ETF Announcement All that Matters this Week

During the holidays, Bitcoin’s price remained steady, ranging between $41,000 and $44,000, but as the new year got underway, it surged to about $46,000.

This week may bring significant price fluctuations due to the SEC’s decisions on ETF approvals, expected from January 5th to 10th.

Both BTC, ETH and alts are seeing high funding rates, indicating a preference for leveraged trades. Despite this, high funding rates are typical in bull markets and don’t always signal a downturn.

Many anticipate a price drop after the ETF announcement, a phenomenon known as ‘buy the rumour, sell the news’. However, the consistent rise in crypto stocks and open interest in trading BTC futures via CME still shows increasing strong interest from tradfi institutions.

Historically, the crypto market often reacts more negatively to actual product launches than to preliminary approvals, as seen with events like the BTC CME futures launch and Coinbase IPO.

At higher market prices, this could lead to short-term sell-offs into the launches if these don’t meet flow expectations. That said, any significant price corrections are expected to be brief due to the favourable macro environment, technical factors, and the anticipation of Bitcoin’s halving.

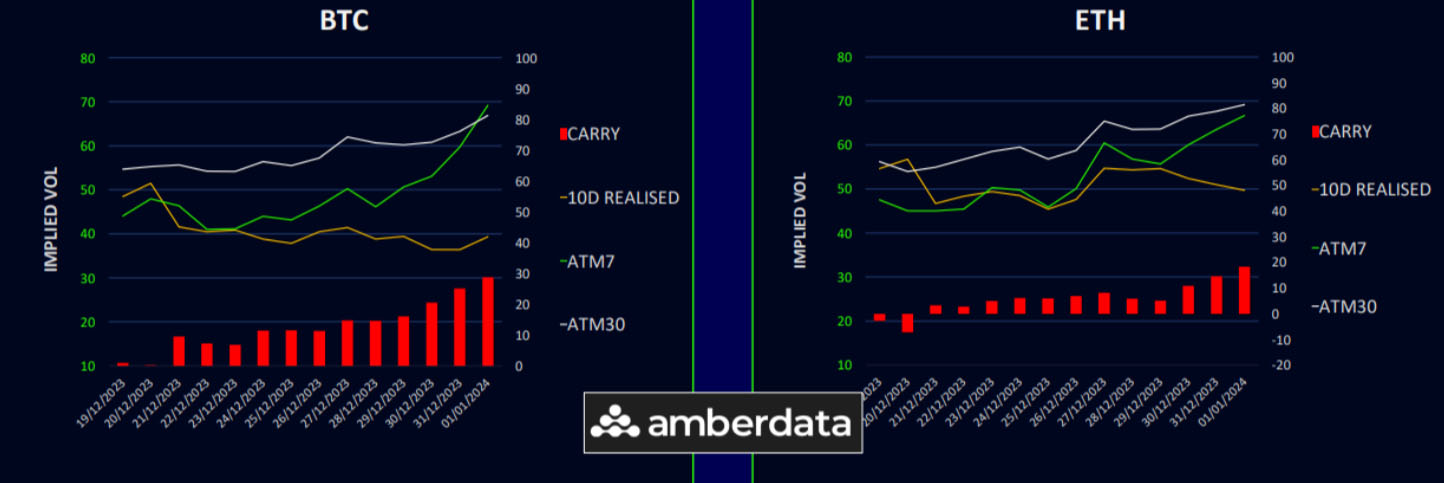

Vol Carry at Extreme Levels

In the past few weeks, Bitcoin’s and Ethereum’s realized volatility has been stable around 40 and 50 vols respectively, but there’s been a recent increase in realized and implied due to excitement over the upcoming ETF approvals. Implied volatility in Bitcoin has risen sharply towards 70, outperforming Ethereum. However, the current volatility levels, with vol carry extremely positive in the 98th percentile, seem unsustainable and should decrease significantly after the ETF news. We think flipping positions into more short or flat VEGA structures makes sense at these levels of spot and vol.

