Bitcoin’s Bullish Technicals Re-Aligned

Following a temporary dip, Bitcoin has swiftly rebounded, surpassing the pivotal $68.5k mark, a critical resistance and hinting at a potential continuation of its upward trend.

In terms of spot BTC ETF flows, a noteworthy shift occurred with the first net outflows from U.S. spot bitcoin ETFs in two months, amounting to $836M from March 18-21. This phase of selling pressure was linked to significant withdrawals caused by the Gemini/Genesis bankruptcy issues.

With these exceptional outflows unlikely to recur again, the market’s outlook remains positive, especially with the Fed’s most recent dovish stance, reinforcing the bull case in crypto.

It’s also worth noting that despite skepticism regarding the approval of a U.S.-based spot ETH ETF, Ethereum maintains its resilience against these decreasing expectations.

Huge Realized Vol in Both Directions

Last week, the cryptocurrency market experienced significant volatility in both directions. Eventually, we saw notable price recoveries from key support levels for Bitcoin and Ethereum.

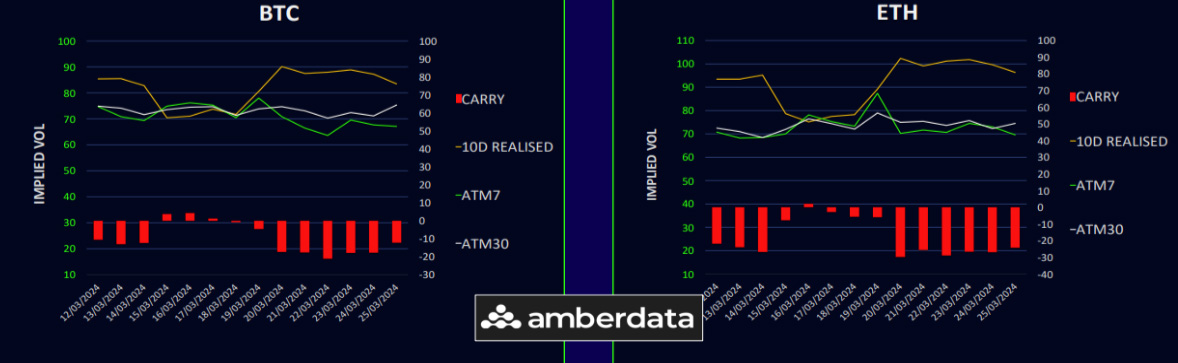

Despite the fluctuations, with BTC 10d realized popping back into the low 80s and ETH realized above 100%, the implied volatility didn’t significantly increase. This suggests flow was mainly switching from downside plays to upside and not a net buyer of outright vol. The completion of the FOMC meeting contributed to a reduction in volatility across various assets as well.

This discrepancy between implied and realized vol has taken vol carry deeply negative at -12 for BTC and -24 for ETH. This won’t last, suggesting that either market movements will stabilize, or implied volatility will have to adjust upwards. My guess is the latter given how quickly crypto is moving at the moment. As the quarter ends, some last minute ETF inflows might re-introduce additional volatility.

Term Structures Remain in Contango

Bitcoin’s volatility term structure remains in contango despite recent high realized volatility. The most notable gains were in contracts between April and June. Long-dated volatility slightly increased to 80% approximately. The market skew shifted towards calls over puts in the short-term.

Ethereum’s term structure also adjusted, reflecting a steeper contango curve, meaning higher expectations for future vol, particularly from April 26 onwards. This adjustment came after a significant shift from put to call skew, indicating changing market sentiment towards more optimism.

