Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The effects of the strong upward move in the spot prices of both majors have rippled through the derivatives markets. More bullish positioning has been observed as both options have skewed towards OTM calls across the term structure. The perpetual markets reaffirm this bullish positioning as funding rates spike, expressing a strong willingness to pay for long exposure through the perpetual contract.

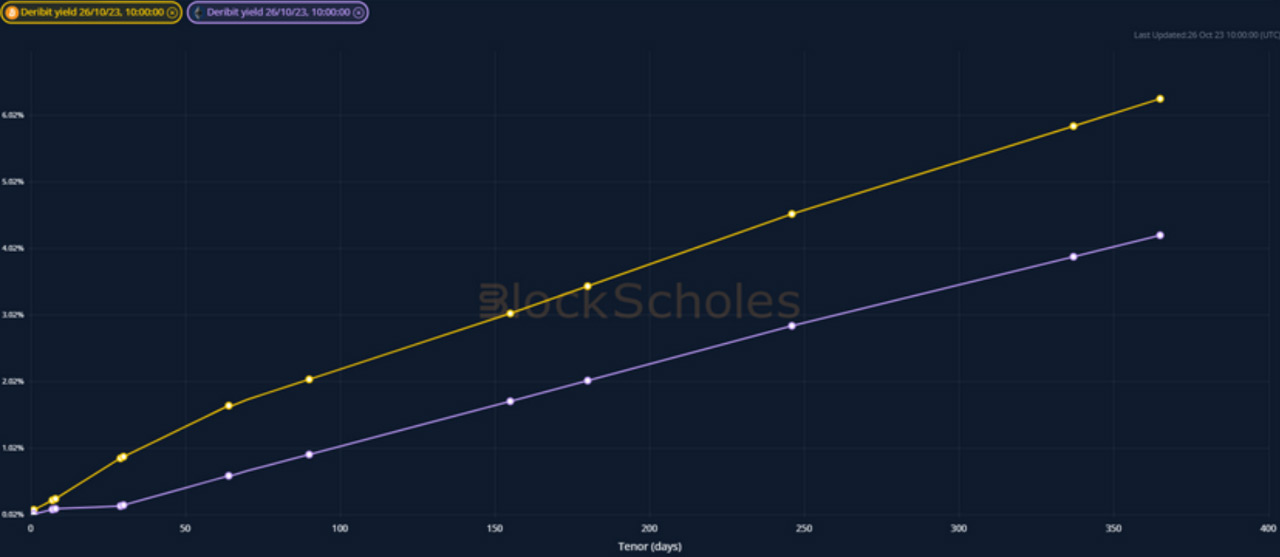

Futures implied yield term structure

Futures

BTC ANNUALISED YIELDS – reached as high ar 25% in the last significantly, continuing the uptrend across the term structure.

ETH ANNUALISED YIELDS – continues to be trade below BTC’s at tenors apart from the 6M, but rising as the spot rally continues.

