Chairman Powell put on another absolute masterclass in communication as the Fed delivered an expected 25bp rate hike (5.25%) followed by a ‘hawkish pause’ with a removal of all forward guidance.

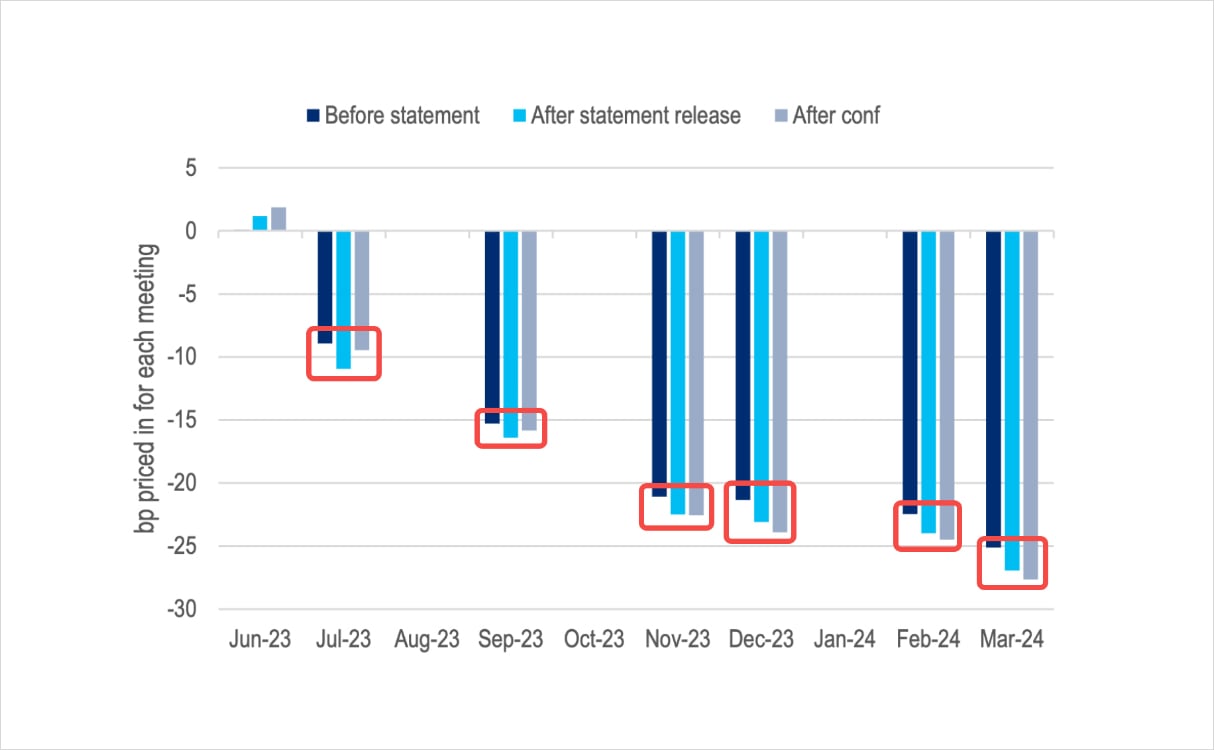

FOMC Rates Pricing Reaction Pre-Statement, Post-Statement, and Post Q&A Conference:

Source: Citi

Key Takeaways:

• The prepared statement led with a slightly more hawkish tilt, with the rate hike being a unanimous decision (surprise), which was balanced against a key removal of the phrase “some additional policy firming” with the following passage to signal the end of forward guidance:

“In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

• The Fed stated an explicit focus on inflation, labour market conditions, and credit availability as the main factors determining policy direction going forward.

– The Fed “remains highly attentive to inflation risks”

– “It’s possible that this time is really different… There’s just so much excess demand, really, in the labour market”

– A key question in the coming weeks will be whether there’s a tightening in credit, including among small and medium-size banks.

• On the economy, Powell remained confident on the Fed’s ability to steer the economy out of a slowdown, and noted that he doesn’t foresee a recession in 2023 due to excess labour demand.

