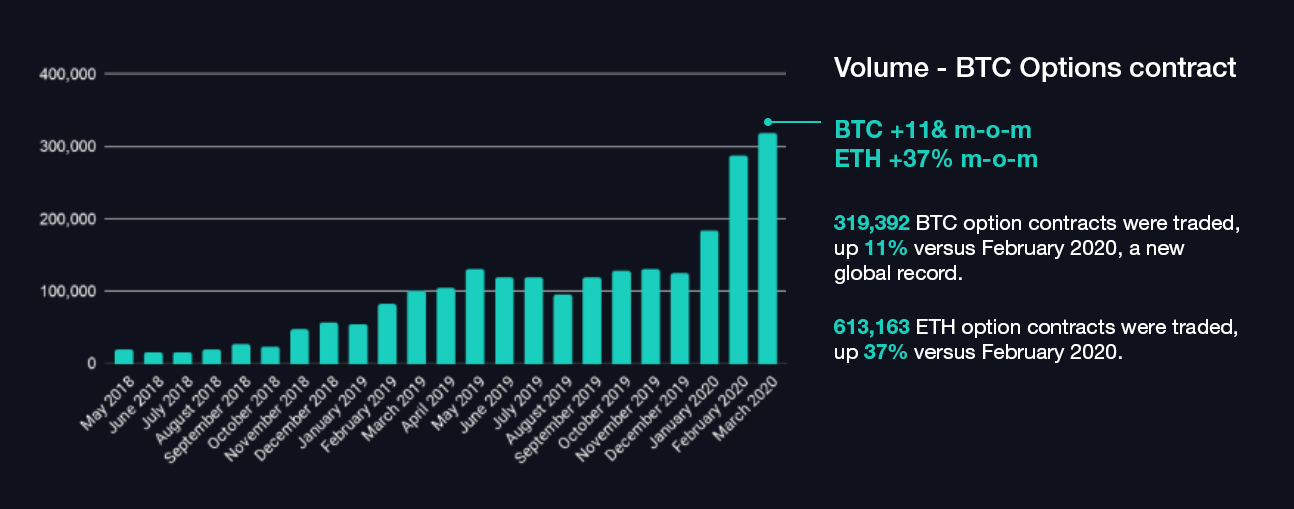

With the rapid multiplicative growth in crypto options trading over the past year on Deribit, I wanted to give a broad overview of all past and present options trading offerings.

It is important to highlight the key differences in market structure between products. Unlike linear derivatives, options markets have unique characteristics that require greater scrutiny. I will analyze these products from the point of view of:

- Two-sidedness: the ability to both buy as well as sell the same option

- Central limit order book: the ability to place bids and asks in a publicly displayed (lit) book of orders accessible to all in a similar manner

- Portfolio margin / Risk-Based Liquidation: margin offset (lower margin requirements) for portfolios that are delta hedged with other options as well as linear products such as swaps & futures. As option markets are essentially hundreds of different orderbooks for each option series, the liquidity per option book is lower compared to for example perpetuals. Selling options because of liquidations during fast markets could be unwise as alternatively the more liquid futures or perps can be used too to hedge the portfolio’s risk.

- Ability to report block trades: Institutional firms tend to trade bigger size and often negotiate terms over chat or other means. These Over the Counter Trades need to be reported to an exchange for processing and margining.

We will exclude CME and Bakkt for now as these venues have onerous capital requirements in USD that make it inaccessible and untradable for the vast majority of interested traders.

MPOE

The earliest instance of BTC options that I am aware of is Mircea Popescu Options Emporium. In 2012-2013, the proprietor of the site was actively quoting BTC options via a bot.

