Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Implied volatility has found stability following the decisive downward move reported last week. ATM implied volatility across both majors largely traded sideways around 40% across their term structures. Despite a short-lived inversion of the term structure caused by increased demand for OTM puts, we see both volatility surfaces trend back towards neutral skews. Demand for leverage long exposure using the perpetual swap contract has largely diminished as indicated by the low funding rates.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – futures to trade sideways at 10% above the spot at an annualised rate with a shallow steepness across the term structure.

ETH ANNUALISED YIELDS – has seen its spread along the term structure narrow, as futures prices trend closer to spot over the last week.

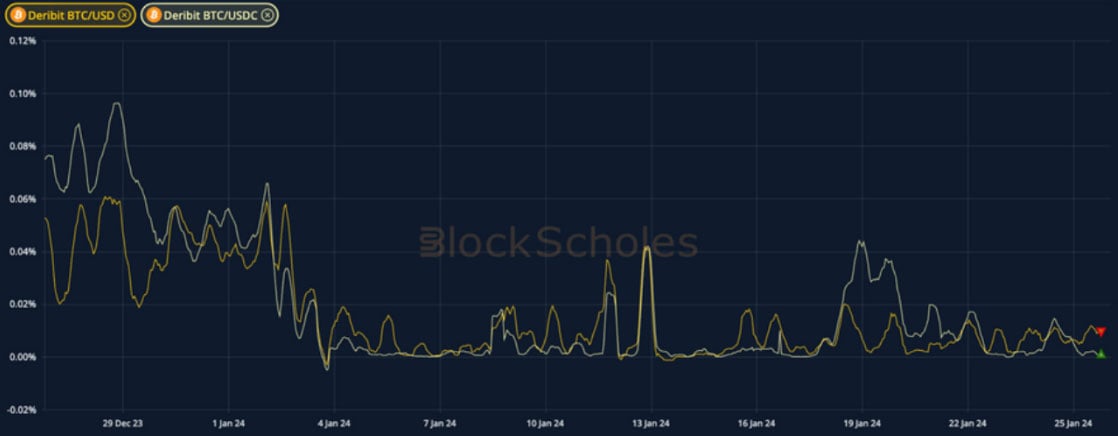

Perpetual Swap Funding Rate

BTC FUNDING RATE – has seen demand for long exposure through the perpetual contract demand diminish, as funding rates trade close to 0.

ETH FUNDING RATE – mirrors BTC as it sees a decline in demand for leveraged long exposure.