• On inflation and rate cuts, Powell stated that the FOMC views inflation as coming down “not so quickly”, and “in that world”, it “would not be appropriate” to cut rates and it’s not in their forecast to do so.

• Furthermore, while the Fed acknowledged that “we are getting closer and maybe even there” on conditions being “sufficiently restrictive”, the Chairman continued to lean away from rate cuts in stating that “people did talk about pausing, but not so much at this meeting”.

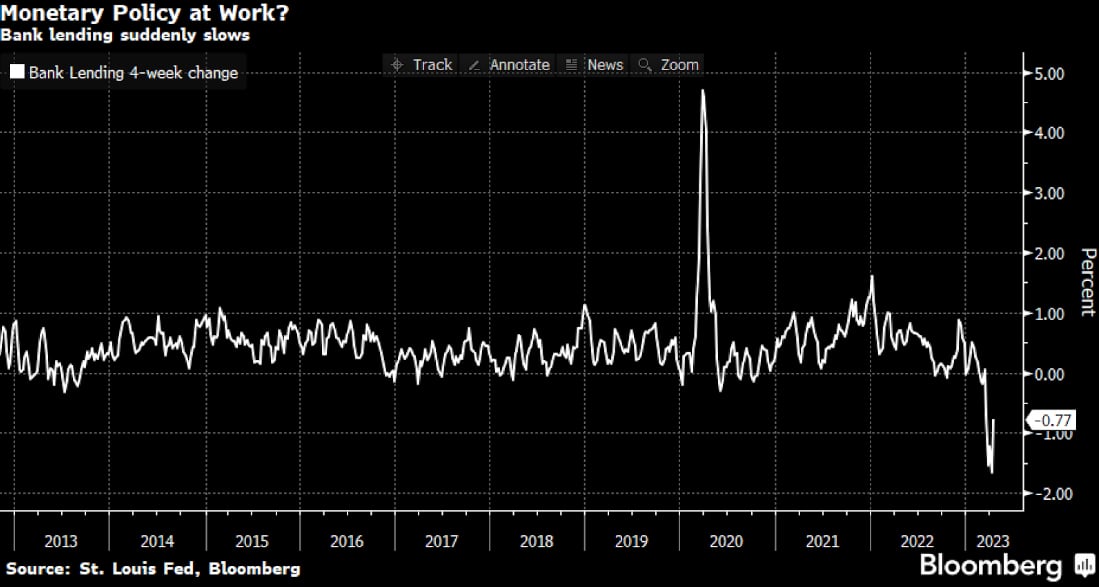

• Despite concerns over bank lending, Powell stated that conditions in the banking sector have “broadly improved since March”, even if lending has slowed, and dismissed the notion that major credit crunch is underway.

• On the debt ceiling, the Fed agreed that it’s “essential” for the limit to be raised, and that “no one should assume the Fed can protect the economy” from a US Treasury default, even if it’s technical by nature.

• Finally, Powell acknowledges that the Fed “has regrets” with regards to banking oversight, and added that he is personally accountable for implementing fixes going forward (likely new regulations focused on duration mis-management).

All in all, macro asset reactions across both stocks and bonds were highly muted compared to previous meetings, with the SPX dropping around just 0.5% and 2yr yields fell 6bp as of ~3:30pm EST. If the success of the meeting is judged by a lack of market volatility against heavy expectations, then this was an absolute masterclass of a performance by the venerable Chairman.

Speculators have Been Aggressive in Betting Against PacWest All Week as the Banking Witch-Hunt Continues:

Source: WSJ

Unfortunately, the market tranquility was fleeting; PacWest shares plummeted 50% in after-market trading as the beleaguered California lender became the latest regional bank to seek a lifeline, as it has instructed boutique investment bank Piper Sandler to help explore strategic options, including a sale. With ~$30bln in deposits, the bank is of much smaller scale than SVB or First Republic, and just 29% of its deposits not covered by the FDIC, down significantly from 52% earlier. However, 3/4 of its total loan book is to real estate, the latest faux pas in the lending world, and the stock has been under pressure all week as traders have been targeting regional banks with large duration risk mismatches.

