Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Volatility remains subdued in the options markets of both majors following the passing of the ETF event risk, with ATM levels continuing their slow trend downward to trade between 40% and 50% across the term structure. The skew towards puts that we saw in the aftermath of the announcement has abated; smiles in both markets and across the term structure now report a sentiment much closer to neutral. Futures markets continue to indicate a willingness to pay for leveraged long exposure — perpetual swap funding rates have been consistently positive and futures prices imply a 10% premium over spot at an annualised rate.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

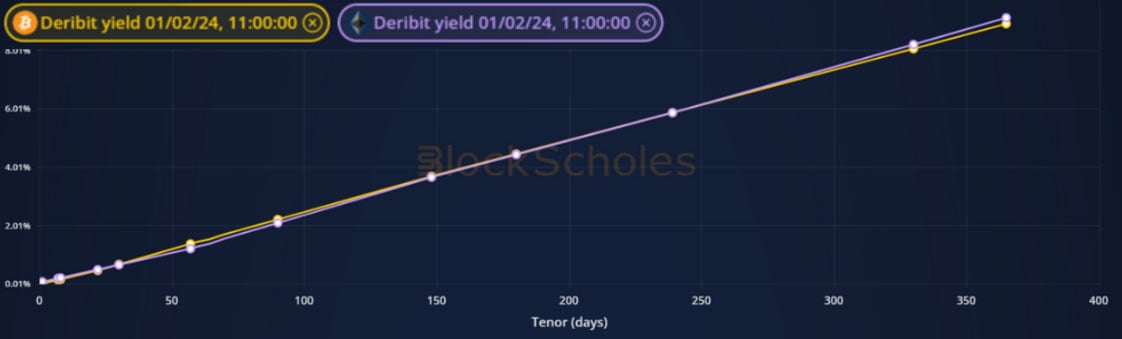

Futures

BTC ANNUALISED YIELDS – remain settled near 10% across the term structure, where they have traded since before the ETF announcement.

ETH ANNUALISED YIELDS – have also settled near 10% across the term structure now that ETH ETF approval narratives have subsided.

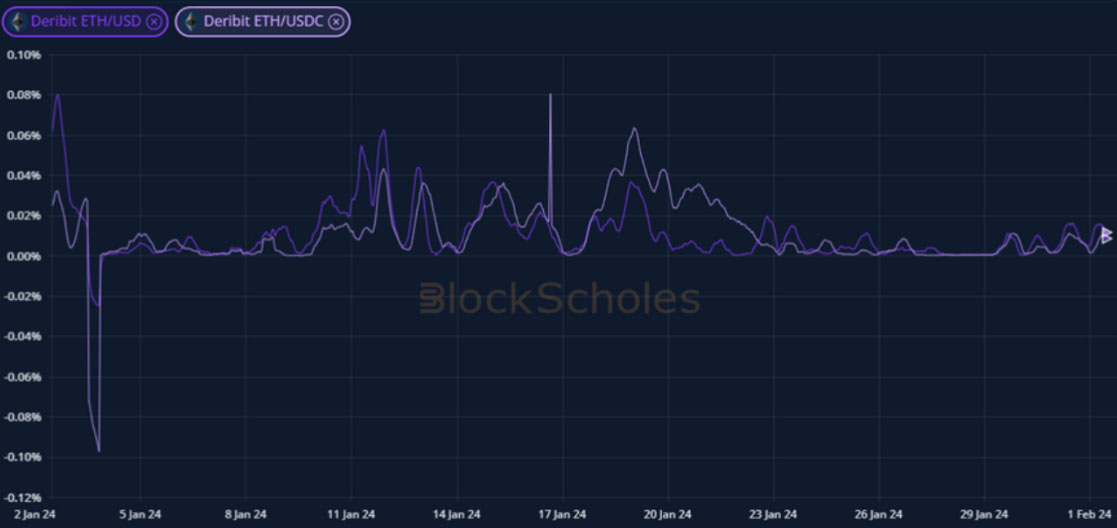

Perpetual Swap Funding Rate

BTC FUNDING RATE – funding rates have remained high and positive despite the lacklustre performance in spot prices over the last month.

