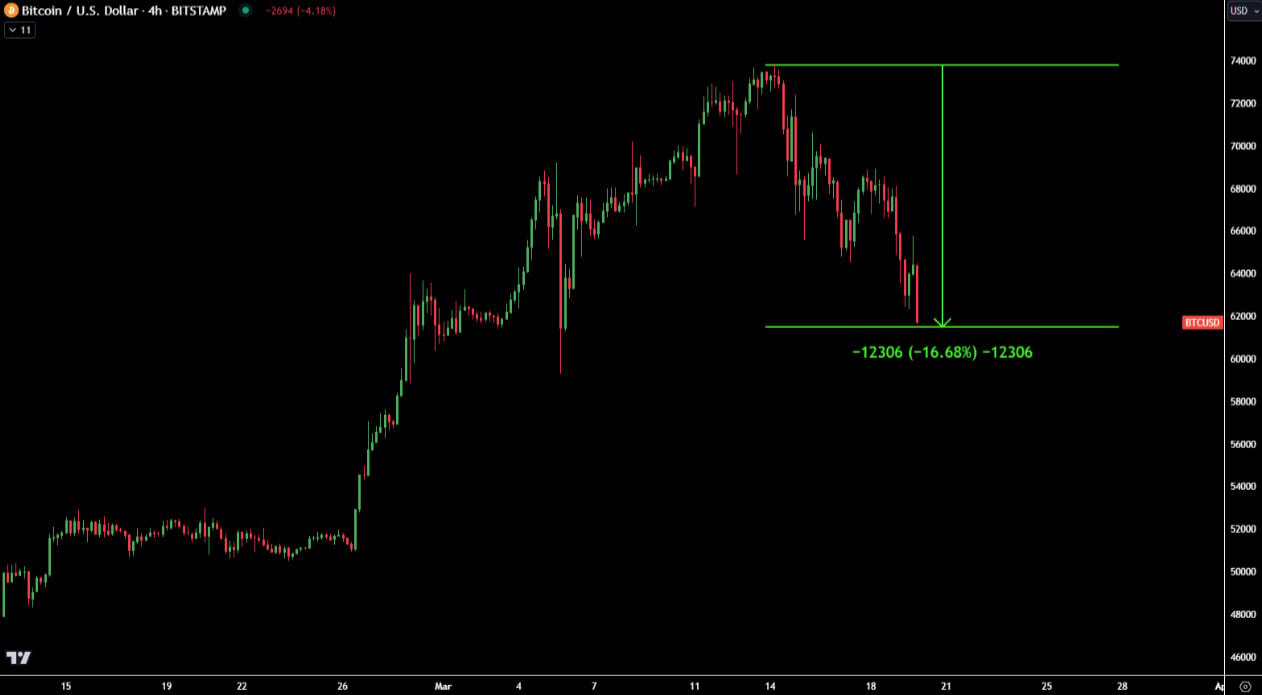

Sharp Correction in Crypto

Bitcoin is cracking lower, driven by a potential saturation in Bitcoin ETF inflows, but also influenced by increased selling pressure from miners ahead of the halving, and an apparent excess in overall speculative flows. Peak search interest in Bitcoin via google searches was also a warning sign.

In fact, we had record YTD daily net outflows of -4,452 BTC for BTC investment vehicles on March 19th. If inflows continued to dry up or we saw major outflows from speculative buyers, this would heighten the chances of further price drops. Recent price fluctuations had already suggested a substantial uptick in profit-taking and a possible consolidation phase as many speculative traders were sucked into the move.

The ongoing correction represents an opportune moment for considering long term investment strategies in Bitcoin and Ethereum given the underlying bullish market we find ourselves in.