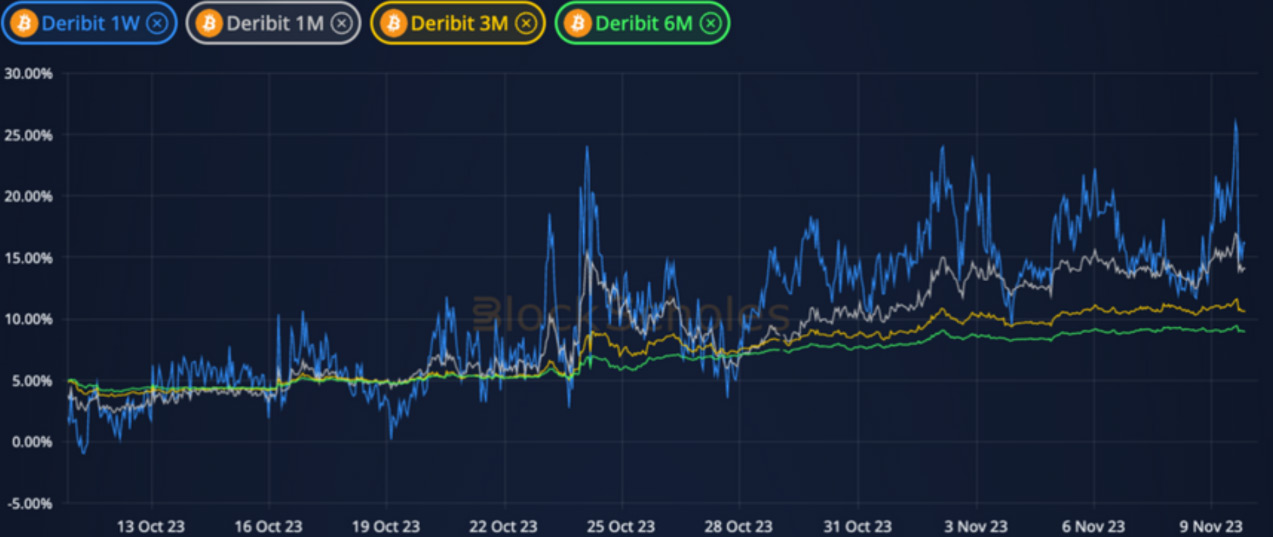

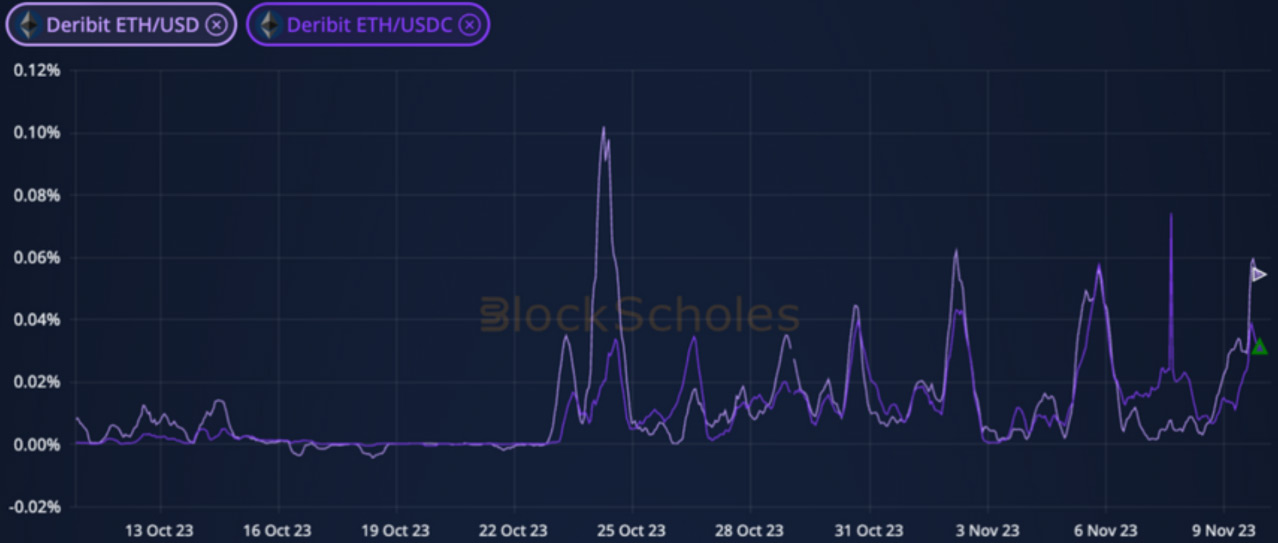

Perpetual Swap Funding Rate

ETH ANNUALISED YIELDS – continues to be trade below BTC’s at tenors apart from the 6M, but rising as the spot rally continues.

ETH FUNDING RATE – mirrors BTC’s movements, with funding rate peaking much higher in the last 24 hours than BTC.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – saw shorter tenors rise significantly in the last 24 hours, narrowing the term structure.