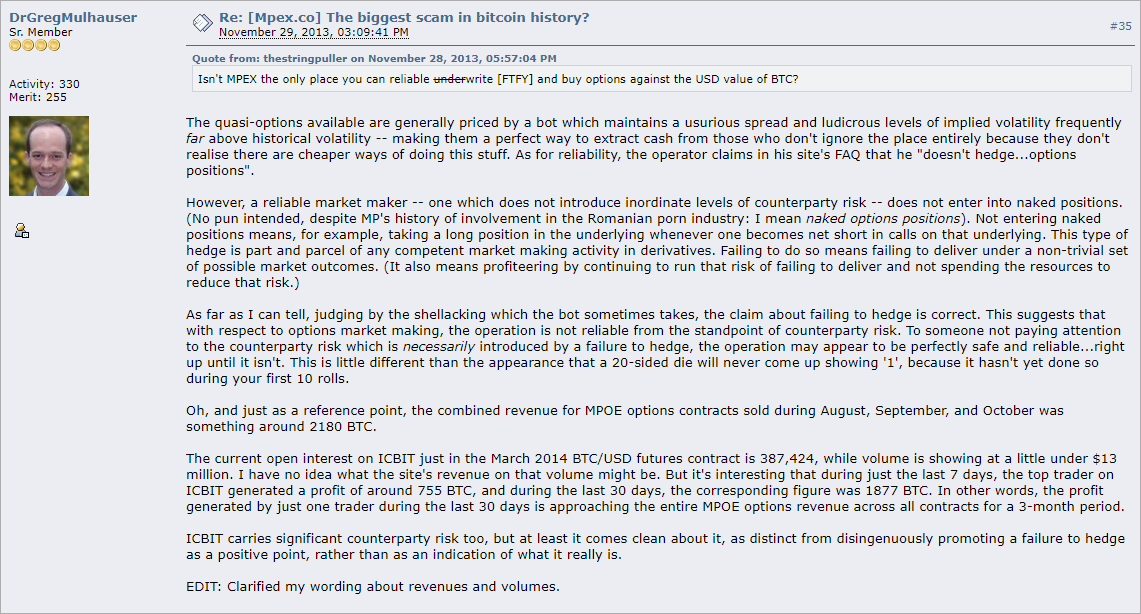

Without getting too much into the controversial site which also had an equally controversial equity issuance, users were concerned with how the MM was hedging. To sell a naked option means to sell a call option–the right but not the obligation to buy BTC/USD at a later date, but not actually owning BTC or otherwise hedging the delta risk on BTCUSD price.

Source: Bitcointalk

As an example, let’s say the price of Bitcoin is $10 and the MM sells a $20 call (strike of $20) expiring in one year. The MM pockets the premium for the call for now, but the danger here is that as BTC price goes from $10 to $100, the buyer of the call now has to wonder how the MM pays out the profits. The premium, the price of the option above at the moment of the trade, would have only been a couple of dollars per BTC, but the MM’s loss would be astronomical if he didn’t hedge.

This early foray into BTC options is somewhat impressive because it was before there was even a liquid derivatives market in large size. Portfolio margin would have been unthinkable, and central limit order books barely even functioned for spot markets. Moreover, because the buyer of the option takes credit risk against the seller, the MM only allows buyers so that he is the only one who can pocket premiums and also doesn’t have to worry about collecting payouts on in-the-money options from others. The real risk for the client is therefore not how MPOE was hedging but whether they would fulfil the obligations under the option contracts sold (in the absence of an insurance or default fund).

Bitmex UP / DOWN contracts

The Bitmex UP/DOWN contracts were launched in 2018 and delisted in Jan 2020. The market reaction can generally be summed up by @ThinkingUSD’s comment that “The BitMEX staff must think we’re unironically retarded at this point.”

Why was the market adoption of these contracts so poor, despite Bitmex’s otherwise strong standing and dominant market share?

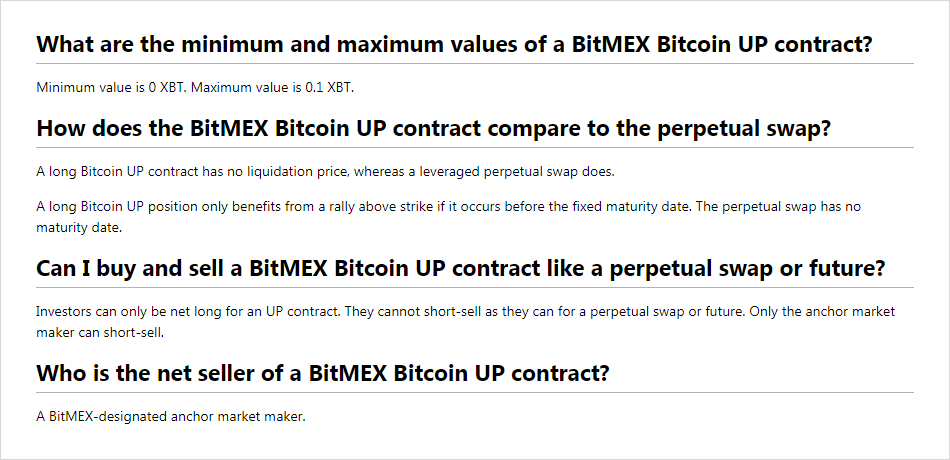

Bitmex decided to design their options products so that you could only buy them as a client. You could only sell contracts that you had previously bought, but you could not open short positions.

