Summary: Traders should not only monitor the breakdown of the chart-technical levels in the market (1,550) that predicts downside pressure but also the implied fair value (sub-800) based on the ETH price vs. the actual revenue being generated for Ethereum in times when yields on staked ETH are compressed, and stakers could head for the exits. ETH put spreads might be the preferable trade into the abyss.

Analysis

Earlier in the week, we had warned (here) that ETH could break its important support line at 1,550, which could set off cascading liquidations. While speculative positioning is relatively light, we believe traders might judge that ETH is overvalued as the Ethereum ecosystem has generated hardly any revenue recently. The interest in engaging with DeFi applications or minting NFTs powered by Ethereum is shrinking.

Technically, 1,550 is of the utmost importance, followed by 1,430 (-7%), and if that level is broken, we could even imagine that ETH would retest the support level at 1,200 (-23%). Traders could buy the 1,400 / 1,200 put with December 29, 2023 expiry for $25 [(45-20)/1540 ~1.6%]. If ETH drops to 1,200 by December 2023, traders will make a multiple of their investment. This is not only technically likely but also fundamentally.

Here is why

Since 2015, Ethereum has generated nearly $17bn in fees, with over >60% of those being converted into revenue. Ethereum usage exploded during the 2021 double bull markets of DeFi summer and the NFT minting craze, so the fees and revenues within the Ethereum ecosystem exploded. But times have changed.

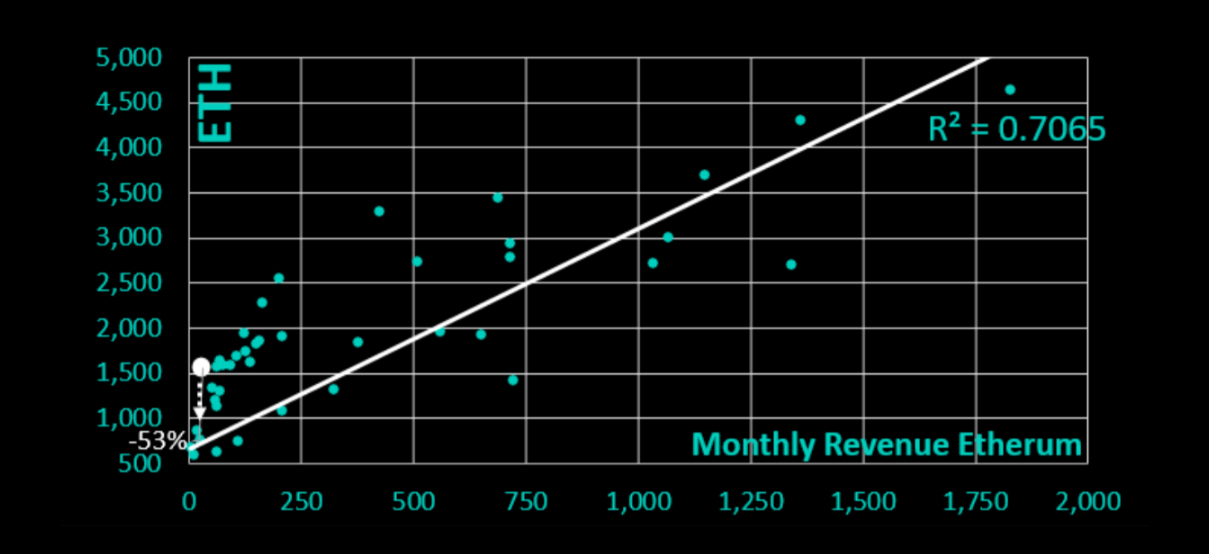

At the peak of the NFT minting bull market in November 2021, Ethereum generated $1.8bn in monthly revenues, and ETH traded near 4,600. When we run a regression analysis comparing monthly revenue with ETH itself, we must admit that ETH appears overvalued by -53% as revenue deteriorates faster than the ETH price. Ethereum has only generated $60m in revenue during the last 30 days, compared to $1.8bn in November 2021 – or in other words, Ethereum’s revenue has declined by -96% from its peak while ETH is “only” down -66%. The regression analysis indicates that the current ETH price (white) should fall back to the white regression line.

