Strong US data (initial claims -22k, Philly Fed Manufacturing +20.9 points), hawkish Fedspeak, and optimism on US debt ceiling de-escalation helped to put US assets back in the driving seat, creating a fresh wave of risk-on optimism globally.

A quick run-through of today’s playlist:

• 52-week highs for US Homebuilders (+23%), German DAX, Nasdaq 100, the Japan Nikkei (all +16%), with the S&P 500 rounding out the back (+8%).

• Bullish technical breakout of the trade-weighted USD FX despite repeated calls for its demise.

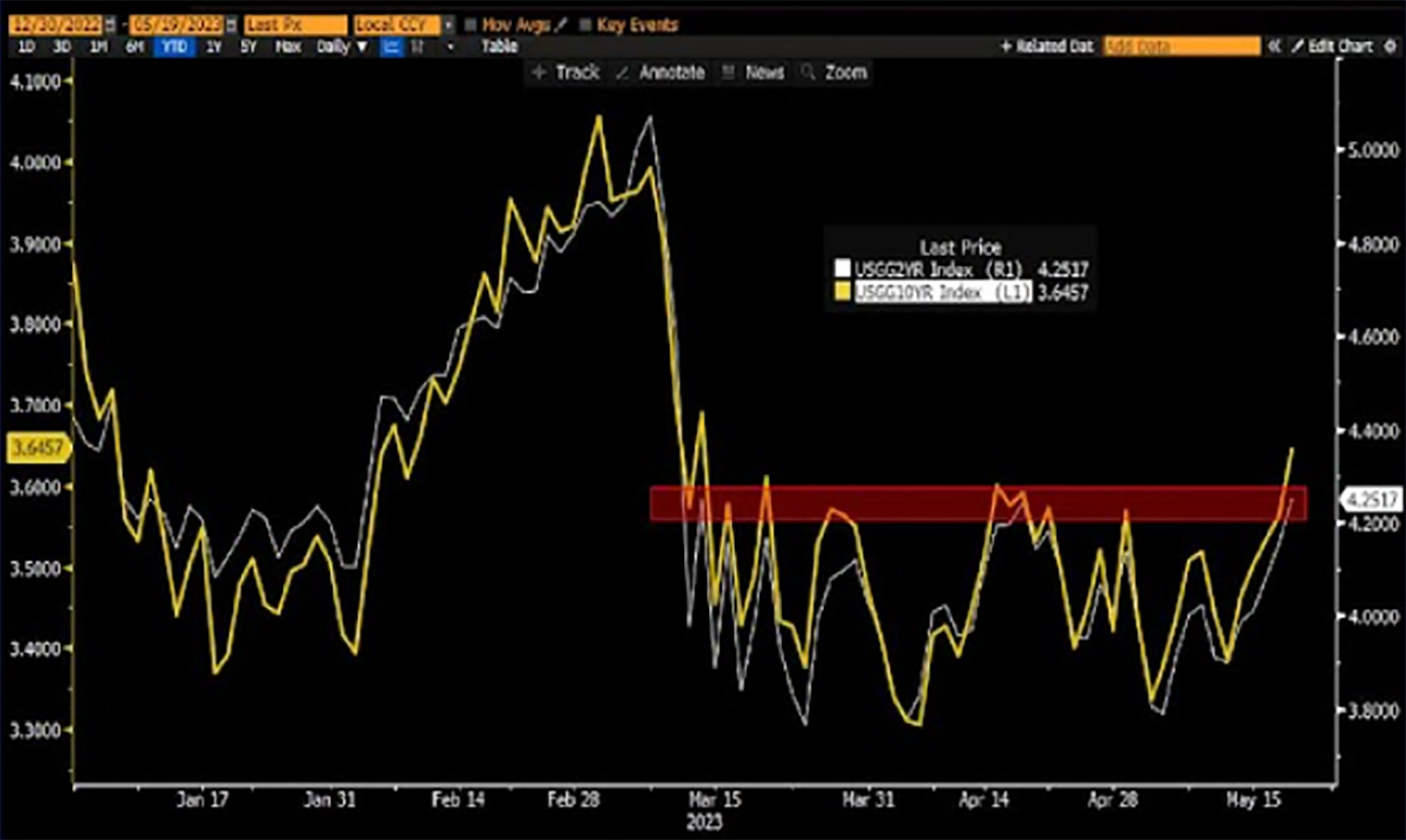

• US Treasury yields shifting higher from its well-defined March range due to hawkish Fed speak and an imminent debt ceiling deal.

