BTC En-route to 60k Round Number

Investor optimism, fuelled by the upcoming BTC halving and robust ETF inflows, is driving Bitcoin’s price upward, with Ethereum piggy-backing on the back of such enormous momentum.

The halving in late April is expected to tighten market supply, attracting more speculators. Historically, such events have led to volatile price fluctuations, as seen with the ETF launch.

The significant inflows into BTC ETFs have been a primary force, allowing it to crack the $52k mark and now aiming for $60k, though with a risk of future declines due to overleveraging.

Besides, rising open interest in BTC and ETH futures on the CME highlights strong rising institutional interest, with ETH showing great potential, especially with an anticipated summer ETF launch.

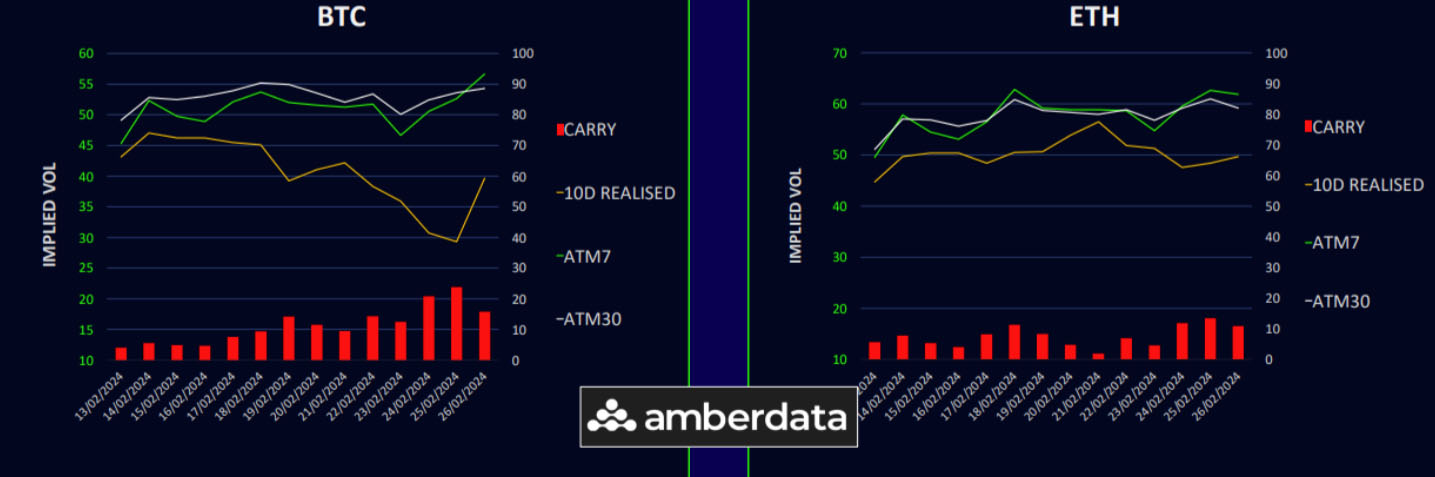

Vol Carry Remains Deeply Positive

Last week, Bitcoin’s realized volatility dropped to 30 as we stabilized into expiry but has since rebounded to 40, with prices reaching 57k. Ethereum’s volatility has been more consistent around the low 50s outperforming Bitcoin until the recent 5% rally in Bitcoin’s favour.

The positive volatility carry for both assets suggests a potential for gamma selling. Despite the focus on this week’s PCE inflation data, crypto markets remain unaffected by hawkish rate market repricing. Those overwriting calls keep facing challenges as both assets rally aggressively. That said, that is where the opportunity seems to be if you own the assets, although the parabolic upside is alluring.

