Crypto Sells Off Post Easter

The crypto markets are bleeding post Easter. Bitcoin (BTC) broke below $70k and Ethereum (ETH) also lost a key support at $3.45k. While there is currently weakness, potentially driven by the US government looking to sell a large stack of BTC from the Silk Road days, the outlook for Q2 2024 is promising as the Federal Reserve’s dovish stance remains intact and new capital inflows into cryptocurrencies and BTC spot ETFs contribute to this positive outlook.

Last week, BTC ETFs saw significant inflows, and on-chain derivatives hit a record $3.4 billion, even as the DeFi sector remained 50% below its peak. The Bitcoin Halving event in mid-April is anticipated but not expected to significantly affect prices, though it will impact supply over time.

Additionally, major financial institutions are nearing the end of a 90-day review period for spot bitcoin ETFs, potentially leading to new offerings from firms like JP Morgan, Goldman Sachs and the likes. This could attract further capital invested into US spot bitcoin ETFs. The interest from institutions remains high, as seen in the open interest and leveraged short positions in CME bitcoin futures, a good proxy that is indicating active bitcoin basis trading and overall interest in the space.

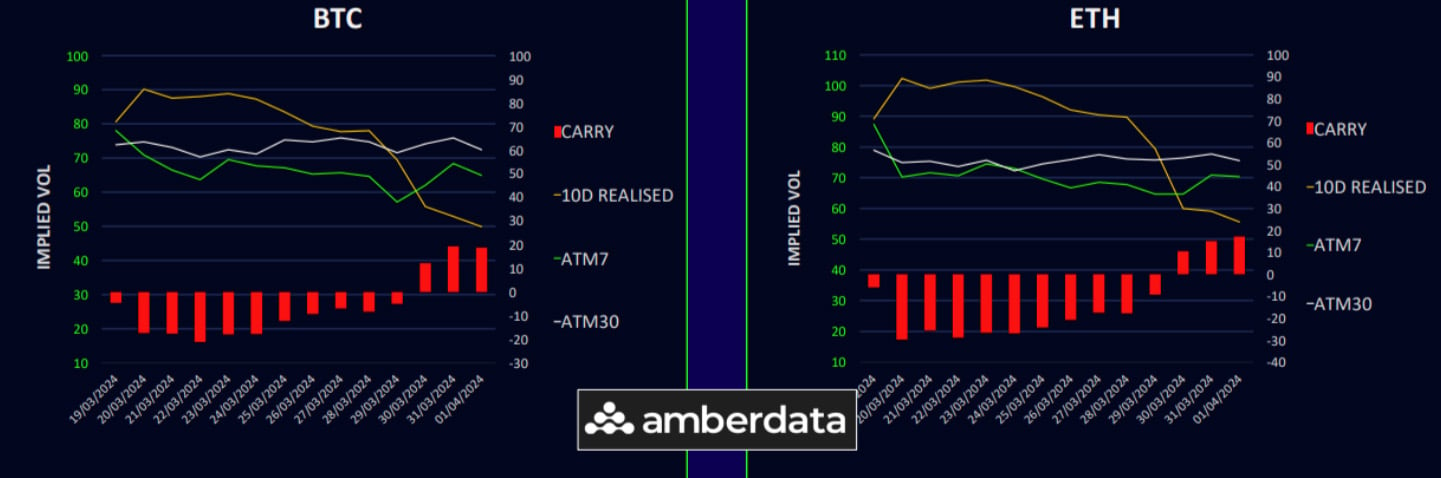

Realized Vol Comes Back to Life

Both Bitcoin (BTC) and Ethereum (ETH) have broken past the $70k and $3.5k levels, respectively, resulting in Monday’s realized vol exploding as 65k and 3.2k get tested. The expectation of significant market movements remain, keeping implied volatility stable. The big move we had on Tuesday makes being gamma sellers less attractive than before, but volatility carry remains positive. With the upcoming halving event, we expect continued interest to own options keeping implied volatility high, with the potential to reset later in the month. On the macro front, the Non-Farm Payrolls (NFP) this Friday is unlikely to significantly impact markets due to lower rates volatility overall.

Term Structure into Steeper Contango

The Bitcoin term structure has entered a more pronounced contango. April expiries are facing pressure but show a slight kink for April 26. Long-term vol remains unchanged, with a decrease in skew across the curve and a return to a put premium at the front end.

Ethereum’s term structure has remained more resilient due to poor spot trading performance. Most of the curve is approximately 2 vols higher, with April and May unchanged. Interest in front weekly vol increased as prices dipped below support this Tuesday, and skew has shifted back to a put premium through May as buyers seek protection.