ETH FUNDING RATE – remains at similar levels to BTC (shown at different scales) over the last week, climbing down from high, ETF-expectant rates.

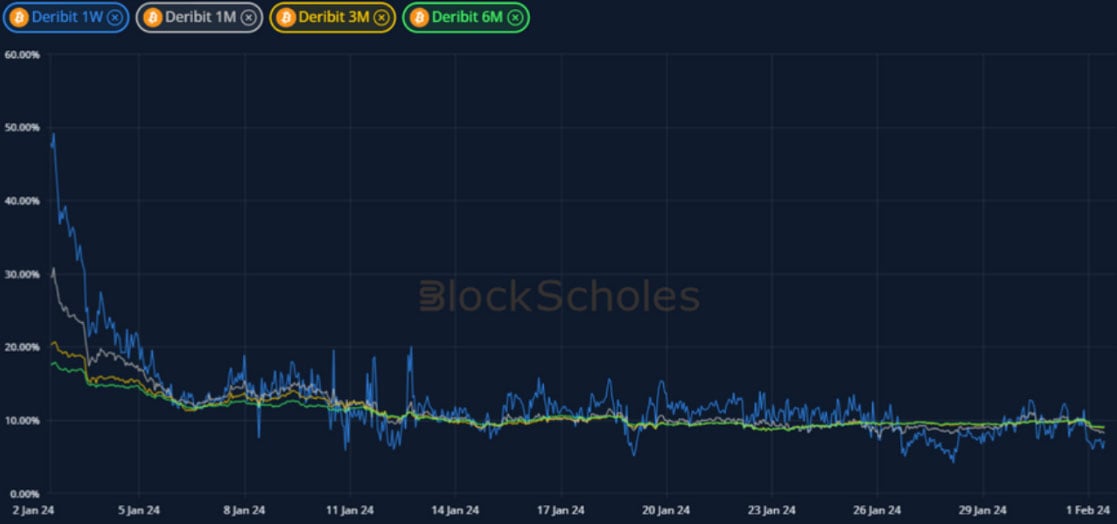

BTC Options

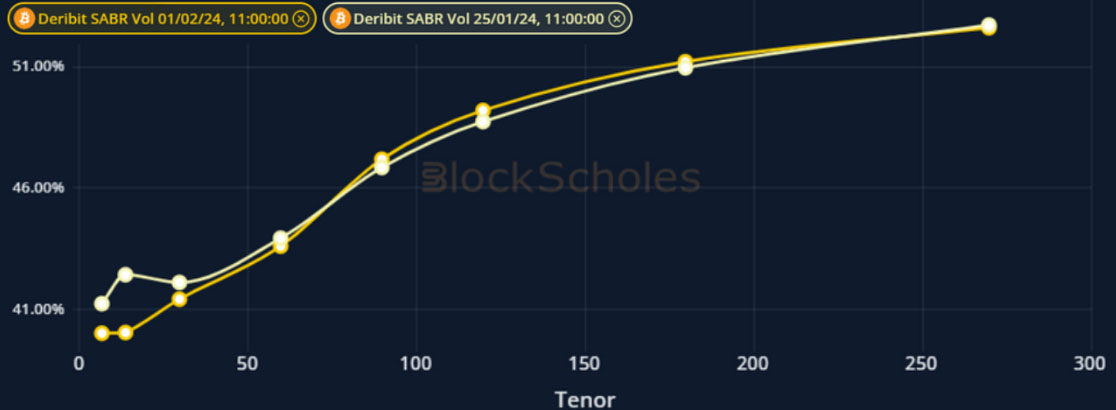

BTC SABR ATM IMPLIED VOLATILITY – trades with a steep structure — 40% at a 1 week tenor, rising to just above 50% at a 6 month tenor.

