BTC’s Momentum Not Receding

Remaining long BTC in expectation of one or more spot ETF approvals continues to be a strong narrative that has kept the asset well bid for weeks.

While technical analysis indicates a potential breach of the $38,000 resistance may be imminent, simultaneously, the evolving macro backdrop is moving quite favourably as it seems increasingly likely we are coming to a halt in the Fed’s tightening measures by 2024 after softer US CPI readings.

Additionally, heightened network activity on-chain, reduced coin supply in centralized exchanges, and the approaching of the 2024 halving are all contributing factors supporting BTC.

Short-term concerns include an overheated Bitcoin derivatives market, although the recent drop to $35,000 may have lessened this risk, as well as further delays in spot Bitcoin ETF approvals.

In other developments, a $4 billion settlement in the Binance criminal case should alleviate a major market impediment from last year, as the market favours certainty.

Moreover, Tether’s USDT market cap growth signals new inflows into crypto. There’s been nearly $4 billion in inflows in the past month, reflecting growing investor interest in large caps and alts.

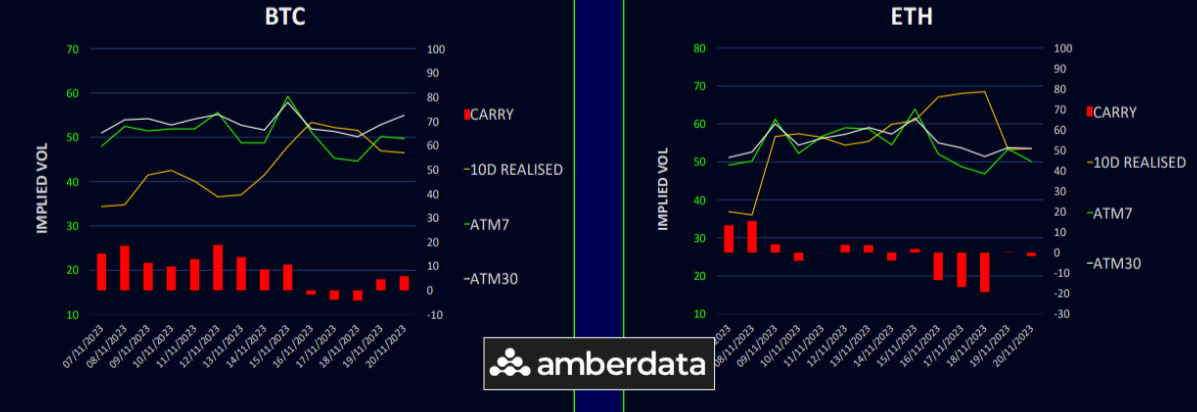

BTC Keeps the Positive Carry

Bitcoin’s realized volatility remained in the mid to high 40s this week, with noticeable fluctuations within the new $35,000 to $38,000 range. Ethereum’s realized volatility decreased as the significant 12% down-day dropped out of the 10-day lookback period, although it’s still slightly higher than BTC’s in the low 50s. The positive carry in BTC has diminished due to stable implied volatility but increasing realized volatility. ETH’s carry is still slightly negative, following a decrease in both implied and realized volatility this week.

The upcoming Thanksgiving holiday might lower realized volatilities further. However, considering recent market swings, implied volatilities, especially those associated with ETF “event risks”, are expected to remain stable. Investors looking to gain THETA during the holiday might find selling BTC options more beneficial due to favorable carry and dealer positioning dynamics. Short-term expiries of 1-2 weeks are advisable for those playing short GAMMA.

BTC & ETH Term Structure: Contrasting Picture

This week, Bitcoin’s term structure showed a slight recovery. The super short-dated expiries dipped due to positive volatility carry and significant selling in December 1st straddles, but firmness was observed from December 29th onwards. Jan 26th ‘24 expiry saw a notable bid, reversing last week’s trend in anticipation of what’s likely to be a single or multiple ETF approvals. The long end of the curve rose by about one volatility point as VEGA demand resurfaced.

ETH’s term structure, however, suffered due to the lack of a breakout above $2,150. The weekly expiry lost about 10 volatility points as realized volatility normalized. The overall term structure saw a downturn, mirroring last week’s uplift and placing pressure across the curve. Both term structures are still trading well above their yearly averages.

