Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

We see signs that volatility markets are pricing an event risk targeted at the end of January, as indicated by the elevated levels of implied volatility at tenors longer than this date compared to shorter-dated optionality. The skew of longer-dated smiles towards OTM calls indicates sizable bullish positioning after this date in both major assets. Positioning for action in the shorter term appears scarce by comparison: future-implied yields and funding rates have moderated considerably alongside short-term volatility.

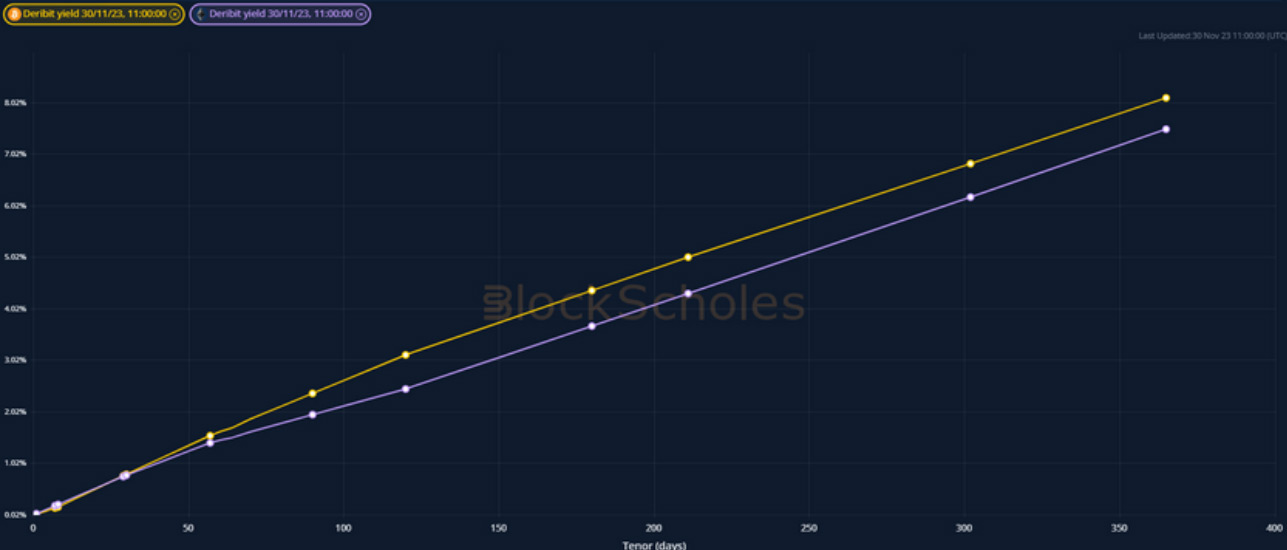

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – each tenor oscillates close to 10%, with shorter tenors trending downwards in the last 24 hours.

ETH ANNUALISED YIELDS – osciallte with a steeper term structure to BTC’s, but largely trade in the same range just below 10%.

