In recent months, innovation in the Automated Market Maker (AMM) space has contributed to the growth of Decentralised Exchanges (DEXs).

Uniswap released its V3 introducing concentrated liquidity which allowed up to 4000x capital efficiency relative to their V2 design, while Bancor V2.1 introduced an interesting tokenomics model to tackle the pain point of impermanent loss, enabling single-sided liquidity provision.

Other DEXs have been innovating in different directions and one that has been increasingly adopted is the single vault model.

SushiSwap’s BentoBox and Balancer’s v2

In March 2021, SushiSwap unveiled its single vault, BentoBox, serving as a decentralized “App Store” where all users can deposit their tokens into a single box, and this box can be accessed by many different applications. For example, funds in BentoBox can provide flash loans, while simultaneously farming in Onsen, and – in the future – even providing liquidity on SushiSwap’s AMM.

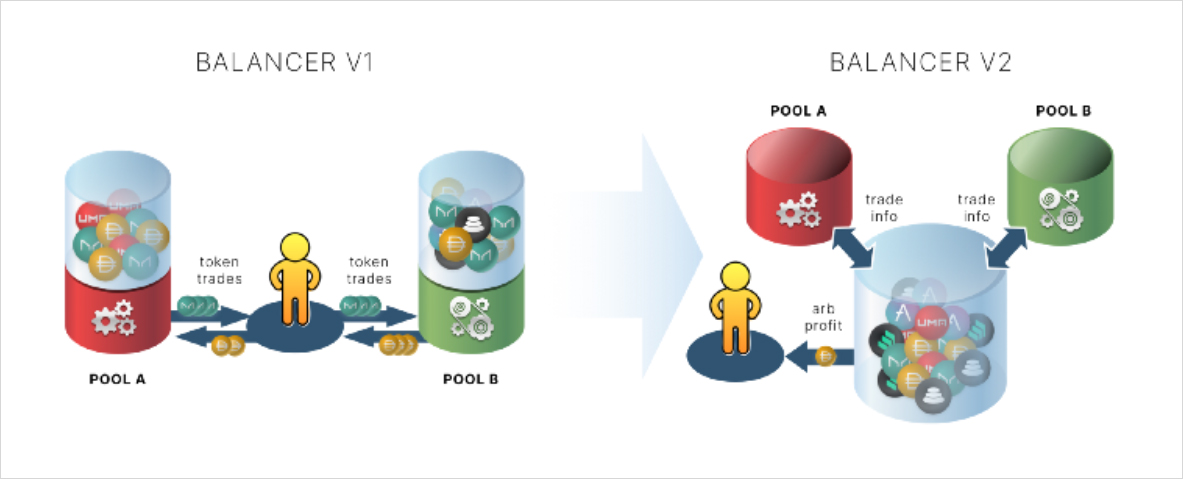

Similarly, Balancer has launched its single vault during their V2 announcement. Balancer’s Protocol Vault aggregates and manages all the tokens added by every Balancer pool. The Automated Market Maker (AMM) logic is separated from the token management and accounting. Token management and accounting are done by the vault while the AMM logic is individual to each pool.

The Lego Baseplate

The single vault can be seen as the lego baseplate allowing for other lego pieces (different DeFi applications) to be built on top of it. Protocols like Uniswap focus on building one lego block well while others like SushiSwap and Balancer are taking a different approach – to synthesize these lego blocks.

The baseplate securely stores tokens and automatically generates a yield on the underutilized assets to reduce opportunity cost. Developers can build directly on top of the baseplate, whose decentralized applications (dApps) can tap into the underlying assets as well as attract more users to increase overall adoption for the protocol.

The holy grail of DEXs is to maximize capital efficiency and yield for Liquidity Providers. In this article, we will attempt to explain how the single vault model optimizes for this goal.