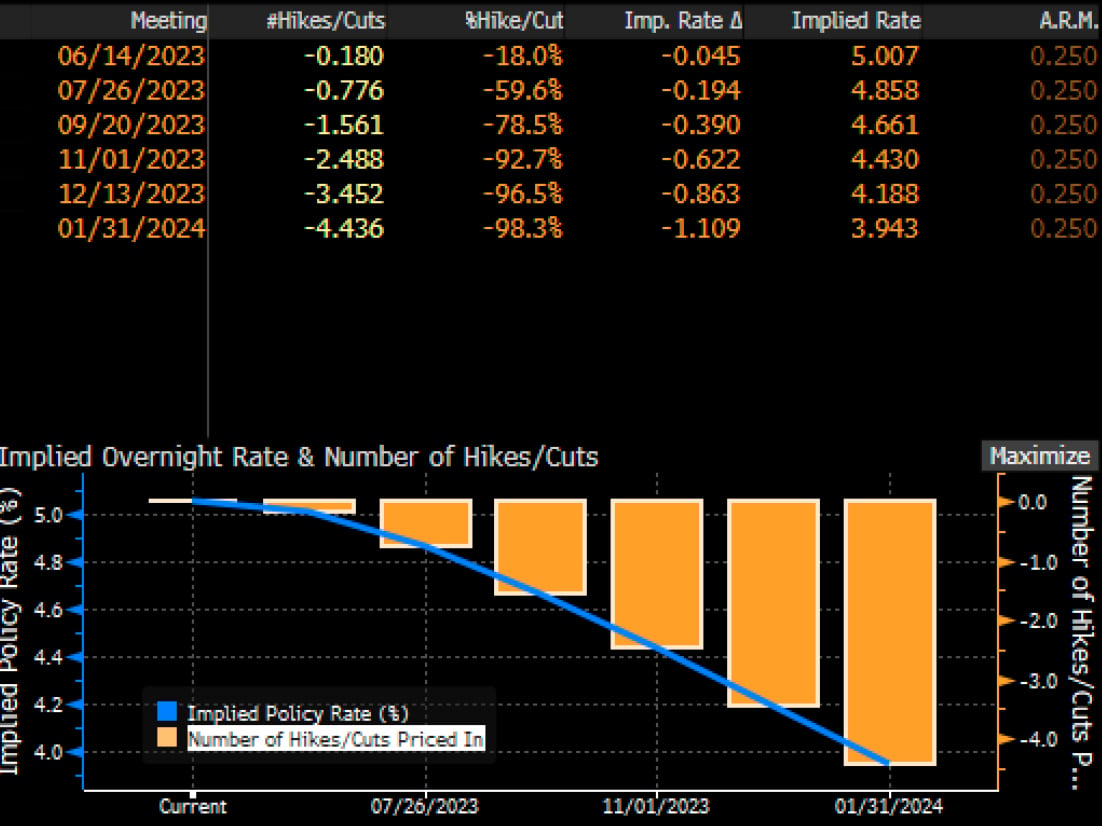

Interest Rates Pricing in 85bp of Cuts into Year-End:

Source: Bloomberg

With the Fed now officially ‘on-hold’ and fully data-dependent, interest rate futures are now pricing a unilaterally downslode slope, with 85bp of cuts priced in until the year-end. Despite the Fed’s more rosy forecasts and Powell’s positivity on the banking situation, markets are rightfully more concerned over the extent of the credit contagion, and the collapse of oil prices back towards 2yr lows (despite OPEC cuts) is firmly a vote of no-confidence on global growth. The EIA crude report from yesterday showed tumbling gasoline demand, with a plunge of 900k/day over the past week, and a lack of growth stimulus out of EM (and particularly China) has been a drag on commodity sensitive sectors.