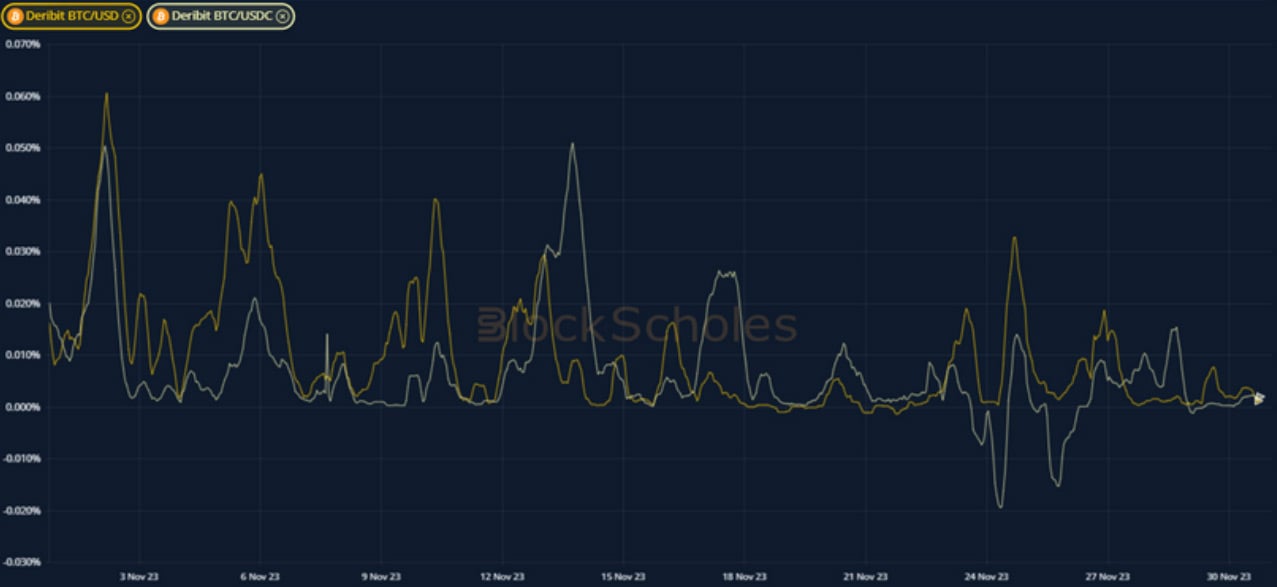

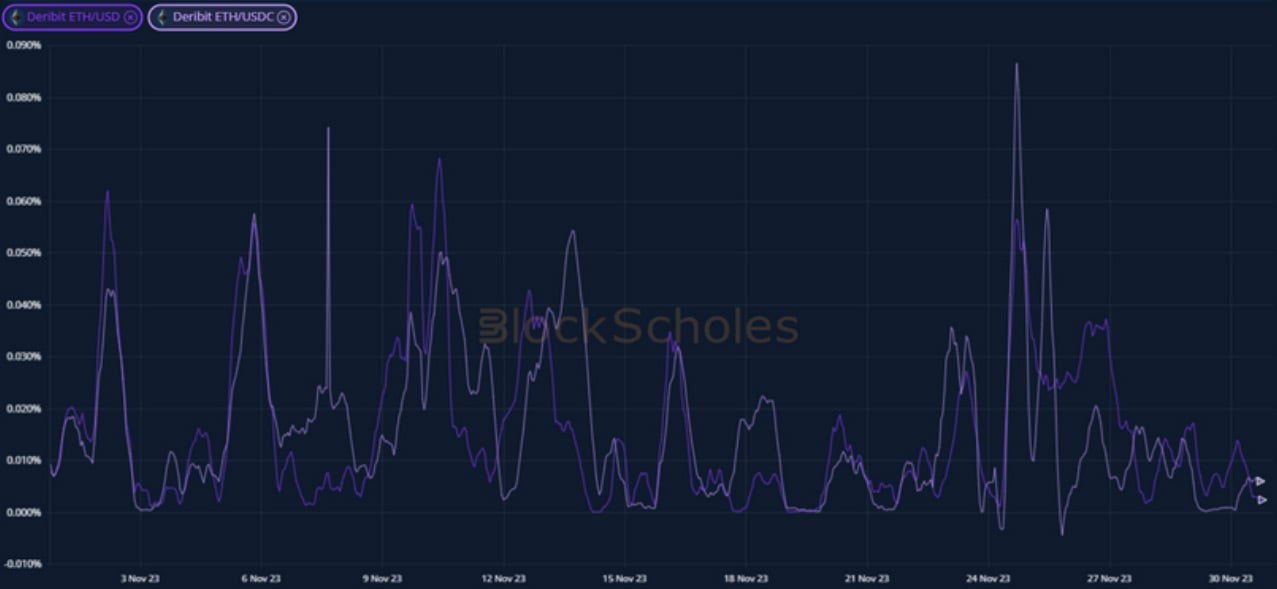

Perpetual Swap Funding Rate

BTC FUNDING RATE – briefly flipped negative for USDC-margined contracts, with a noticeably lower magnitude in the last 7 days.

ETH FUNDING RATE – has spiked above the levels indicated by BTC’s contract as ETH spot outperforms BTC’s for the first month since July.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – trades in a spread between 40% and 55%, with longer tenor options indicating a higher risk premium.

