Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Implied volatility has trended decisively downward since the resolution of the ETF announcement event risk last week. With it, we see the resolution of the vol term structure that pushed 1-week tenor options to their highest levels since November 2022. ETH futures prices remain strongly elevated above ETH spot price as the expected follow-on ETF approval for ETH has traders showing a willingness to pay for leveraged long exposure. This is in contrast to the yields implied by BTC futures prices, which remain resolute at 10% across the term structure.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

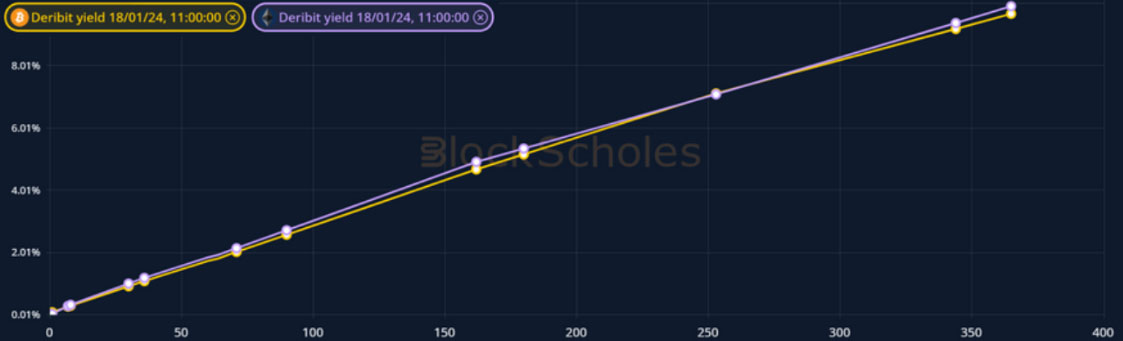

BTC ANNUALISED YIELDS – BTC futures prices remain 10% above spot at an annualised rate across the term structure.

ETH ANNUALISED YIELDS – report a much wider spread of short-tenor ETH futures prices above spot prices at an annualised rate.

Perpetual Swap Funding Rate

BTC FUNDING RATE – trend upward once more following several days of lower levels than before the announcement of a spot BTC ETF.

ETH FUNDING RATE – climbs higher alongside the yield implied by ETH futures prices, indicating a willingness to pay for leveraged long exposure.

BTC Options

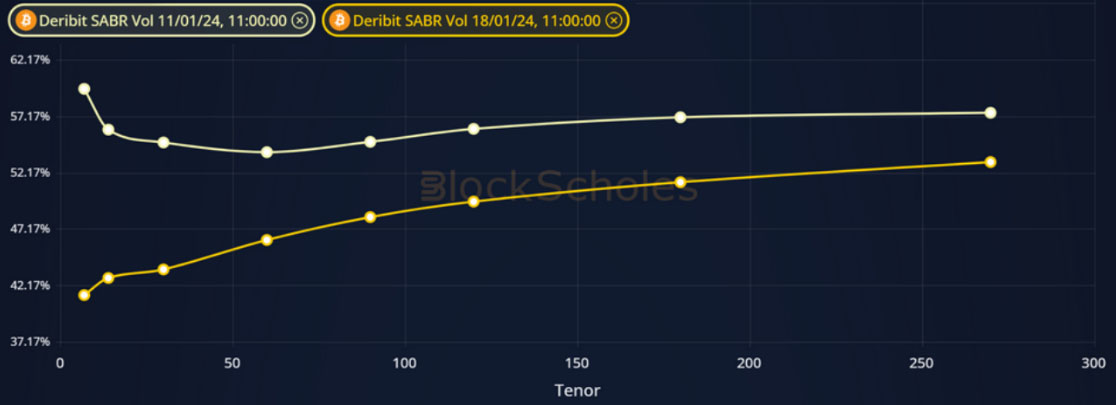

BTC SABR ATM IMPLIED VOLATILITY – drifts lower across the term structure having resolved the inversion that we saw last week.

BTC 25-Delta Risk Reversal – has traded negative for much of the last week following the ETF announcement, but has moved towards 0 recently.