Lingering Concerns on Global Growth Continues to Weight on Commodity Sensitive Sectors:

Source: Bloomberg

China Reopening Optimism hasn’t Resulted in Any Meaningful Outperformance vs US Stocks Despite Consensus:

Source: Bloomberg

While the strong ADP report yesterday (+296k, led by services sector) and ISM non-manufacturing services pointed to continue labour and pricing pressures, the collapse in oil prices has led to a corresponding drop in tradeable 1y inflation expectations. Combined with the observed slowdown in credit lending, rates markets are pricing in a much harder slowdown than the Fed’s latest forecasts, with Powell’s favoured curve inverting to -200bp and well in recession territory. This gap between market pricing and Fed rhetoric is likely to persist for a while longer, and will require further data to ultimately decide the “winner”, therefore justifying the Fed’s removal of all forward policy guidance.

Collapse in Oil Prices Dragging Inflation Expectations Lower, Supporting the Case for Lower Rates in 2H23:

Source: Bloomberg

Credit Conditions Remain an Unresolved Pain Point for the US Economy Going Forward:

Source: Bloomberg

Powell’s Recession Curve Indicator Continues to Invert into Deep Negative Territory:

Source: Bloomberg

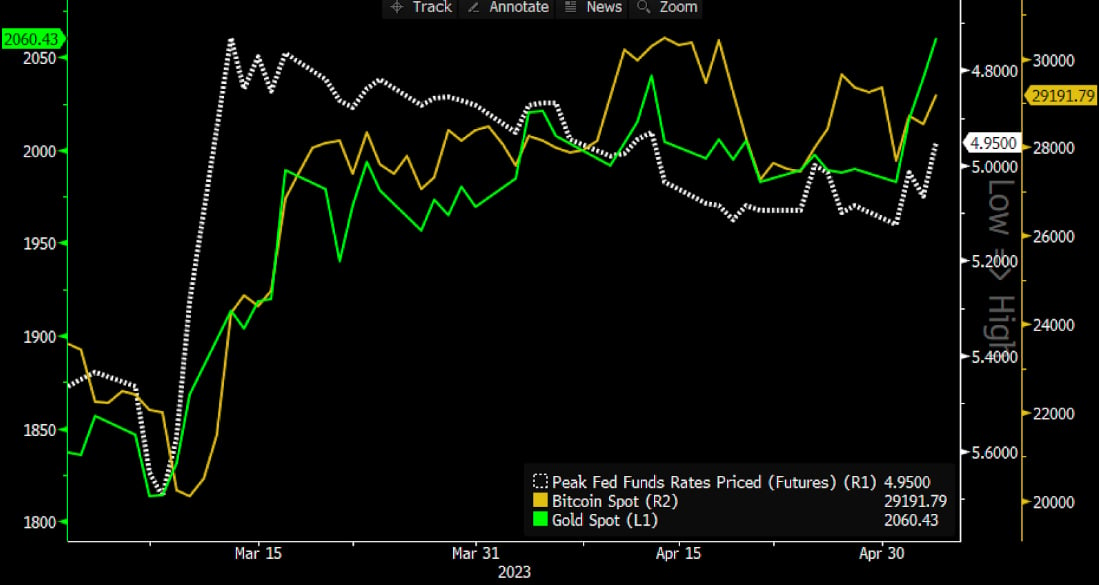