BTC 25-Delta Risk Reversal – shows a similar structure to outright vol levels, with a preference for OTM calls at 3M and 6M tenors.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – highlights a similarly steep term structure, indicating the pricing of an event risk at the January end expiry.

ETH 25-Delta Risk Reversal – shows a similar demand for OTM calls at longer tenors, albeit at lower levels than BTC’s risk reversals.

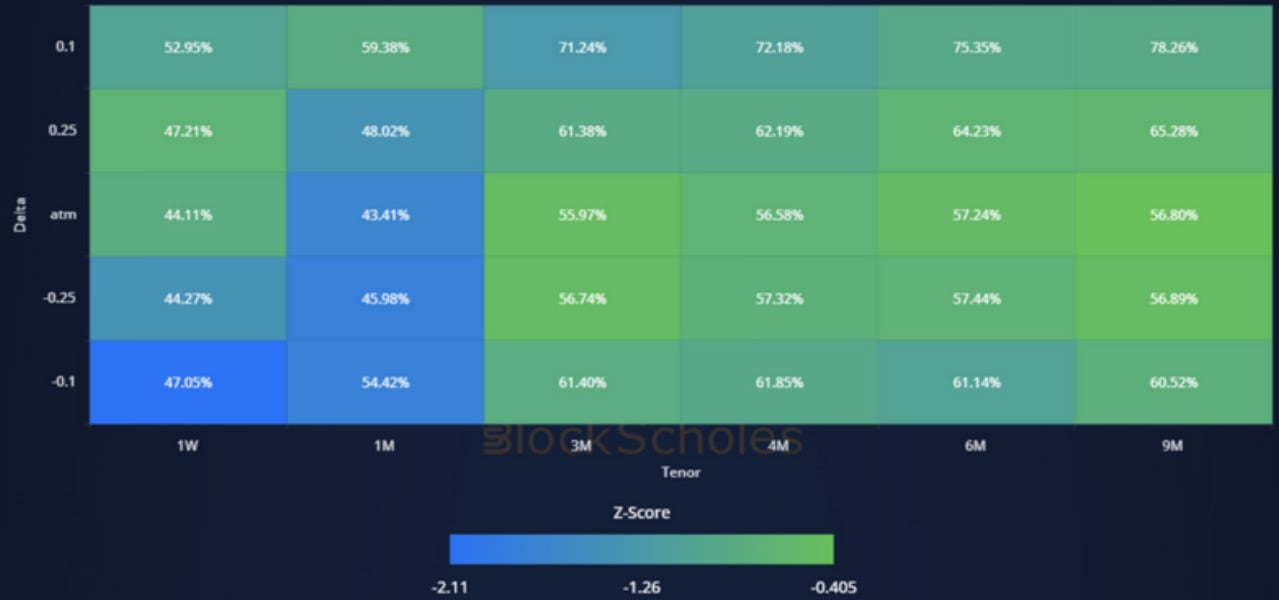

