With the growth in cryptoderivatives over the past few years, the market has fragmented significantly and come up with numerous options for trading across a number of exchanges.

Today we analyze the difference between two main classes of futures: cash-settled and asset-settled. We hope to dispel some myths about cash-settled futures and also explain the reason why participants, both in crypto and non-crypto markets, may prefer one type over another.

Expiry

Firstly, we observe that the distinction between cash-settled and asset-settled futures is with respect to the question of how the future terminates at its expiry date. Buyers buy futures expecting to make money when the value goes up, while sellers sell the futures expecting to profit when the value goes down. At expiry, the futures contracts must come to an end. How do the concurrent buyers and sellers of this derivative agree that this derivative no longer exists, and what are the resultant flows of capital?

Let’s take the example of a BTC/USD future which has a contract value of 1 BTC.

Cash-settled

1) The buyer and seller agree on a time of day to observe the price of BTC/USD on other exchanges and agree to settle the profit & loss of their expiring futures based on the prices observed. A simple credit or debit occurs in the respective accounts of buyers and sellers and they have no other obligation to deliver or receive any BTC or USD.

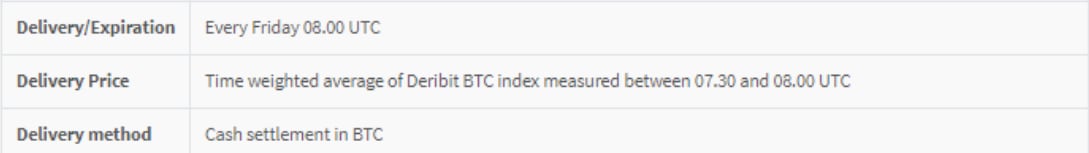

As an example, in the case of Deribit weekly derivatives, they expire each Friday at 8AM UTC based on the time-weighted average price of an index of exchanges from 7:30AM to 8:00AM.

Asset-settled

2) Toward expiry, because the future is asset-settled, this means that the buyer must actually deliver USD for the entire notional–or contract value of his outstanding long contracts and the seller must receive that USD and deliver the corresponding BTC amount. In effect, the future becomes equivalent to a spot trade.

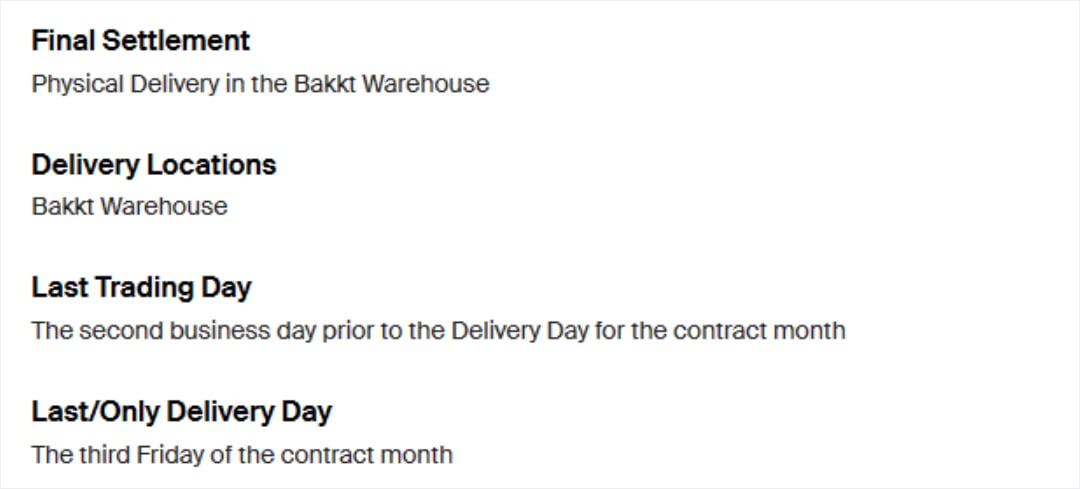

Currently, the main asset-settled Bitcoin future would be Bakkt. The below shows that their monthly BTC/USD future asset-settles into BTC at the Bakkt Warehouse.

Safe Passage

The main pro of cash-settled is that less sophisticated investors can let their futures expire safely. A buyer of a cash-settled future can go on vacation and forget about his position, come back, and login to see that his future has been effectively sold at the expiry price. He does not have to worry about coming up with large amounts of USD to be able to settle against the BTC that he bought.

