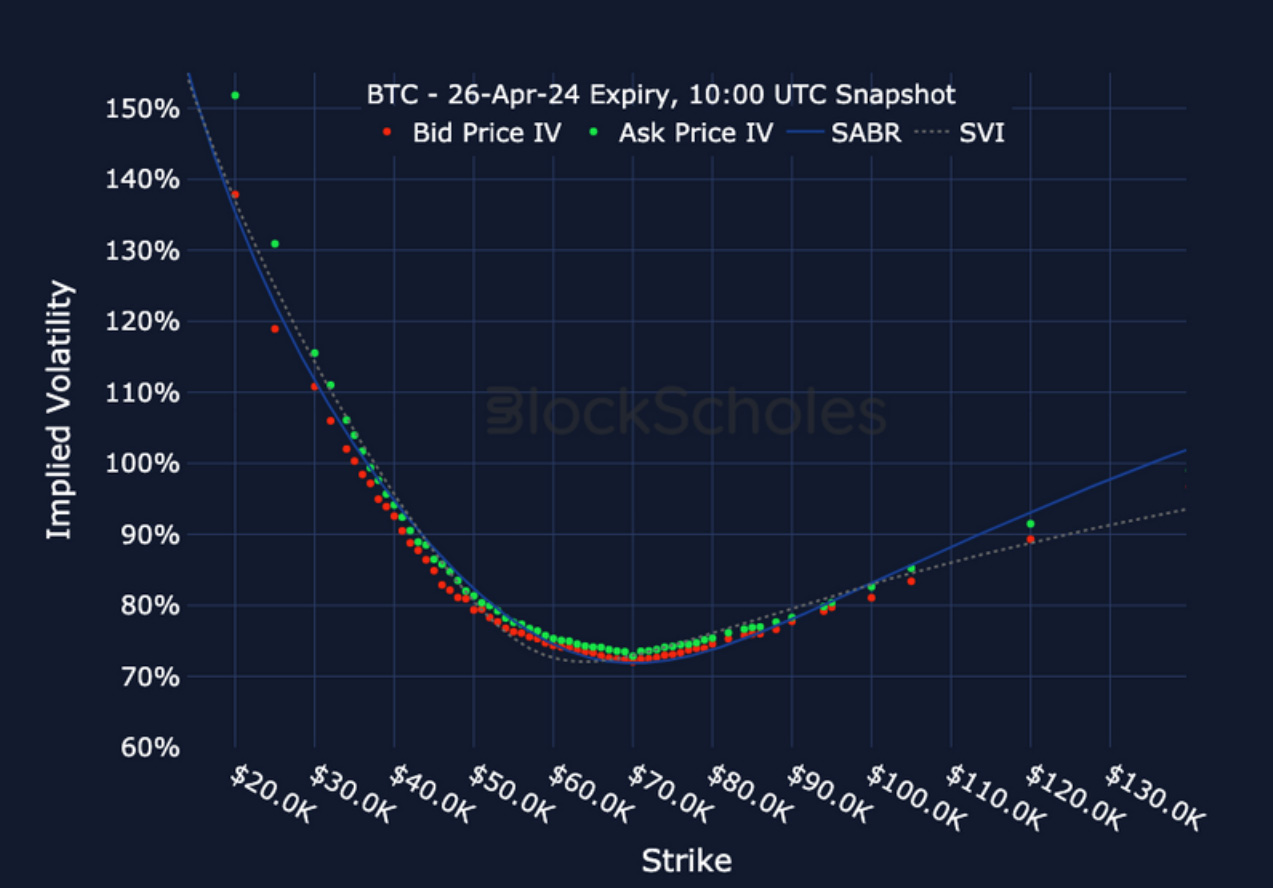

BTC SMILE CALIBRATIONS – 26-Apr-2024 Expiry, 10:00 UTC Snapshot.