Volatility Surface

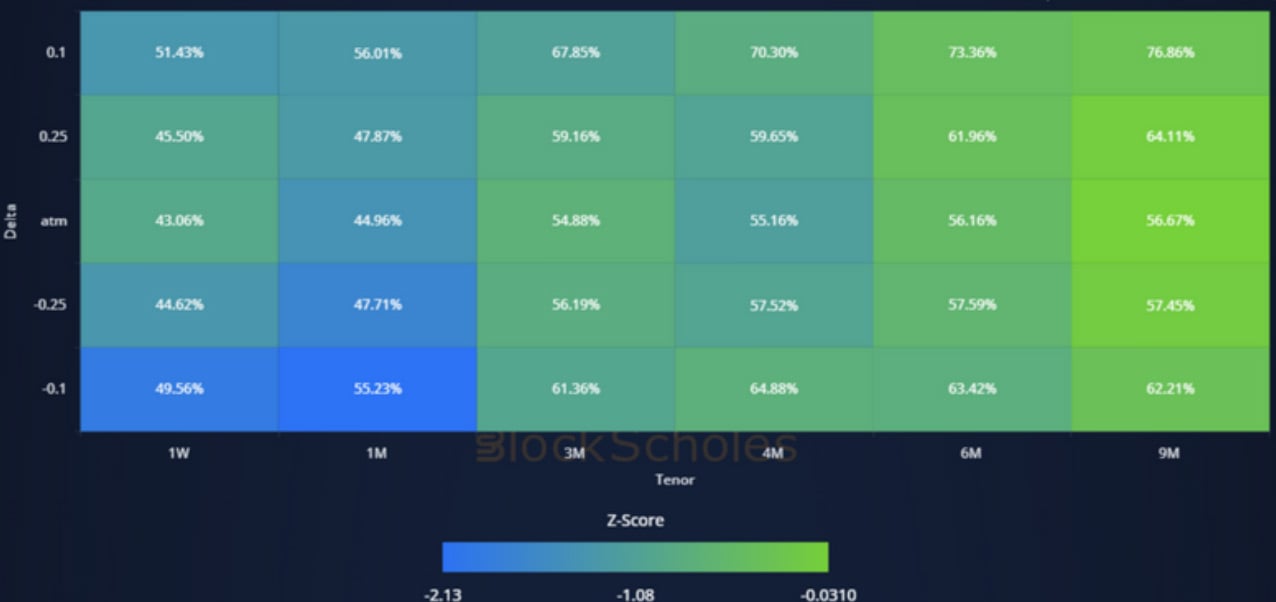

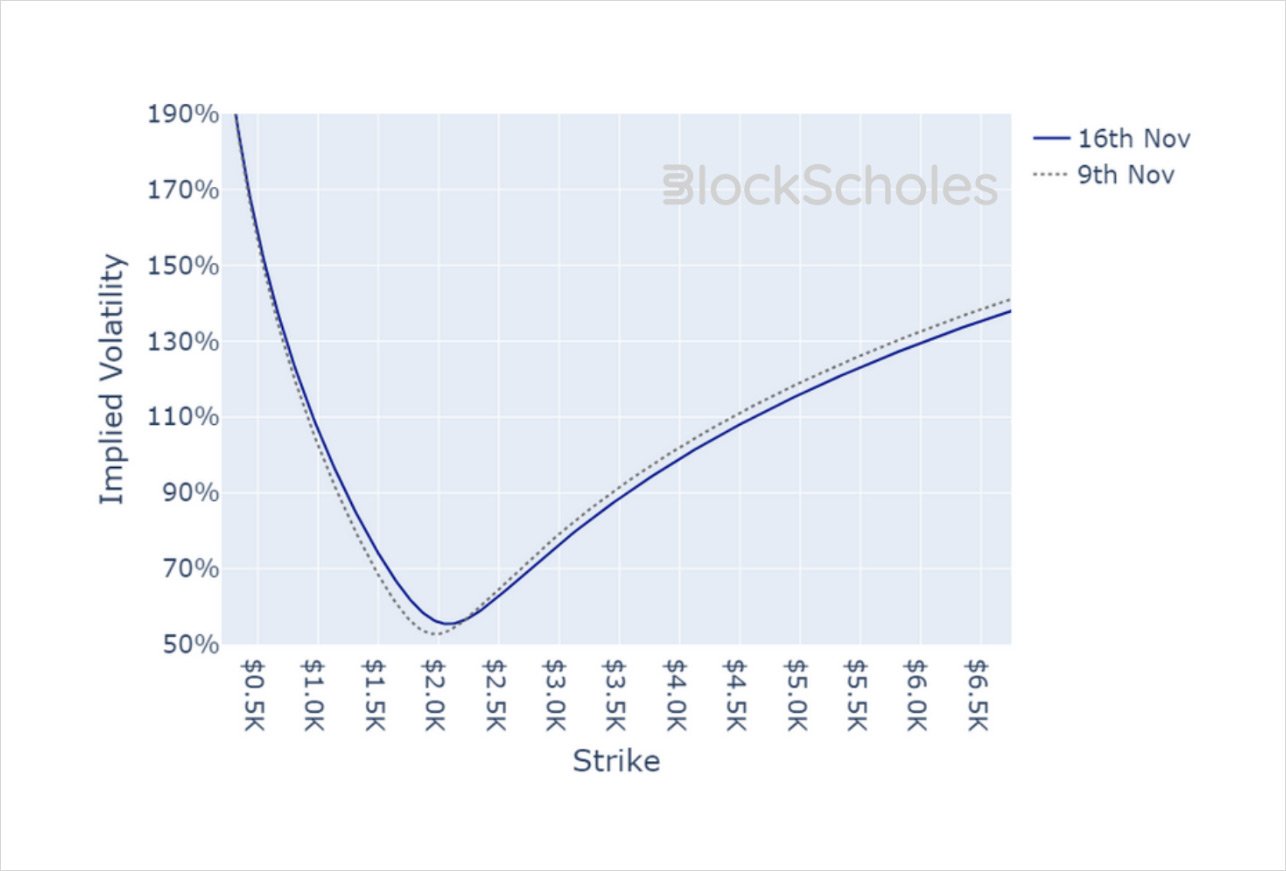

BTC IMPLIED VOL SURFACE – we see a strong cooling in implied vol across the term structure that is most prominent in short term OTM puts.

ETH IMPLIED VOL SURFACE – the widening gap between long and short tenor implied vol levels has grown by a faster fall in short term volatility.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

