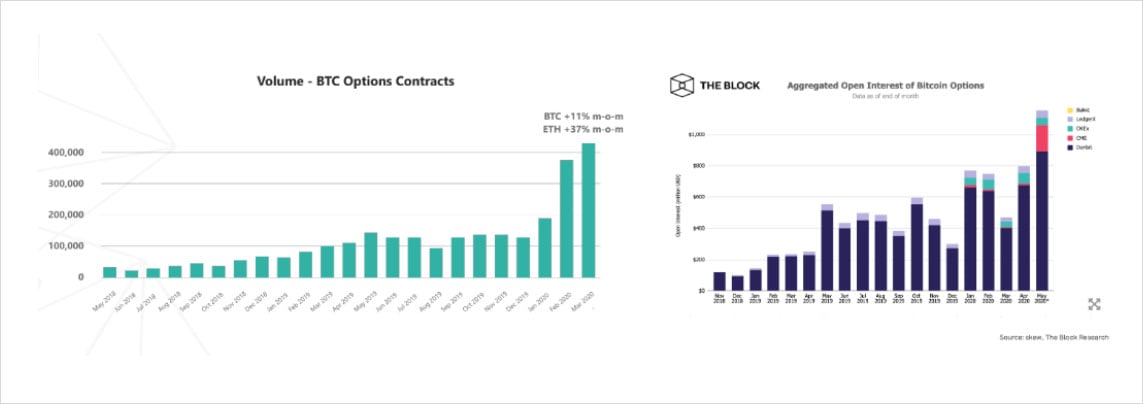

As we near the end of the first half of 2020, the explosive growth in crypto options trading on venues such as Deribit has continued its torrid pace.

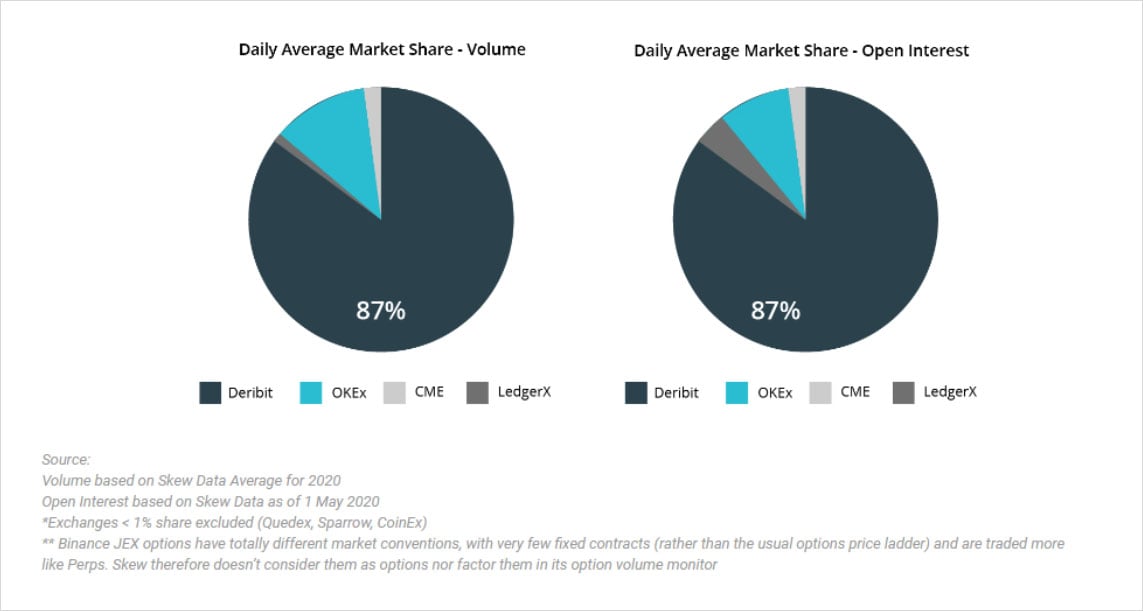

The US-based venues for options trading are CME and LedgerX, while the non-US are Deribit and OKex.

In particular, May 2020 ushered in a wave of options activity on the Chicago Mercantile Exchange (CME) which led to all-time-highs in open interest and volume on Deribit as well.

Such growth is especially impressive in a challenging backdrop where prices of underlying coins have gone sideways. What are the factors chiefly responsible for such growth, and what does this augur for the future?

Why do people trade options?