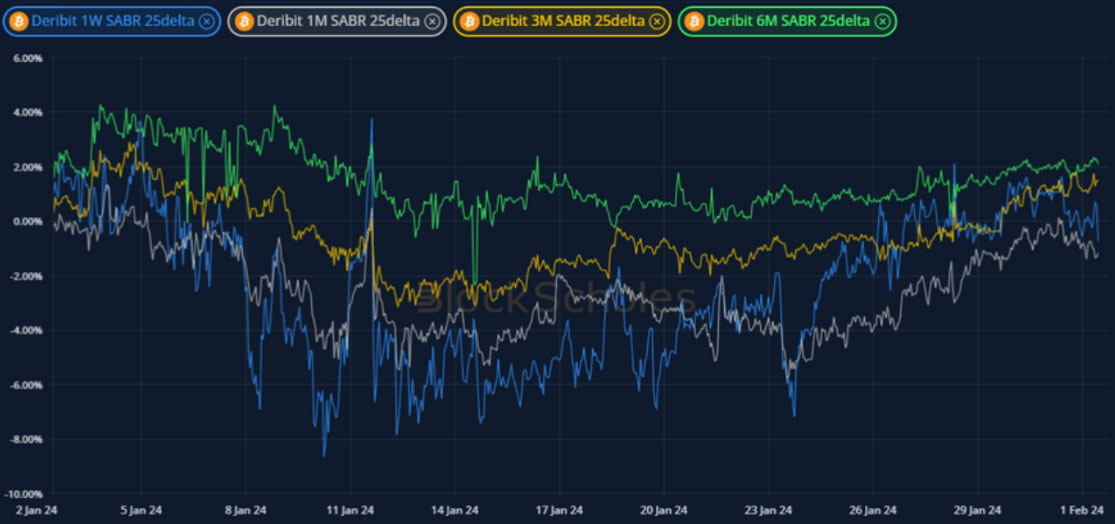

BTC 25-Delta Risk Reversal – has trended upwards over the last week towards a slight tilt towards calls at longer-dated tenors.