ETH Options

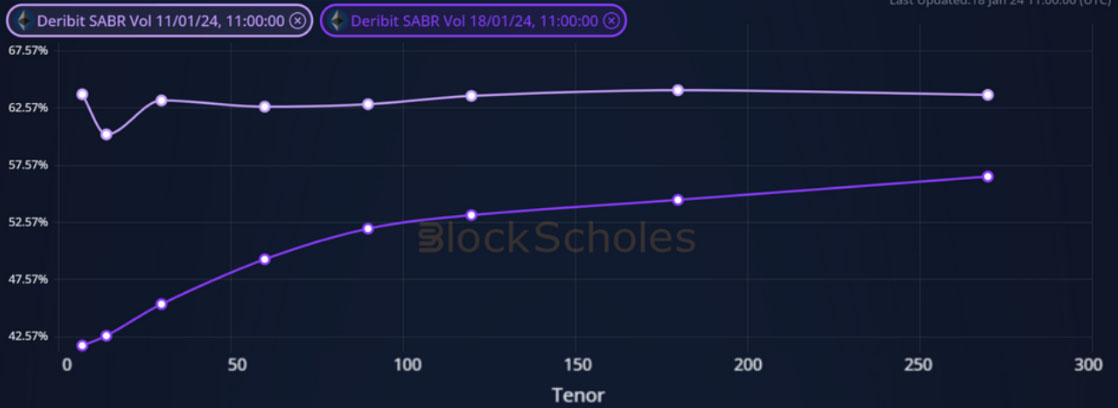

ETH SABR ATM IMPLIED VOLATILITY – follows a similarly downward trajectory post-ETF despite the dominant ETH rotation narrative.

ETH 25-Delta Risk Reversal – has curbed the downward trend that saw the IV of OTM puts dominate for much of the past week.

Volatility Surface

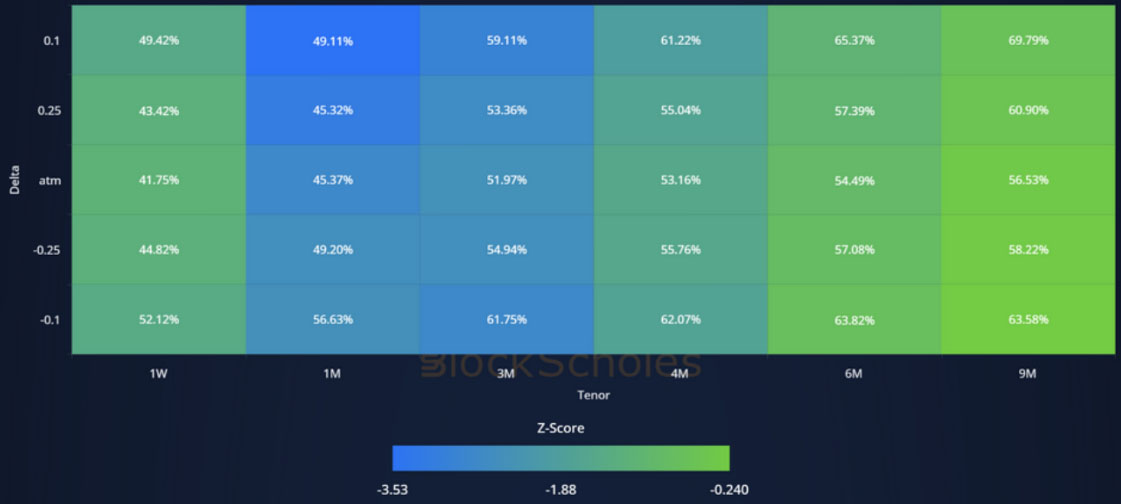

BTC IMPLIED VOL SURFACE – reports a surface-wide cooling, with the 1W tenor closer to its 30-day historical average than other tenors.

ETH IMPLIED VOL SURFACE – sees a similar surface wide cooling that is less extreme at longer-dated tenors than on BTC’s surface.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