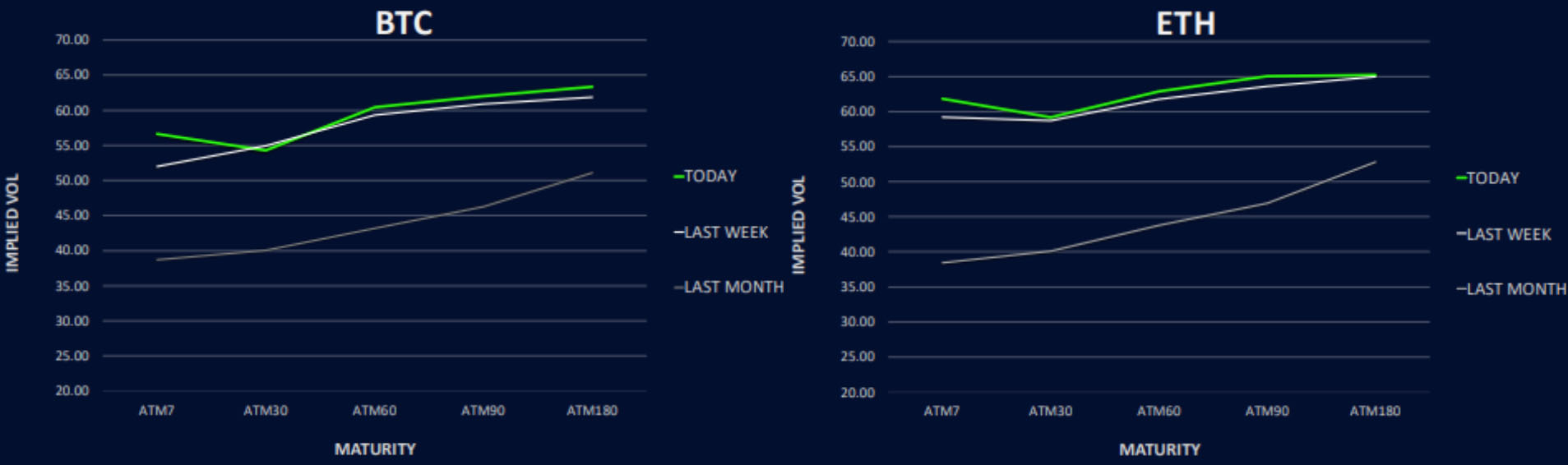

Front-End Term Structures Inverted

The BTC term structure shows a front-end inversion, with 1-2 week expiries gaining interest due to impressive gamma performance, while longer-term vol and call skew across the curve have adjusted slightly.

Ethereum’s term structure is similarly inverted but less than BTC as 1-month ETH was also well bid, with increased volatility extending to June 24 expiries. Dec 24 expiries are seeing selling pressure, and there’s a shift in skew towards put premium in short-term expiries.

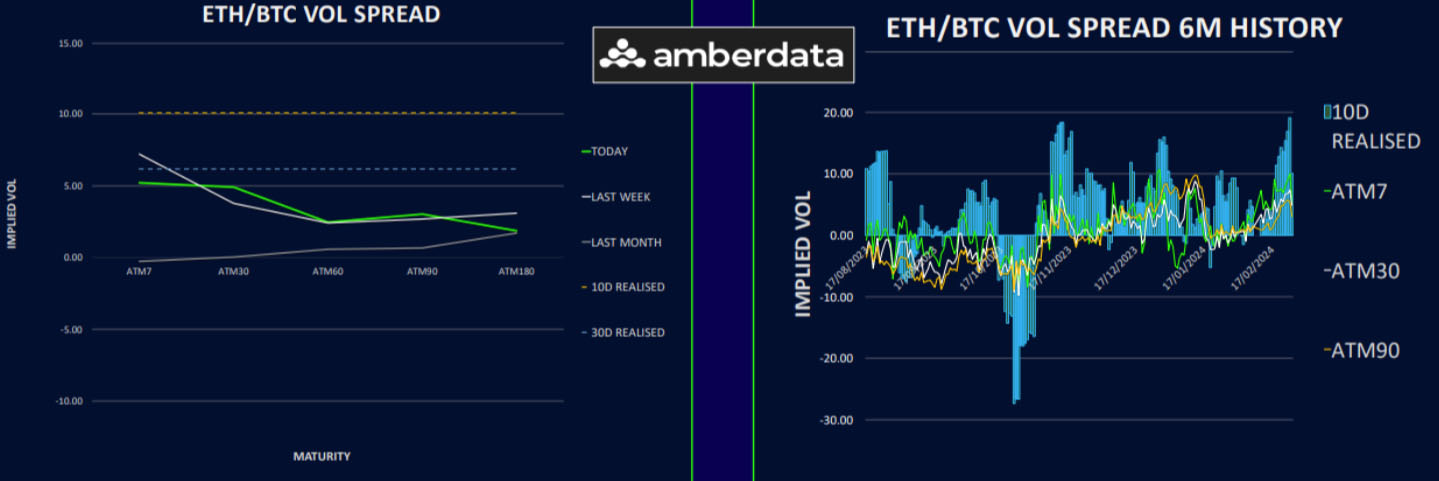

ETH/BTC Spread Holds Decent Premium

The ETH/BTC volatility spread maintains a significant premium, favouring ETH with a 5-10 volatility advantage, even if some tweaks across the curve were noted.

