While the concept of liquidity mining has been around for a while, it has exploded in popularity after Compound launched a new mechanism to distribute its new governance token COMP to its users. As the name suggests, these users are rewarded for providing the system with liquidity (in addition to the regular yield), both to the lending and borrowing side of the market.

The community has invented fancy new names such as “yield farming” and “crop rotation”, but under the hood, liquidity mining works similarly to an already established mechanism: PoW mining.

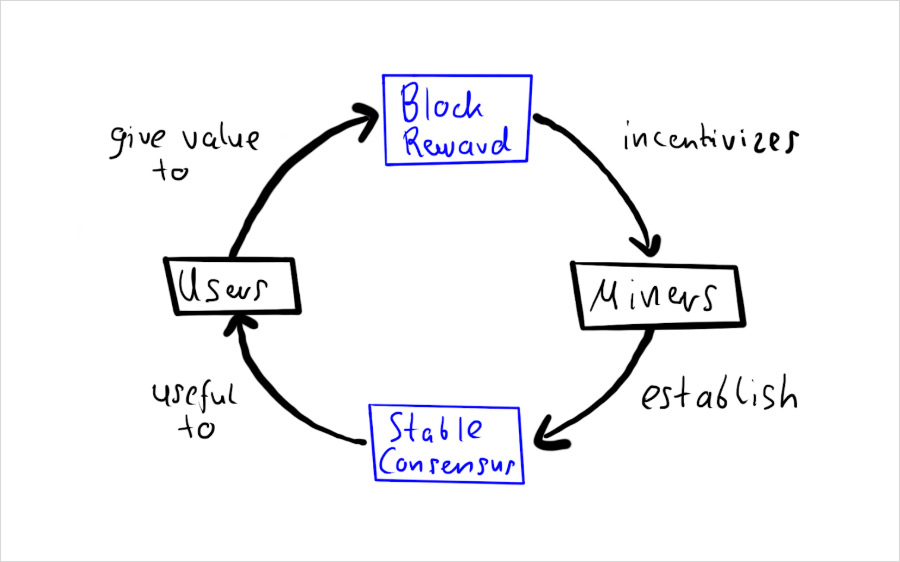

PoW mining in a network like Bitcoin or Ethereum has two primary functions:

- Initially distributing coins into circulation;

- paying miners for the valuable service of attesting to blocks. The attestations enable distributed consensus and make bitcoins valuable to users who buy them from miners

From a high level, liquidity mining works the same way: A fixed amount of 0.44 COMP is distributed to the market per Ethereum block, and that reward has a value to market participants. In order to earn it, they provide a valuable service to the Compound: the provision of liquidity.

Where PoW mining and liquidity mining differ is 1) the priority of the two goals and 2) how they are implemented.

Different priorities

In PoW mining, paying miners to attest to blocks is arguably more important than fairly distributing coins. Without attestations, there would be no distributed consensus and no functioning blockchain. The distribution of coins is a side-effect: you can empirically have a large premine (as Ethereum had) and still produce a functioning blockchain.

These priorities are reversed in Compound. Technically, it doesn’t need to pay liquidity providers at all in order to function. This should alleviate the concerns of some people that liquidity mining is “Ponzi finance”. COMP tokens have positive value because they will earn fees from the protocol in the future. Giving them to users should be compared to the previous status quo in the Defi space: a 100% premine for early investors, who get to sell these tokens on the market.

Compound decided to distribute COMP to a wide base of holders for several reasons:

- the distribution itself attracts new users (same as CPU/GPU mining did for cryptocurrencies)

- the token can vote on changes in the Compound protocol, and a large base of owners is less likely to pass byzantine or short-term oriented changes than a very concentrated one

- it’s easier to convince regulators your coin is not a security when users earn it by doing work for each other vs. paying off early investors.

Different implementations

Incidentally, both Bitcoin and Compound have some level of control over what actions they want to reward. They can use this control to create specific incentives for miners. In Bitcoin, the incentives are for miners to include as many transactions as they can and always mine on the tip of the chain.

Bitcoin needs miners to follow this specific strategy to be secure (also called Nakamoto Consensus), so it’s incredibly important to get the incentives right. Nakamoto Consensus has a clear definition, and it must always be the most profitable strategy in the Bitcoin network.

To highlight the stakes, it was a big deal when in 2013 Eyal et al. discovered that a different strategy (called “selfish mining”) could be more profitable, leaving Nakamoto Consensus in second place. If used, it would potentially destabilize Bitcoin and boost mining centralization. While we haven’t seen evidence of selfish mining in the wild, the risk that miners discover a better strategy that doesn’t benefit Bitcoin users always exists.

Compare that to Compound, and the optimal strategy for liquidity miners has changed dramatically more than a few times now. This is made possible because liquidity miners have a huge array of strategies to choose from, as almost any action you can take in the protocol pays some amount of COMP.

This is a conscious design choice, as Compound’s priority is explicitly not on incentivizing specific behavior but on getting their token to a large number of users. For a counterexample, we can look at Synthetix, which uses their token SNX in a more targeted way. In order to defend the peg of their synthetic stablecoin, they pay liquidity providers on Curve to contribute to the Dai/USDC/USDT/sUSD pool.

One COMP strategy that was optimal for some time required liquidity providers to corner the market for BAT in order to drive up interest rates. Miners strictly followed their incentives, as their share of COMP rewards was based on interest paid. However, this equilibrium did nothing for users. Not only did those who supplied or borrowed “real” assets hardly benefit from the COMP block reward – there wasn’t even more liquidity in BAT markets to draw from, but less.

Where from here?

Compound quickly patched the distribution mechanism to make this no longer the best strategy, but the question remains: what to replace it with? Compound has no “Nakamoto Consensus”, no clearly defined strategy they want miners to follow. They probably want at least some of the rewards to not be captured by deviant strategies but go to simple users who deposit USDC and USDT, as these represent the easiest as well as stickiest inflows from the existing banking system. Onboarding billions of bank deposits into crypto would certainly be a big success.

In either case, there are going to be tradeoffs. A protocol that wants to prioritize the distribution aspect of mining will always want to reward a larger number of actions (resulting in a large number of possible strategies) than a protocol that implements one very specific strategy and then builds its distribution around that.

AUTHOR(S)