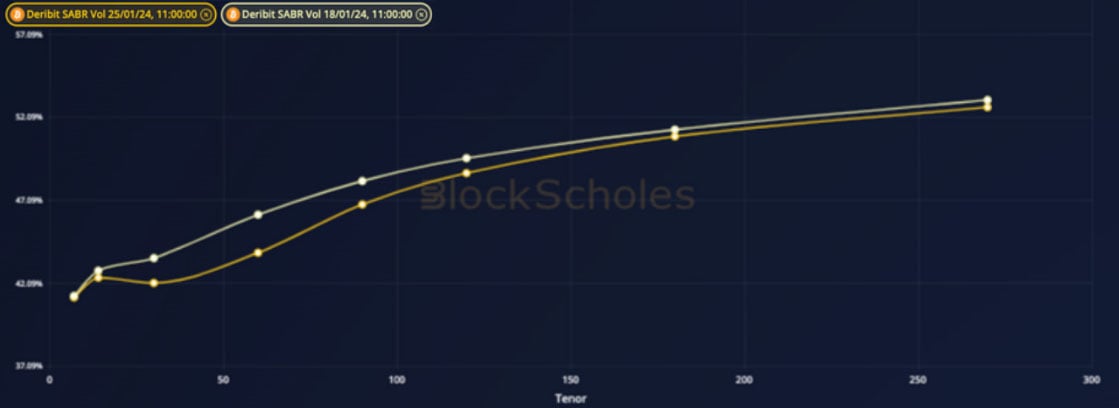

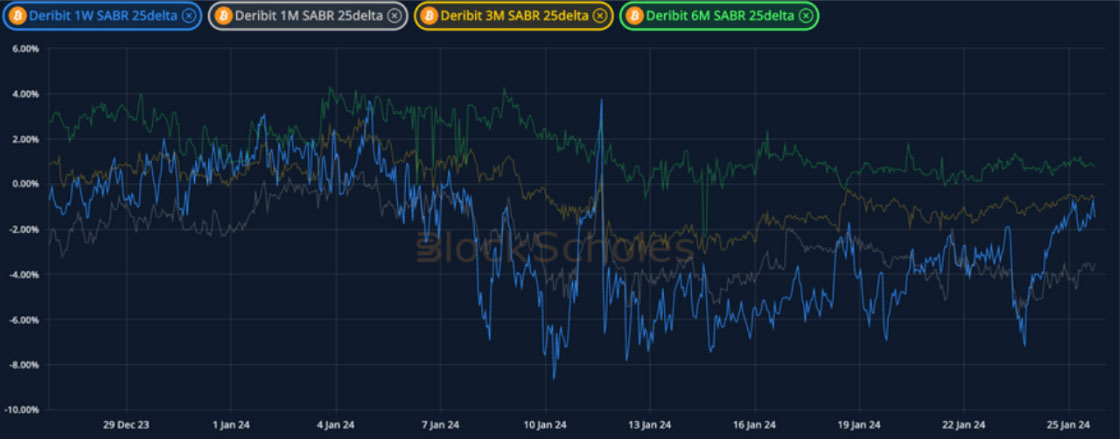

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has resolved yet another inversion in its structure, with implied volatility of short-tenors declining afterwards.

BTC 25-Delta Risk Reversal – mid-to-long dated tenors trade sideways, with short tenors resolving a skew towards OTM puts.

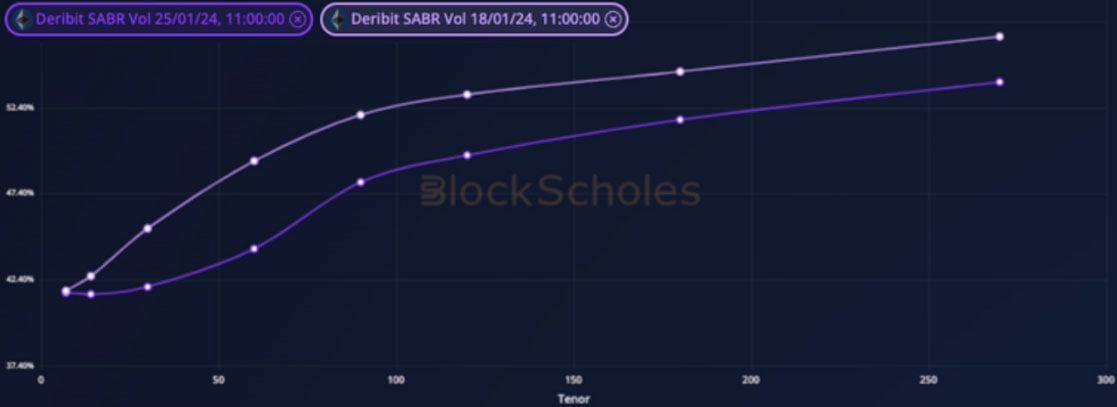

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – inverted similarly to BTC, but trades sideways across the term structure at pre-inversion levels.

ETH 25-Delta Risk Reversal – recovers towards a more neutral skew across the surface.

Volatility Surface

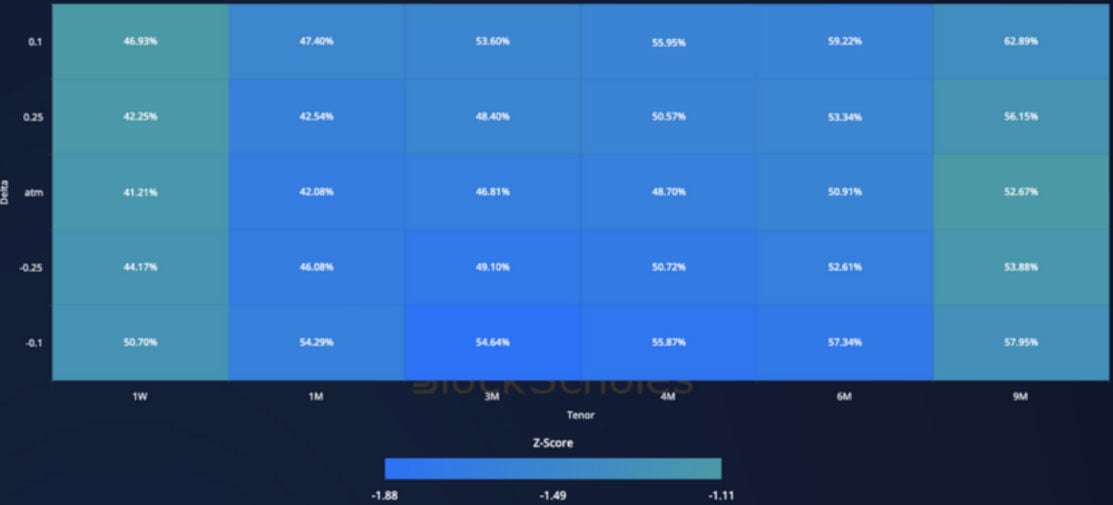

BTC IMPLIED VOL SURFACE – reports a cooling across the whole volatility surface.