Despite BTC’s recent price surge, the ETH/BTC spot spread has been dominated by bulls in February with potential for further rallies.

The strategy of owning outright calls or call spreads, rather than selling BTC calls for financing (as suggested to our subs last week), has been favourable due to the strong price momentum.

Not long until SOL options to become available in Deribit. We will explore upside opportunities, especially given SOL/ETH’s recent consolidation.

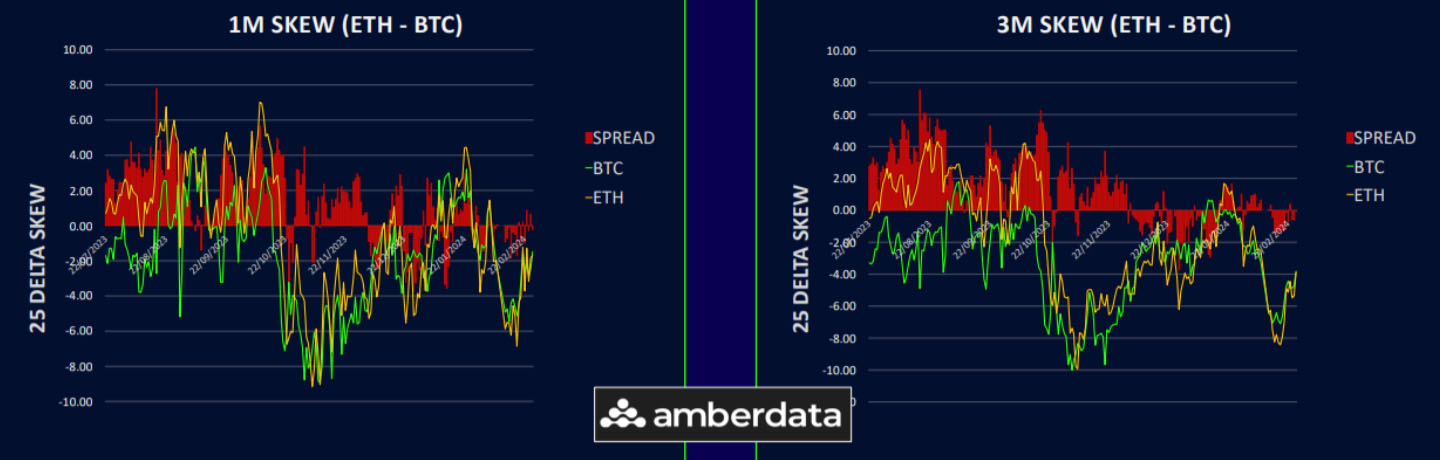

Call Skew Drifting Lower

BTC’s front-end call skew diminished with the test near 50k last week and hasn’t recovered yet, while long-term call skew is also drifting lower. The curve goes from 0 to ~ 5 for calls in a uniform fashion.

ETH experienced similar dynamics, with a slight put premium emerging in the front end and call skew remaining in the back end. The decrease in call skew, despite high spot prices, suggests a shift towards call spreads by traders seeking to manage higher implied vols and positive vol carry.

This trend indicates a demand for near-term put hedges, anticipating potential market corrections.

Option Flows And Dealer Gamma Positioning

BTC trading volume decreased by 30% to $5.5Bn, with a shift towards put buying for March expiries post-February 23. Strategies included put flies for March and calls for a potential break higher.

ETH’s trading volume remained steady at $4bn as prices exceeded $3,000, with March calls attracting interest. The significant blocks in April call spreads didn’t drastically change call skew, reflecting a balanced bullish sentiment.

As per dealer gamma, post-February 23, BTC dealer gamma positioning has stabilized, with current positions indicating a balanced market. Ethereum’s dealer gamma remains slightly positive, with March options sales indicating a cautious outlook beyond 3300 strikes.

Strategy Compass: Where Does The Opportunity Lie?

I know the market feels crazy bullish right now and it feels dirty to be hedging, but if you’ve ridden the wave higher from last Oct/Nov, sticking on some hedges looks very sensible to me. Short dated put spread collars are sting up beautifully to hedge longs with higher implied vols on the latest move up.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)