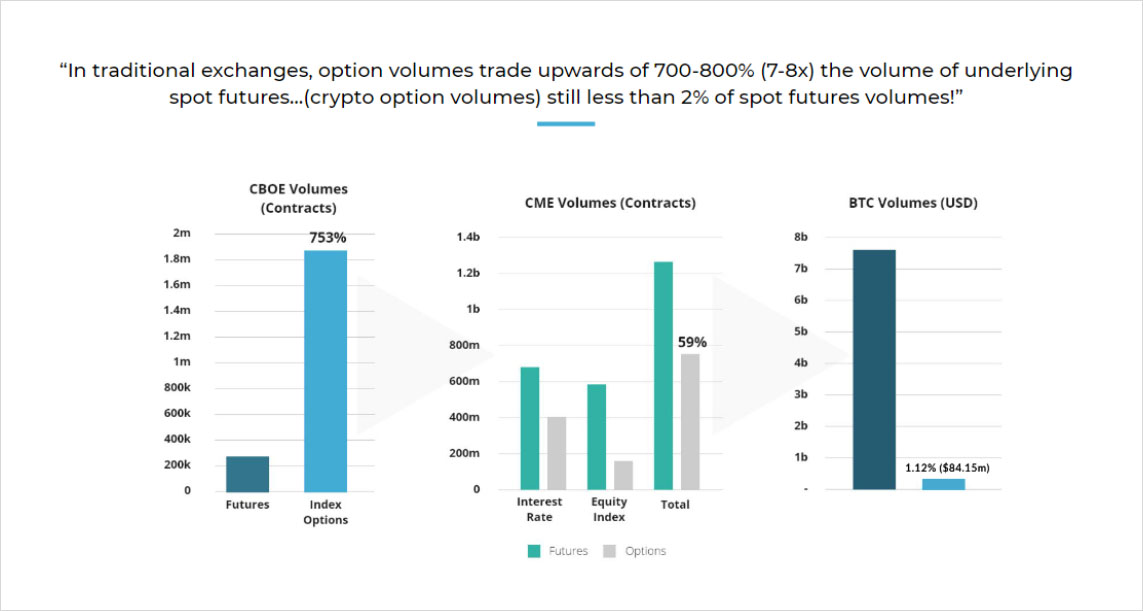

It may surprise people to know that in the traditional markets of interest rates and equity index, options comprise 59% of futures volumes. On the volatility-focused CBOE, index options are an astounding 753% of futures volumes. While BTC options volumes are only 1% of futures and swaps volumes today, there are numerous indicators that Bitcoin derivatives markets will follow a similar pattern of growth.

The original reason people trade options is alluded to in my previous article explaining skew, the idea that investors seek options to buy insurance against a large pre-existing portfolio. Put simply, the world is structurally long equities, so participants enter the equity options markets chiefly to hedge against downside moves. The converse may occasionally be true as well. If an investor believes they will gain access to additional cash in the future, they may buy calls to hedge against the markets going up before they have a chance to deploy that cash.

Before Black Scholes was formulated, options were thought of as similar to life or fire insurance. Financial intermediaries found it difficult to offer clients such options because they did not know how to price or hedge the product. When faced with a client wanting to buy puts to hedge against the market going down, they would struggle to price the option throughout its lifecycle from trade date to expiry. Liquidity was terrible, which in turn made it unappealing for clients to buy this insurance.

After Black Scholes, dealers realized they could dynamically replicate the risk of an option by hedging their delta–their exposure to the price movements of the underlying market, throughout time. An example: let’s say the S&P500 is trading at 3,000. If a client buys a three month 2,500 strike S&P put, the dealer could short S&P futures at inception at a certain hedge ratio prescribed by Black Scholes. As the market goes up to 3,500, the chance that the client’s put will end in-the-money goes down and the dealer would unwind their hedge as it becomes unnecessary. As the market goes down to 2,500, the dealer would need to short additional S&P futures to hedge and generate profits to be able to pay the client on his puts. While buying high and selling low is a recipe for systematic losses, the dealer is of course well-compensated for this in the form of the initial premium that the client pays for his put.

Black Scholes ties together the cost of replication with the cost of the option itself. The dealer uses an implied volatility to price the option, and then has exposure to the realized volatility of the underlying while dynamically hedging. If the market moves much less than he assumed, he wins. If the market moves much more, he loses.

The presence of these portfolio hedgers then enables a whole host of sophisticated participants to enter the market. If portfolio hedgers structurally buy options from dealers, then this bids up implied volatility to be structurally expensive versus realized volatility. This then attracts covered call and covered put participants to the market. A natural covered call seller in Bitcoin would be someone who is already long BTC or denominated in BTC, who nonetheless would like to sell some BTC to USD as the market goes up. They could sell upside calls on coins they already own, and get paid for being willing to let go of their coins at those levels. A natural covered put seller would be someone rich in USD who does not mind buying BTC/USD if markets fall. They have plenty of USD to fund their purchases and would like to get paid for being willing to buy at depressed levels.

Eventually, all sorts of participants find it expedient and cost-effective to express their views and hedging needs via options. Coinholders sell covered calls, bullish speculators buy calls, miners buy puts, and cash-rich institutional investors sell puts.