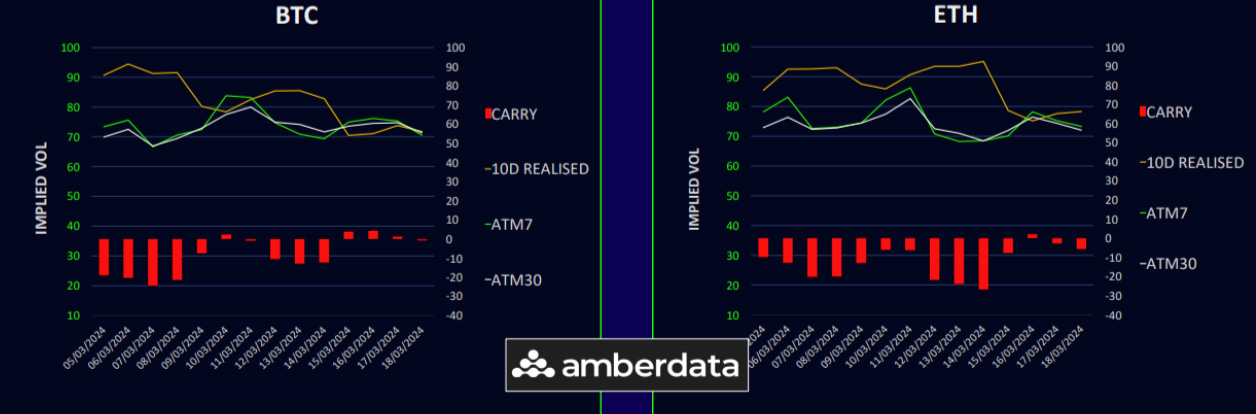

Realized Vol Remains Higher in ETH

Despite a notable drop from peak spot prices, realized volatility had been decreasing throughout the week, with Bitcoin and Ethereum’s realized volatility falling to 72% and 78%, respectively, on a 10- day basis.

The implied volatility has also been reducing as of late as investors offloaded call options following the break of support levels. Bitcoin’s volatility carry is now balanced, indicating fair pricing of options, while Ethereum’s remains slightly negative due to higher realized volatility.

Solana was the real mover, soaring by 40% and then dropping like a stone about 20% from its new high. As Solana’s options market grows, we’ll continue to analyze and identify opportunities.

Going forward, the upcoming FOMC meeting and potential rate adjustments based on the dot plot could temporarily influence crypto valuations.

Term Structures Revert Back to Contango

The Bitcoin term structure is reverting to contango, with the front expiries decreasing by approximately 7 vols into the high 60s and the back end seeing a slight increase due to Sep 24 call buying flows. There’s a significant shift towards a put premium in the short term skew.

Similarly, Ethereum’s term structure has adjusted, with front expiries dropping by 5 vols due to larger realized vol compared to Bitcoin. The long-dated expiries were firmer by 2 points, indicating a volatility increase that leaves IV (implied vol) around 80% in both assets. The skew term structure has steepened, showing a deep put premium in the short term but a significant call premium in the long term.

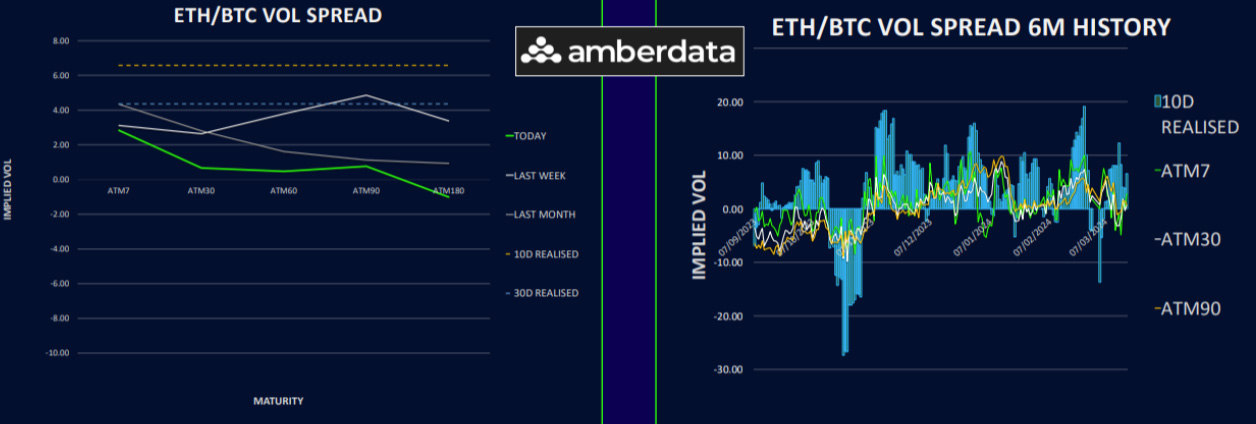

ETH/BTC Spread No Longer Offers Alpha

The volatility spread between Ethereum and Bitcoin remains stable in the front end but narrows to zero or even shifts to a slight Bitcoin premium in the long end. The realized volatility spread still shows an Ethereum premium, varying from 4 to 6 vols.

