Bitcoin is a decentralized digital asset that uses cryptographic methods to verify transactions. Invented by Satoshi Nakamoto in 2008, the blockchain, Bitcoin’s underlying technology, has since ushered in a new era of financial innovation.

Bitcoin’s excellent performance has brought a lot of attention from mainstream media and financial markets to the digital asset space. With Bitcoin’s price increasing from $0.07 in August 2010 to over $10’000 in February 2020, an investment of $1’000 would have been worth $143 m (Source). But for investors it hasn’t been an easy feat to stay in the market during this time as they had to endure multiple severe drawdowns of more than 80%.

A lot has changed since the early days of cryptocurrency. Increasing financialization through derivatives such as futures, options as well as ETPs and lending has led to further participation from institutional investors and professional traders. Bitcoin’s volatility has thus been trending down ever since it peaked in 2011 and institutional demand has increased substantially, with CME’s futures surpassing $100 bn in total notional value traded since their launch in December 2017.

Classifying digital assets is challenging

Although almost $170 bn is stored in Bitcoin, many investors struggle to understand whether Bitcoin is a currency, a commodity, a stake in innovative technology or a different asset altogether. Navigating the regulatory thicket is not an easy endeavor either. In 2019, the US securities and exchange commission (SEC) has released a 13-page framework for determining whether a digital asset falls under securities law and thus be registered with the SEC. According to this framework, Bitcoin is not considered a security, although some digital assets might be. Other government agencies, such as the Commodities and Futures Trading Commission (CFTC) label Bitcoin as a commodity, while the IRS classifies cryptocurrencies not as cash but property, thus making all digital assets taxable.

Therefore, it is not surprising that there is significant confusion – even among professionals – as to which asset class Bitcoin belongs. A survey conducted by Bitwise (Source) showed that more than 40% of financial advisors in the US would not fund an allocation to digital assets from alternatives, but instead would decrease cash or draw from the allocation set aside for equities, commodities or fixed income.

Bitcoin is usually compared to traditional assets such as cash, stocks and bonds. However, this comparison doesn’t show the full picture, as it is comparing different asset classes with different economic factors and risk-return characteristics.

In this paper, it is therefore argued that digital assets like Bitcoin should be considered as an asset class on their own. Several characteristics will be examined to establish a definition of an asset class and what makes an alternative asset “alternative”. Next, an overview of the alternative asset market is presented and Bitcoin’s unique risk and return profile is examined. Further, it is argued, that with the rise in regulated service providers for custody and insurance solutions as well as the market’s rapid maturing, Bitcoin is gaining more and more significance in the eyes of investors. Several positive fundamentals such as the growing adoption and a decrease in supply should help to extend the largest cryptocurrency’s price appreciation. Due to its high liquidity and nontraditional risk factors, Bitcoin provides a unique opportunity for diversification with high upside potential every investor should consider.

What is an Asset Class, Anyway?

In the seminal paper termed “What is an Asset Class, Anyway?”, Robert Greer has defined three superclasses of assets. These superclasses share fundamental economic characteristics that make them unique. All traditional and alternative asset classes can be subsumed under these superclasses.

Capital Assets

- Ongoing source of something of value

- Provide a stream of monetary rewards which can be discounted to determine net present value

- Examples: Stocks / Bonds / Real Estate

Consumable/Transformable Assets

- Have economic value and are consumable directly or transformable into other assets

- Do not yield an ongoing stream of value

- Examples: Oil / Corn / Cattle / Copper / Gold

Store of Value Assets

- Cannot be consumed

- Cannot be valued through discounted cash flow models

- Examples: Art / Collectibles / Gold

Traditional assets like stocks, bonds and income-producing real estate are categorized as capital assets, as they represent a claim on the underlying asset’s cash flow stream. However, not every asset can be uniquely assigned to one superclass. There are assets that belong to multiple superclasses. Gold, for example, acts as a store of value with strong demand during market turbulences, is being “consumed” in the production of electronics or jewelry and also exhibits characteristics of a capital asset, as it can be leased and thus generates income.

Traditional Assets offer Limited Diversification

Most traditional assets are subject to three generic factors: the risk-free interest rate, corporate earnings as a proxy for the level of economic activities and a market risk premium. Due to the exposure to the small set of risk factors, a traditional investor’s diversification level is limited. In periods of economic instability, the situation is exacerbated, as many investors painfully have noticed in late 2008. The correlation of many asset classes that previously showed low correlations suddenly spiked during the global financial crisis. To make matters worse, these assets were a drag on returns during bull markets yet failed to provide sufficient diversification benefits when needed.