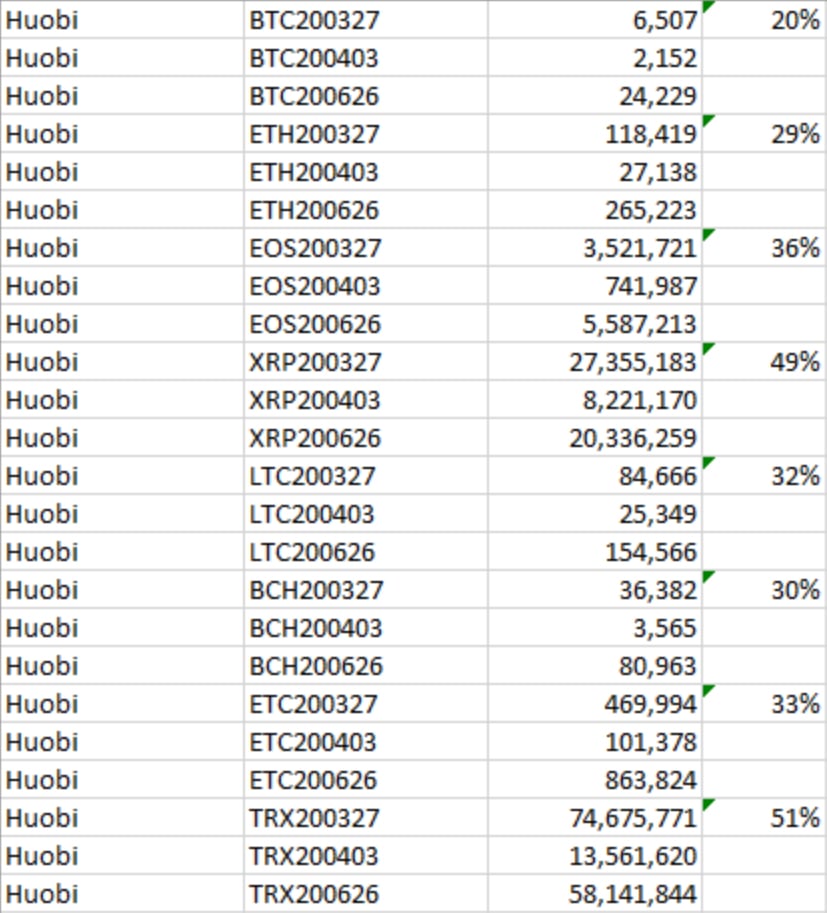

Indeed, empirically we see that much of the open interest in quarterly cryptoderivatives on exchanges such as Huobi are not yet rolled even three days before expiry. In the below table, we see that anywhere from 20 to 50% of the open interest for 27th March expiry has not yet been closed out. For whatever reason, it seems many traders prefer to let their positions expire and then evaluate whether they wish to put on the same position again.

Source: Three Arrows Capital internal calculations on 24th Mar 2020

If these same futures were asset-settled, buyers and sellers who do not wish to take physical delivery would need to close out their futures and re-open new contracts on a later expiry date to maintain their same exposure. They would not have the luxury of letting their futures expire and then trading the new contract.

The first day on which physical delivery can occur is called the First Notice Date, and convention in traditional markets is to close out all futures and roll to new months at least two days before the FND. Empirically, only around two percent of open interest ever makes it to physical delivery, which means there is a mass shepherding of open interest from one month to another whenever the expiry date gets close.