Benefits of Single Vault Model

Gas Efficiency

SushiSwap’s core frontend developer, Omakase, described BentoBox as: “A layer 1.5 solution, where everything has been put into one token vault.” The single vault promises a gas efficient infrastructure by reducing unnecessary token transfers by allowing the ability to hold internal token balances inside the vault.

Today, gas fees are wasted on multiple approvals on the same token. This will not happen in a single vault. Once a token is approved for the vault, it can be used for all protocols that are built on the vault.

Previously, the increased gas fees due to the complexity from Balancer’s Smart Order Routing algorithm has overshadowed the potential saving from lower price impact. The new model solves the issue completely, allowing for better prices.

With Balancer’s new vault, trades can be performed against multiple pools and only the final net token amounts will be transferred from and to the vault. This will reduce the number of transactions under the hood and save a significant amount of gas for users.

High-frequency traders can also avoid posting any ERC20 transactions for short term positions. This is especially useful for DEX aggregators.

Furthermore, by utilizing flash loans, arbitrageurs can arbitrage with no tokens by trading information between pools resulting in a more efficient process and a less capital intensive operation.

Source: Balancer Medium

Overall, developers can build dApps without concerning themselves with gas optimization overhead. At the same time, traders will also opt to trade on these platforms as gas fees eat less into their profits.

Secure and Flexible Foundation for other applications to be built upon

By decoupling the pools’ AMM logic from the token management and accounting, a single vault model creates a strong foundation for developers to build on top of. The low level details can be entrusted to the vaults, removing any technical overheads for developers. Such modular architectures allow teams to become more focused and efficient.

SushiSwap

The first dApp built on BentoBox is Kashi which utilizes assets on BentoBox for lending, borrowing and one-click leverage trading transactions. Since all of the tokens are stored in the central vault, it benefits from reducing the number of transactions and overall gas processing fees for internal token transfers. For example, with BentoBox and Kashi, shorting with more than 1x leverage can be done in a single transaction.

MISO will also be built on BentoBox. It is a launchpad for project founders to launch new projects on SushiSwap. MISO creates a suite of smart contracts so that non-technical founders can easily launch their new tokens through their launch and migration of the liquidity into SushiSwap. The smart contracts include features to create new tokens for projects, vaulting options to lock up tokens over time, initial token offerings and crowdsale, and a farm for new tokens to be farmed as rewards by users.

Balancer

Balancer’s token vault can now act as a launchpad for teams to innovate with different AMM strategies and dApps. There are 2 official partnerships that have been announced:

Element Finance, a Fixed Rate Interest Protocol, will be building a custom trading curve on Balancer V2 to avoid the hassle of forking or building an AMM from scratch.

“Element Finance needed to implement a custom invariant or trading curve but did not want to go through the technical overhead of forking or building our own AMM with custom logic. To avoid these issues, we chose to build on Balancer V2.” – Element Finance, April 2021

Balancer-Gnosis-Protocol, a joint collaboration between Balancer and Gnosis that will bring to market Gnosis’s DEX aggregation and batch auctions that are designed to mitigate miner extractable value.

Both BentoBox and Balancer’s vault will allow dApps who integrate in the vaults to become interconnected – providing synergies between these dApps and harness the value of network effects. At the same time, dApps bring in new users for the vaults resulting in TVL and protocol growth.

Capital Efficiency

Pools have full control over the underlying tokens they add to the vault. This opens up vast design space to improve capital efficiency where asset managers and dApps can be built on the vaults. After being nominated by the pools, external smart contracts that have full power over the pool’s tokens can have a role to play by using the underlying tokens for other use cases like voting, farming and lending.

SushiSwap

Assets on BentoBox can be used to provide flash loans, even while the same tokens are being farmed in Onsen. Even if the assets are not being borrowed, users can still use their tokens to earn yields or LP fees. This maximises the revenue earned by users at any point in time.