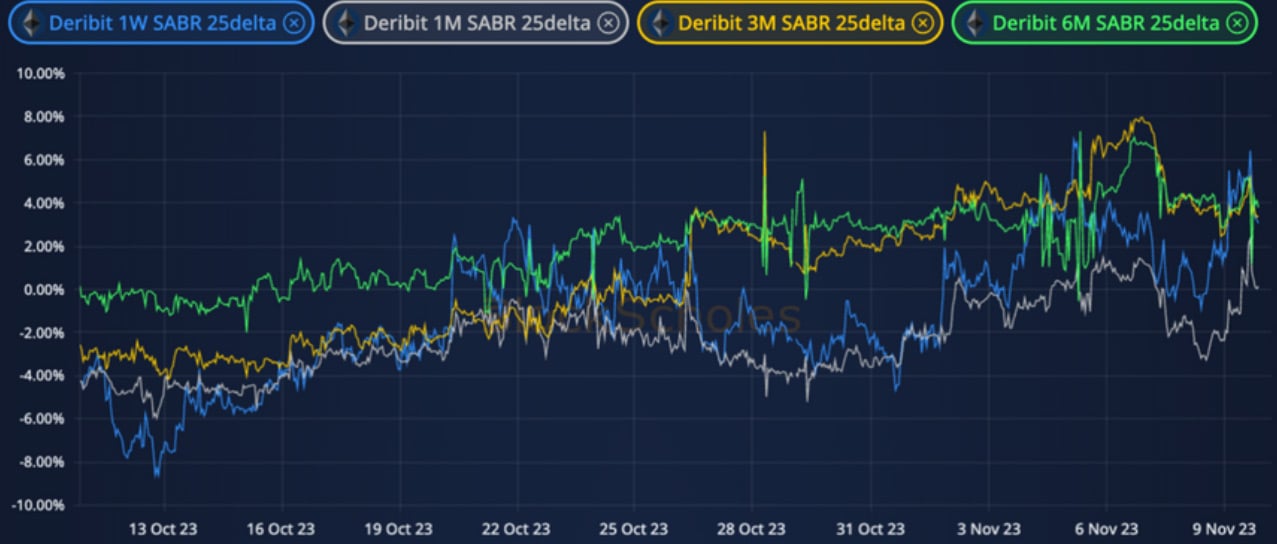

BTC 25-Delta Risk Reversal – shows a distinct skew towards OTM calls at longer tenors relative to shorter tenors. The most recent spot price rally in the last 24 hours narrows the skew term structure.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – traded similarly to BTC with the term structure narrowing in the last 24 hours.

ETH 25-Delta Risk Reversal – the skew at all tenors has shifted towards a neutral-to-positively skewed smile.