Bitcoin – The new “Digital Gold”

The classification above shows that Bitcoin differs from traditional assets like stocks and bonds in its fundamental economic characteristics. But with a finite supply like gold, Bitcoin shares many of the same attributes with the precious metal. Due to this fact, the narrative of Bitcoin becoming a store of value has gained quite some traction in the investment community.

When it comes to gold, no one knows how much of it is left on the planet. The current stockpile of gold has been accumulated over thousands of years and is orders of magnitude larger than annual production. In fact, the production rate over the last decades has always hovered around 1.6%. In other words, gold has a yearly inflation rate of approximately 1.6% or a stock-to-flow ratio of 62, much higher than silver’s stock-to-flow ratio of 22 (Source: Saifedean Ammous (2018): “The Bitcoin Standard”).

The stock-to-flow ratio of a commodity is essentially a measure of scarcity and is the ratio of current stockpiles of the asset divided by the amount produced every year. The high stock-to-flow ratio is what makes gold so attractive as a store of value: Even if annual production were to be increased substantially, it will have a subdued effect on price, as the additional production capacity only is a fraction of current stock. This characteristic has given gold a significant monetary role in human history to serve as a store of value.

This exact opposite is true for consumable commodities: If, for example, the price of zinc or copper rises, production output will increase massively compared to its current stock, and in turn pushes down prices. Although gold’s supply schedule has been relatively stable in the past, it cannot be ruled out that this might change in the future if new deposits are discovered or if technology makes space mining – a project on which several companies are currently working on – feasible.

With its known and digitally hardcoded finite supply of 21 million mineable coins, Bitcoin will never be subject to such supply shocks. At the time of the halving in May 2020, when the mining reward per block will be reduced from 12.5 to 6.25 BTC, it is estimated that 18.375 million or 88% of Bitcoins will be mined already (Source). Bitcoin’s stock-to-flow ratio will then double to 50 from its current 25, making it the asset with the highest stock-to-flow ratio after gold. Even if Bitcoin only manages to gain a fraction of gold’s market cap, it could see an immense price appreciation. Some analysts have predicted a market capitalization of $1 trillion or a Bitcoin price of $55,000 by the time of the halving in 2020, which would be only a fraction of the entire market cap of gold (Source) (see Table 1 below).

To conclude, Bitcoin has fundamental economic differences to stocks and bonds and is not comparable to consumable commodities, as its elasticity of supply is almost perfectly inelastic due to the fact that miners will not be able to produce more of it once the 21 million coins have been mined. A comparison to other alternative assets is thus more sensible.

What’s so “Alternative” About Alternatives?

Investors allocate to alternative assets for a number of different reasons: They seek high absolute and risk-adjusted returns in private equity and venture capital, use real estate and infrastructure assets for diversification and income purposes and allocate to hedge funds and natural resources due to their low correlation to other asset classes.

Alternatives are usually defined by having a low correlation. Although this might be true for most alternatives, it is not a sufficient criterion. Correlations are not stable over time and might break down when diversification is most needed. Going back to the initial definition of an asset class, it is the unique risk factors that distinguish alternatives from traditional long-only positions in stocks, bonds and cash.

However, lower liquidity, less regulation and lower transparency are aspects to be considered when investing in alternatives. Assets are difficult to value as current market prices might not be available and a liquidity risk premium needs to be taken into account. Historical risk and return data are limited or sometimes even problematic, as volatility will be understated in comparison to traditional investments and is subject to survivorship and backfill biases. For retail investors, it is difficult to get exposure to certain alternative assets, as many hedge funds require investors to be accredited.

The Alternative Asset Market

The alternative asset market has seen tremendous growth in the last decade. Global alternative assets under management increased from $6.43 trillion at the end of 2013 to over $10 trillion by mid-2019. The market research firm Preqin expects this trend to continue and the amount of assets held by investment managers to grow even further to $14 trillion by 2023 (Source).