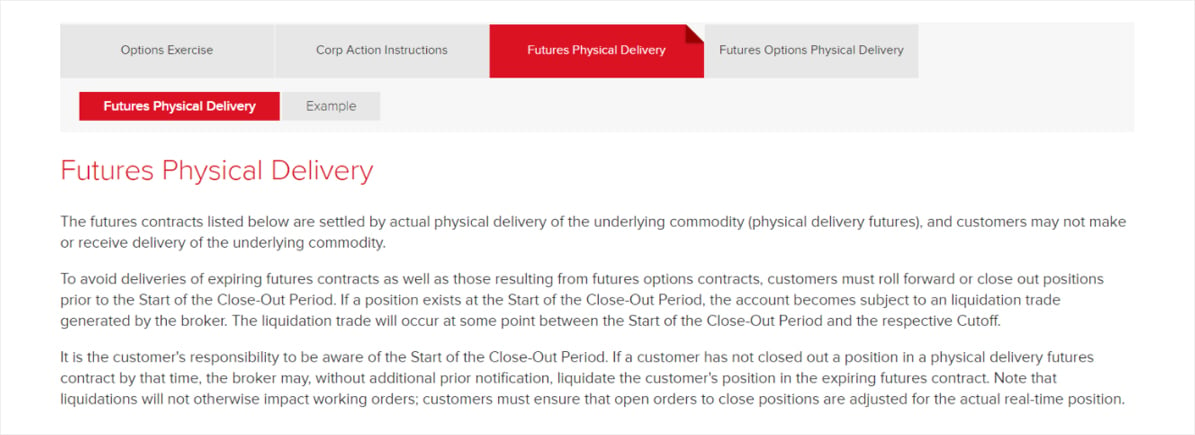

If clients with no ability or desire to physically deliver somehow forget to roll their futures, then they will end up with an impossible situation on an expiry date. While the urban myth is of the Chicago-based junior trader who has to figure out how to take delivery of cattle on a farm, in practice the hapless trader would need to liquidate his position versus someone who is set up to take physical delivery–at a hefty cost. Futures brokers tend to act as a safeguard for less sophisticated clients; they will automatically roll futures for clients or liquidate them if the client does not roll in time.

Below, we see that Interactive Brokers, a top retail futures broker, will liquidate a customer’s position before a certain cutoff if the client forgets to handle it himself.

Cost of Replication

In traditional financial derivatives, commodities have tended toward asset-settled while financials have tended toward cash-settled. There is a misconception that the main reason for this is that people want to take actual delivery of commodities. Nothing could be further from the truth. As we noted previously, only a small fraction of open interest ever makes it to physical delivery.

The real reason is that the cost of replicating the expiry print is very high in commodities while it is very low in financial derivatives.

What does replicating the expiry print mean?

Let’s say you are an arbitrageur and the current market comprises investors and speculators who wish to be long, so naturally you sell them a BTC/USD future and buy BTC/USD spot to lock in a riskless spread. As the expiry date comes near, you have two choices: 1) you may choose to roll your short future to a further expiry, or 2) you may choose to let your position expire. The decision of whether you will roll or expire depends on how well the market will pay you to roll your futures to a later date. If you feel the market is not paying you enough for your cost of capital, you then elect to expire and prepare yourself to sell BTC/USD spot against the expiry mechanism. Implicitly, if the market prices are not enticing for you to roll, this likely means that the longs whom you traded against have also not rolled their positions.

In the case of Deribit, this would mean that you send your BTC to Bitstamp, Bittrex, Coinbase Pro, Gemini, Itbit, Kraken, and LMAX Digital evenly, and then sell BTC/USD time-weighted from 7:30AM to 8:00AM on the expiry date.

The price that your futures expire at will equal the price that you sold your BTC spot at –and you are now left with no positions and a locked-in profit. The main cost is the commissions that you would need to pay on each of the spot exchanges. If you didn’t have access to all seven exchanges, you could decide to only choose the ones you have access to on the lowest fees and then internalize the risk that one of the venues would have a significantly different price from others.

Given sufficiently high fees on these spot exchanges, arbitrageurs would then lobby aggressively for asset-settled instead of cash-settled expiry. This is because the higher the fees, the more expensive it is for these arbitrageurs to let their positions expire.

Turning back to commodities versus financials, it is generally extremely cheap to trade equities and the price discovery venues are lit and easily accessible. In commodities such as precious metals, oil & gas, and agriculture, there often exists no central limit exchange that is not prohibitively expensive to trade on. Consequently, arbitrageurs would prefer to simply deliver the asset against dollars instead of replicating that transfer of risk on an underlying spot venue.

Conclusion

The biggest misconception I have seen surrounding asset vs cash settled is the idea that asset-settled futures involve buying real Bitcoins while cash-settled futures do not.

As an arbitrageur, there is no difference whatsoever between the hedge I would do when selling an asset-settled future vs when selling a cash-settled one. In both cases, I buy spot to hedge. As we showed earlier, the only difference occurs at expiry when I must now elect to roll or expire. The economic exposure that enters into the Bitcoin market when someone buys these futures is indeed the same regardless of how they expire.

AUTHOR(S)