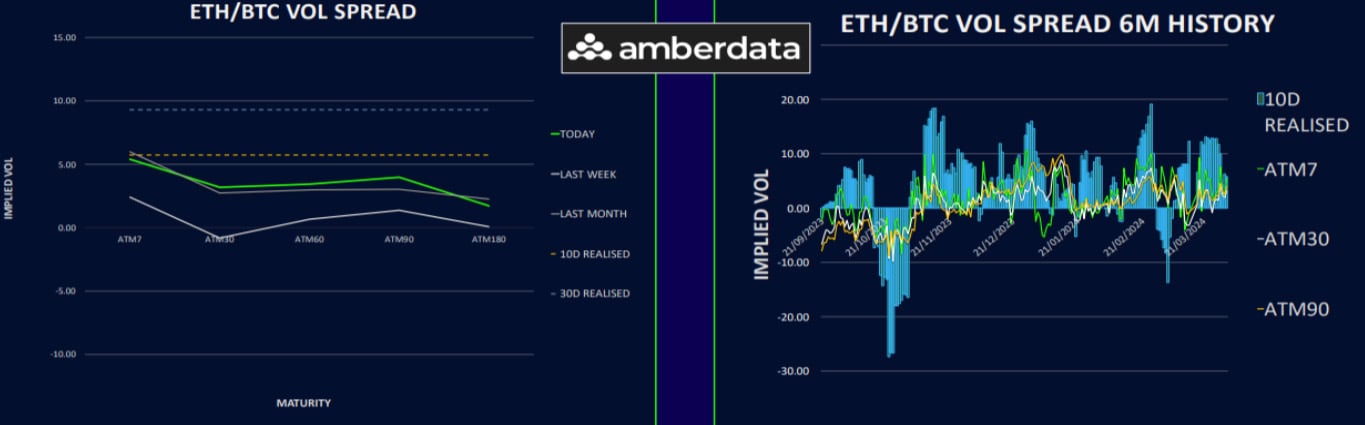

ETH/BTC Spread Shifts Higher Across the Curve

The volatility spread between Ethereum and Bitcoin increased as Ethereum’s volatility remained firm and Bitcoin’s softened last week. The realized volatility spread supports the widening gap, with Ethereum showing stronger performance over both 10-day and 30-day periods. The spot spread between ETH/BTC is breaking down, suggesting a potential significant downward movement. This is reflected in the higher relative premium for ETH puts compared to BTC puts. Given the expected bullish impact of the halving event on Bitcoin, which may attract more ETF flows, a drop in Ethereum’s value could present an opportunity to enter longer-dated call spreads.

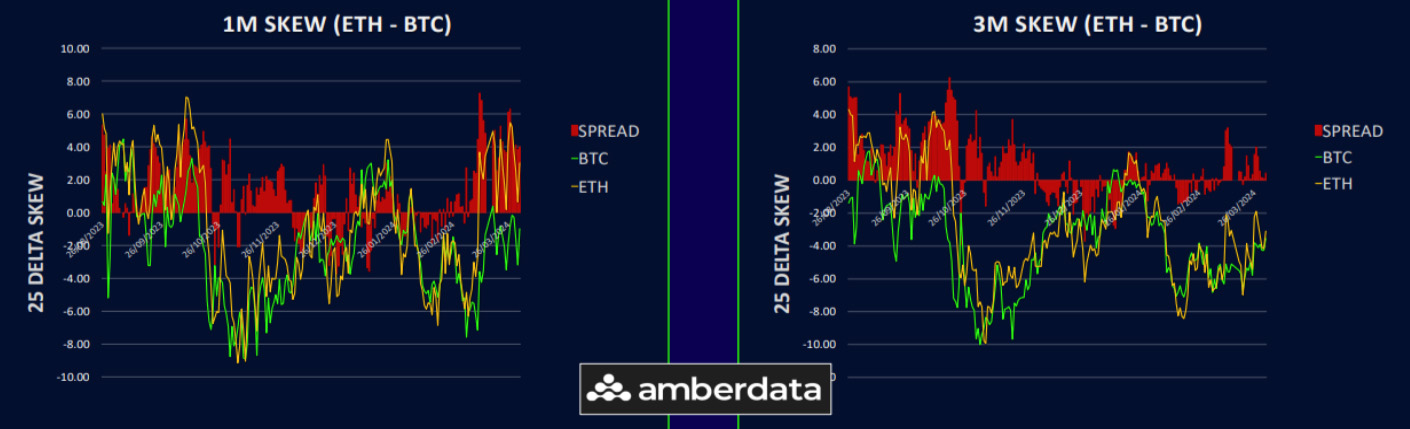

Put Skew Returns in the Front End

Last week’s rally faltered, leading to an increase in put premiums as investors sought protection. The BTC curve shows a slight put skew into mid-April, transitioning back to a call skew, peaking near 8 vols in March 2025.

The ETH skew curve is more pronounced with as much as 5 vol premium for puts in April 19, and a 6 vol call skew in the back end of the curve. Ethereum’s higher volatility and the absence of immediate catalysts have made the market cautious, supporting the use of hedging strategies such as the use of put spread collars to hedge ETH exposures at current volatility levels.

Option Flows And Dealer Gamma Positioning

Bitcoin option volumes decreased by 20% to $8 billion, with significant activity around April 26 due to halving strategies, including hedging with 72k puts and bearish 66k/80k risk reversals. Conversely, bullish strategies involved selling 60k/55k put spreads for April 26 and buying 70k/85k call spreads.

Ethereum volumes fell by 30% to $4.7 billion, with bearish flows dominant in April expiries through outright puts and put spreads. However, there were bullish positions in calls and call calendars, particularly with April 26 at a 4000 strike.

Bitcoin’s dealer gamma maintaining last week’s level at small short, despite spot price breaking below the $70k mark. Ethereum’s dealer gamma showed a brief dip into negative territory but has since recovered, with spot trading weak down towards $3000. These movements suggest that broader market forces are currently more influential than gamma positioning.

Strategy Compass: Where Does The Opportunity Lie?

With vol elevated and crypto markets under pressure, we think using put spread collars to add hedges makes sense. For those looking to buy the dip, we still prefer long dated call spreads to utilise the call skew further out the curve.

Those expecting markets to find a range should consider iron condors to harvest the elevated volatility carry that has come back since last week.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)