Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The kink in the term structure of ATM volatility has shifted to shorter tenors as the expected date for an ETF announcement draws nearer, and outright volatility levels for tenors later than the end of January remain stable in the mid 50s. We have seen a recovery in BTC’s short tenor skew, driven by an increasing demand for OTM calls that has not been replicated in ETH’s surface. Instead, we see 1W ETH upside volatility falling while the 1M smile prices for a more neutral skew. Futures-implied yields climb higher once more, while the funding rate of both assets’ perpetual swaps continues to signal strong demand for leveraged long exposure.

Futures implied yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

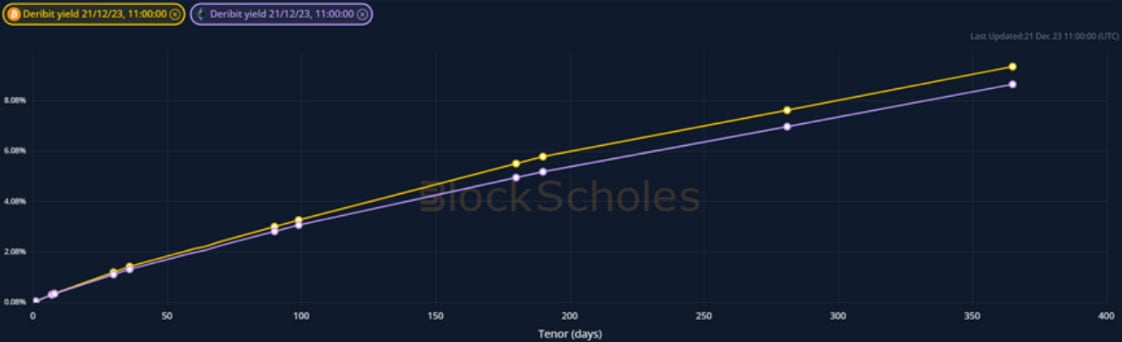

Futures

BTC ANNUALISED YIELDS – have climbed higher in the last 24 hours, with short-dated futures boasting the largest annualised yields above spot.

ETH ANNUALISED YIELDS – trade at the top end of their most recent monthly range.