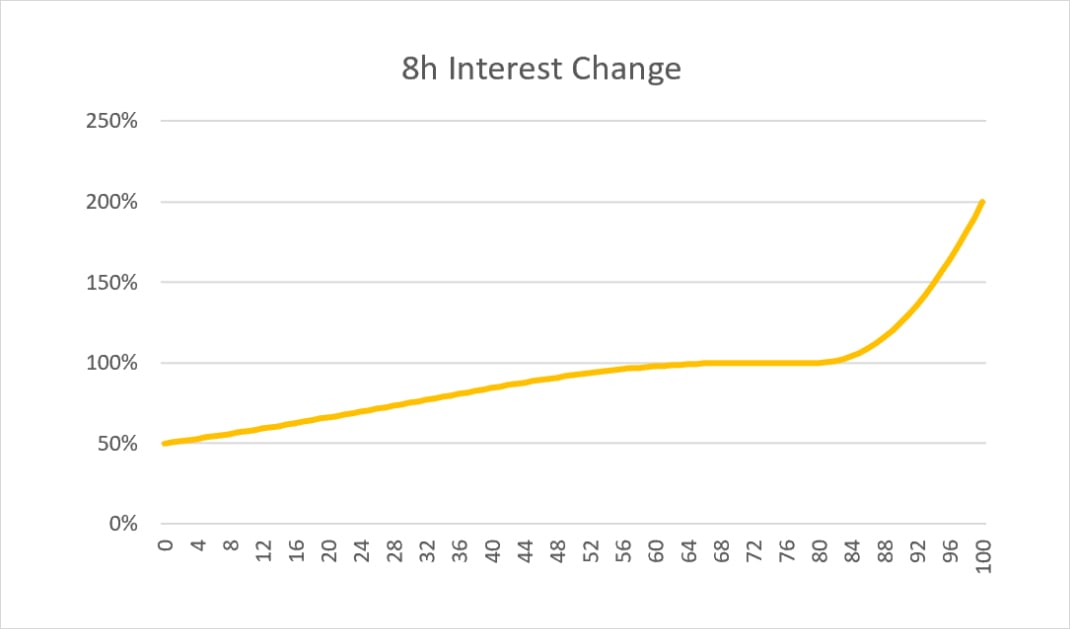

Kashi has a target utilization rate between 70 to 80%. This utilisation rate is defined as the percentage of assets that are currently borrowed against the total supplied. It will attempt to achieve this through an elastic interest rate that fluctuates depending on the utilization rate.

Source: SushiSwap, BoringCrypto’s Blog

Balancer

Similar to BentoBox, assets in Balancer’s vault can also be used for flash loans. In addition, Balancer has partnered with Aave to build the first Balancer V2 Asset Manager that allows idle assets in V2 pools to earn yield on Aave.

Source: Medium Blog

The GIF depicts the fact that only a small percentage of assets in liquidity pools are exchanged and most assets have been idle within the liquidity pools. With the Asset Manager, these assets can be programmatically deposited into Aave pools based on certain thresholds.

Source: Medium Blog

As the asset ratio in the pool becomes more unbalanced over time, large sized trades may fail. When that happens, the Asset Manager will automatically replenish the pool with DAI and send more WETH to Aave to maximize the yield generation.