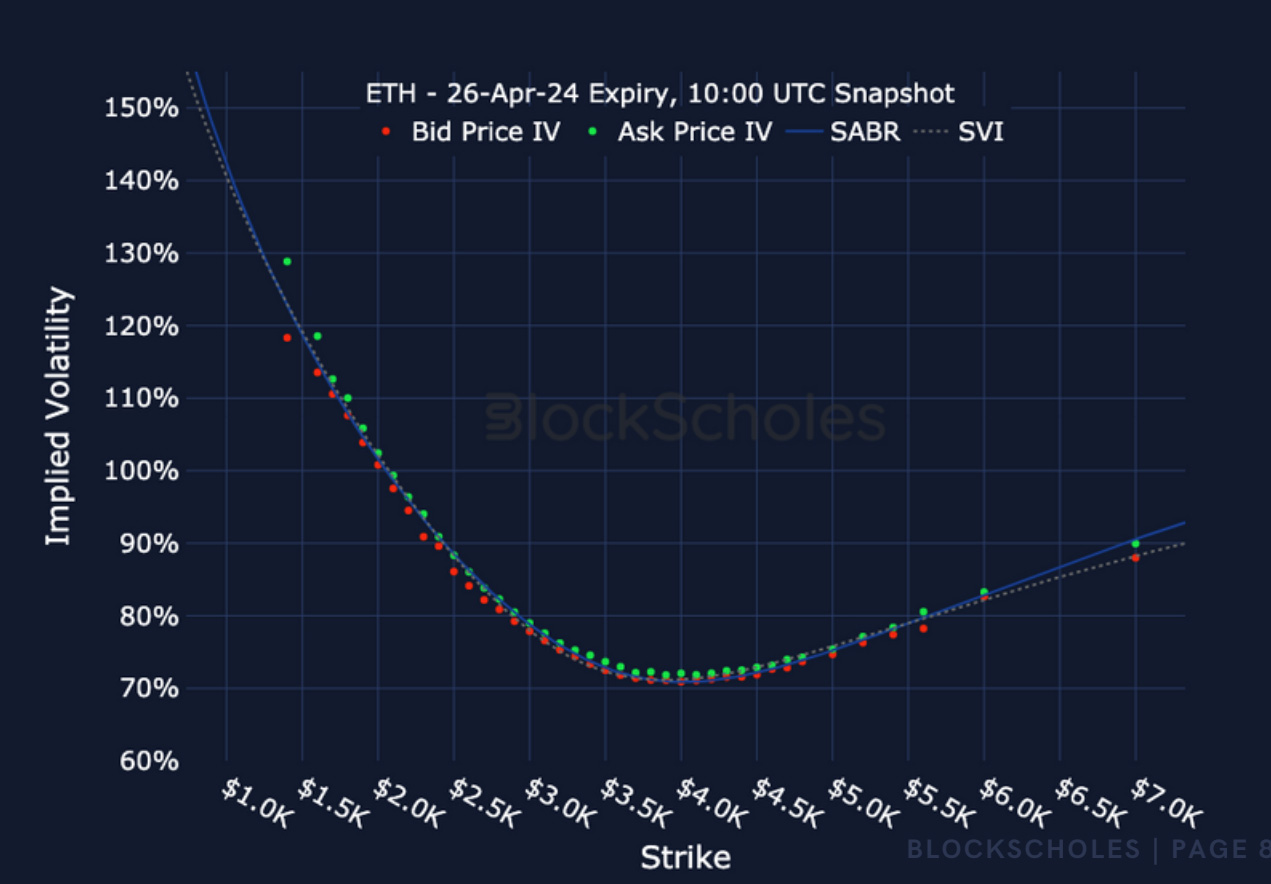

ETH SMILE CALIBRATIONS – 26-Apr-2024 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