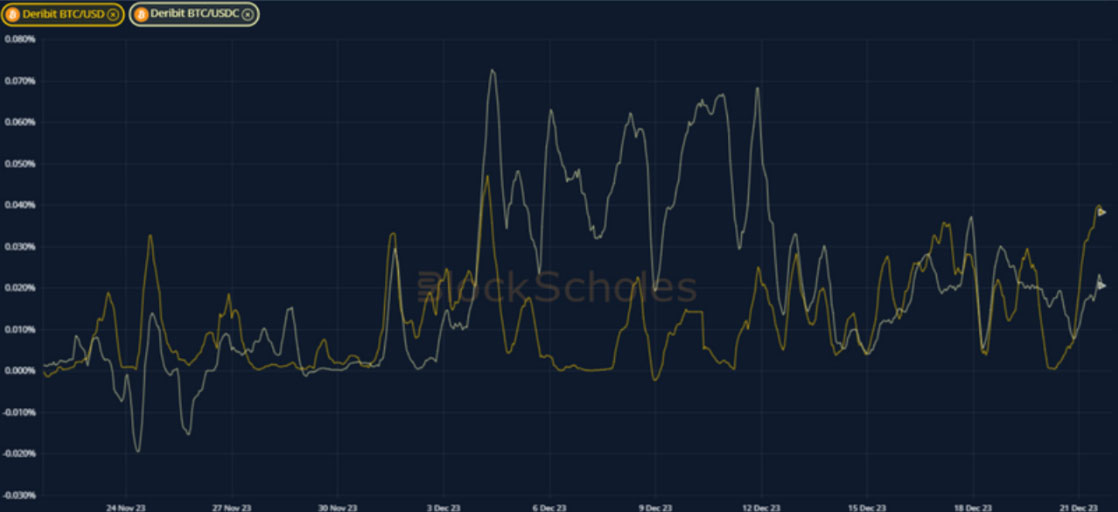

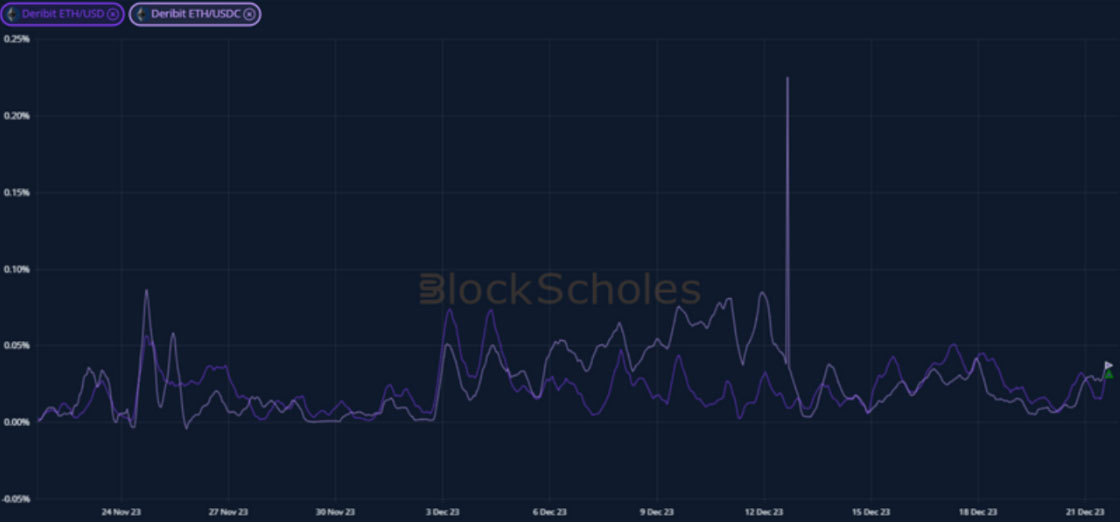

Perpetual Swap Funding Rate

BTC FUNDING RATE – continues to indicate strong demand for leveraged long positions late into the year.

ETH FUNDING RATE – reports similarly strong demand for long positions through the derivative contract.

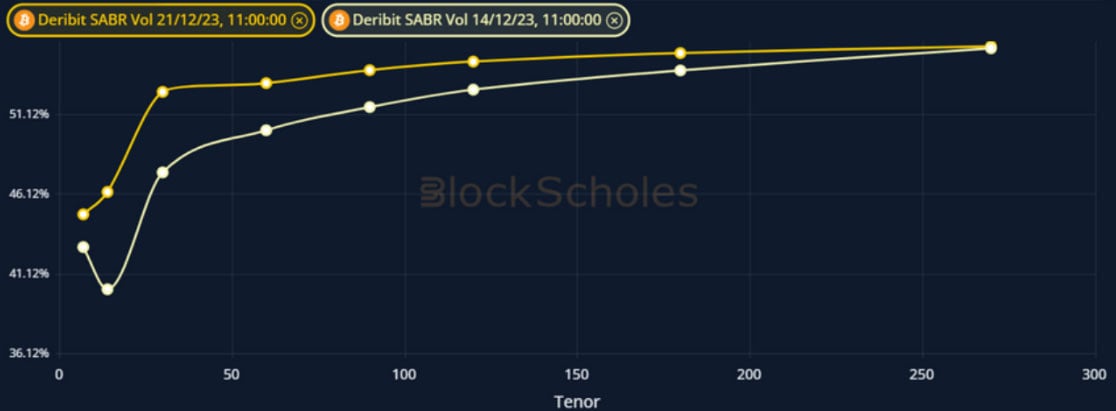

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – The 1M tenor vol rises as the expected ETF announcement date moves closer along the term structure.

BTC 25-Delta Risk Reversal – has posted a strong recovery since signalling the selloff in spot price that we saw in early December.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – repots a widening gap between the 1W and 1M tenors as the expected ETF announcement date draws closer.

ETH 25-Delta Risk Reversal – does not report the same recovery in short- tenors as BTC, appearing to be slightly dislocated at a 1W tenor.

Volatility Surface

BTC IMPLIED VOL SURFACE – highlights the recovery in 1M OTM calls relative to the rest of the surface in the last two days.

ETH IMPLIED VOL SURFACE – indicates that it is a decreasing demand for OTM calls rather than an increase in demand for OTM puts that has seen the 1W skew move in contrast to the rest of the term structure.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