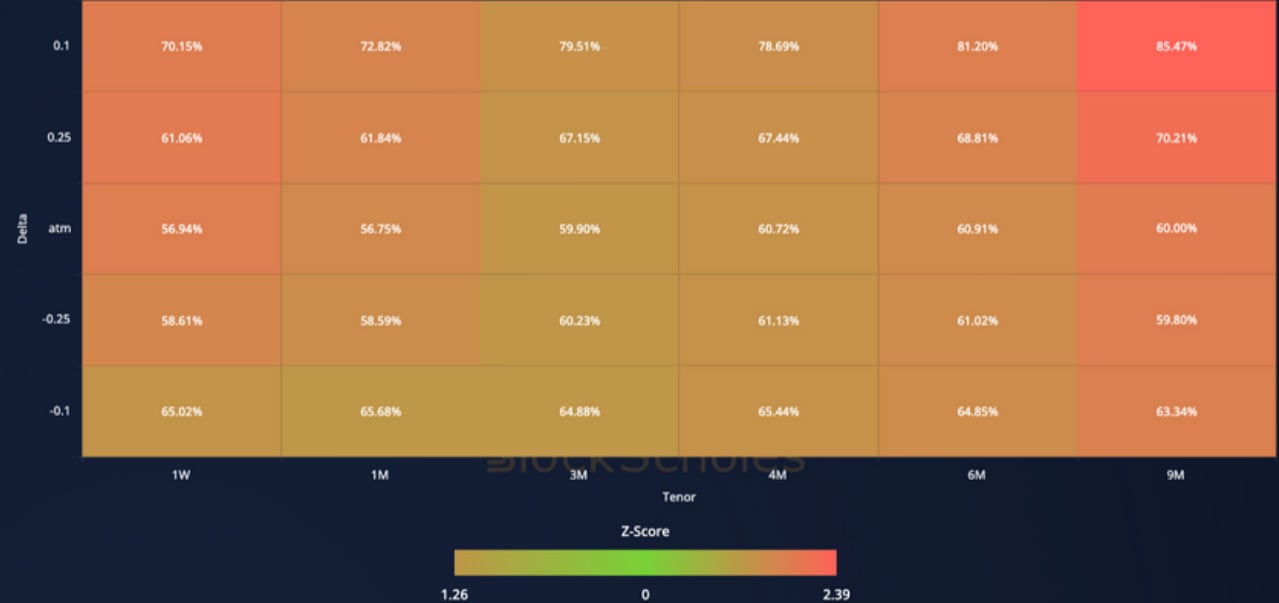

Volatility Surface

BTC IMPLIED VOL SURFACE – reports a significant increase at all points on the volatility surface, with short and longer tenors increasing the most.

ETH IMPLIED VOL SURFACE – volatility has risen at all tenors, with longer tenors rising the most compared to their recent values.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