ETH/BTC Vol Spread Shifts Back Down Aggressively

The ETH/BTC vol spread has aggressively decreased as the ETH/BTC spot price failed to maintain its higher level, giving back 2/3 of its recent gains. Despite ETH’s marginally higher realized volatility, the spread has shifted to a slight BTC volatility premium. This fluctuation in the spread indicates market uncertainty about the next major driving factor for crypto prices. While BTC ETF approval is expected first, the market may shift focus swiftly and chase developments centered around ETH.

The primary influence on this volatility spread will be realized volatilities, now that call overwriting supply has decreased. Utilizing flat vol spread levels to leverage ETH’s upside against BTC’s, especially in more out-of-the-money options, looks sensible. This approach is based on the belief that BTC’s upside on ETF approval news is limited, as it is largely priced in by market participants.

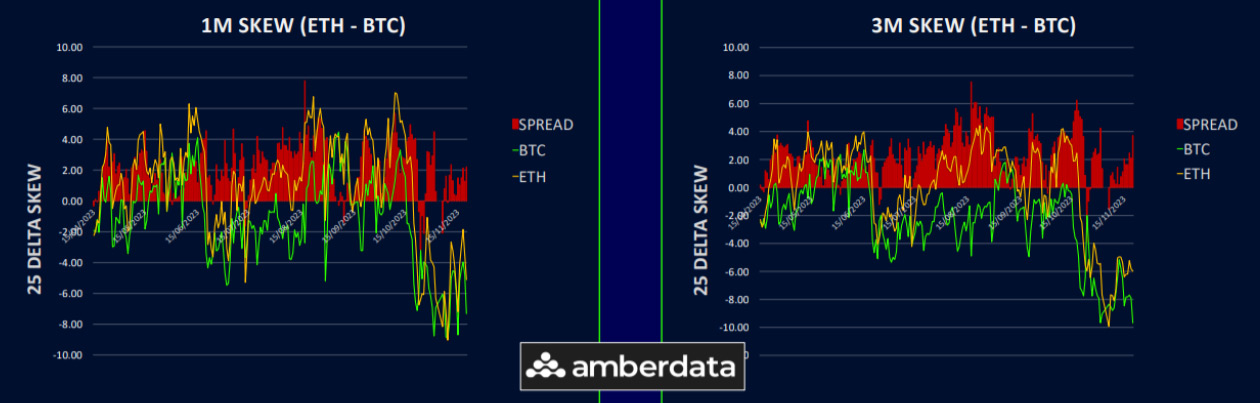

Skew: BTC Re-Takes the Lead

The tug-of-war between BTC and ETH skew continues, with BTC currently leading. BTC’s skew shows an 8-10 vol call premium, indicating that a breakthrough above $38,000, potentially reaching $42,000, may be imminent. This could introduce further volatility.

On the other hand, ETH’s skew has declined from its highs, especially in near-term expiries, showing only a 4 vol call premium at the front, extending to 8 vols at the back end of the curve.

Despite these dynamics, owning call switches in ETH vs BTC remains a favorable strategy in my opinion. The BTC ETF’s impact is already largely factored into prices, and a significant rally past $40,000 seems unlikely. Conversely, ETH has greater potential to rally if it breaks the $2,150 mark.

Option Flows And Dealer Gamma Positioning

BTC option volumes decreased by 15% as the spot failed to break above the $38,000 resistance. This trend mirrors last week’s, where put spreads were bought for November 24th to guard against a downturn. Call options continue to roll from November and December expiries to higher strikes in December and January, with January being the most anticipated period for ETF approvals.

ETH volumes only fell by 5% this week. There was notable VEGA selling as Nov 24th $1,700 calls were bought, and January and March 2024 calls were sold on the $2,400-$2,500 strikes.

BTC dealer gamma positioning dropped significantly into last Friday’s expiry but has since balanced out over the week. Dealers become shorter above $38,000, where calls for November and December have been concentrated. The primary long strike for dealers is $36,000 on the downside, which may provide support. ETH dealer gamma has been steadily declining over the past month, with more balanced flows observed. Dealers remain short on the $1,900-$2,100 strikes for this Friday, which could result in choppy market conditions. ETH’s landscape is markedly different from most of 2023.

Strategy Compass: Where Does The Opportunity Lie?

Selling gamma via BTC 01Dec strangles or iron condors is probably the safest way to capture some of the volatility carry over Thanksgiving and not run too much event risk in case an ETF related headline comes out in December that may trigger a break either way. Smart money seems to be doing this trade already.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)