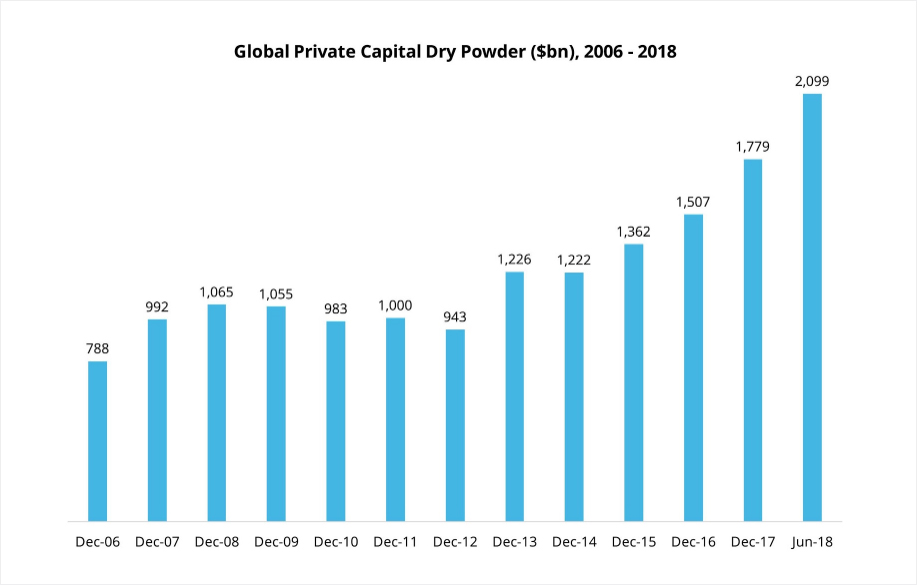

Due to stretched asset valuations, weakening economic growth and increasing protectionism, the decade ahead presents itself as challenging. In search of higher diversification, return-starved investors are therefore looking to alternative assets. Over 80% of investors plan to increase their allocation to alternatives in the next five years (Source). Furthermore, increasing participation, that is, the number of investors that come into alternatives, is expected to grow as well. The amount of dry powder – or capital to be deployed – that has been accumulated by fund managers is at an all-time high and surpassed $2 trillion in 2018 (see Figure 1) (Source).

Figure 1: Global Private Capital Dry Powder

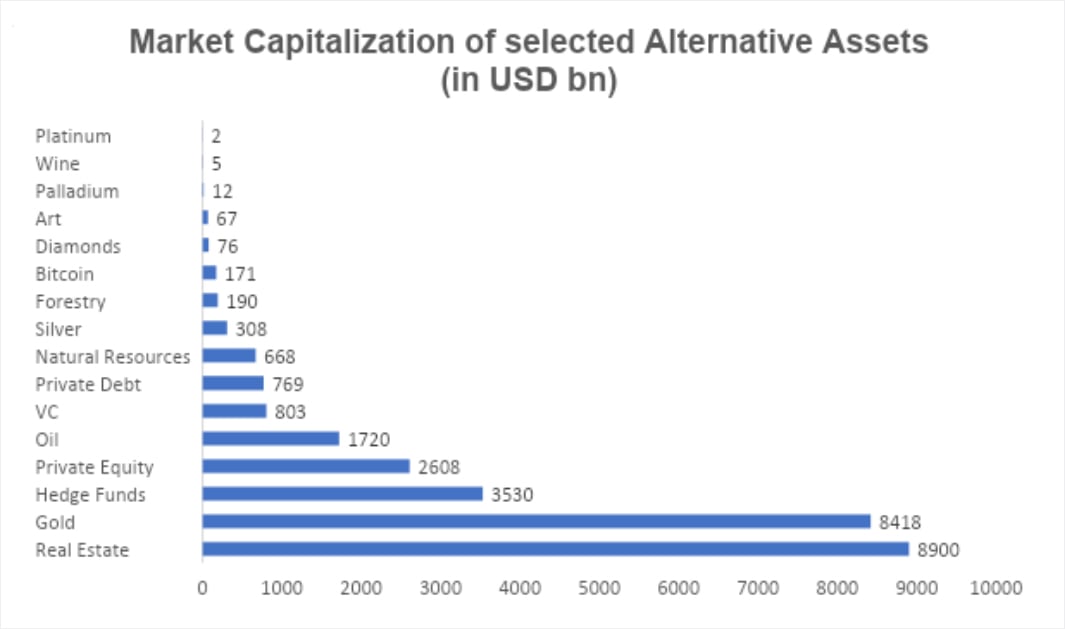

In this challenging economic environment, the search for returns continues. As soon as investors realize that digital assets have unique risk-return characteristics not found in other alternative assets, larger allocations to Bitcoin can be expected. As has been shown in a report by Stack, diversification benefits from Bitcoin allocations are substantial and increase a portfolio’s Sharpe ratio significantly (Source: Stack AM: “The Case for Bitcoin”). Comparing the market capitalization of Bitcoin to other alternative asset classes, it becomes evident that Bitcoin has not yet become a portfolio staple and most investors have not taken advantage of this benefit yet.