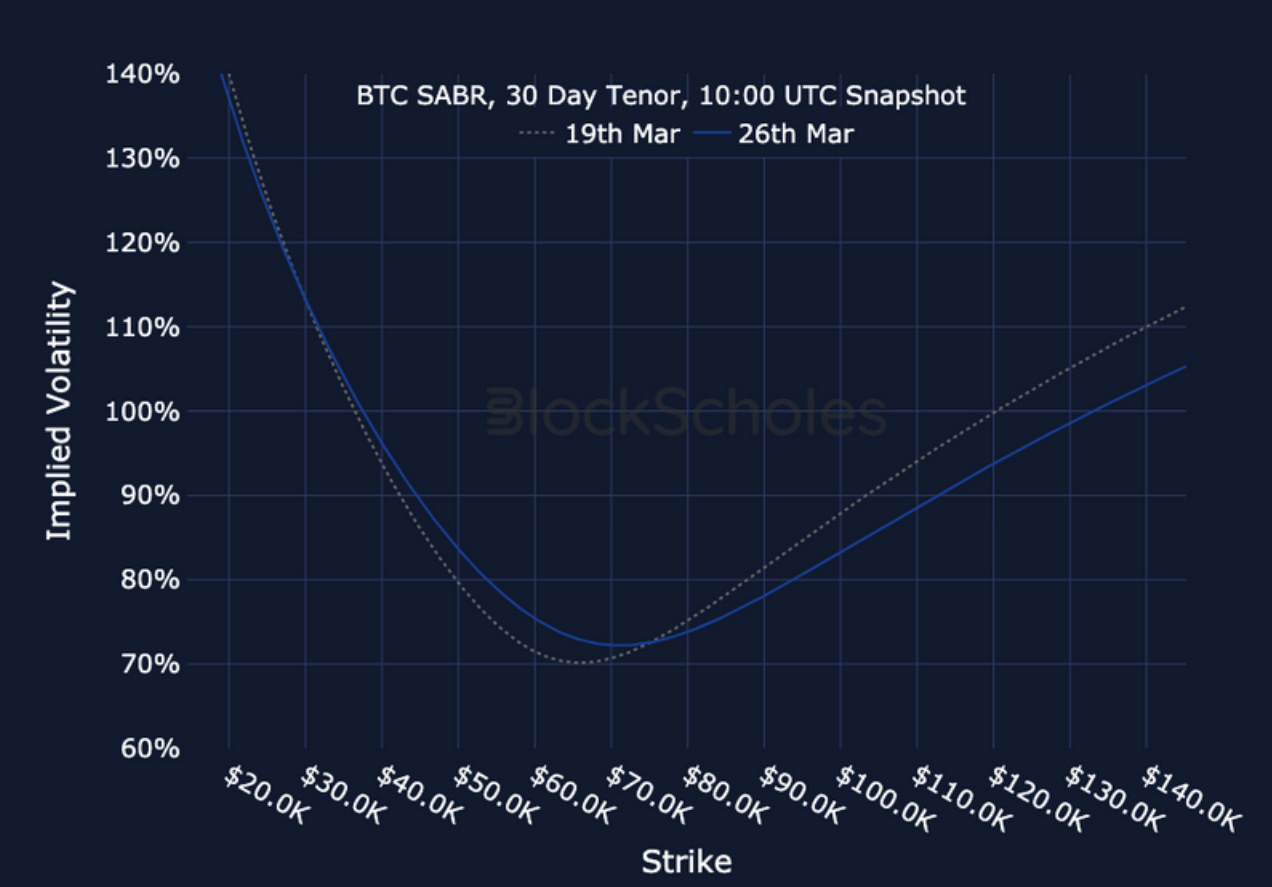

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

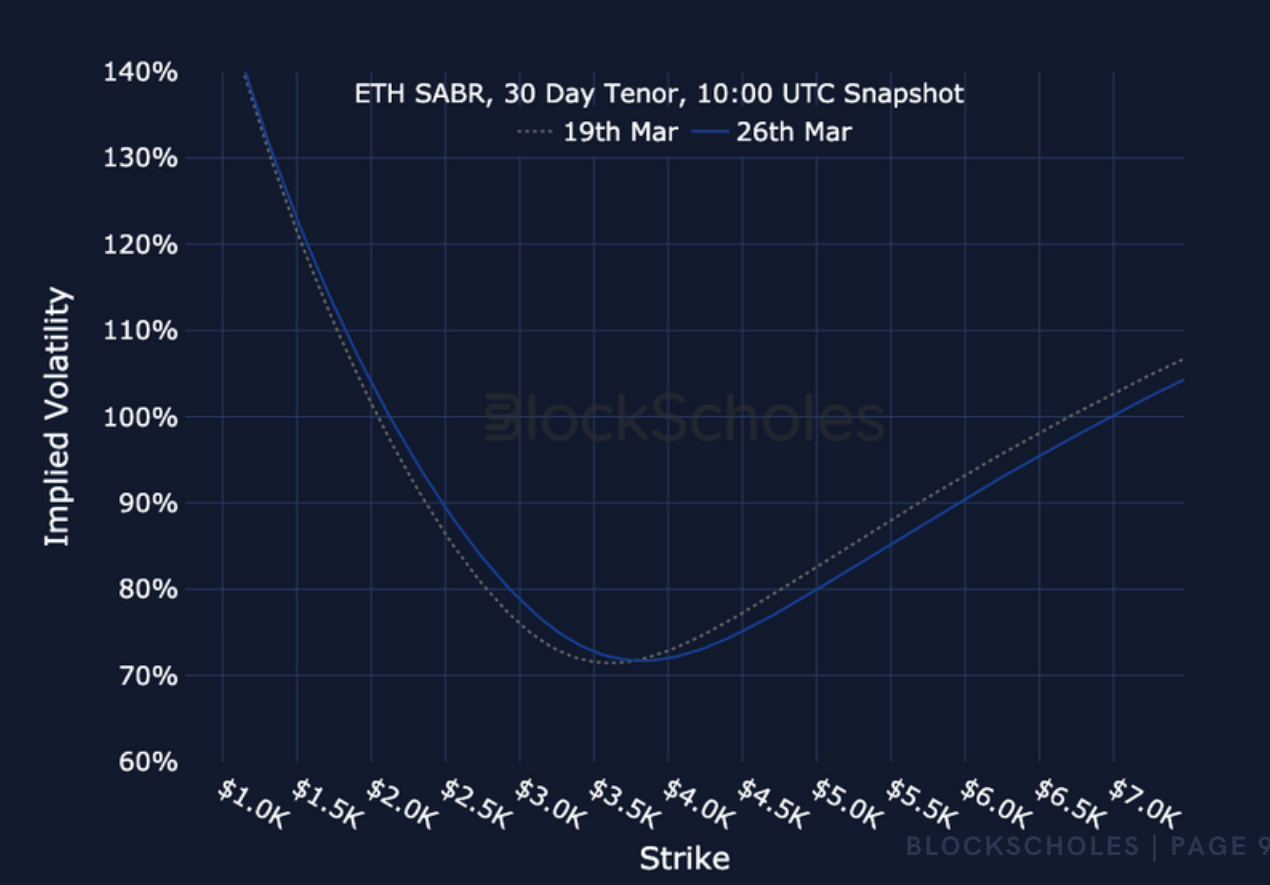

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)