We have observed a swift flattening in BTC’s volatility smiles, firstly at a 1M tenor and followed one day later by a similarly swift flattening in the 2W tenor smile. While short-dated OTM puts remain in demand, the levels of volatility implied by options struck ATM and by OTM calls have risen at similar paces — reducing the overall steepness of the smile. However, as the flattening is limited to these two tenors only, we speculate that this is a dislocation caused by the recovery of short-dated OTM calls to the level held by OTM puts, following the strong skew towards OTM puts that we observed ahead of the spot market selloff beginning on the 4th of December.

Smile Grows Flatter

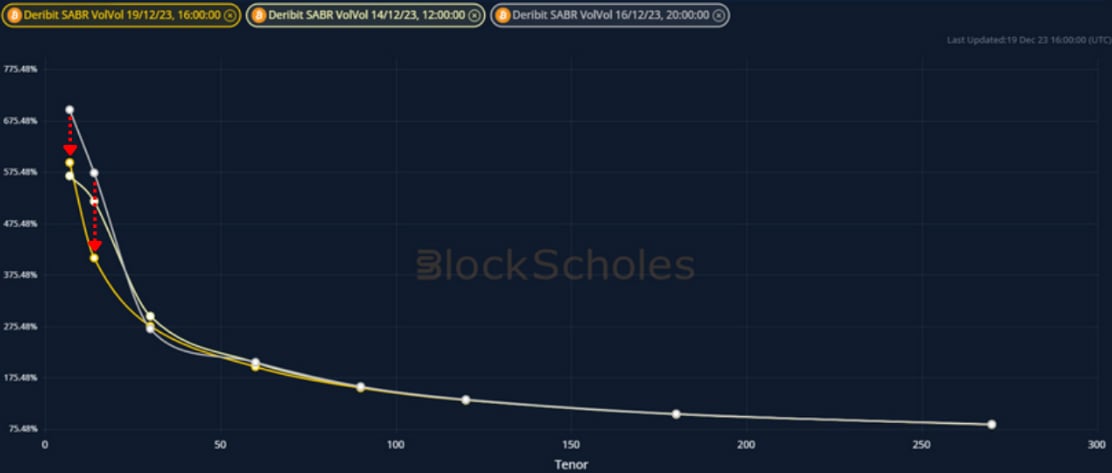

Figure 1 Term structure of BTC SABR VolVol parameter (steepness) at several snapshots (see legend) over the past 5 days. Source: Block Scholes

- The term structure of BTC’s SABR VolVol parameter (which measures the steepness of a tenor/expiry’s volatility smile) has grown flatter at a 2W tenor.

- We expect to see an “inverted” structure like the one above as shorter-dated tenors exhibit steeper wings.

- However, we have observed a significant climb down in the steepness of the 2W tenor over the last 5 days.

One Month, Then Two Weeks

Figure 2 Hourly BTC SABR VolVol parameter over the last month at several constant tenors. Source: Block Scholes

- We first saw a fall in the steepness of the 1M smile one day earlier.

- The flattening of the 2W smile was sharper having trended steeper in the days before.

- However, we have not seen a similar flattening at other tenors, suggesting that this could represent a dislocation between the 2W and 1M tenors.

- The 1M tenor now covers the Jan 12th expiry that is expected to see much of the anticipated ETF action, so we would expect to see the smile grow steeper as the uncertainty builds around the event.

Wings Higher Or ATM Lower?

Figure 3 Hourly BTC implied volatility of 10-delta call (blue), 10-delta put (pink) and 50-delta (grey), 1-month tenor options. Source: Block Scholes

- The fall in the steepness of the 2W vol smile is due to an increase in the ATM level of implied vol (grey above) while implied vol of OTM puts (pink) has remained level throughout this period.

- Additionally, the implied vol of short-dated OTM calls has risen at a similar rate, retracing the strong skew towards puts that we saw ahead of the spot market selloff in early December.

- The ATM rally from 35% to 45% arrests its slide from highs of 55% on the 9th of November.

- While this brings 2W vol closer in line with longer-term vol, we continue to see a premium of around 6 vol points assigned to expiries later than the 12th Jan.

AUTHOR(S)