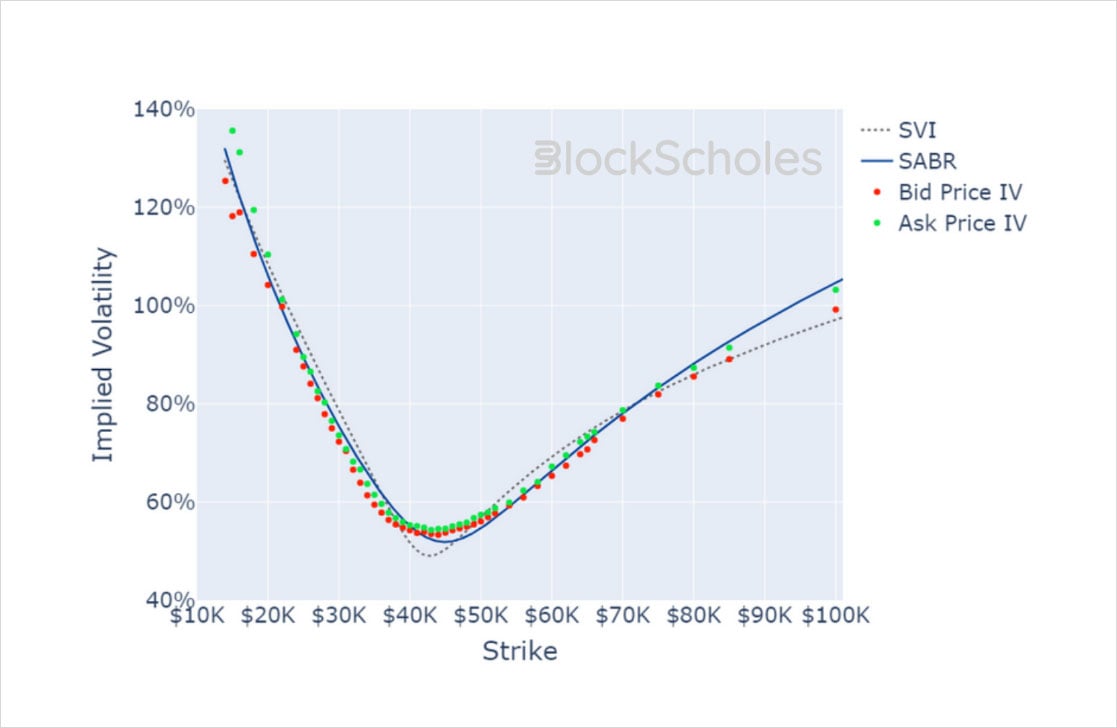

BTC SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

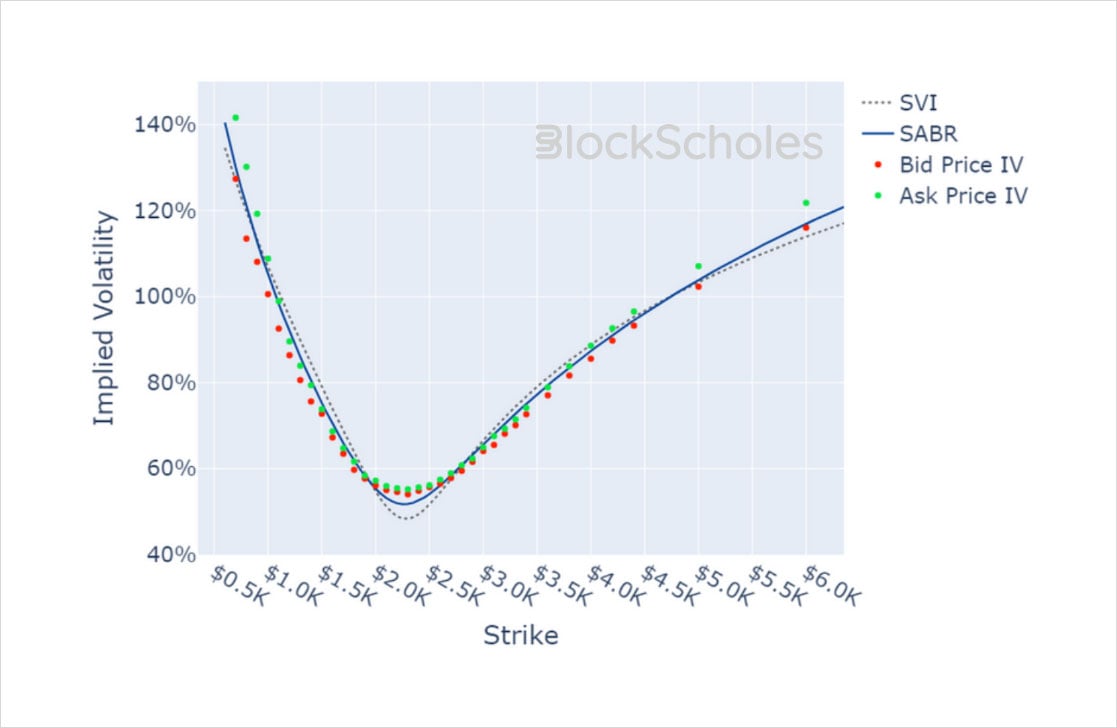

ETH SMILE CALIBRATIONS – 26-Jan-2024 Expiry, 11:00 UTC Snapshot.