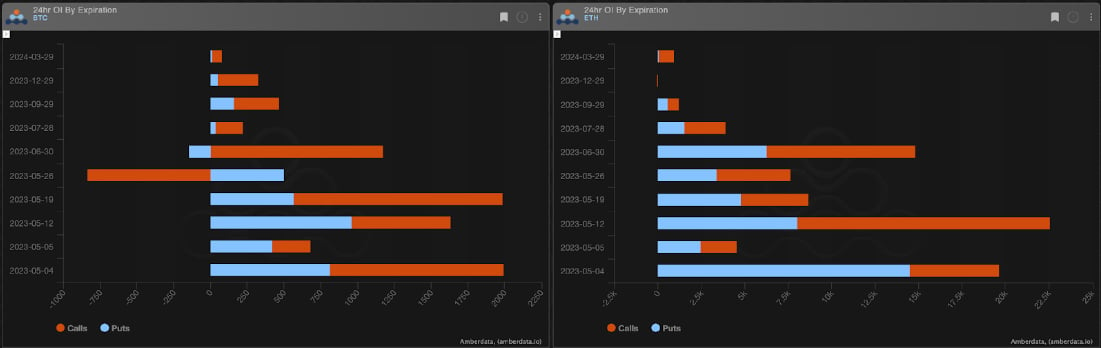

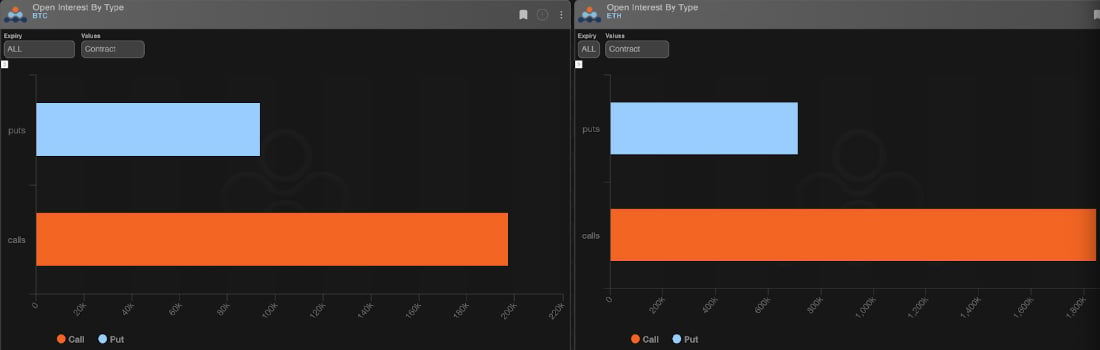

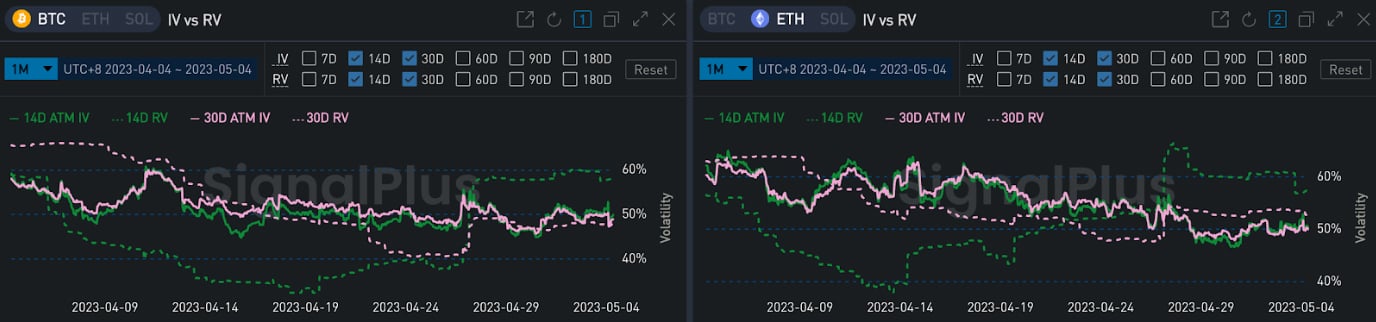

Crypto prices continue to oscillate with the move in Gold prices, which itself is led by the movement in interest rate expectations. A drop in terminal SOFR rates to sub 5% helped to boost gold prices to 2060, and BTC correspondingly to above $29k. The last 24 hours saw a fair amount of option call activity across both BTC and ETH, with total options open in calls significantly above puts. Implied volatility has been subdued heading into FOMC, and will likely see even more downward pressure from here given a lack of significant catalysts, along with the policy pivot to data-dependent mode. Markets should continue to oscillate in the near-term depending on the daily FUD around regional banks, though we remain inclined to think that the worse is over and the focus to evolve back on the longer-term macro outlook.

BTC Prices Rallied Along with the Move in Gold Above 2K, as Peak Terminal Rates Fell Below 5% Post-FOMC:

Source: Bloomberg

BTC/ETH Options Activity Saw Much More Interest on Calls Over Puts Over the Past 24 Hours:

Source: Amberdata

Implied Volatility and RV Momentum has Remain Subdued, and Could See More Downward Pressure with the FOMC Event Now Over:

Source: SignalPlus

AUTHOR(S)