So who would be available to sell to you if nobody could buy? The BITMEX-designated anchor market maker. This euphemism meant that only a single Bitmex-affiliated trader would be able to sell these options. Because of the monopolistic edge that this single trader would have, contracts traded at 10x their equivalent onon Deribit–and clients quickly realized that this was not a real market. Without competition (multiple market makers) traders end up at the mercy of the single supplier which does not have the incentive to offer the most competitive prices.

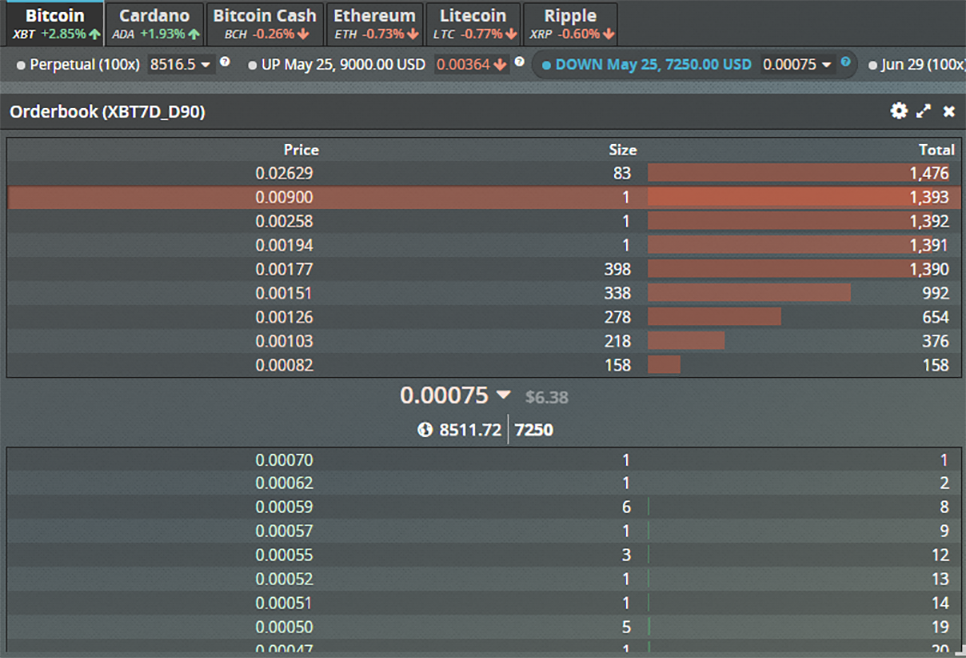

As we can see in this screenshot,the anchor marketmaker is, understandably, eager to sell some contracts. Clients are less eager to buy them.

Okex

Okex, a leading China-based derivatives exchange, launched its own options trading offering in early 2020. All contract specs are cloned from Deribit and their marketmaker is one of the more active ones on Deribit as well. The main disadvantage is their lack of support for portfolio margin.

A portfolio margin based model determines margin requirements on historical volatility by valuing a specific portfolio over a range of underlying price and volatility moves. The largest theoretical loss identified is the margin required for the position. A model like this would also take positions in futures and options combined into consideration, which may help reduce the margin requirement of a portfolio.

Traders using portfolio margining have significantly better and effective use of capital allowing these traders to potentially capture more market opportunities when conditions arise.

In the absence of such a model, it is difficult for non-designated MMs to provide consistent liquidity in all strikes and expiries. Buying options requires the buyer to pay the full premium while selling options is margin based. So when selling all these options and hedging these with futures, the marketmaker would have to put up too much collateral/margin, thus limiting their quoting ability.

Also, without portfolio margin, regular delta-neutral traders cannot hedge their options portfolios with swaps from a margin perspective.They cannot hedge risk parameters but must hedge actual contracts irrespective of the risk they represent.