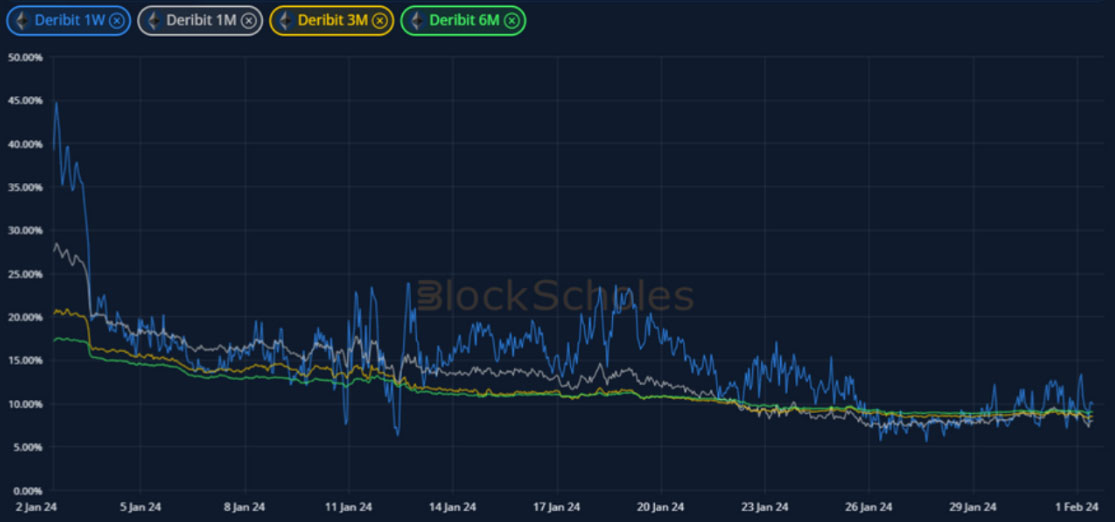

ETH Options

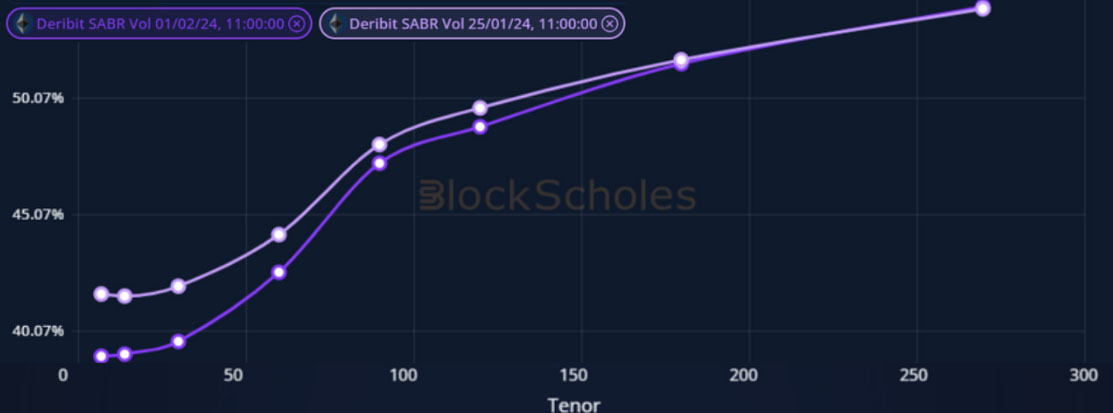

ETH SABR ATM IMPLIED VOLATILITY – traded sideways in the 40-50% range over in last week, with short tenors briefly pushing higher.

ETH 25-Delta Risk Reversal – reflects a similar shift in sentiment towards neutral smiling as BTC over the last week.

Volatility Surface

BTC IMPLIED VOL SURFACE – volatility has fallen across the surface, with a stronger fall in puts resulting in the upward move in its risk-reversal.

ETH IMPLIED VOL SURFACE – reports a surface-wide cooling that is stronger in shorter-dated tenors.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