The market capitalization of Bitcoin is approximately 2% of the entire value of gold or about 21% of investments in venture capital. From a different viewpoint: If only 8% of available capital in the private markets would flow into Bitcoin, its market value would approximately double.

Table 1: Market Capitalization of selected Alternative Assets (in USD bn)

Digital Assets as a Separate Asset Class

Although the history of Bitcoin is still relatively short and it has yet to be seen how prices react during an economic crisis or a prolonged risk-off period, risk-return characteristics of digital assets are unlike traditional asset classes. It has been found that Bitcoin moves almost independently of stocks, currencies, macroeconomic factors and precious metal commodities. However, Bitcoin is subject to specific factors relating to digital asset markets, namely momentum and investor attention. These factors are characteristics that help to explain the long-term risk and return performance of Bitcoin (Source: Tsyvinski, Aleh; Liu, Yukun (2018): “Risks and Returns of Cryptocurrency”. NBER Working Paper).

How Traditional Market Factors influence Bitcoin

Looking at the co-movement of stocks and Bitcoin, traditional models such as the Fama-French three-factor, CAPM and Carhart models, are unable to account for Bitcoin returns. The size, market, and value premium, which explain a large part of the variation in stock returns, have no explanatory power for Bitcoin, as it produces significant alpha across all these models. Alpha is used to describe the surplus return that cannot be statistically explained by the risk factors. In this case, it ranges from 16% to 19% for the various models above.

No consistent evidence has been found that digital assets are exposed to fluctuations in traditional currencies. Considering the five major ones, namely the Australian Dollar, Canadian Dollar, Euro, Singaporean Dollar and UK Pound, no statistical influence has been found and alphas are still large (approximately 24%) and significant.

Analyzing the influence of commodities such as gold, platinum and crude oil, no exposure has been found between the returns of these commodities and Bitcoin either. For macroeconomic factors such as non-durable consumption growth, durable consumption growth, industrial production growth, and personal income growth, none are significant risk factors that would explain returns in Bitcoin.

Factors that Drive Digital Asset Markets

Since these traditional factors are not explaining Bitcoin price behavior, analysts had to look elsewhere. The digital asset market has been found to exhibit unique risk-return characteristics that are unlike the ones in traditional markets.

It has been discovered that momentum is a significant predictor of Bitcoin returns. Momentum describes the tendency of an asset to perform well in the future if it has performed well in the past. Likewise, if an asset has shown negative returns in the past, performance is also expected to be worse in the near future. The momentum factor is categorized as a persistence factor, as it relates to market trends. Bitcoin’s daily return is positively correlated with its future returns over several daily timeframes as well as over one to four weeks ahead. Thus, current returns positively and significantly predict future returns over these timeframes.

Investor attention, proxied by the amount of Google searches for the keyword “Bitcoin”, have strong explanatory power for the returns over one and two weeks ahead. However, negative investor sentiment is also reflected in Bitcoin returns. More frequent Google searches for negative phrases such as “Bitcoin hack” lead to negative returns in the short term.

To conclude, the variables that drive Bitcoin stem from people’s attention and curiosity for Bitcoin and its resulting demand for the digital asset. Furthermore, it can be argued that the varying attention leads to the significance of momentum and therefore to strong trends over short-term periods. Interestingly to note is that presumably important variables such as the price of gold, oil, volatility as well as on-chain metrics such as transaction volume and wallet addresses seem to have no significant influence on returns (Source). However, due to Bitcoin’s dynamic nature, its price fluctuations and an ever-evolving ecosystem, these factors will vary over time (Source).