While not offering portfolio margin is bad for MMs, it is also very bad for clients. Imagine selling an out-of-the-money put and then having to buy back the same put to be able to reduce your margin usage. Your exit liquidity will cost you astronomically relative to the true cost of risk.

Okex has active perpetual swaps and futures markets but doesn’t offer portfolio margin between these yet either. You cannot buy 100 BTC of a perp swap and sell 100 BTC of a future and gain any margin offset.

FTX

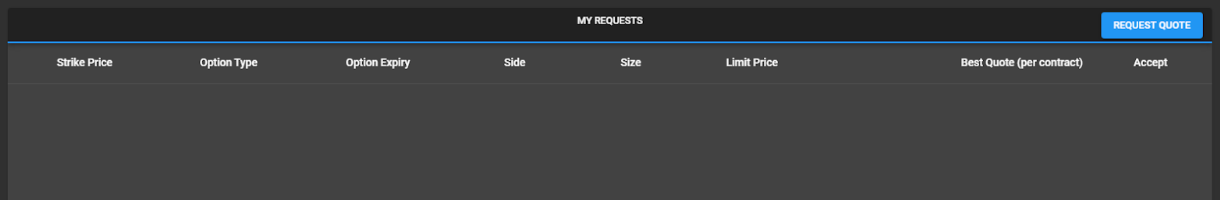

FTX launched options trading in early 2020 as well. Their product is on a Request-for-Quote basis, also known as RFQ. This means that there is no central limit order book where orders are displayed, but users can query to see a two-sided price. There are some advantages to this approach, which are that MMs can quote bigger sizes than are shown on screen, and also that they can quote broken dates, or custom dates that may not be available as weekly, monthly, or quarterly dates. The main disadvantage is that you yourself cannot interact with other client flow–it is essentially an OTC product where you are interacting with marketmakers. Also because prices are not lit and continuous, a trader would not be able to see consistency in provided prices, you might get an attractive spread today, but who knows what it’s going to be when you plan to reverse the trade.

There is no portfolio margin in terms of offsetting deltas, but you can use existing collateral on the derivatives side for options.

Conclusion

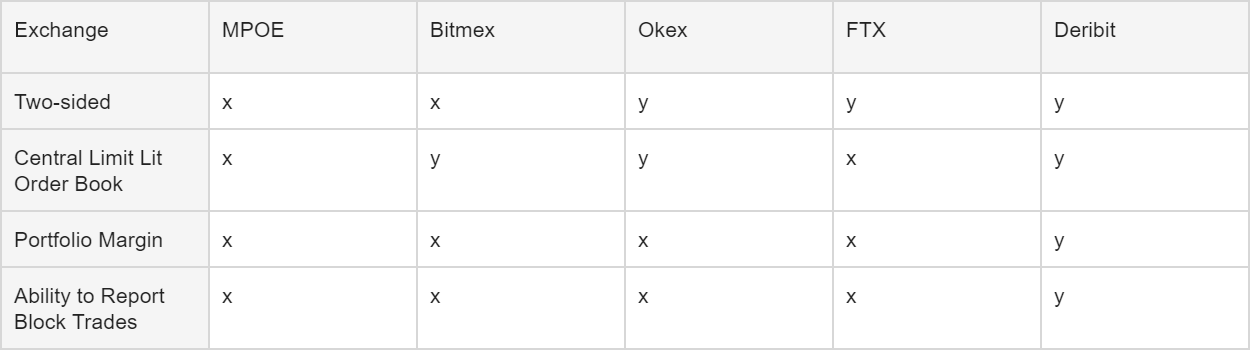

I’ve summarized our adventures with a table.

If I had to make some recommendations, MPOE and Bitmex no longer have options products, so they can be immediately ruled out. If you are a seller of volatility and have a lot of collateral, you could consider checking Okex prices–as the implied volatility is usually higher there to compensate for higher liquidation risk & inability to portfolio margin. If you’re looking for custom dates and specific sizes and also to use your existing collateral on FTX and you intend to keep the option until expiry, then their RFQ platform could make sense. Finally, if you’re looking to trade options on both BTC and ETH on a two-sided order book where you can interact with multiple MMs as well as other clients equally, and to be able to dynamically hedge your portfolio using linear derivatives, Deribit would be ideal.

AUTHOR(S)