• June FOMC now pricing a +35% chance of a 25bp hike.

• Massive +8% YTD out-performance of the cap-weighted S&P 500 vs its equal weighted brethren, thanks to unbridled interest in AI-related large caps names (our Nvidia AI overlord is up +100% YTD).

• Impressive outperformance of US equities despite significant weakness in China stocks and a worrying break of the 7.00 level in USDCNH.

52-Week Across Global Stock Indices, With Particular Strength from US Homebuilders:

Source: Bloomberg

Bullish Technical Trend Break of the Much-Aligned US$ FX (Trade Weighted):

Source: Bloomberg

Treasury Yields Shifting Higher from its SVB-Induced March Lows:

Source: Bloomberg

June FOMC Hiking Odds Back Above 35%:

Source: Bloomberg

Massive 8% YTD Outperformance of the Cap-Weighted SPX vs the Equal Weight Index, Thanks to Dramatic Interest in AI-Related Large Caps:

Source: Bloomberg

US Equities Able to Withstand Weakness in Chinese Equities and Rapidly Weakening CNY FX:

Source: Bloomberg

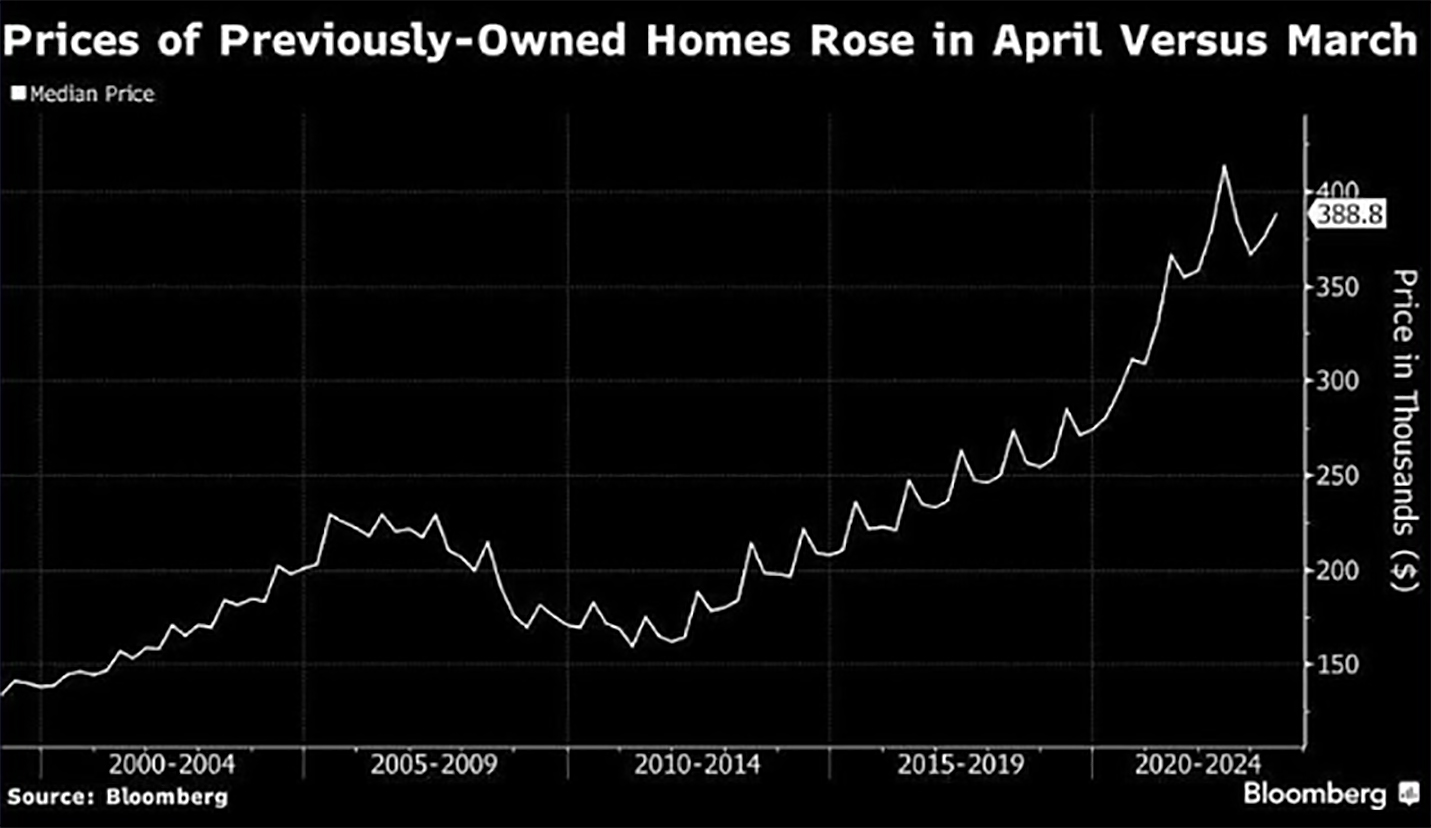

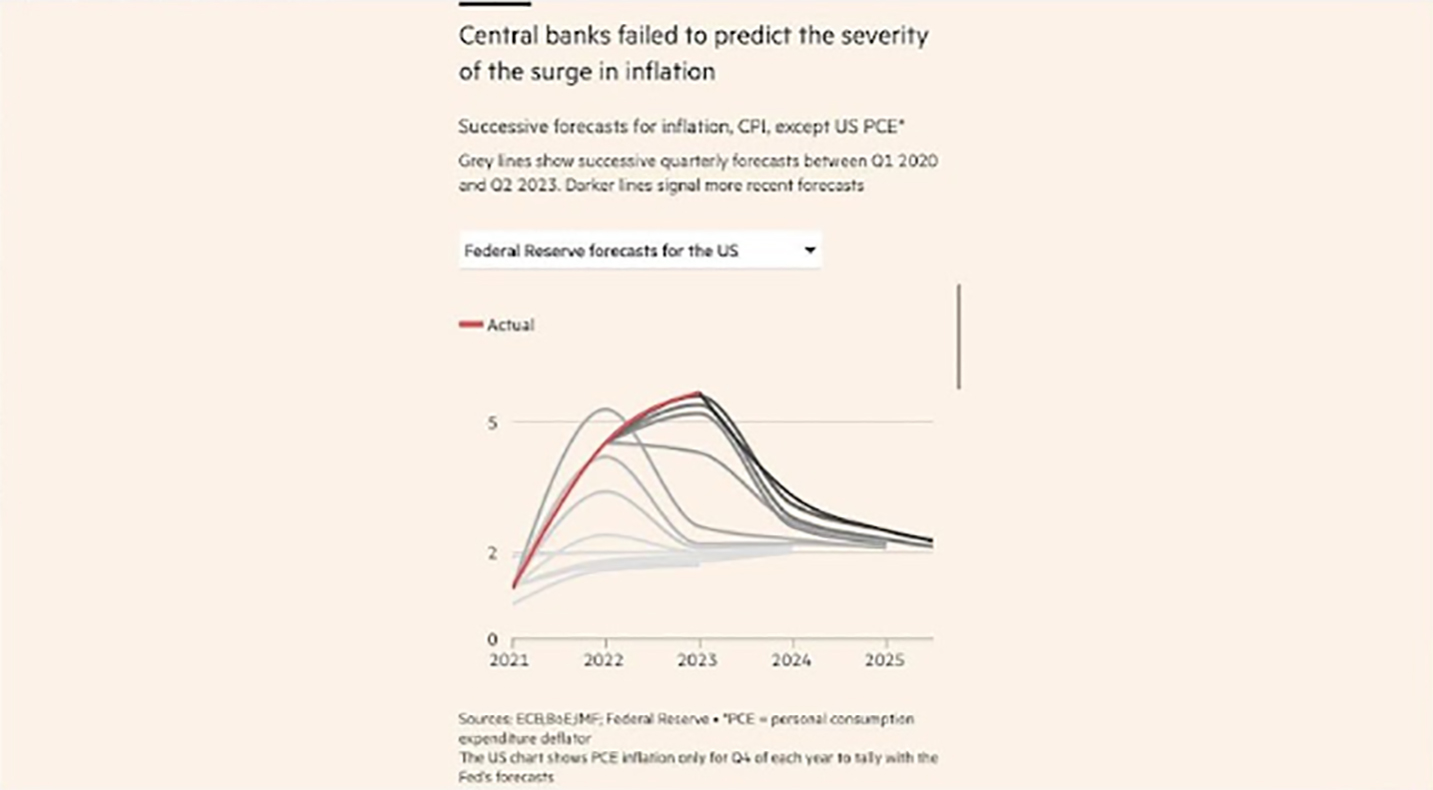

A re-established stability in jobless claims (with removal of previous fraudulent data), significantly improved debt ceiling optics, and a US equity market roaring back to the August Jackson Hole highs (calling Peak J-Pow) has raised the chance for a significant forecast upgrade in the June SEP (Summary of Economic Projections), with June FOMC hiking odds adjusting higher in unison (~33%). A full line-up of hawkish Fed speakers resurfaced with their latest expectations management exercise, with Dallas Fed’s Logan saying that “current data doesn’t justify pausing rate hikes yet”, Jefferson declaring inflation to be “too high” though the impact of high rates have not been fully felt yet, and Bullard reaffirming his support for higher rates as insurance. With core CPI still running at 5%, job market still hot by historical standards, and housing market rebounding sharply thanks to low inventories, all eyes will be on the Chairman’s speech today (10am CDT) to see whether he re-channels his ‘peak inner hawk’ to wrestle the rampant US equity market lower from its current exuberance.

US Housing Prices have Quickly Rebounded Due to Low Inventory Levels:

Source: Bloomberg

Global Central Bankers have Completely Missed their Inflation Forecasts Over this Current Cycle:

Source: Bloomberg

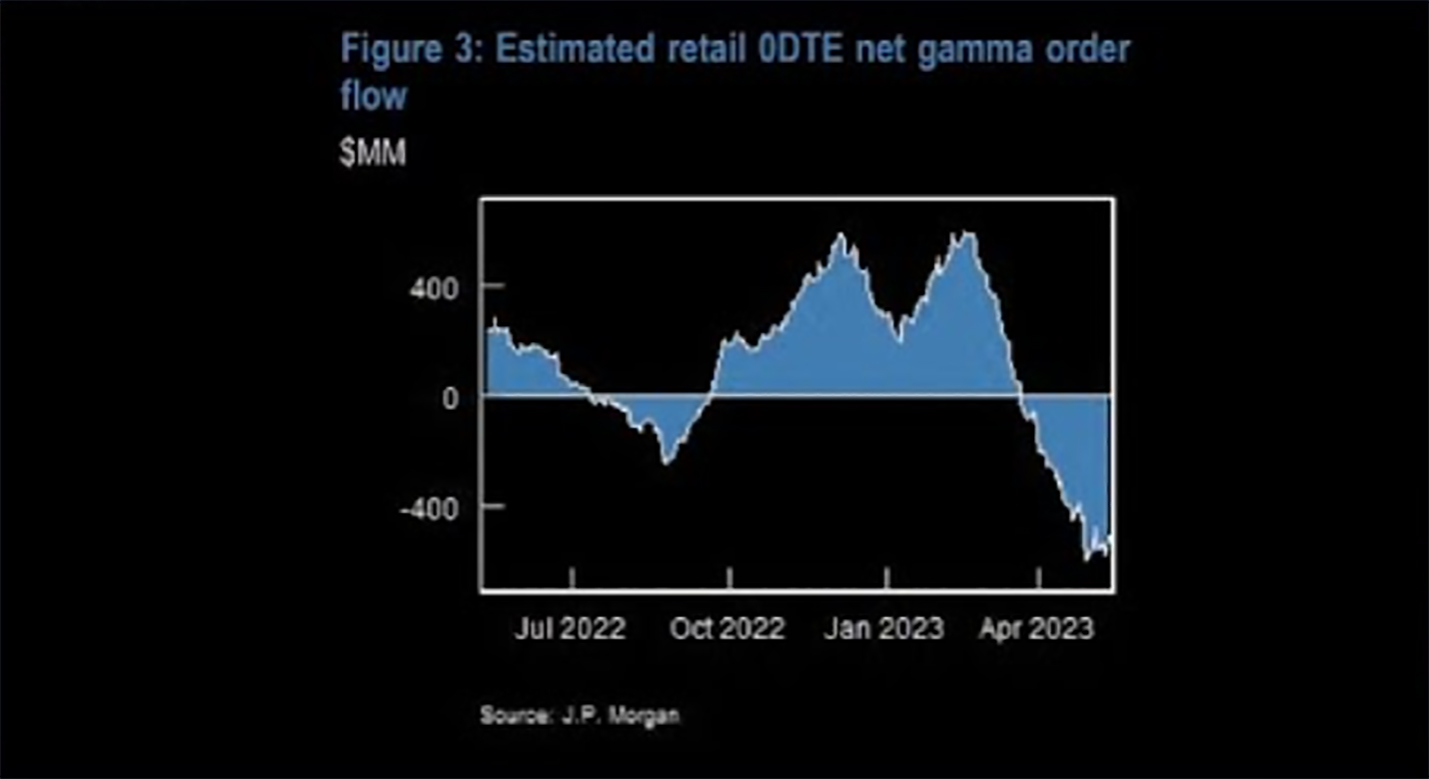

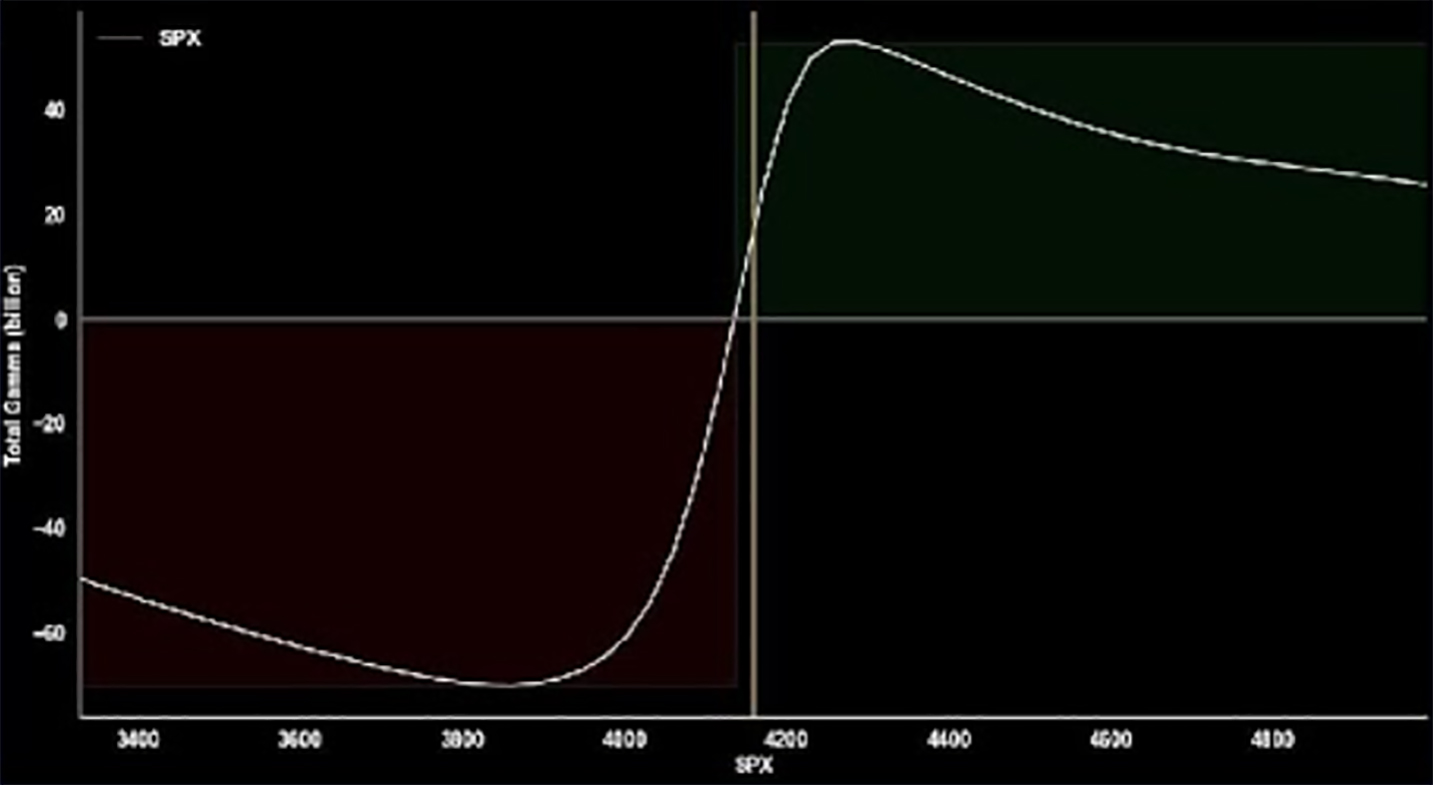

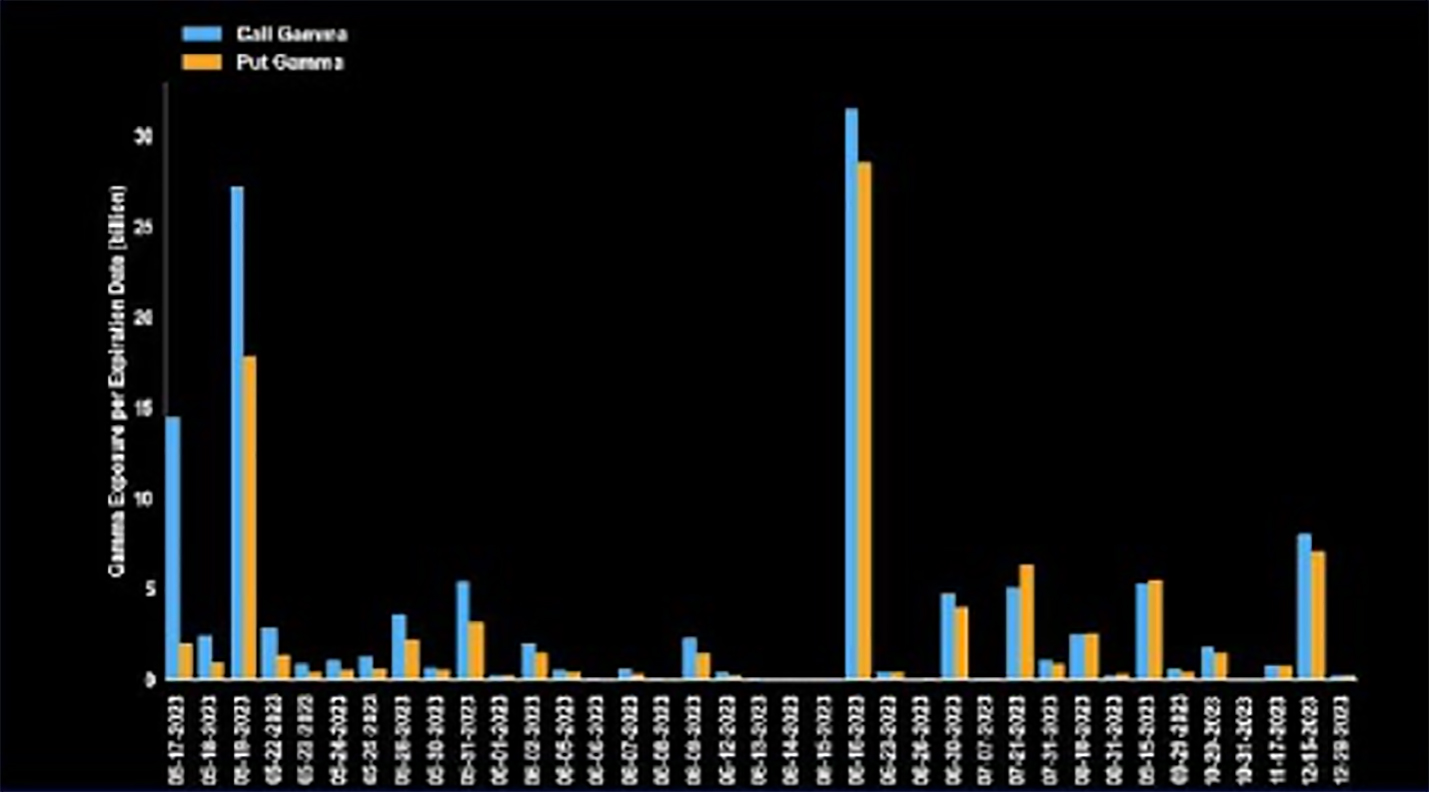

With their well-advertised long biases in fixed income vs underweight in equities, hedge fund and professional money managers have been scrambling to add long-call exposures in the SPX over the past few sessions as stocks squeezed higher. The ferocious market rally blew past the areas of max call exposures in a hurry (~4185 on cash SPX), with 0DTE players having flipped to (supposedly) net short gamma since April, thus adding further rally fuel on the way up. Street research now estimates market gamma to be back positive at the current index levels, and we’ll also be seeing a decent sized OpEx expiry today which should add to an exciting close to the week.