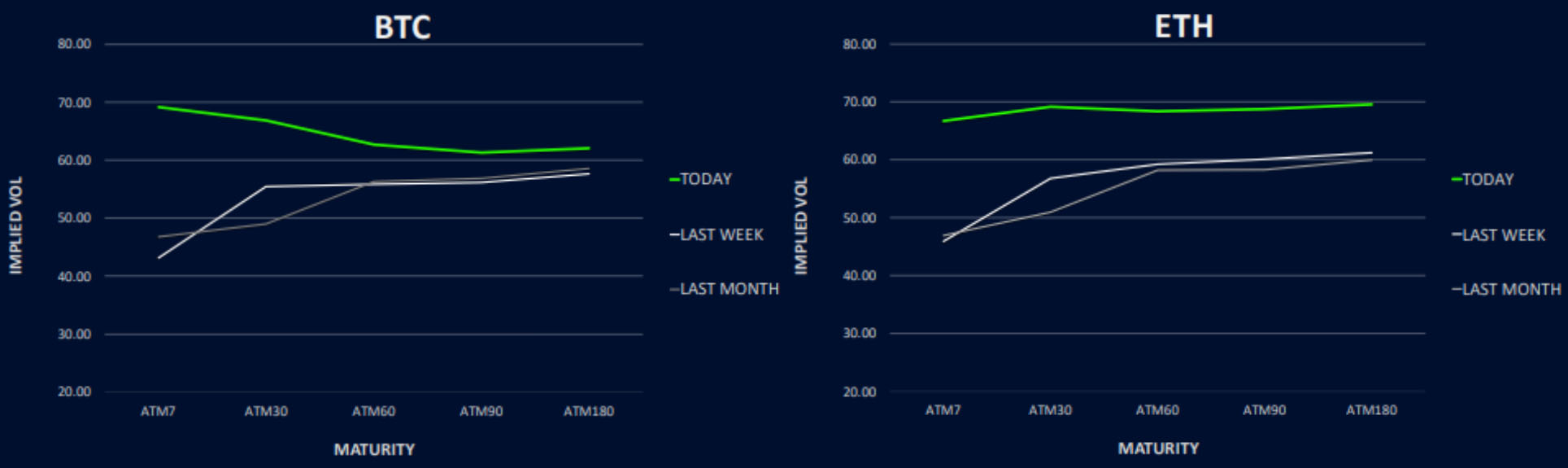

BTC’s Term Structure in Backwardation

Bitcoin’s term structure is in backwardation, a typical dynamic before any major news like the ETF deadlines. The highest volatility is expected at the January 12th contract. The rest of the curve also well bid, with even long dated maturities up 4 vol points. Again, we see a VEGA reset coming.

Ethereum, while similar to Bitcoin, hasn’t yet reached inversion. That said, its long-term volatility is outperforming Bitcoin’s, suggesting optimism for Ethereum in 2024.

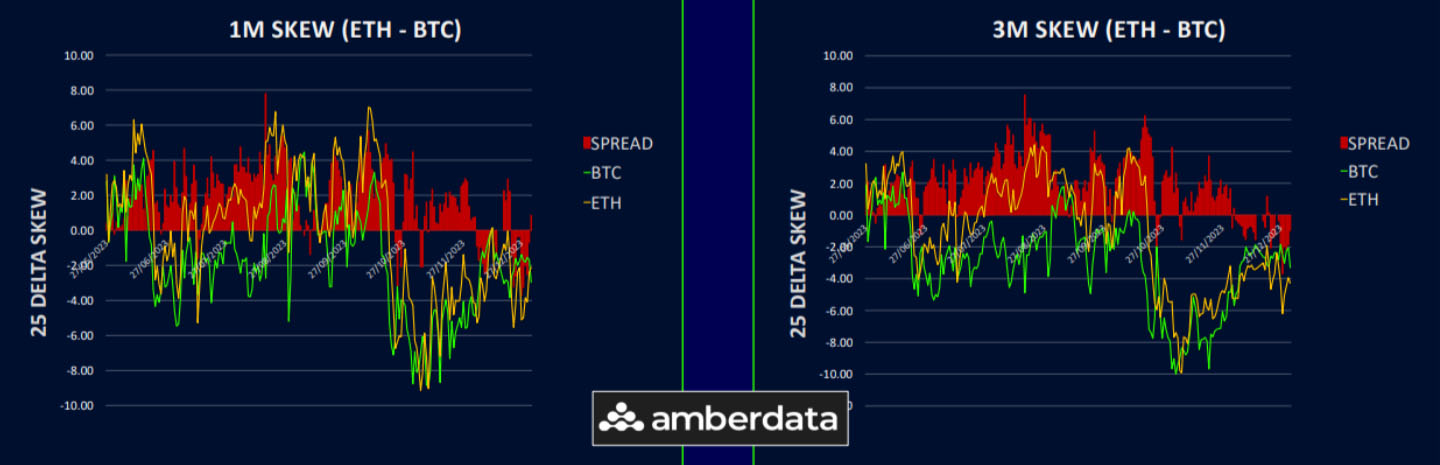

ETH/BTC Vol Spread Collapses

The volatility spread between Ethereum and Bitcoin has narrowed significantly, especially in short- term expiries, due to heightened event risk for Bitcoin with the SEC decision looming.

The ETH/BTC spot spread fell but has since recovered, and it might drop again following the ETF approval. Nevertheless, the long-term outlook for ETH/BTC remains positive in our view, and buying opportunities may arise if the spot levels drop further. We continue to like ETH/BTC call switches and would use dips in the relative spot prices to enter more.

Skew Hints ETF News Mostly Priced in

Bitcoin’s call skew recovered quickly after recent market fluctuations. The most sensitive to spot moves is the weekly skew, with longer expiries showing a consistent call premium. Despite the impending ETF decision, the options market isn’t paying a huge premium for calls compared with October/November level (options markets think the news is mostly priced in), as bullish call spread trades have been preferred to outright calls.

Ethereum maintains a consistent call premium, especially in the long term, indicating market positioning for a shift in focus to Ethereum following Bitcoin ETF approvals. The ETH call premium is expected to remain, especially in the long term. The short end will likely find some call overwriting flows given the high volatility carry.

Option Flows And Dealer Gamma Positioning

Bitcoin’s (BTC) option volumes decreased last week to around $5 billion, despite the significant activity around the 29Dec expiry. The market saw buying in 26Jan call spreads and selling in put spreads, alongside call calendar trades. Ethereum’s volumes increased, surpassing $3 billion, with major activity in call spreads and some protection buying in put spreads.

BTC dealer gamma positioning has become less short as the spot price approaches $50,000, a key level due to the concentration of call spreads. ETH dealer gamma remains relatively flat, with potential shifts if the price crosses $2,500.

Strategy Compass: Where Does The Opportunity Lie?

Selling BTC options is our preferred bias now, given the huge volatility carry and large anticipated moves. We also like adding hedges against core BTC long exposure because the near-term upside from here looks limited. Call overwriting, bearish risk reversals work well against long positions.

To speculate on the downside, we prefer put butterfly structures to be short vol in a moderate move lower as the vol premium gets taken out of the curve post event.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)