ETH/BTC Vol Spread Stays Stable

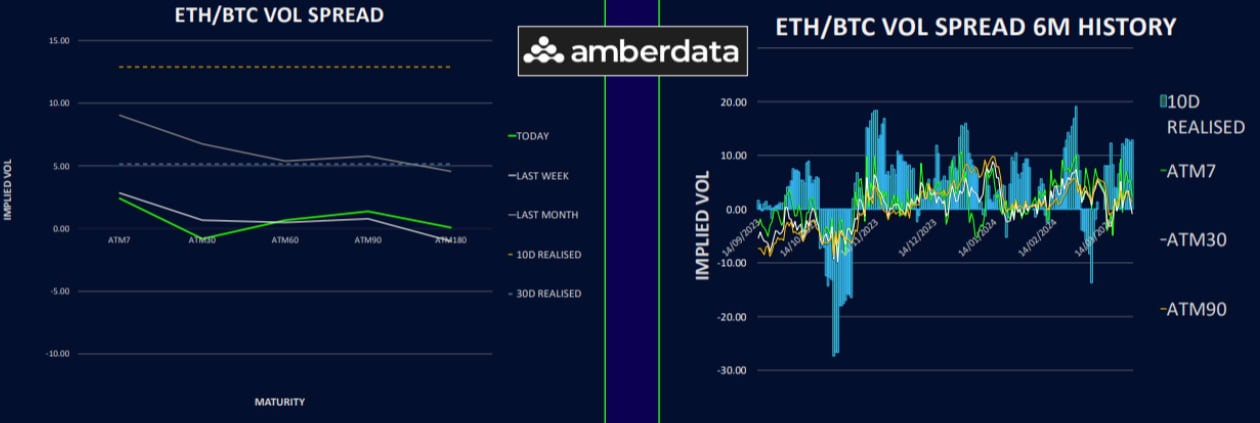

The volatility difference between Ethereum and Bitcoin remains relatively stable, though slightly reduced for the 1m period, with Bitcoin receiving more interest due to the upcoming halving event.

ETH sluggish performance against BTC and the reduced likelihood of an ETF approval have not significantly influenced the implied volatility spread. Realized vol spread is still massively in ETH premium as 10d spread was around 13 vols.

The current low in the ETH/BTC spot rate could see further drops if Bitcoin pops post halving, driven by more ETF inflows. This situation would present a potential opportunity long-term in the volatility spread, especially if Ethereum’s volatility remains cheap due to Bitcoin driving the action.

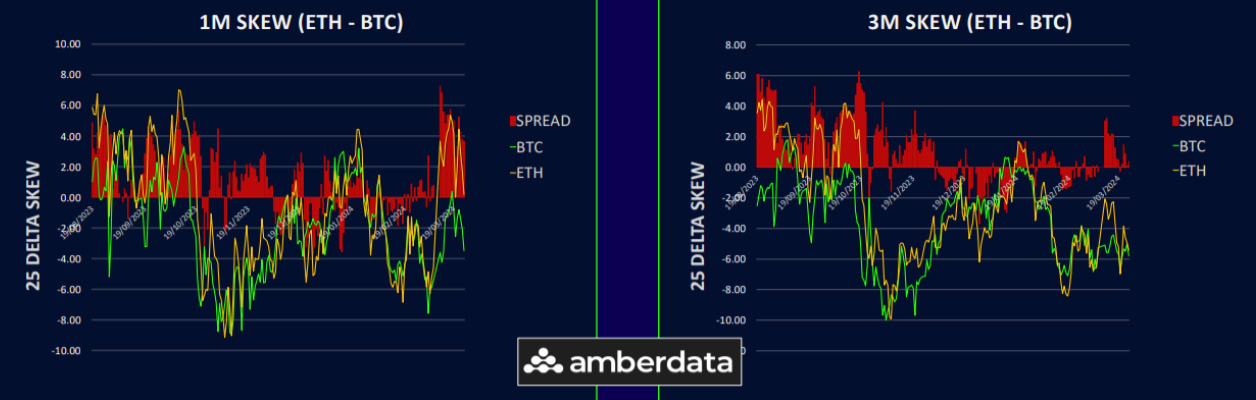

Skew Sees Major Reversal into Call Premium

Last week, the demand for short-term put skew surged. These trades were monetized as spot tested key supports and we saw a major reversal in skew back into call premium.

The BTC skew curve is 1-2 vol call premium in the front and moves up to 6-7 in the back end. The ETH curve is similar, but this week’s expiry has 6 vol call premium and has been very volatile.

This shift indicates that investors are more optimistic about the potential for further legs higher. Being long the underlying with some risk reversal hedges looks like a no brainer here. It might make sense to hedge in ETH more than BTC as it won’t have the ETF flows supporting it.

Option Flows And Dealer Gamma Positioning

Bitcoin option trading volumes decreased by 30% to $10 billion, with noticeable activity in protective put spreads and a shift towards bullish positions. Notable clips were seller of 26Apr 55k puts, 26Apr 66k and 27Sep 90k call buyers.

Ethereum’s trading volume was more resilient, only falling by 10% to $6.7 billion, with significant put monetization and bullish call positions. The main bullish trade was 26Apr 4000 calls bought outright.

In terms of dealer gamma positioning, Bitcoin’s turned negative, with the big short strikes for Friday expiry at 68k and 70k. If we move up to 75k then the long strikes may slow us down.

Meanwhile, Ethereum still shows positive dealer gamma. The big short strikes for this week’s expiry are 3500 and 3700 which will get bigger as the week progresses. We expect spot to remain unstable.

Strategy Compass: Where Does The Opportunity Lie?

With negative volatility carry, this suggests that gamma (highest in short-dated options) is good value to own. We see scope for more volatility this week, especially on the upside if inflows come back for quarter end. Using short dated ATM calls and selling longer dated OTM calls can be a nice way to participate in a near-term rally and not have to pay too much decay.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)