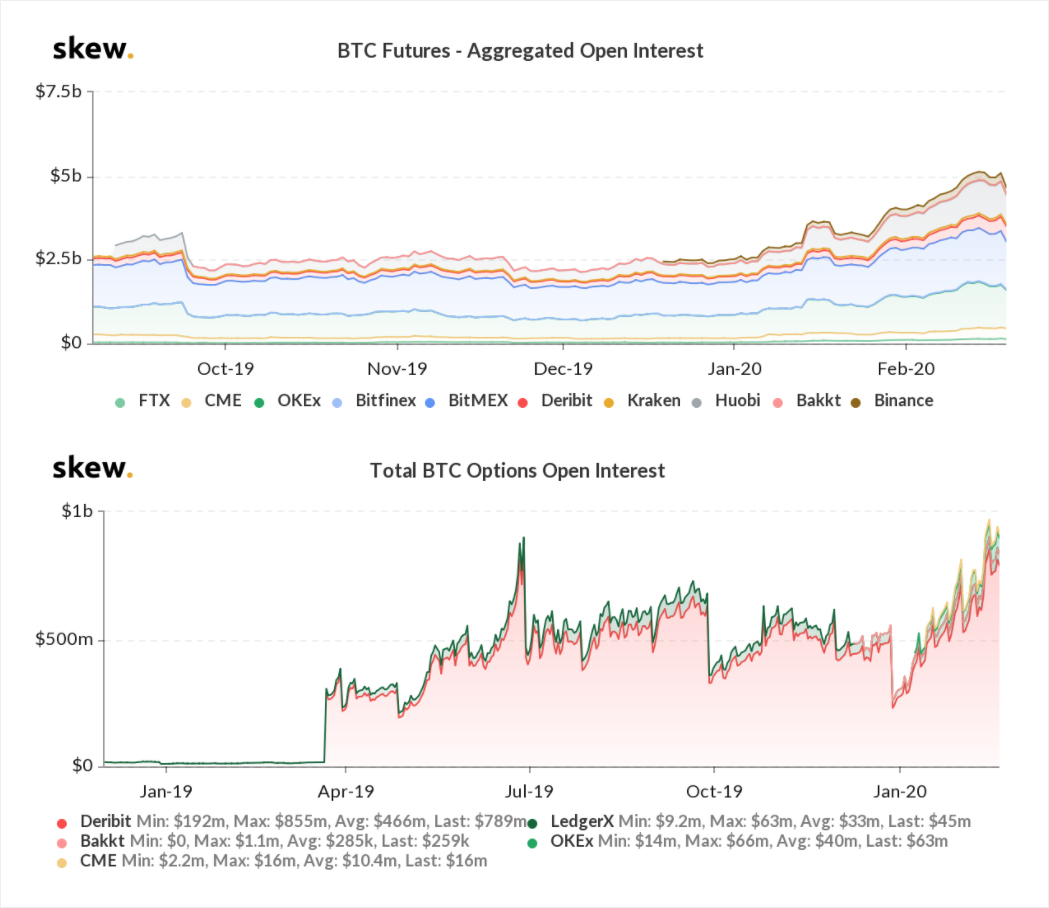

Bitcoin – An Alternative Asset with High Liquidity

Unlike many other alternatives, bitcoin offers high liquidity due to its fungibility and high financialization. The futures and options markets have seen a tremendous increase in volumes over the last few years, substantiating the fact that the interest of institutional investors has been increasing.

Figure 2: Bitcoin Futures and Options Open Interest

In contrast to the low transparency and availability of other alternative assets, Bitcoin offers an easy way to get exposure to non-traditional risk-return factors and its resulting diversification benefits. Furthermore, whereas other alternative assets such as hedge funds or real estate funds are costly to manage and may result in high fees, getting exposure to Bitcoin is inexpensive.

Legal and tax implications of Bitcoin and various other digital assets are still changing rapidly and vary among jurisdictions. However, with traditional financial institutions showing increasing interest in providing custody for digital assets and the launch of insurance solutions with full coverage for client assets, more regulatory clarity is to be expected in the near future.

Conclusion

Often, whenever the Bitcoin price falls, people like to describe it as a failed store of value. This is an exceptional standard to hold any asset to, much less a rapidly growing and nascent one. In reality, we should not abuse language but rather hold to the original meaning of store of value–which is a durable, non-consumable, zero cash flow, low correlation alternative to traditional assets.

Bitcoin, when seen in this light, presents an attractive asymmetric investment opportunity. Not only is it uncorrelated to traditional assets such as stocks, bonds and commodities, but also offers true diversification due to its unique risk-return factors not found in traditional markets. Due to their economic characteristics, digital assets constitute an asset class on their own. With growing institutional adoption driven by advanced custody and insurance solutions and significant dry powder waiting to be deployed, it can be expected that investment managers will increasingly allocate to digital assets to harvest these alternative risk premia.

AUTHOR(S)