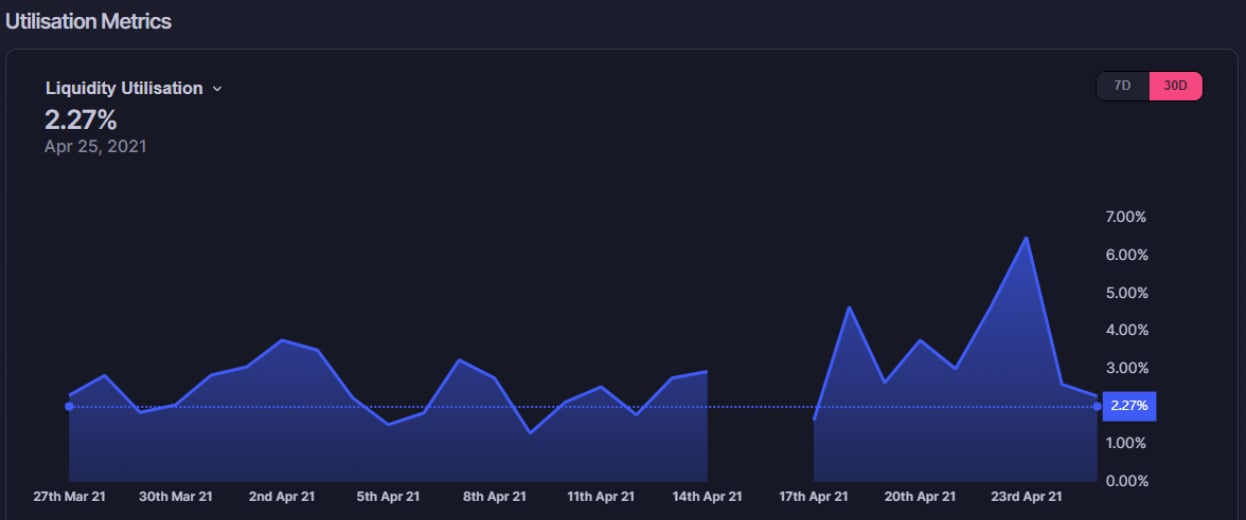

Currently, only a small percentage of TVL in AMMs has been productive. We should expect liquidity utilization metrics (% of assets that are productive in generating yield) to increase tremendously with the implementation of the asset managers in single vault.

Source: Balancer Dashboard

Disadvantages of Single Vault Model

When all assets are in a single vault, the smart contract risk will increase due to the complexities. While it is no doubt that both the Balancer and SushiSwap teams have put in great effort to ensure the security of the funds, such innovations represent a certain degree of risk.

In particular, dApps and Asset Managers are imbued with a high degree of authority on the vault assets and could represent additional attack vectors. The complex logic involved should be reviewed carefully.

Vision and The Road Ahead

“The innovation of the BentoBox lies in its effortlessly scalable design. Its scalar design allows BentoBox to serve as the future infrastructure for forthcoming DeFi protocols on Sushi. Unlike other protocols, it creates a primary source of liquidity that any user can access with minimal approvals, minimal gas usage, and maximal capital efficiency.” – SushiSwap, May 2021

Other than obtaining the various tangible benefits from the vault, an important factor to consider is the substantial competitive moat that it creates for the integrated protocols. Such an advantage is hard to get by in DeFi and it will make the resulting protocol-complexes almost impossible to fork and replicate.

Imagine Yearn living in the same vault with SushiSwap, and Aave with Balancer. These protocol-complexes would effectively be the entry point to take part in DeFi and generate sustainable yields on user’s assets. This will also increase the barriers to entry and prevent other upcoming DEXs from eroding the market share of SushiSwap and Balancer.

In this transition, it can be seen that SushiSwap and Balancer are targeting the passive liquidity providers as more active liquidity providers flock to Uniswap after its V3 upgrade. SushiSwap and Balancer are good options for retail liquidity providers who want to passively manage their liquidity whereas Uniswap will cater more active strategies that aim to draw in more sophisticated players to the space. It will not be surprising to see a mass migration of assets if the single vault model fulfills its vision as the go-to for passive liquidity providers.

The DeFi Citadel will be made of Money Legos. Source: TwistedSifter

Returning to the Lego analogy, SushiSwap and Balancer see the AMM as one lego piece on top of their ecosystem. Taking a page from Polygon’s playbook to actively incentivize established DeFi protocols such as Aave and Curve to deploy onto their L2 platform, the next move will be to incentivise more lego blocks to be built on top – populating the Lego Baseplate with a myriad of lego structures.

With time, the structure could grow more complex with protocol integrations, achieving an impenetrable moat for Sushiswap and Balancer. The Lego Baseplate would serve to be the strong foundation for the gargantuan DeFi Citadel to be built on.

AUTHOR(S)