Based on this regression analysis, ETH fair value is sub-800 and expectations for a decline towards 1,200 might be conservative. This is a trading market and positive catalysts currently appear limited to Bitcoin (Blackrock ETF, store of value, alternative to monetary debasement or fiscal spending, etc.).

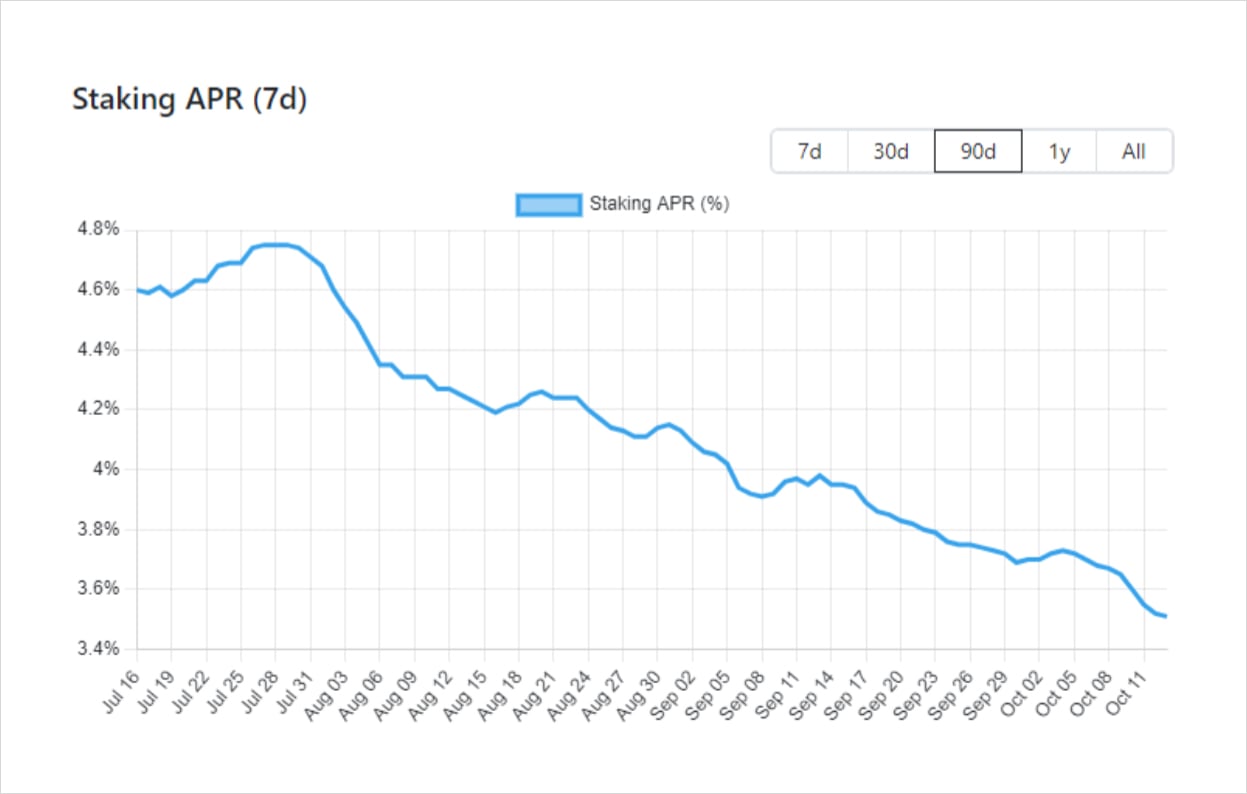

US Treasury bond yields (5.25%) are significantly above ETH staking yields (3.6% for Lido Finance’s ETH staking rewards). This could cause a slow outflow of crypto as declining ETH prices add to the misery of yield-hungry crypto investors. Those stakers ‘principal capital’ is slowly melting when prices fall.