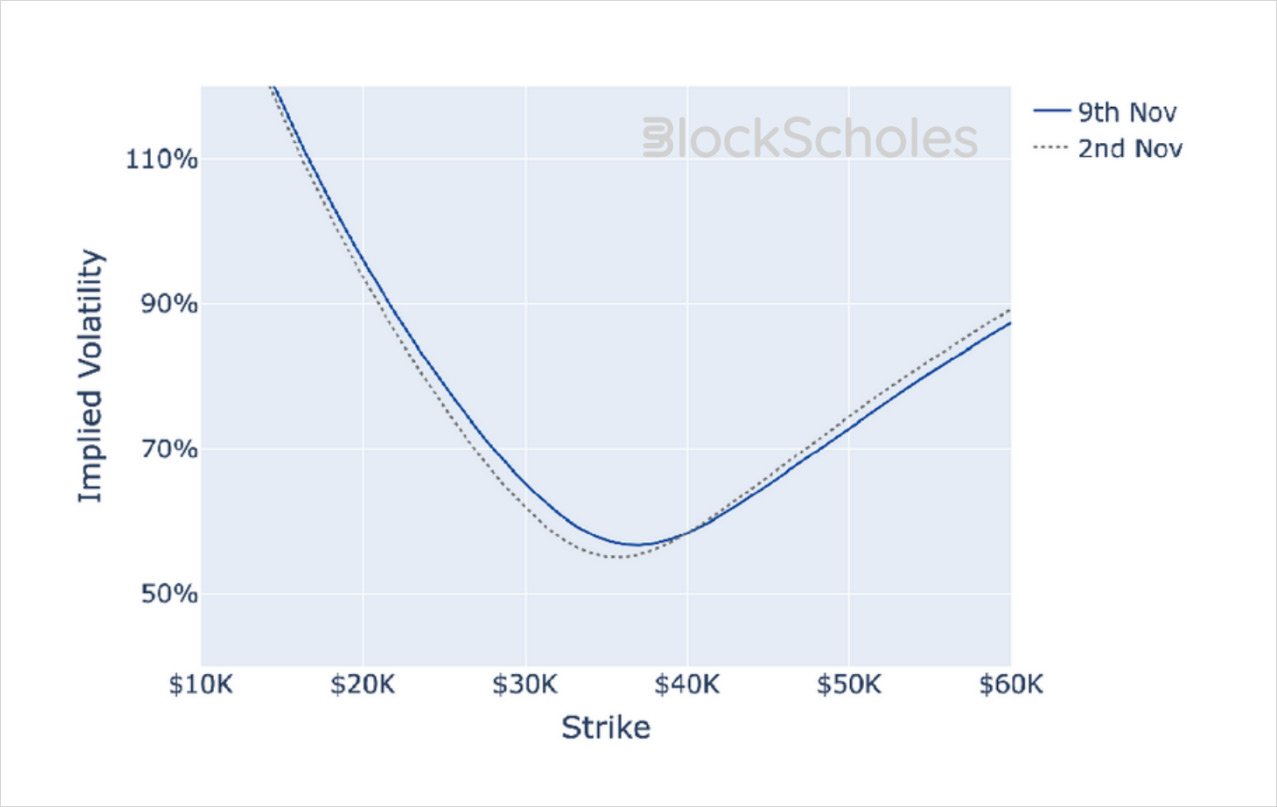

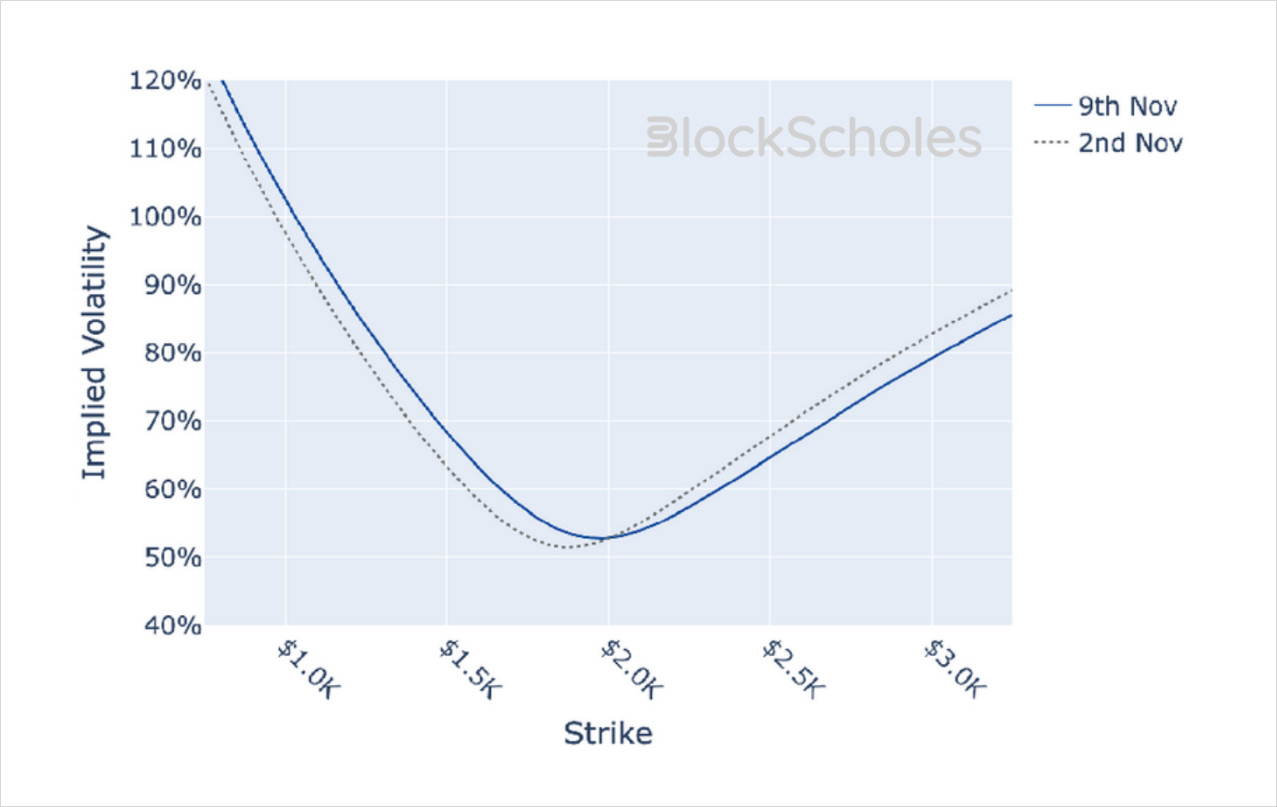

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)