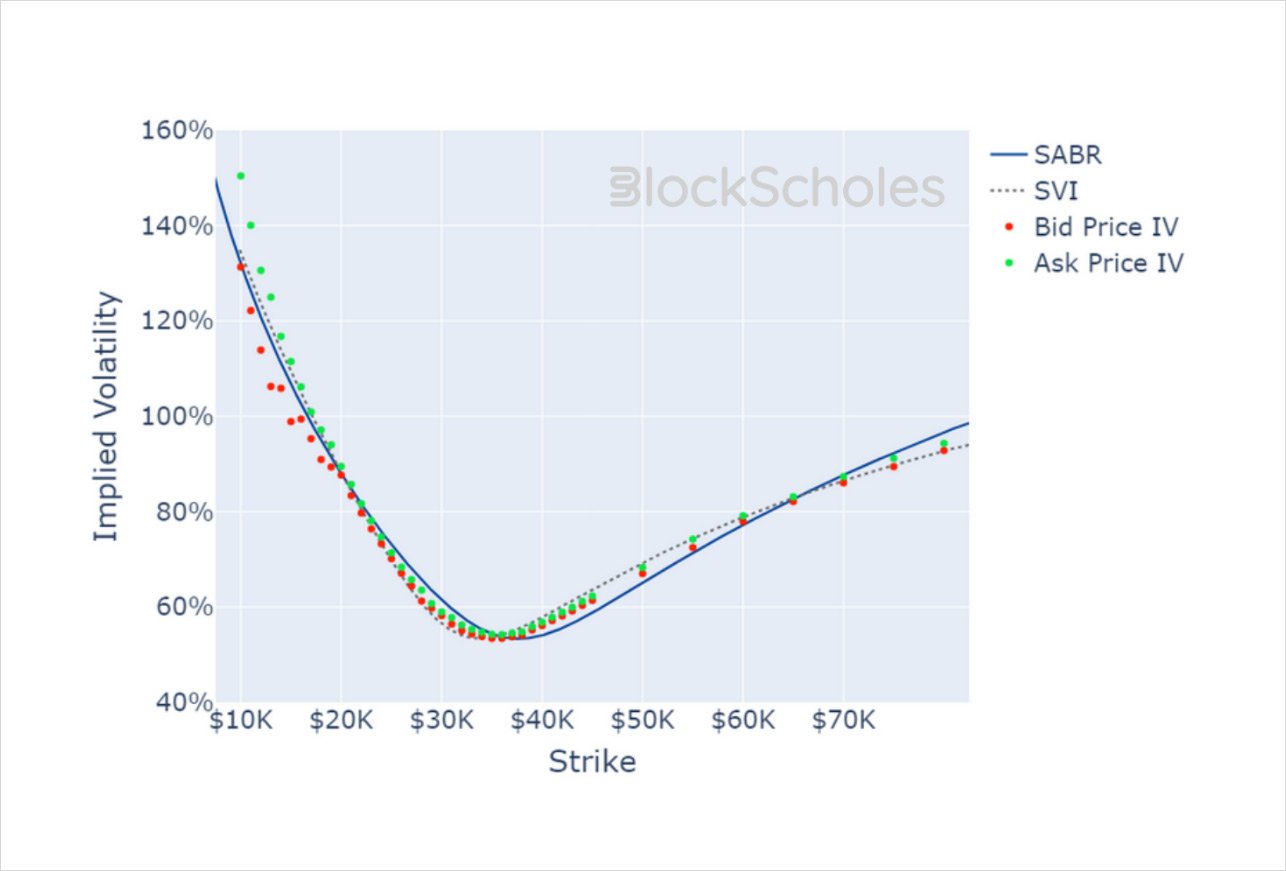

BTC SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