Historical SABR Volatility Smiles

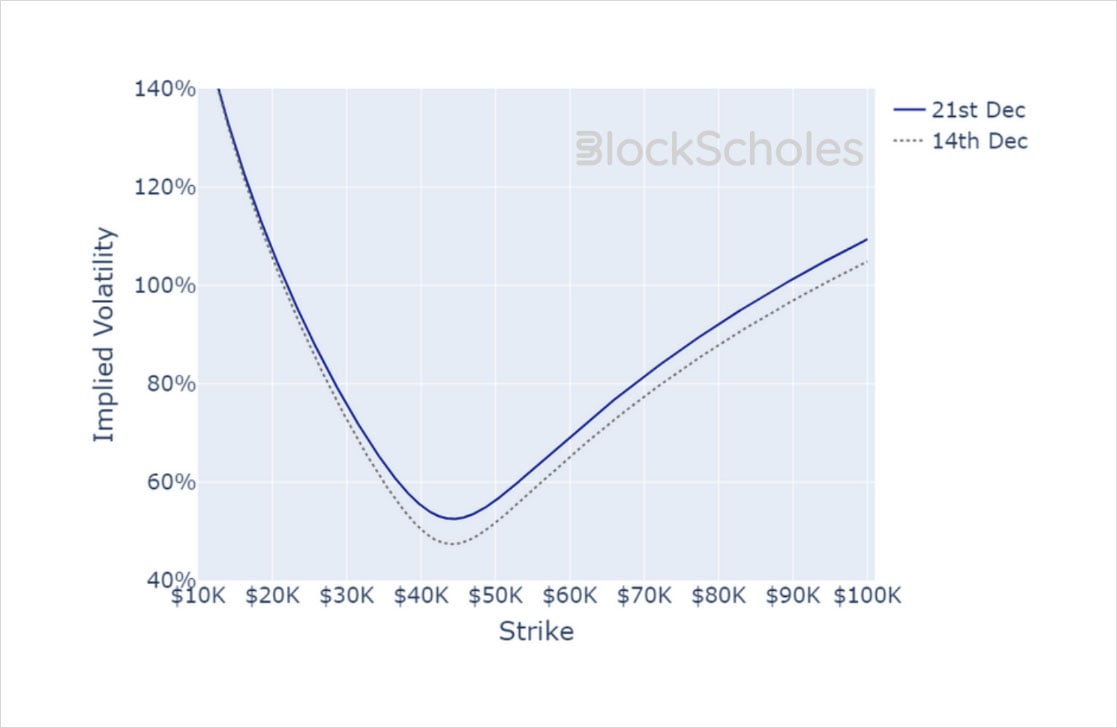

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

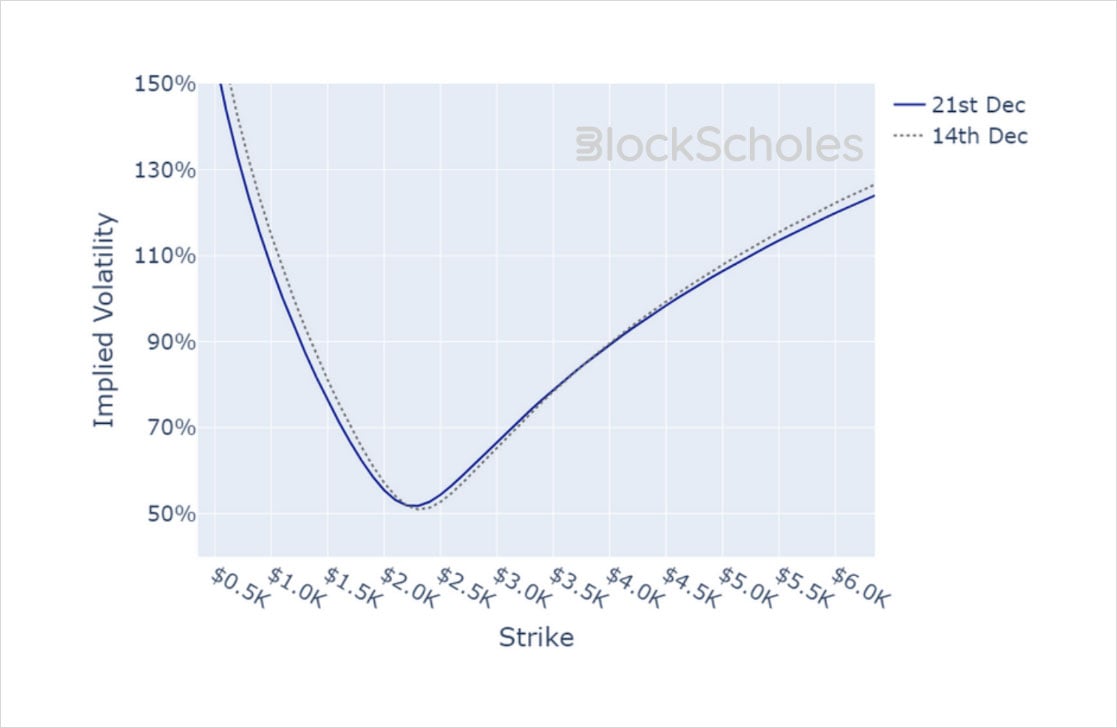

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)