The ETH/BTC spot spread has decreased significantly, mainly driven by concerns over the potential rejection of an Ethereum ETF this year. Our analysis last week indicated no further alpha from the spread due to the high volatility, allowing us to secure profits in ETH calls before a reversal. A warning signal was the shift in Ethereum’s skew, prompting us to adjust risk levels accordingly.

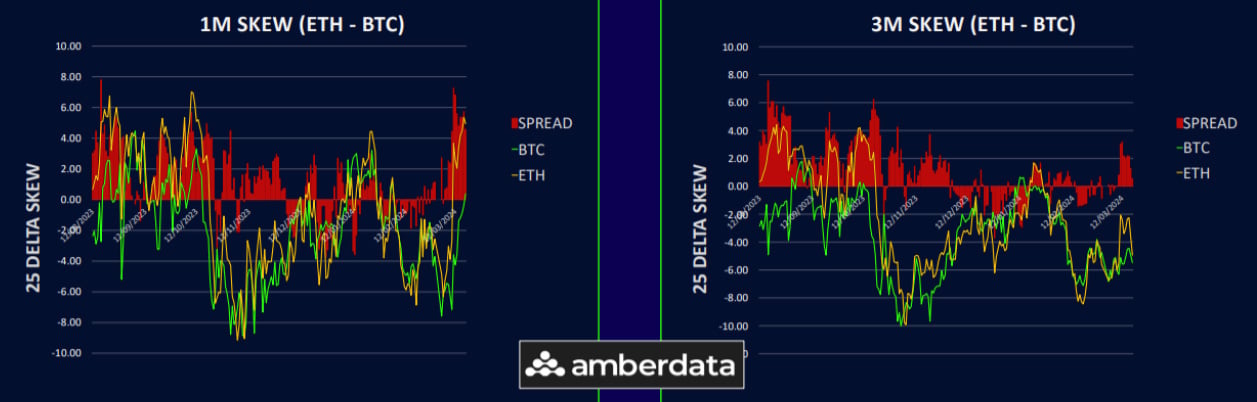

Put Skew Keeps Rising in the Front End

As the spot market continues to crack lower levels, investors are increasingly seeking protection, pushing up the put skew. Bitcoin’s weekly skew has shifted to a 6 vol put premium, while April’s skew remains flat. Long-dated expiries still show a call skew of 6 to 7 vols, suggesting the market views the downturn as temporary and remains bullish on the fundamental narratives.

Ethereum’s skew movement last week was the key signal to de-risk. This put premium has gone deeper to 11 vols in the short term. Despite this, the call premium in the long term not only persisted but intensified as Dec 24 trades 9 vols for calls, suggesting enduring optimism.

For those reducing risk last week, utilizing significant support levels at $60k and $3 respectively for bullish risk reversals could be a sensible strategic approach.

Option Flows And Dealer Gamma Positioning

Trading volumes were small down but remain substantial at around $14 billion, with continued belief in the market's potential for a rally around the halving event. Notable transactions included purchases of call spreads and calls for various dates, alongside protection strategies such as put spreads and outright puts in response to price drops.

Ethereum’s trading volume also declined to $7.4 billion, with increased put buying and continued investment in bullish positions despite market downturns.

BTC dealer gamma flipped into short as some put buying came in and spot sold off. Dealers are long 29Mar 65k and 60k strikes. ETH dealer gamma moved back up into positive territory as we moved back down towards dealer long strikes at 3000 and 3200. We may find ETH is better supported in the 3000-3200 range but in a rally, we may rip back through 3500 quickly if the gamma is any guide.

Strategy Compass: Where Does The Opportunity Lie?

After the steep drop over the last week, we see value in monetising some hedges. This can either be done by buying futures or buy using bullish risk reversals. Leaning on the large supports down at 60k on BTC and 3000 on ETH makes sense when selecting strikes.

For those not willing to sell puts, upside structures that make sense are medium term call spreads, which keep the theta bleed down and give plenty of time for the rally to resume.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)