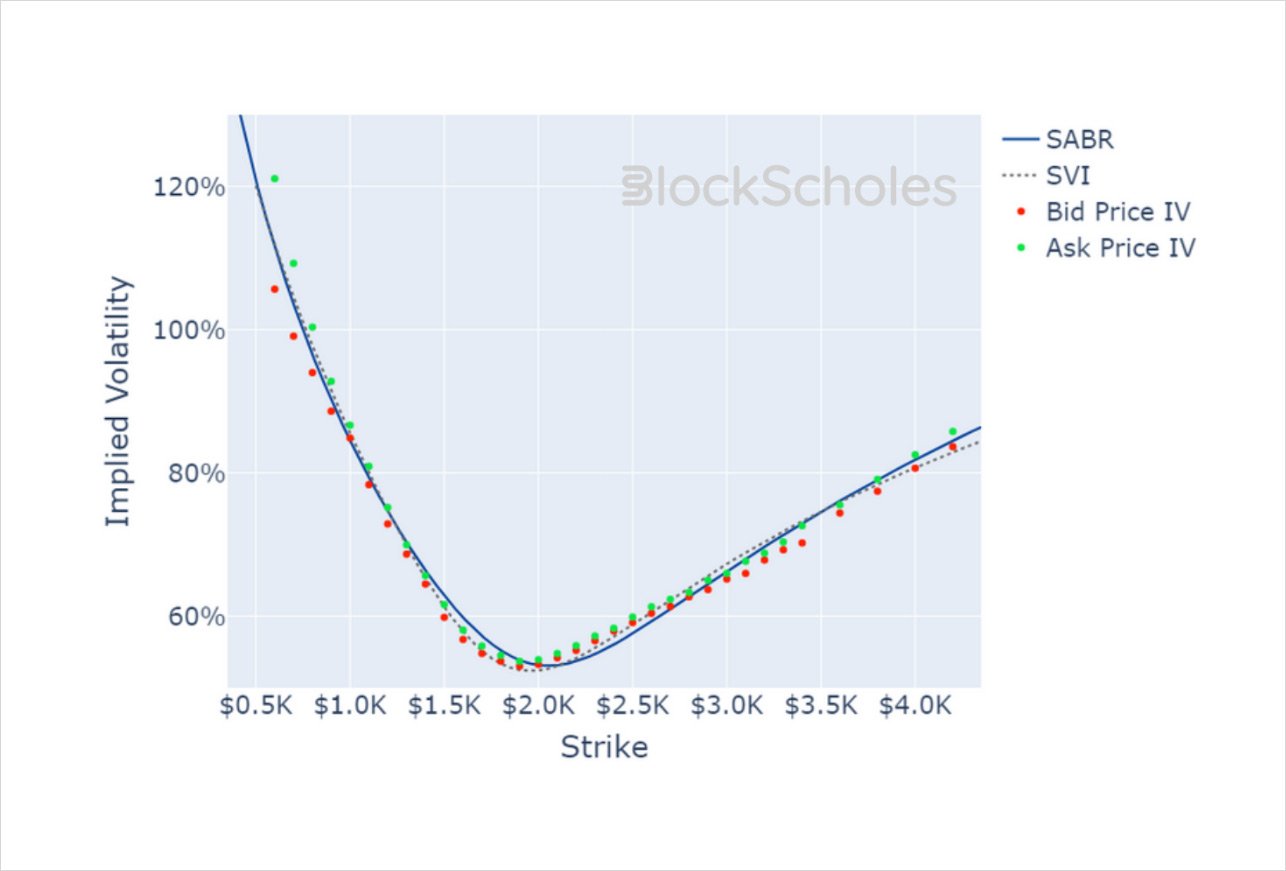

ETH SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