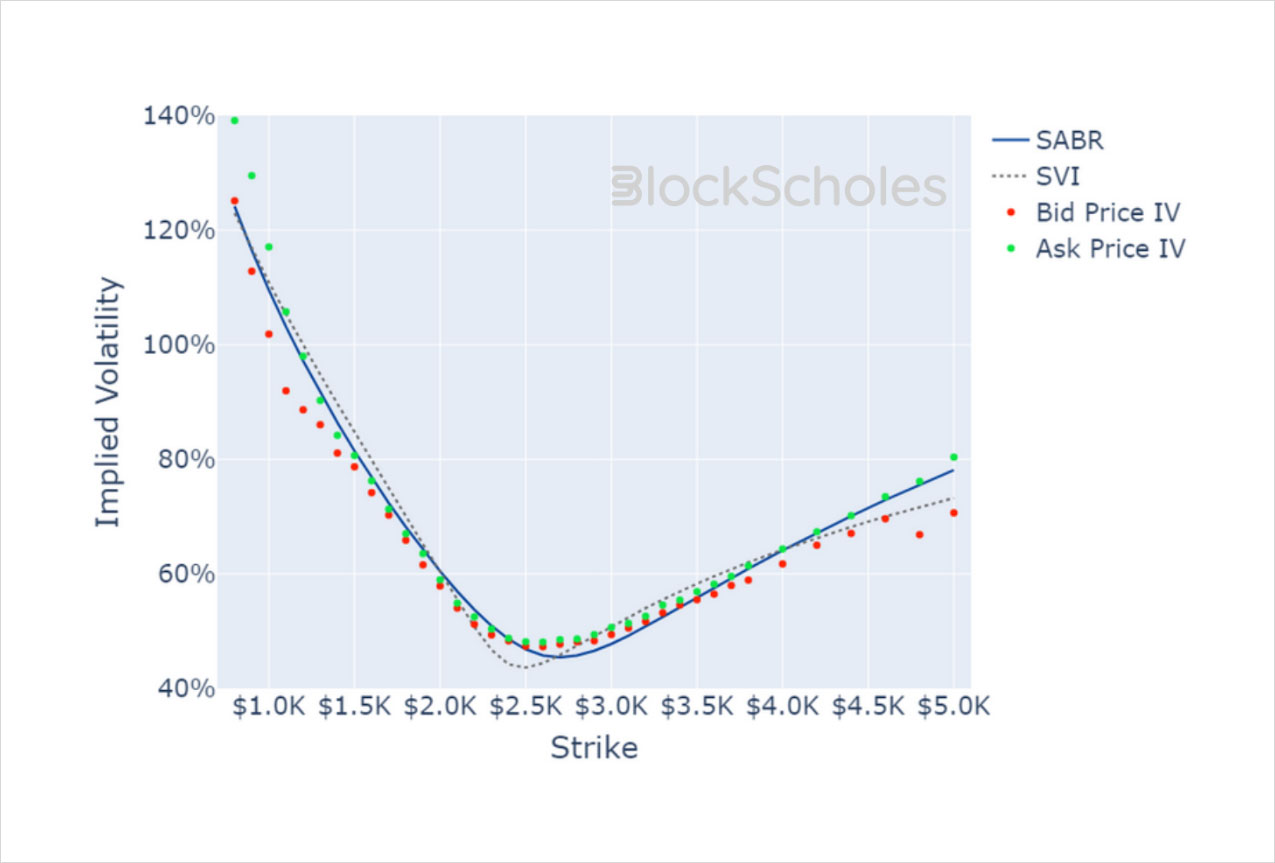

BTC SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

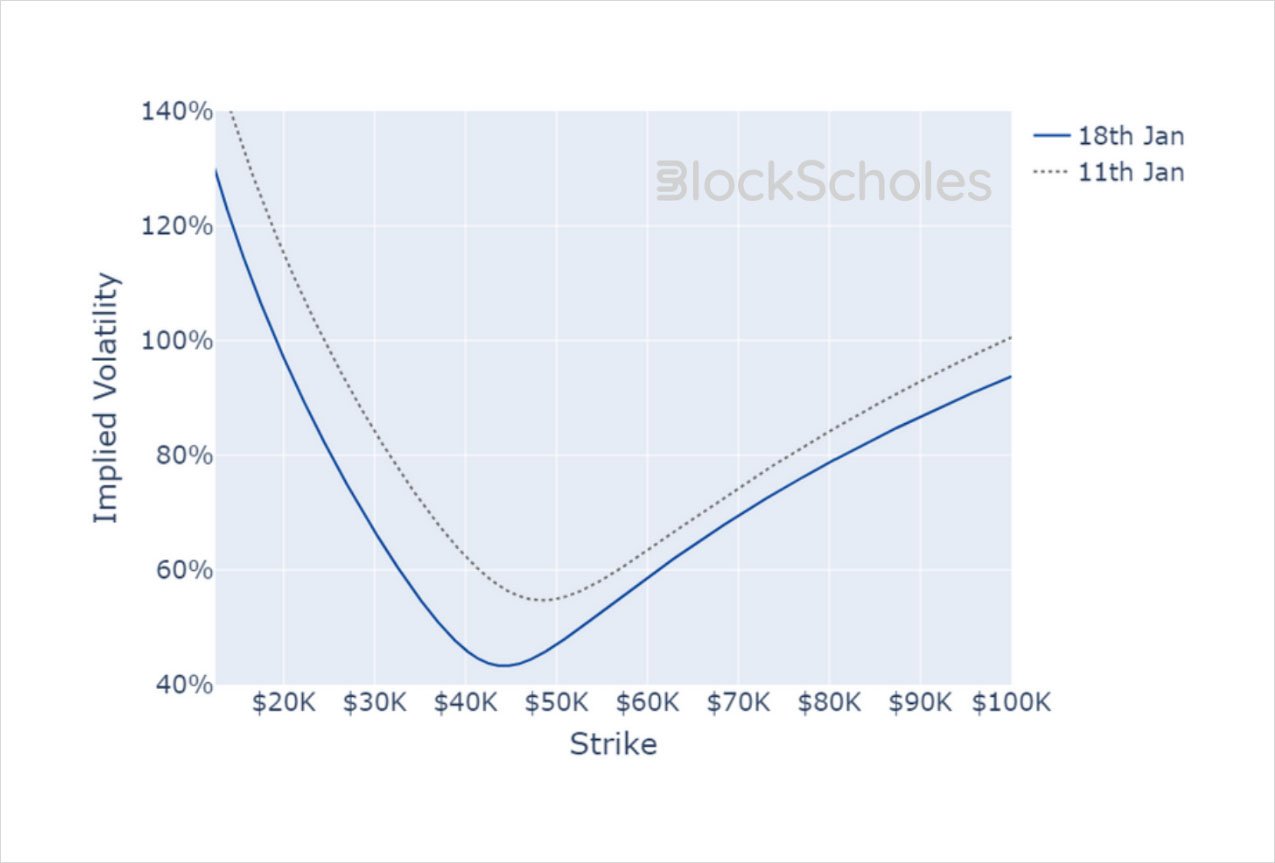

