ETH Vol Surges as Spot ETF Chatter Returns

Ethereum has led a rapid recovery, holding key support at $3.2k only to surge past the $3.65k resistance before giving back half of its gains in the last 24h.

The move comes as the market speculates that an ETH spot ETF (upcoming deadline of 23-May) may not be fully ruled out after all. This is despite the SEC is not clustering ETH spot ETF deadlines the same way they did in the lead up to the BTC spot ETF approval.

Meanwhile, BTC continues to benefit from ETF inflows, with over $14 billion this year, and anticipated higher demand from banking powerhouses the likes of JPM, GS, and China asset managers.

It’s worth noting that despite inflation concerns in the U.S. and less cuts signalled by the Fed, the crypto market remains buoyant. Institutional interest in crypto also remains evident in the growing open interest in CME’s bitcoin futures, reaching $10 billion, indicating significant hedging activities.

The upcoming Bitcoin halving in late April is expected to further boost market sentiment.

Surge in ETH Realized Vol

This week, Bitcoin maintained stable realized volatility, while Ethereum saw a surge. Implied vol remains high due to factors like US inflation data and geopolitical tensions, making volatility trades, particularly in BTC, attractive. The mid-April halving event could keep volatility levels elevated, presenting opportunities for vol trading strategies, which we will present to our subscribers.

Stable Term Structure

Stability is observed in BTC term structure, with only a slight uptick in vol around the April-May halving event. Long-term vol is slightly decreasing. There’s a notable interest in short-term calls.

Ethereum also shows a flattening term structure and increased vol in short-term options, suggesting a heightened interest in near-term market movements.

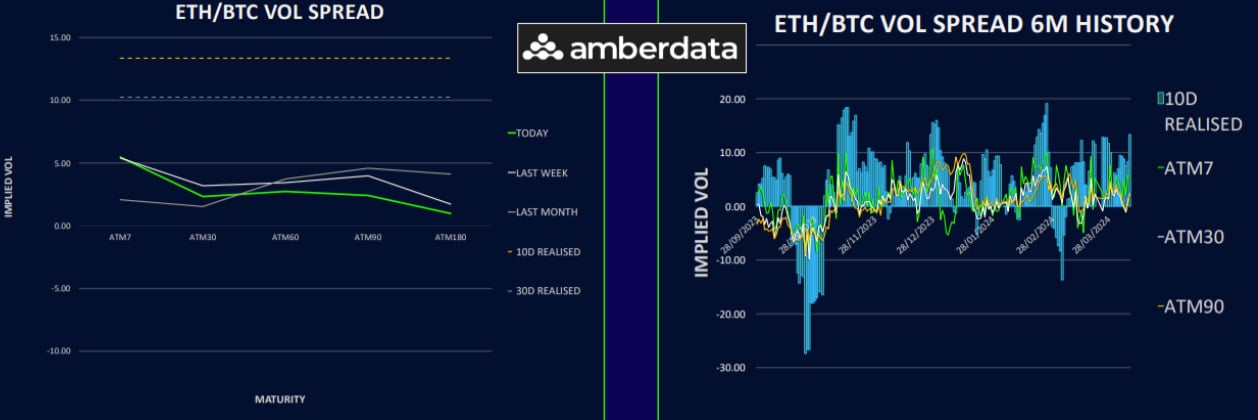

ETH/BTC Spread Keeps the Premium

A small vol spread between Ethereum and Bitcoin remains, with ETH maintaining a premium due to its higher realized volatility. Despite ETH’s recent rally, its long-term performance against BTC remains uncertain without significant catalysts like an ETF approval. Opportunities for strategic options positions in ETH may arise if the asset sees renewed weakness. We will be alerting our subscribers as and when we see actionable opportunities.

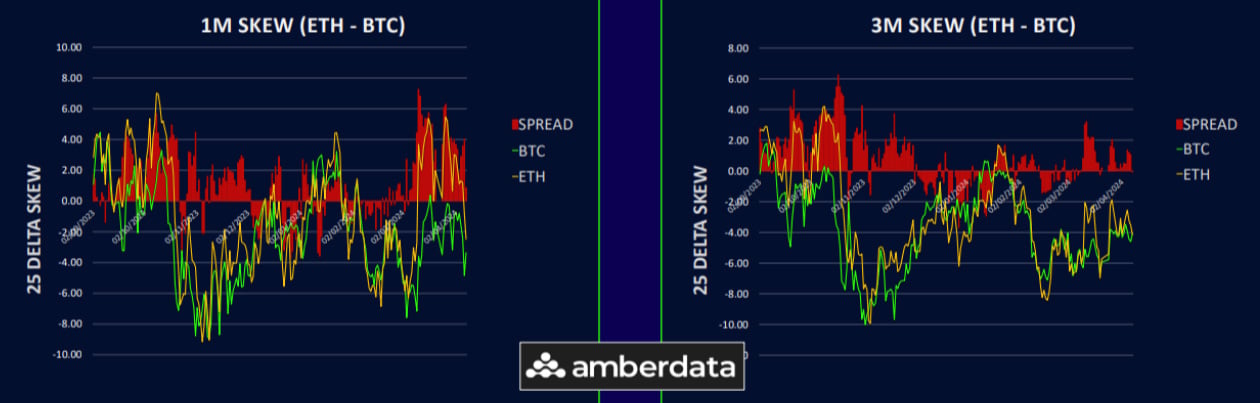

Skew Sees Shift Back Towards Calls

After holding key support levels, the market has shifted towards favouring call options for both Bitcoin and Ethereum, reflecting increased optimism. This trend extends to longer-term options, suggesting a sustained interest in the upside potential although the premium for long-tern calls drifted a touch lower this week.

Option Flows And Dealer Gamma Positioning

Trading volumes in Bitcoin options saw a slight decrease, even as BTC’s price surpassed $70k, with significant interest in bullish strategies for the upcoming halving. Ethereum trading volumes remained steady, with notable activity in call calendar spreads and short-dated calls. Market dynamics indicate a choppy period ahead due to dealer positions, particularly in BTC.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)