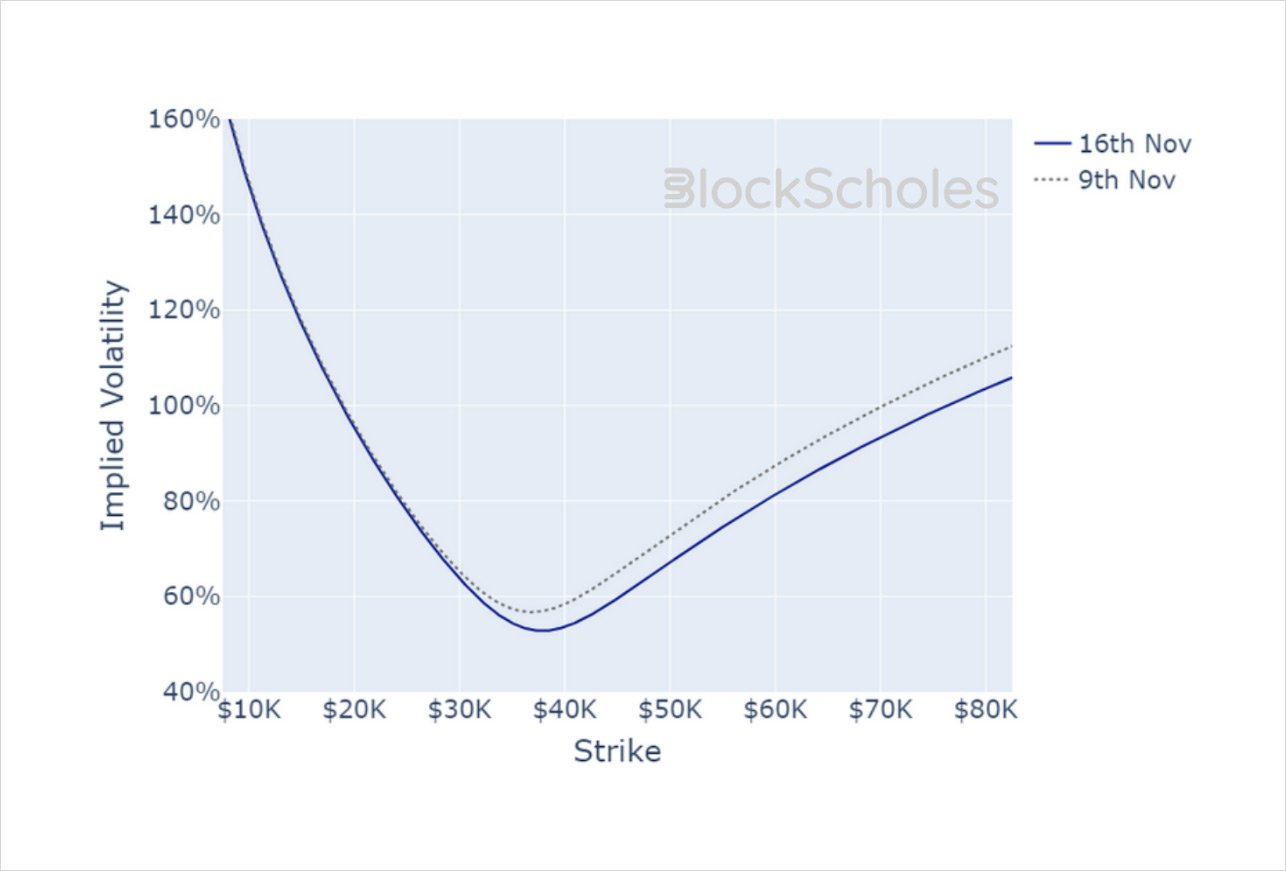

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)