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

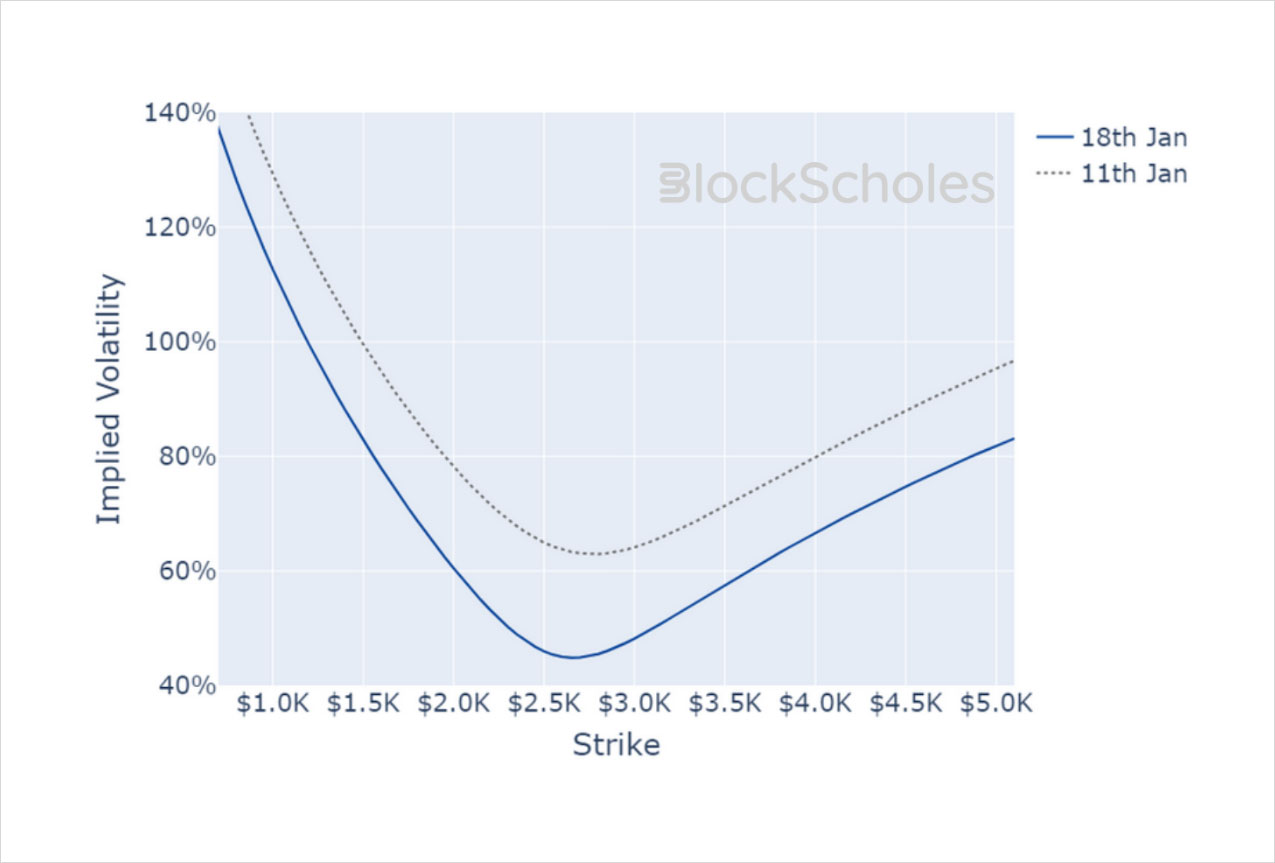

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)