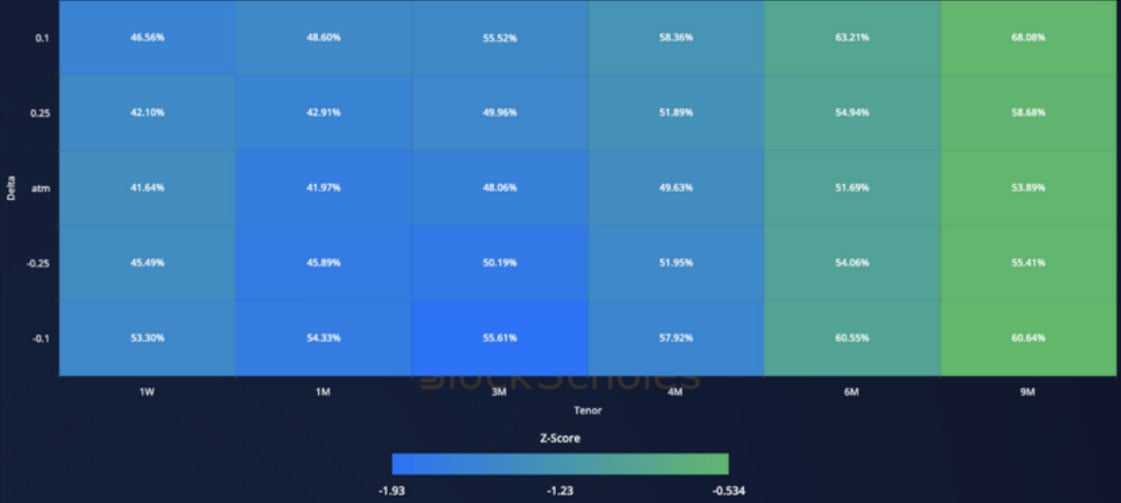

ETH IMPLIED VOL SURFACE – sees a similar surface-wide cooling, with long dated tenors being further away from their historical 30-day average.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