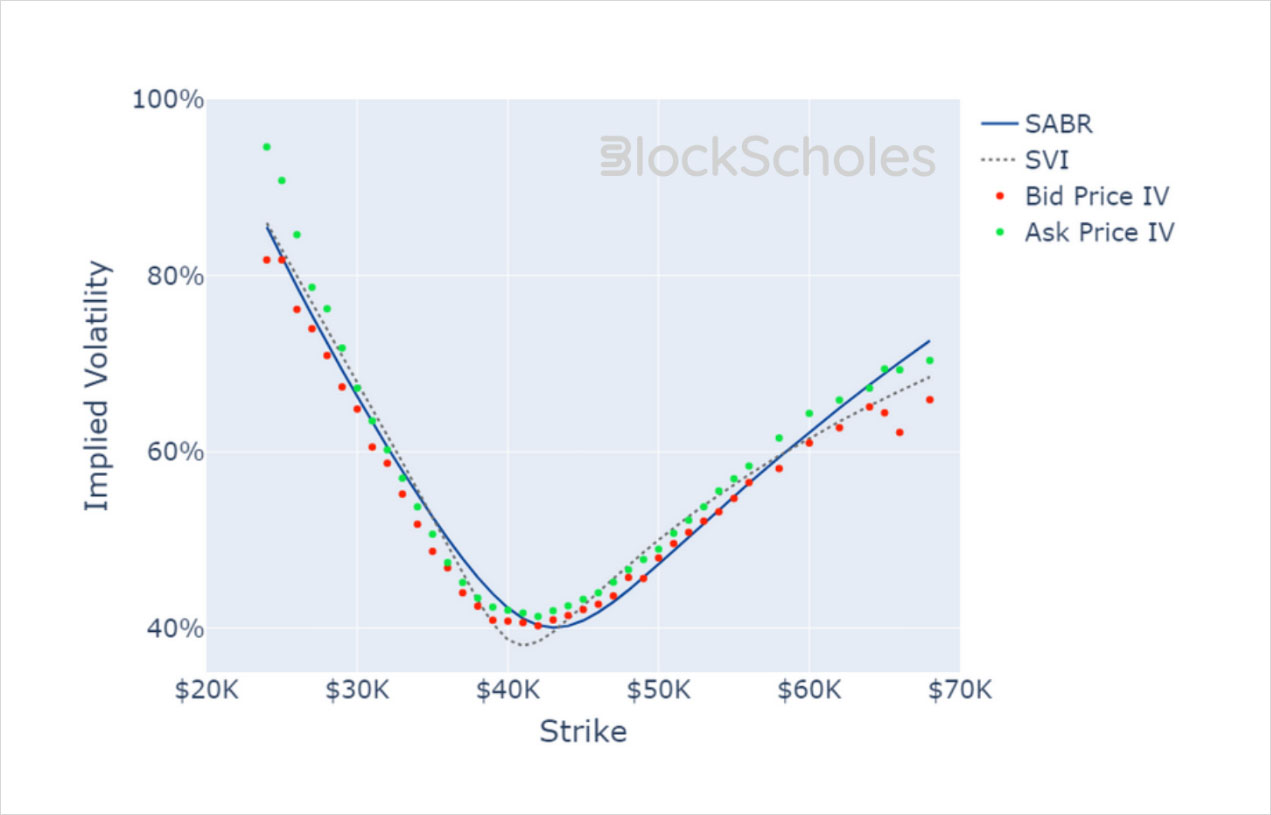

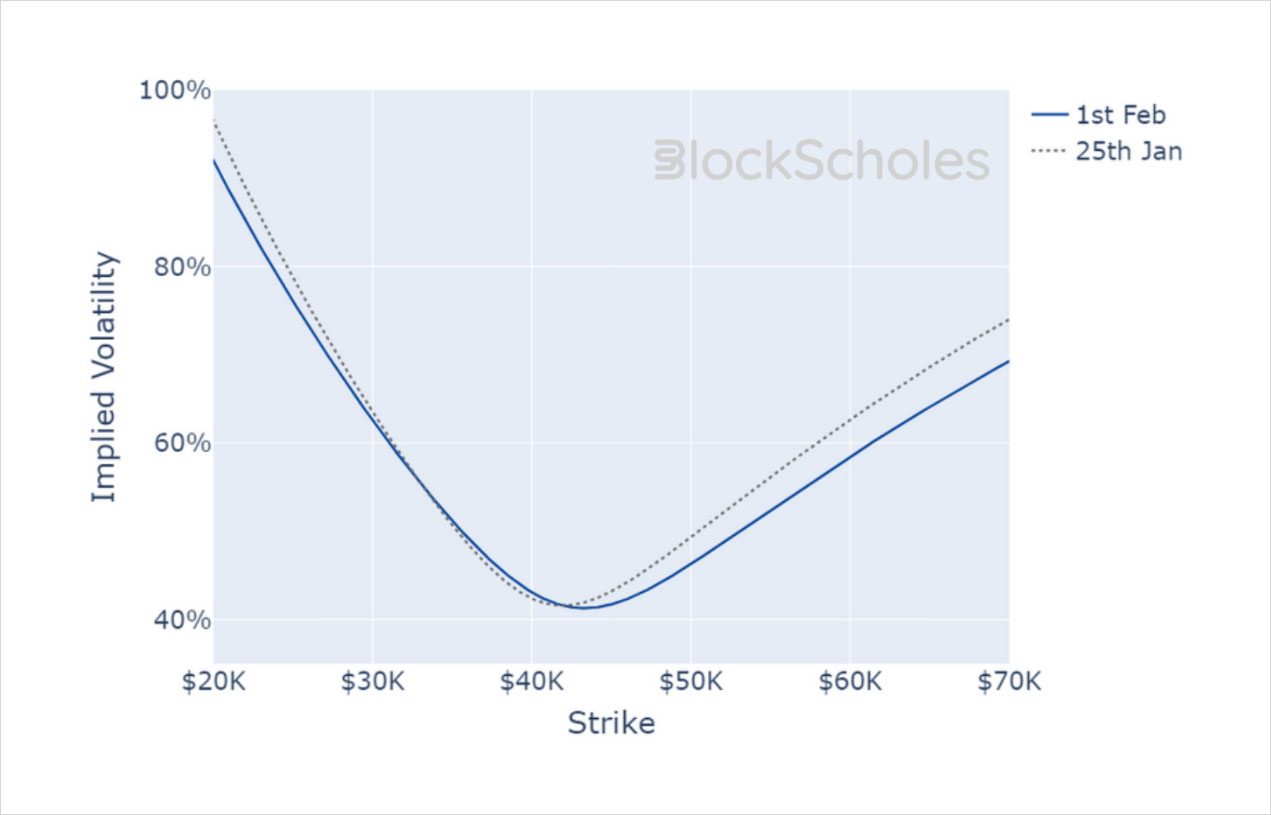

Volatility Smiles

BTC SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 23-Feb-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)