SPX Option Profile Shows Decent ITM Call Open Interest at the Current Levels:

Source: Bloomberg

JPM Estimates Retail 0DTE Flows to have Turned to Net Selling (Short Gamma) Since April:

Source: Bloomberg

Market Gamma Profile Estimated to Be Positive at the Current Juncture, Though with a Decent Sized OpEx Schedule Today:

Source: Bloomberg

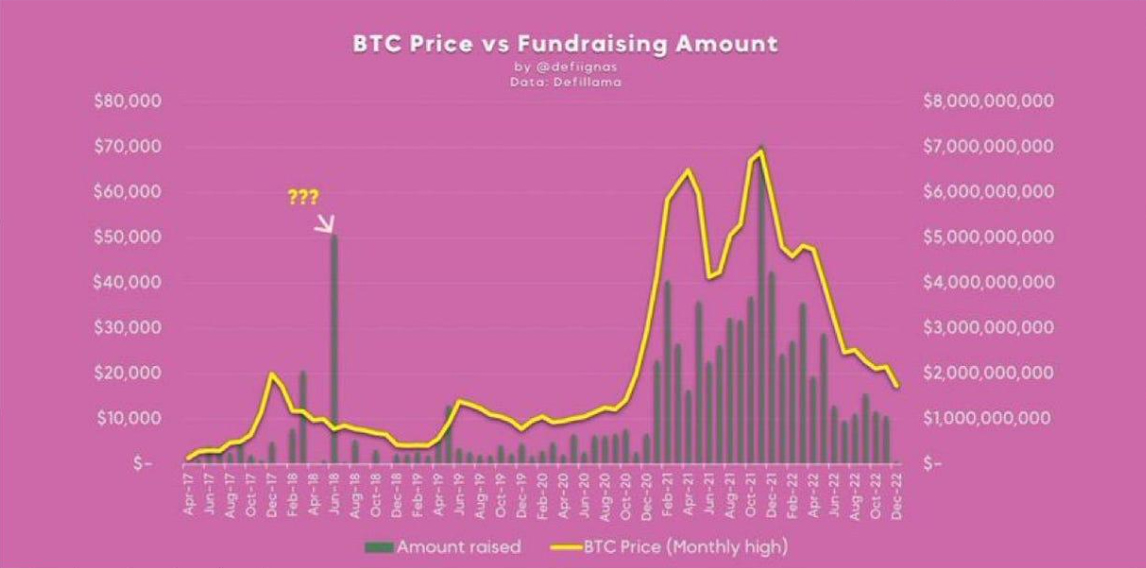

As has been the case for the past few weeks, crypto participants didn’t receive the party memo as we have completely missed the latest rally across TradFi assets. Furthermore, an interesting charm from DefiLlama shows an interesting relationship between Bitcoin prices vs VC fund raising levels, which basically argues that crypto still requires ongoing mainstream participation and external capital injection to sustain its upward trajectory (FOMO in a nutshell), both of which are difficult to come by at the moment unfortunately. On more uplifting news, the HKMA has announced a high-profile launch of their e-HKD program on Thursday, detailing the stablecoin’s multiple potential use-cases across consumer payments and tokenized deposits. A group of 16 institutions across the financial, payment, and tech industries have been selected to participate in the pilot, including HSBC, SCB, BoC, CCB, Alipay Financial Services, Visa, Mastercard, and most interestingly Ripple. While there are still no official plans on the timing and decision to launch the e-HKD, this pilot is a major step in the right direction to give real-world use cases for the crypto industry, and is a welcome break from the constant regulatory onslaught that the SEC is still waging on the US side. The crypto meccas should continue to flow East as Asia continues to take a methodical but practical approach to digital assets, and we remain hopeful that this trend will be sustained even in the medium to long term.

Bitcoin Prices vs VC Fund Raising Amount:

Source: DeFi Llama

AUTHOR(S)