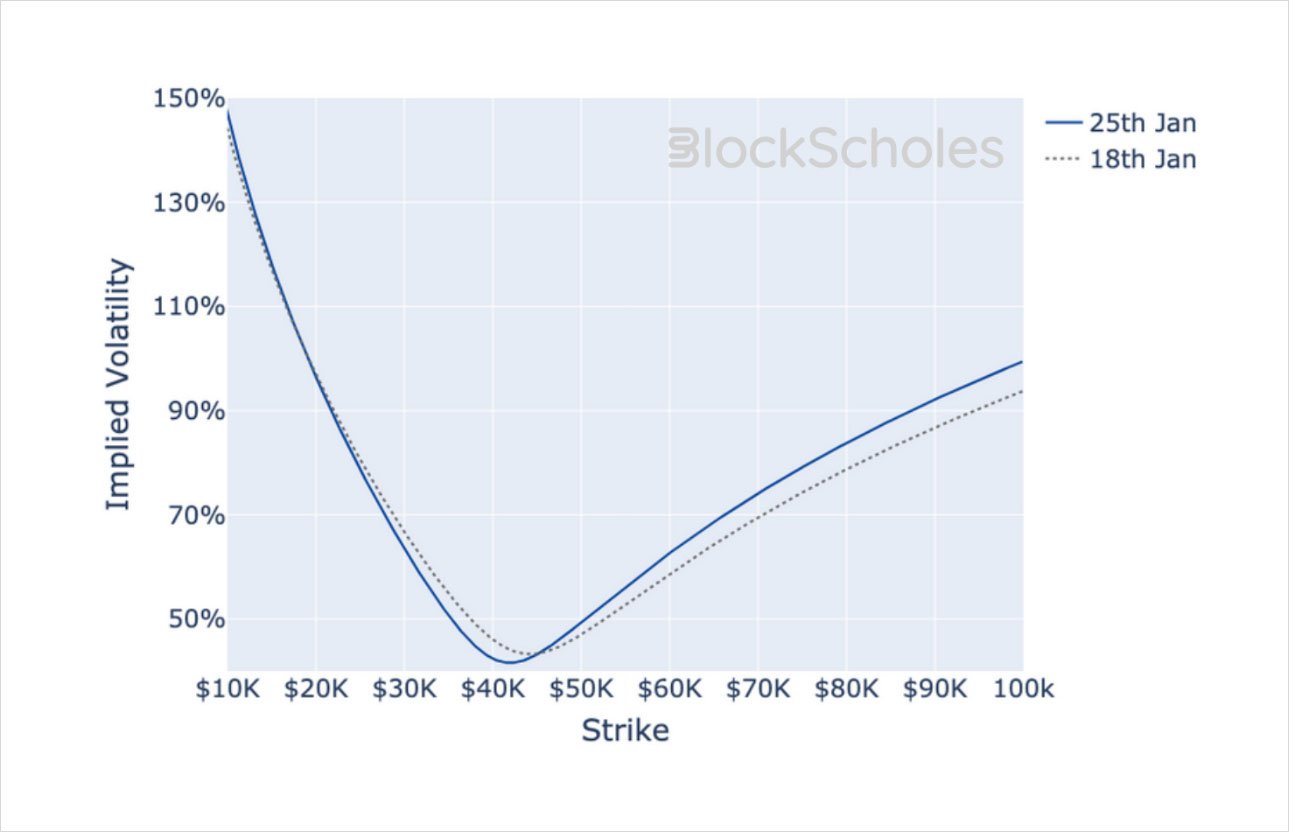

Volatility Smiles

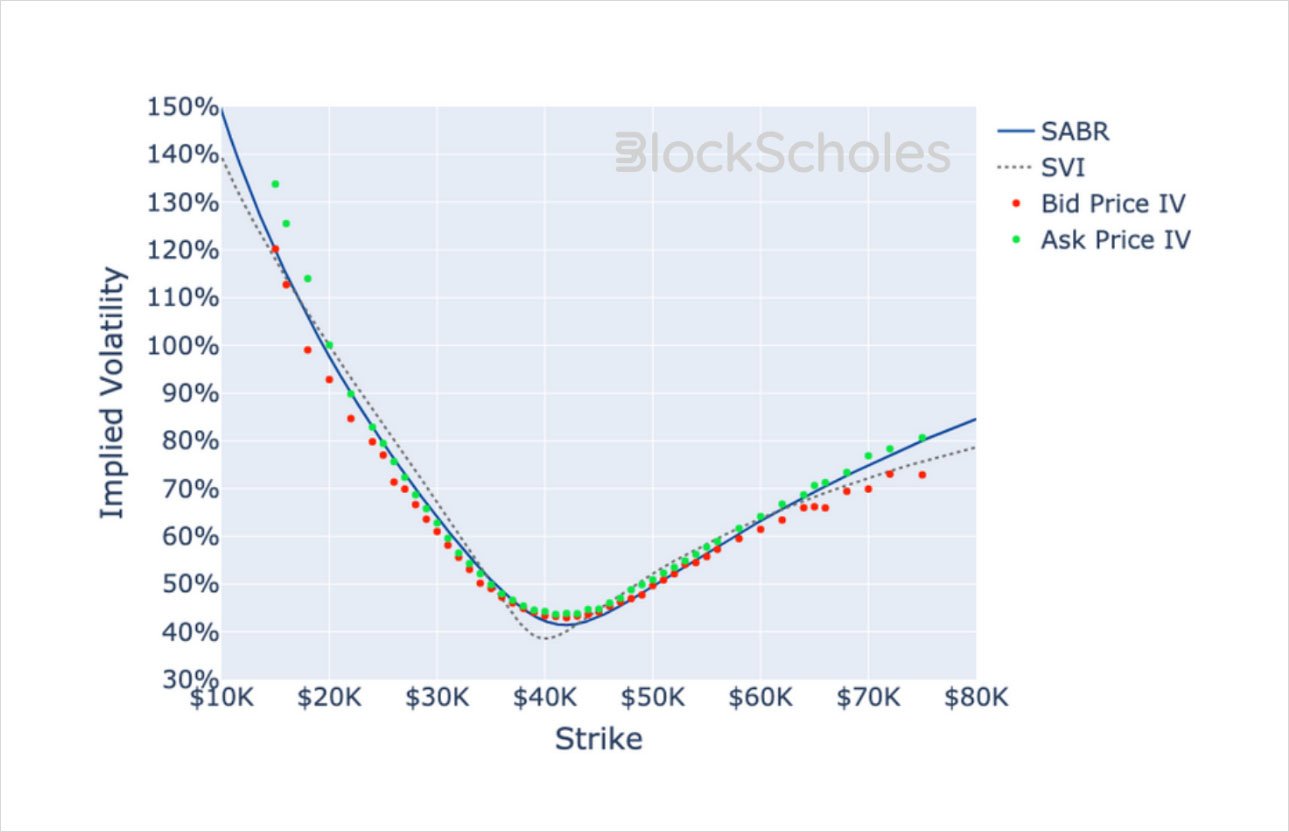

BTC SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

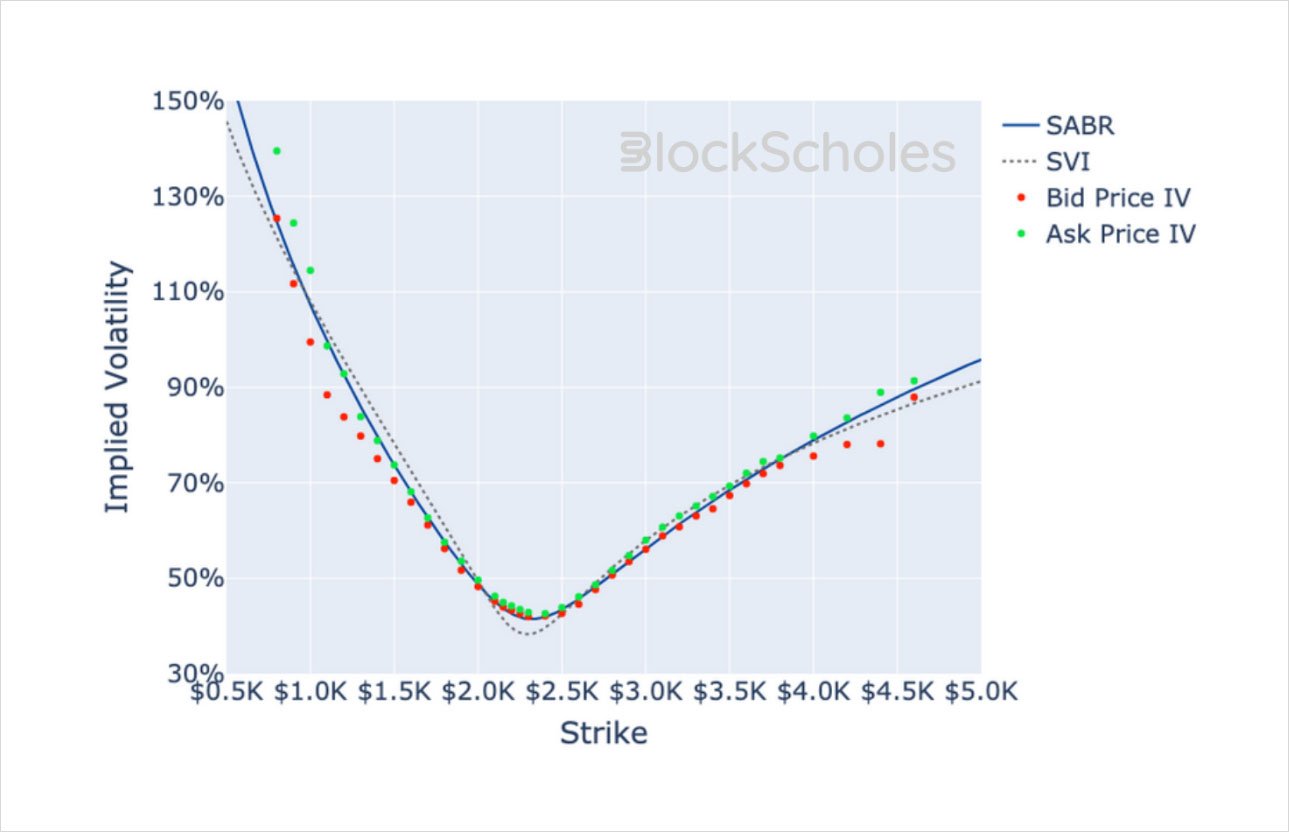

ETH SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)