Conclusion

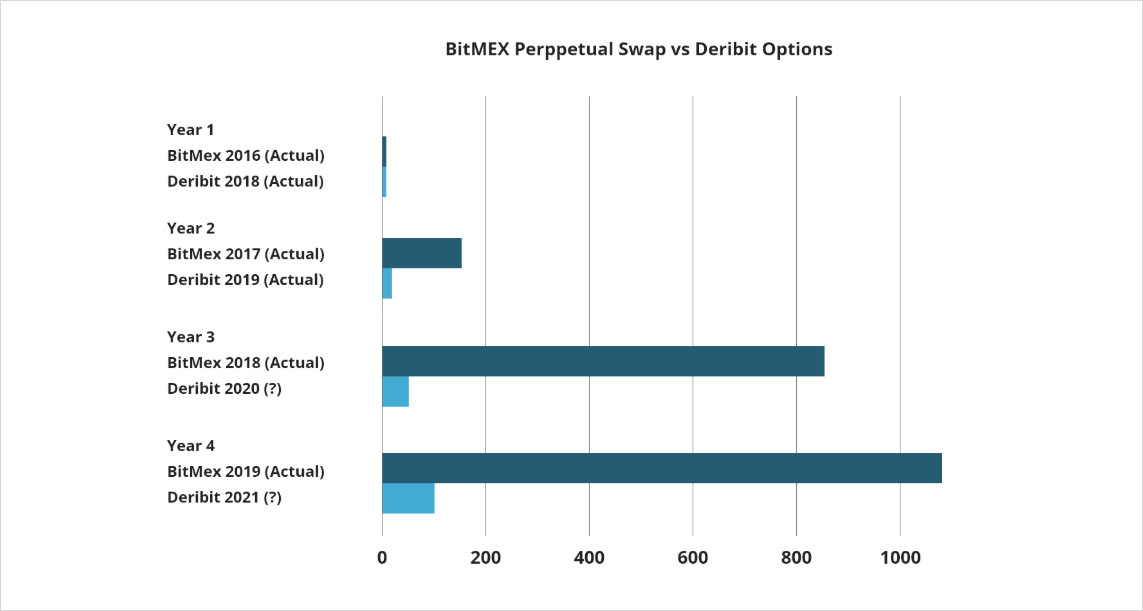

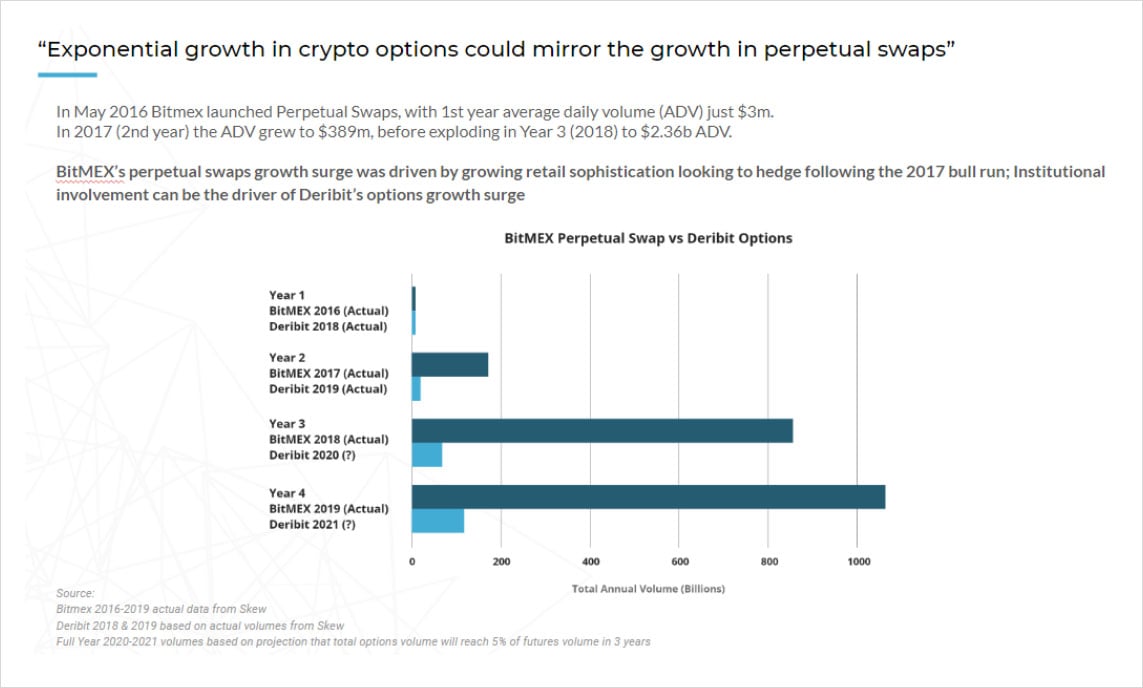

Given the importance of dynamic hedging for dealers to be able to price and hedge options, it is no surprise that the recent growth in options trading has come after a period of exponential growth and maturation in perpetual swap markets.

Now that the derivative markets are liquid enough to handle aggressive hedging in volatile conditions, the innate desire of financial markets to trade options has become unleashed in crypto as well.

In fact, crypto options have even become liquid enough that structured products–packaged options strategies offered by dealers to clients, have started to emerge. In traditional markets, these products span trillions globally. In Asia and Europe in particular, their flows are so large that they dominate movements on both underlying and implied volatility.

While still nascent today, the first large structured crypto options funds have been formed already and could be the impetus for the next wave of exponential growth for options volumes. The beauty of options markets is their intrinsically positive-sum nature; as we’ve seen with CME and OKex, every additional entrant into the space expands the overall pie.

AUTHOR(S)