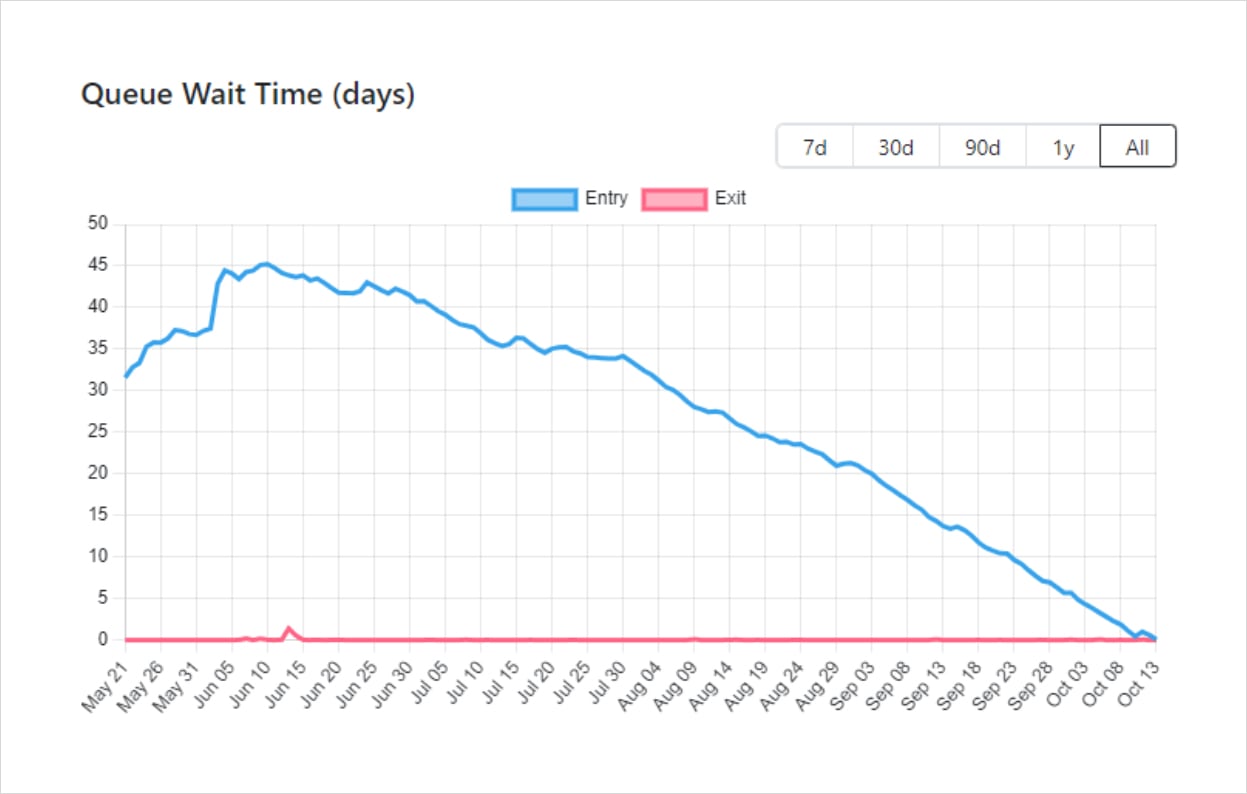

During the last 90 days, the amount of staked ETH has increased from 21.5m to 27.5m – nearly 23% of all ETH outstanding. This increased staked ETH resulted in the estimated yield decreasing from 4.6% to 3.6%. But what is more important is that the “queue wait time” for validators to stake their ETH was 46 days in June 2023 and has now decreased to zero days waiting time.

This means that everybody who wanted to stake ETH is now staking, and there is no trade-off in un-staking your ETH as you can always go back in. The market can change from a “long-only” to a “two-way” flow. If we suddenly see an increase in “exit” requests, we can assume that those ETH might be converted to fiat or BTC. This could add to the selling pressure.

Traders should not only monitor the breakdown of the chart-technical levels in the market (1,550) that predicts downside pressure but also the implied fair value (sub-800) based on the ETH price vs. the actual revenue being generated for Ethereum in times when yields on staked ETH are compressed, and stakers could head for the exits. ETH put spreads might be the preferable trade into the abyss.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)